Revisione del mercato.

Strategia di ribilanciamento dell'indice

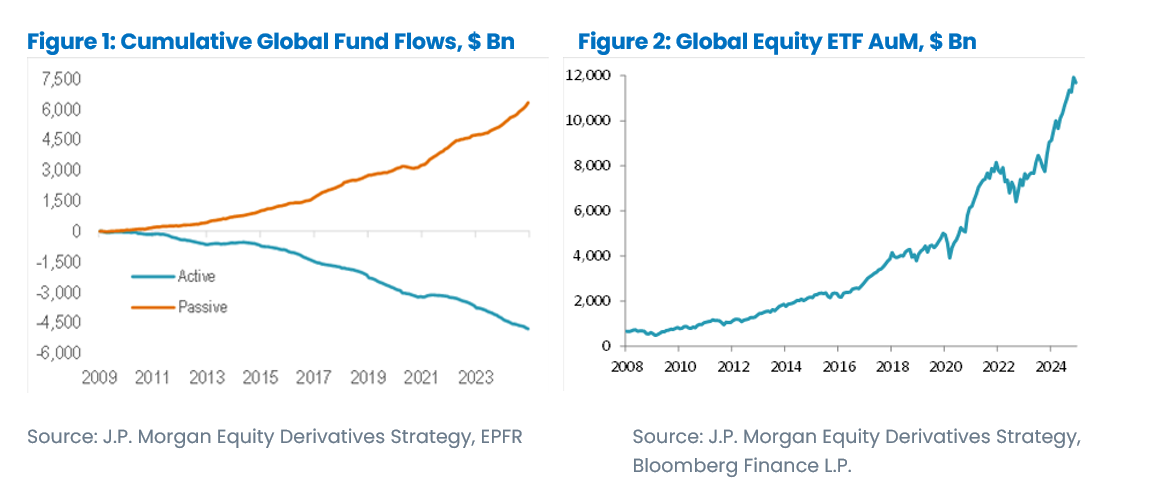

Il 2024 è stato un altro anno record per il settore passivo, con una forte crescita degli asset che ha superato il record del 2021. Inoltre, il 2024 ha segnato una pietra miliare significativa, poiché gli asset in gestione (AuM) gestiti passivamente hanno superato quelli gestiti attivamente, come risultato di diversi anni di afflussi per i primi e di deflussi per i secondi.

Questa forza strutturale costante è di buon auspicio per il successo continuo della nostra strategia.

Fonte: Italiano: Strategia sui derivati azionari Morgan, EPFR Fonte: Italiano: Strategia sui derivati azionari Morgan, Bloomberg Finance L.P.

