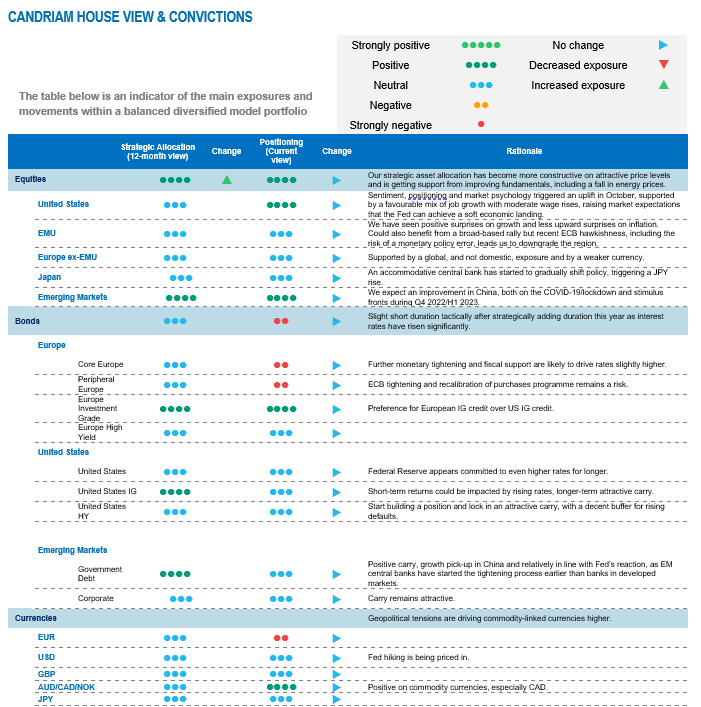

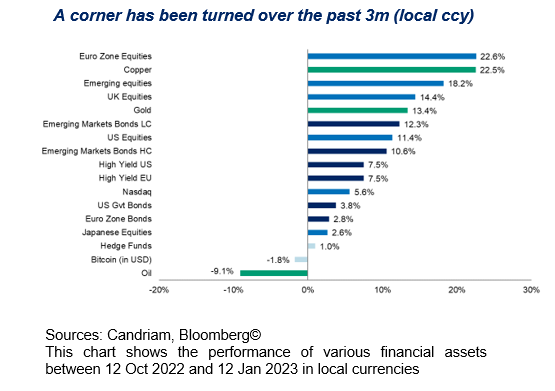

We have started 2023 with a preference for equities over bonds, as our investment strategy turned more constructive on attractive price levels in October. This allocation is paying off, and European and emerging assets have made a particularly favourable start to the year. Here, relatively high temperatures are driving gas prices lower, and there, China’s re-opening to the world after three years of isolation is giving a fresh boost to the global economy. As investor positioning and market sentiment are neutral, but not euphoric, the rally may not be over. However, the rise in risky assets is likely limited to the upside by the actions of central banks, which will ensure that financial conditions do not ease too quickly if the economy is holding up well.

Navigating the challenges of 2022

Candriam’s Multi-Asset strategy has navigated between anticipation and adjustment to the challenges of 2022.

- The war in Ukraine. We reduced equity positions to neutral in February, shortly before the conflict in Ukraine broke out (we were previously overweight, with a preference for Europe and Emerging markets, as the outlook was relatively good if we look back to the beginning of the year).

- Accelerated monetary tightening by central banks. Regarding bonds, we have been negative (underweight, short duration) for quite some time, anticipating a rise in interest rates. In stark contrast to the previous situation, expected bond returns turned positive again in 2022, leading us to gradually lengthen portfolio duration. Today, we prefer quality issuers in the credit space with relatively neutral durations.

