Bonds are Back…So Which Ones?

Consider a Euro Aggregate Strategy.

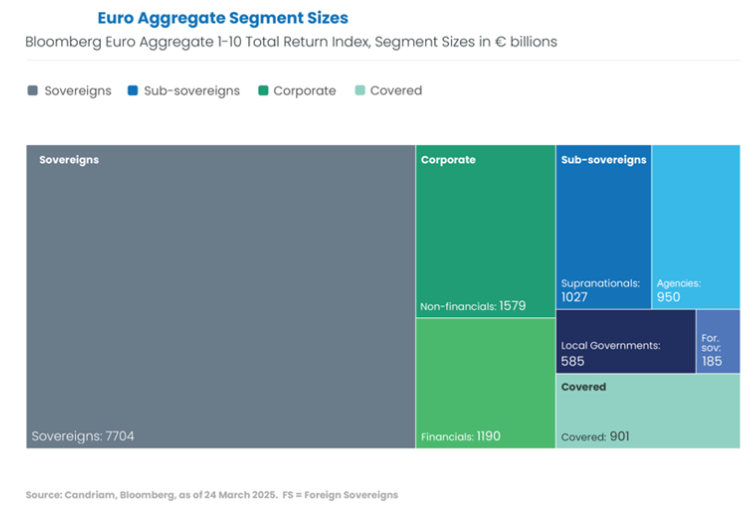

But which fixed income segment or segments should a euro-based investor emphasize? Some investors may prefer to leave the rebalancing decisions within the euro fixed income segments to asset managers by choosing an aggregates strategy. The Bloomberg© Euro Aggregate Universe, for example, includes sovereign, agency, supranational, corporate, and collateralized sectors. At Candriam, when considering the euro aggregates universe we not only re-allocates among these sectors for you across the macroeconomic and market cycles, but from time-to-time we may also include high yield or convertible bonds when their risk/return characteristics are particularly attractive.

Risk-Adjusted Returns are Our Mantra.

Read our work over time and you will find us devoted to risk-budgeting, but also to actively-managed, Conviction-based portfolios. We balance active positioning and portfolio manager Convictions against benchmark disciplines, constantly measuring and managing the risk exposure of your investments.

The Bonds are Back in Town.

Interested in the basic principles of our Euro Aggregate strategy? Our portfolio managers describe how to benefit from active allocation among fixed income segments in our article.

Fixed Income Asset Allocation: How to Leverage Portfolio Manager Convictions

When you say “do the math”, are you the type who wants formulas along with your figures? Our quantitative team gives you that and more on our active risk budgeting in their new white paper.