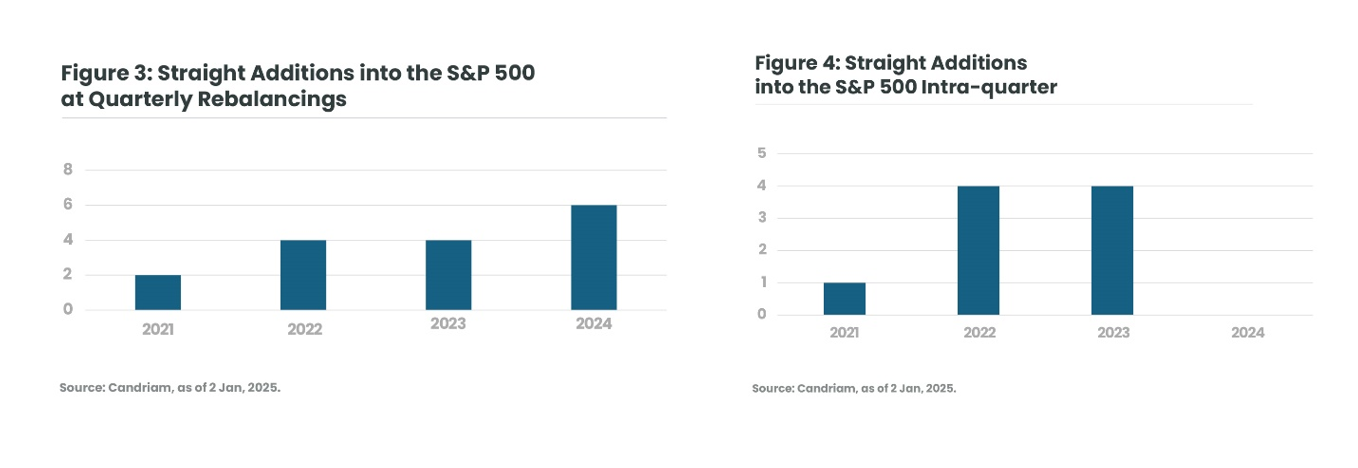

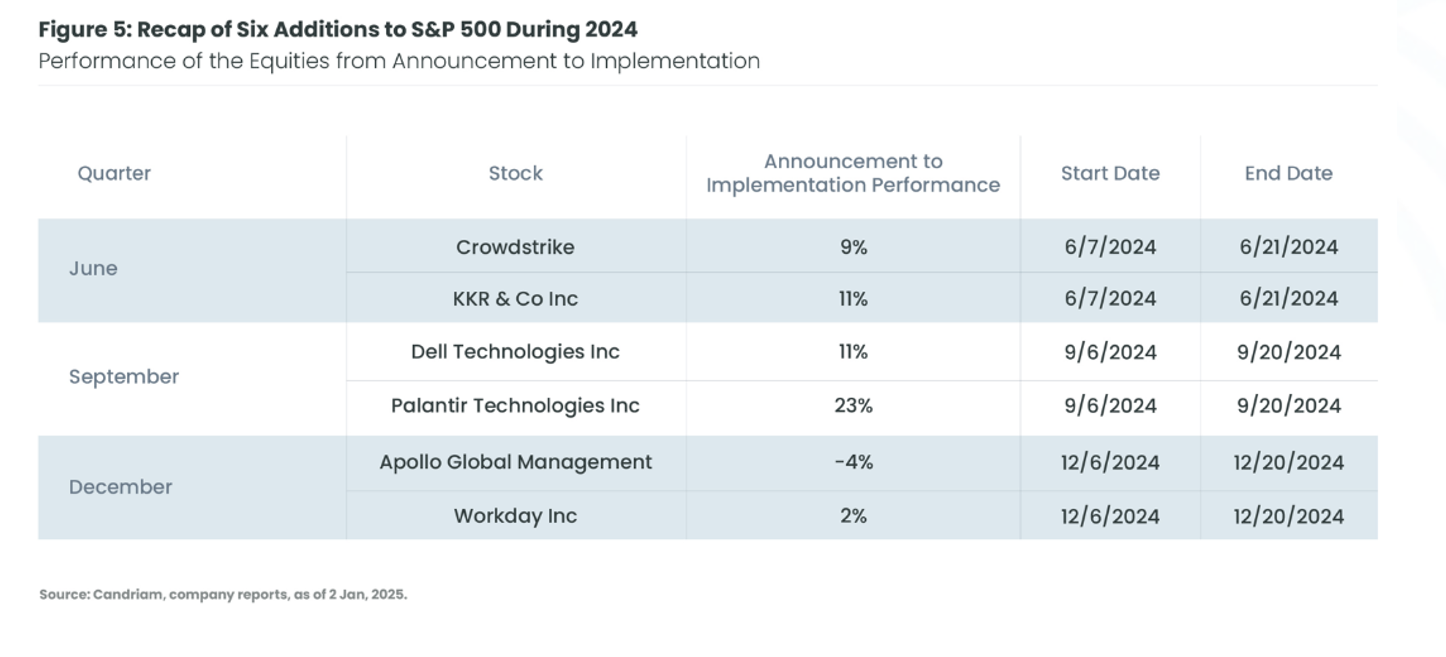

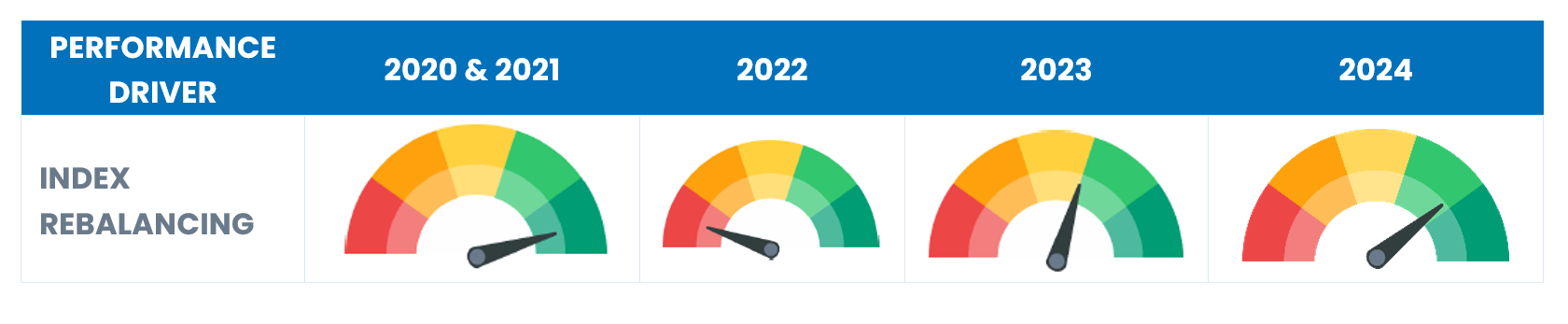

Nella seconda parte del 2024 e per tutto l'anno, la nostra strategia di ribilanciamento degli indici ha registrato buoni risultati. Nella seconda metà dell'anno la performance è stata trainata soprattutto dai ribilanciamenti trimestrali, che hanno registrato un turnover molto elevato. Infatti, sulla scia di due anni consecutivi di mercati rialzisti guidati dall'intelligenza artificiale e con un minor numero di transazioni M&A concluse, quest'anno si è assistito anche a un numero significativo di aggiunte dirette all'indice S&P 500 in occasione di eventi trimestrali, senza aggiustamenti intra-trimestrali.

Dopo la performance positiva delle aggiunte consecutive di giugno e settembre, la performance di dicembre, successiva al ribilanciamento, ha mostrato alcuni segnali di sovraffollamento, con una performance negativa di Apollo Global Management tra l'annuncio e l'implementazione. Tuttavia, il nostro approccio coerente ci ha consentito di generare rendimenti positivi dalle restanti operazioni di dicembre.