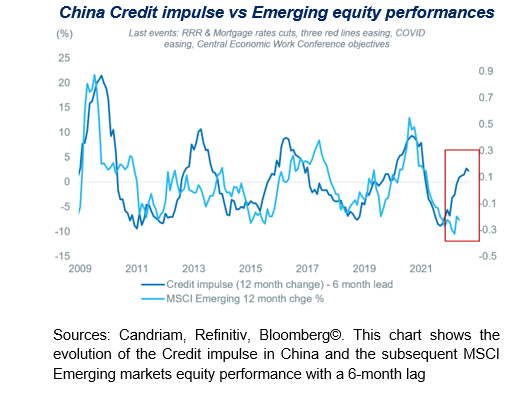

- China: Zero-Covid strategy. This approach resulted in strict lockdowns during 2022, which weighed on domestic demand as well as on exports, dampening global economic activity. With China accounting for 40% of the emerging market equity index, the entire asset class was negatively impacted. We anticipated a reversal of the restrictive health measures and maintained our positive view for a subsequent catch-up and rebound.

- Exaggerated pessimism at the beginning of Q4 2022. Our analysis of investor sentiment, market psychology and the technical picture indicated widespread and exaggerated pessimism. This extreme scenario and the depressed measures represented a buy signal and justified a market rebound. In this context, we decided in October to add risk to the portfolio via equities (US and Europe) and high yield bonds.

Overweight equities and IG Credit

While the beginning of the rally in financial markets in mid-October can easily be associated with an exhaustion in investor pessimism, several important shifts have fuelled performance since then. More specifically, many market participants have been surprised by the strength of the relentless risk-on moves and declining bond yields since the turn of the year. This is likely due to the consensus assumption expecting a weak H1 followed by a recovery in H2.

Looking into detail, we observe three notable shifts at the turn of the year:

- The end of “Zero-Covid” in China. Authorities have put an end to lockdowns and quarantine measures and clearly shifted towards pro-growth. Equity flows and valuations still appear underwhelming.

- An unseasonably warm winter in Europe. Gas prices have fallen sharply as temperatures have risen, leading to cooling inflation and an upward revised 2023 economic growth scenario for the eurozone of +0.8% in GDP.

- A more likely US soft landing. We still expect some pain to be felt on EPS but expect the Fed to keep driving the valuation considering its data-dependent approach.

We see equity markets moving within a broad range: limited to the upside by the actions of central banks, which will ensure that financial conditions do not ease too quickly if the economy is holding up well and supported by a faster monetary policy pivot if the economy is hit too hard.

Hence, we have a constructive positioning – i.e., overweight equities with a preference for emerging markets and IG Credit – with a controlled risk budget.

Our outlook for 2023

Our current economic scenario encompasses a deceleration in inflation and economic growth but without a severe recession, and we do not expect to see a lower market low than the one seen last October (unless an unexpected financial crisis hits).

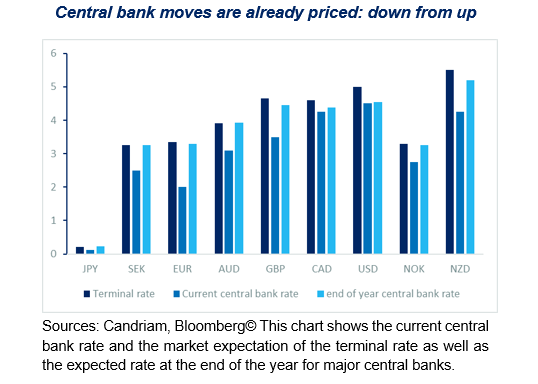

Central banks are slowing the pace of monetary tightening, aiming for a final target rate to be reached in 2023. The debate is not if central banks will keep on hiking, as markets have already anticipated it. For those central banks which began their tightening policy the soonest, it is about the duration of their hawkish policies.

As inflation expectations continue to decline despite China’s re-opening, the focus is shifting towards growth while maintaining financial stability. Downside risks would be a monetary policy error via over-tightening in the US or in the eurozone.

We expect emerging markets to outperform on a 12-month horizon, as valuations have become more attractive while Asia maintains superior long-term growth prospects vs. developed markets, specifically in a re-opening scenario with significant pent-up demand.

The likelihood of eurozone growth being severely hit by the natural gas crisis has decreased thanks to warm weather. As the labour market and consumption are holding up, we expect European assets to show resilience.

Regarding bonds, the carry that was reconstituted by the rise in yields in 2022 now looks more attractive. The deceleration in inflation should lead to a drop in volatility on bonds, allowing for an easing of volatility on other asset classes. In this environment, we also expect the positive correlation between equities and bonds to decline and Alternative investments to perform well.