After a respite in July, August saw negative performances across the board for almost all asset classes. In G10 rates, investors in Japan suffered the least (-0.97%), whilst the UK posted the largest losses (-6.36%), followed by EMU peripherals at –5.34%. EMU core markets fared somewhat better at -4.71%, but with a sizeable distance away from US government bonds at -2.73%. Breakevens were positive across the board, although barely so in the eurozone.

In Credit, Senior Debt outperformed subordinated issues. Reflecting performance in government bonds, Euro corporates underperformed their US peers, but credit quality was not a major determinant of performance.

Commodity currencies again were the strongest outperformers vs. the EUR (CLP, RUB, MXN and BRL). The USD was up 2.83%. Relatively few major currencies ended the month softer against the EUR, but noteworthy among these were the JPY (-1.24%), HUF (-1.62%), GBP (-1.95%) and SEK (-3.51%). Fundamentally, our economic outlooks for both the US and Europe remain unchanged. We continue to believe it is more likely than not that the US can avoid a full-blown recession, although this remains a distinct possibility. In Europe, persistently high natural gas prices now appear to the most likely economic backdrop for the rest of the year and into 2023.

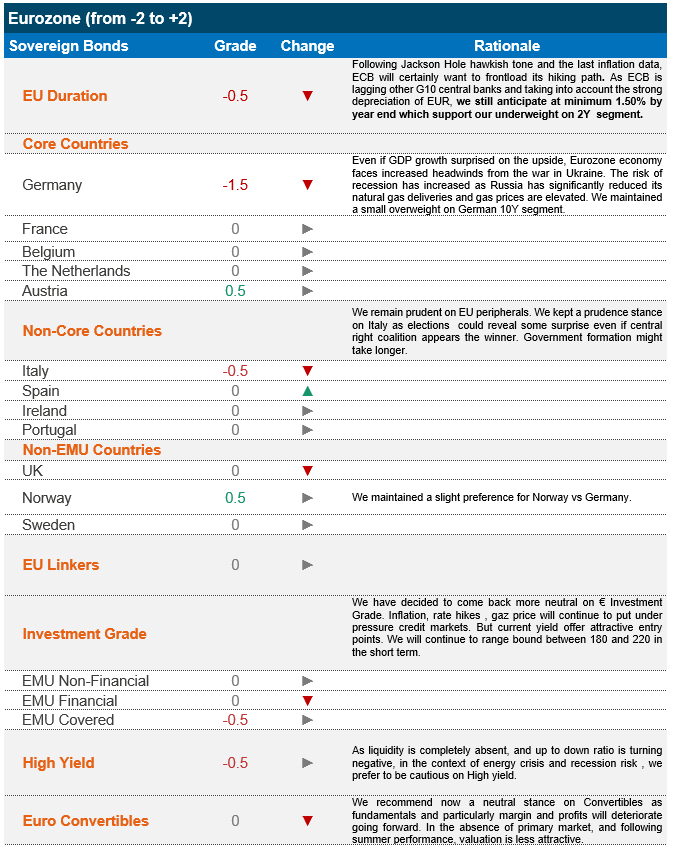

Inflation may have temporarily peaked in both the US and the eurozone, but central banks have little control for the time being over wage growth, which could have second-order effects by pushing producer and finally consumer prices higher still. As many observers had expected, Jerome Powell seized on the opportunity of Jackson Hole to put the US public on notice that some pain would be inevitable in the fight against inflation. This also served as a hawkish reminder to markets that the Fed has no intention of pivoting in a dovish direction as the economy slows. Although any previous doubts were likely based on misapprehensions, his affirmations did not fail to have their intended effect, and risk appetite turned negative. The Fed funds curve is now fully aligned with the FOMC “dot plot”, with markets expecting a peak of 4% in 2023. It bears repeating that slowing inflation growth will not be enough; the economy will need to traverse a period of dis-inflation in order to bring price increases back down to its mandate level of 2%. Accelerating quantitative tightening underlines the Fed’s willingness to stay the course. Indeed, expiring treasuries are insufficient to meet its targets of balance sheet reduction – which should lead the Fed to also tap into its holdings of short-dated paper. Growth in the US is already showing signs of slowing, but a full-blown recession still doesn’t seem the likeliest outcome. In the EMU, however, given the region’s greater exposure to the energy crisis caused by Russia’s invasion of Ukraine, the slowdown will be more acute. Nonetheless, in her comments following the latest 75 bps rate hike, Christine Lagarde also struck a decidedly hawkish tone. With previous inflation forecasts having been too low, the bank’s credibility in its willingness to fight inflation was at stake. In the UK, meanwhile, inflation growth has shown no signs of abating, while growth has been slowing more quickly than in the US or eurozone. Inflation has been a great worry for central bankers and citizens across the developed world, but the picture may be more nuanced in Japan, where policymakers have for a long time sought unsuccessfully to provoke inflation. Higher prices – driven there as elsewhere by energy – is feeding through into producers’ and consumers’ price expectations. With the government having introduced legislation to incentivise wage increases as well, the world’s third-largest economy may now have an opportunity to exit its deflationary spiral.

Credit remains volatile. In the EUR HY segment in particular, fundamentals are broadly holding up, but we are now seeing an increase in downgrades and more “fallen angels” than “rising stars”. Many firms in this segment currently prefer to use credit lines with banks for their financing needs rather than refinancing on the market (the flipside of this is increased issuances of European financial issuers). The picture looks different in the US, where significant issue volumes are expected in both IG and HY. Convertible bonds also suffered big losses. Like the US HY market, we expect a wave of new issues in a market that has been hungry for primary market activity for a long time.