Per quanto riguarda gli incrementi intra-trimestrali, come delineato nella nota sintetica del primo semestre, l'attività è rimasta piuttosto contenuta rispetto agli anni precedenti. Tuttavia, tra le aggiunte più degne di nota all'indice S&P 400 ci sono state Docusign a ottobre e l'azienda di alimenti per animali domestici Chewy nello stesso mese.

Siamo certi che l'attuale contesto sia favorevole alla strategia.

Strategia relative value del valore relativo

Ricordiamo che la strategia relative value cerca di sfruttare le inefficienze a medio termine sulle valutazioni adottando posizioni lunghe su azioni sottovalutate (cosiddette economiche) e posizioni corte su azioni sopravvalutate (cosiddette costose).

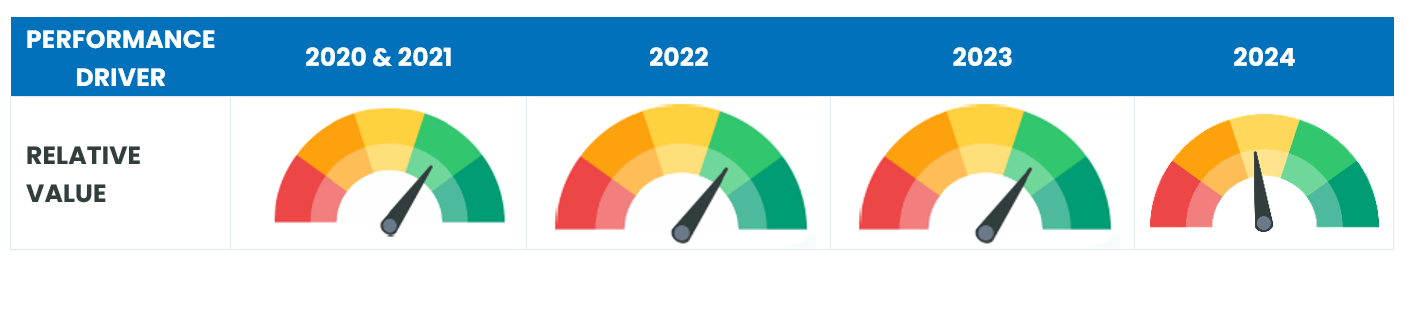

Come delineato nella nota di revisione del primo semestre, la strategia ha dovuto affrontare delle sfide dovute all’attuale contesto macroeconomico prevalente, caratterizzato dalle crescenti valutazioni dei settori tecnologici e dalla sensibilità di azioni potenzialmente sottovalutate al percorso di taglio dei tassi della Federal Reserve. I dati sull’inflazione sono migliorati e la Federal Reserve ha implementato tagli ai tassi (50 punti base a settembre, 25 punti base a novembre), il gruppo del relative value ha dovuto affrontare condizioni più semplici, tuttavia, la posizione aggressiva della Fed a dicembre ha esercitato una pressione sugli spread di valutazione.

Analisi delle distorsioni di valutazione a lungo termine[1]

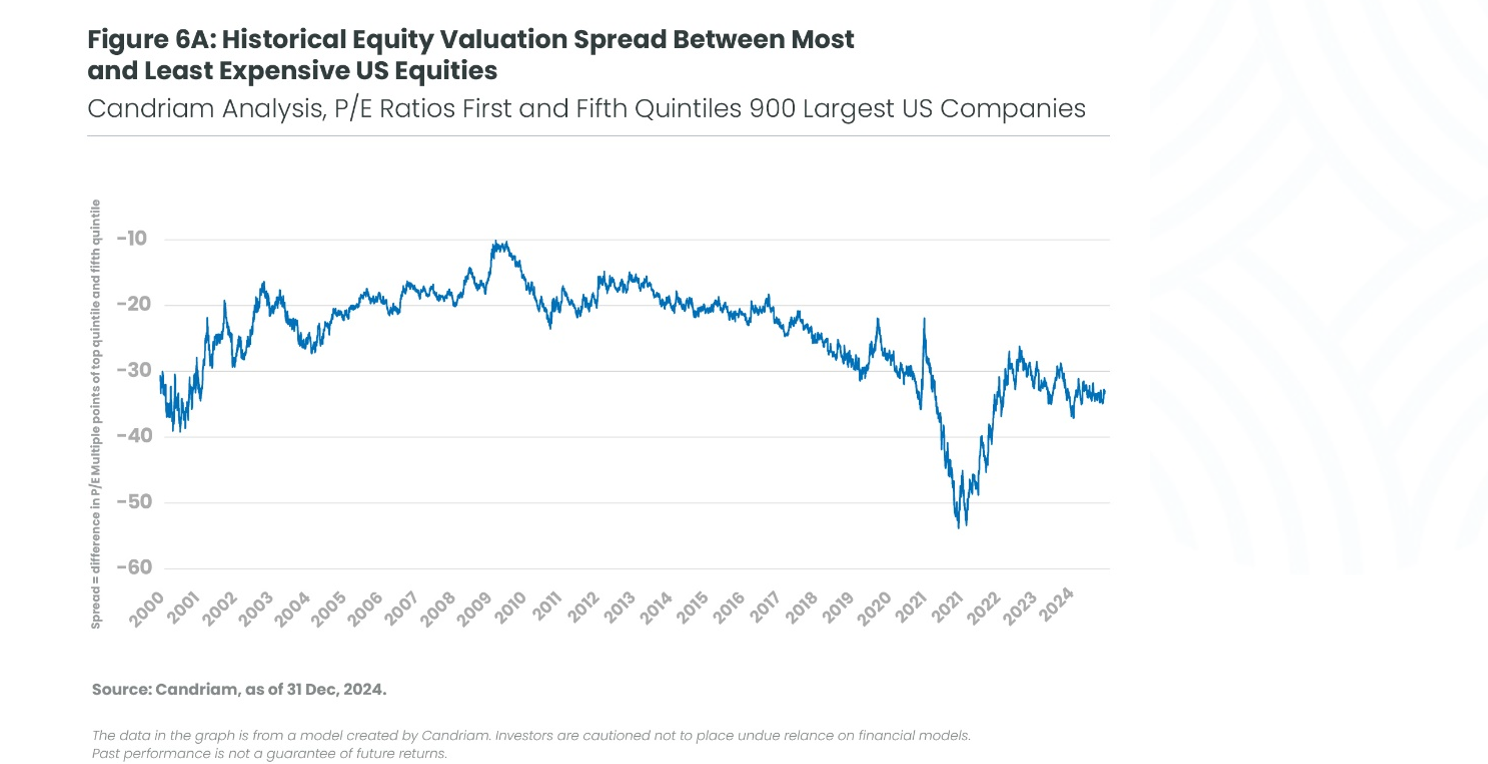

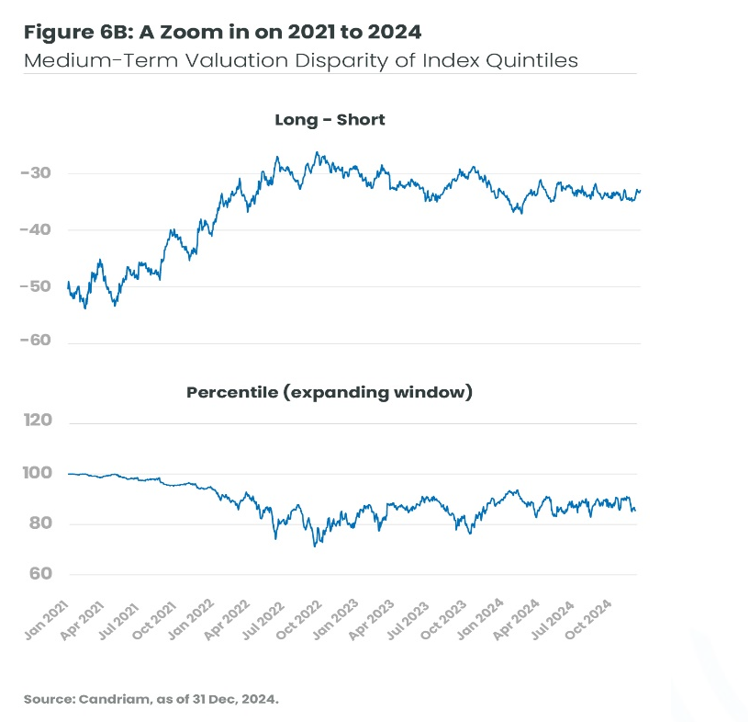

Riteniamo che la strategia del valore relativo sia particolarmente interessante nel contesto di valutazioni distorte. Nelle Figure 6A e 6B mostriamo i risultati di uno studio condotto da noi sugli spread di valutazione storici.

Un'analisi preliminare indica che, fatta eccezione per il 2021, all'inizio del 2025 gli spread si attestano su livelli storicamente elevati, prossimi a quelli registrati al culmine della bolla tecnologica all'inizio del 2000. In quel caso, gli spread elevati furono seguiti da una forte inversione di tendenza in seguito allo scoppio.

La figura 6B mostra una visione più dettagliata degli ultimi quattro anni, illustrando il percentile corrispondente ed espandendo il grafico (la scala di sinistra corrisponde a questi quintili dell'anno 2000, come da nostro studio e dalla figura 6A).

Dopo i livelli record degli spread del 2021 e fino alla fine del 2023, si è registrato un significativo restringimento degli spread nell'universo di studio. In quei due anni, le nostre strategie di valore relativo hanno contribuito positivamente alla performance della nostra strategia EMN.

Come mostra la Figura 6B, si è verificato un ampliamento degli spread di valutazione all'inizio del 2024, sia a giugno che a fine dicembre. In molte occasioni gli spread hanno raggiunto la soglia del 90° percentile, il che indica distorsioni storicamente notevoli.

Alla luce di queste osservazioni, siamo fermamente convinti che il nostro portafoglio sia ben posizionato per beneficiare di una regressione alla media su entrambi i fronti.

Nota: Questa è una “finestra in espansione”. Ciò significa che il percentile mostrato nel grafico è il percentile basato sui dati giornalieri da gennaio 2001 fino a quel punto (data) nel grafico.

Prospettive per il 2025

L'effetto del ritorno delle M&A sugli indici

Sebbene nel 2024 si sia registrata un'attività di M&A maggiore rispetto ai due anni precedenti, prevediamo che il 2025 sarà un anno positivo negli Stati Uniti, sostenuto dal calo dei tassi di interesse e da un contesto normativo più favorevole. Durante la precedente amministrazione statunitense, la presidente della Federal Trade Commission (FTC), Lina Khan, adottò un approccio rigoroso alle questioni anti-trust, che portò alla risoluzione di alcuni accordi e dissuase alcune aziende dal perseguire fusioni o acquisizioni. Il neo-nominato presidente Andrew Ferguson ha promesso di guidare una FTC destinata a “restare al suo posto” dopo “quattro anni di assalto normativo alle aziende americane”.

Di conseguenza, prevediamo che questo contesto in evoluzione avrà un impatto significativo sul numero di ribilanciamenti degli indici e ci offrirà numerose opportunità di arbitraggio di ribilanciamenti ad hoc intra-trimestrali.

Nuovo anno, nuove regole?

Nel 2024 un numero significativo di fornitori di indici ha avviato consultazioni in merito alle proprie regole.

Descriviamo alcune delle consultazioni che potrebbero avere interessanti ricadute sul commercio su alcuni temi chiave:

Ridurre la concentrazione all'interno degli indici

Uno dei temi principali per il 2024 è stata la concentrazione su una grande componente tecnologica, trainata da uno slancio positivo.

In seguito al feedback positivo dei partecipanti al mercato, il fornitore dell'indice FTSE Russell ha deciso di implementare una metodologia di limitazione sui suoi indicistatunitensi a partire da marzo 2025. [2]Nello specifico, il Russell 1000 Growth Index soffre di problemi di concentrazione, che dovrebbero essere corretti dalla nuova metodologia, simile al ribilanciamento del Nasdaq Special del 2023.

Sebbene i flussi possano variare prima dell'implementazione, prevediamo flussi di vendita molto ampi su alcuni dei nomi dei "Magnifici 7" come Nvidia, Apple, Microsoft, Google e Amazon.[3]

Questa modifica delle regole è simile a quanto fatto da S&P a settembre, quando ha modificato le regole di limitazione dei propri indici, un'azione che ha avuto un impatto immediato sul settore Technology Select.

Aumentare il numero dei ribilanciamenti ricorrenti

Dopo una consultazione durata 15 mesi, FTSE Russell ha annunciato una modifica alla tempistica della sua ricostituzione annuale. Solitamente si tratta del più grande evento di liquidità dell'anno e, a partire dal 2026, verrà implementato semestralmente. La data di giugno rimarrà invariata e l'altra ricostituzione avverrà a fine novembre.

La decisione è dovuta alle preoccupazioni relative alla dimensione sproporzionata della ricostituzione risultante dal metodo attuale; i calcoli iniziali di Russell indicano che la somma dei fatturati di due ricostituzioni supererà l'attuale fatturato annuale.

In futuro, prevediamo che questo cambiamento avrà un effetto molto positivo sul trading, creando maggiori opportunità di arbitraggio per la strategia.

Ulteriori opportunità derivanti dalla domiciliazione aziendale

Infine, mentre il 2023 e il 2024 sono stati caratterizzati dalla cancellazione delle azioni dall'Europa agli Stati Uniti, il 2025 potrebbe vedere un nuovo sviluppo nel campo delle quotazioni di più società.

Per contrastare l'esodo dall'Europa, la FCA (Financial Conduct Authority) del Regno Unito ha avviato una consultazione per modificare la propria struttura di quotazione e semplificare l'idoneità al FTSE. A ottobre, Coca-Cola Europacific Partners ha presentato domanda di licenza commerciale, una mossa che potrebbe comportare un cambio di nazionalità per l'azienda secondo le regole FTSE. Se la liquidità sarà sufficiente, la società potrebbe essere aggiunta all'indice FTSE 100 a marzo. La società farebbe quindi parte sia dell'indice FTSE che del Nasdaq 100

[1] Descriviamo brevemente la metodologia dello studio mostrata nelle Figure 6A e 6B:

- Sulla base di un universo composto da società statunitensi a grande e media capitalizzazione, abbiamo costruito due tipi di portafogli in base ai loro rapporti prezzo/utile (P/E):

- Gruppo di azioni ‘economiche’: Il 20% dell'universo con il P/E più basso

- Gruppo di azioni ‘costose’: Il 20% dell'universo con il P/E più alto

- I portafogli modello vengono ribilanciati mensilmente.

- Abbiamo analizzato la differenza tra il P/E mediano del “portafoglio economico” e il P/E mediano del “portafoglio costoso” a partire dal 2000.

[2] Fonte: Metodologia di limitazione FTSE Russell

[3] I nomi delle aziende qui menzionati sono forniti solo a scopo illustrativo.