Last week in a nutshell

- The FOMC minutes confirmed what financial markets had largely hoped for, thereby triggering a rather positive response. The Fed will dial down the intensity of its policy tightening, with the ultimate rate being likely higher than officials had previously thought.

- Global flash PMI showed a slight ease in the euro zone contraction. While Business sentiment remained subdued, cost pressures fell to their lowest in about a year.

- The European Commission discussed at what level to cap Russian oil prices to curb Moscow's ability to pay for its war without causing a global oil supply shock. As no decision was made, talks should resume shortly.

- The Vice-President of the European Central Bank, Luis de Guindos, thinks that the euro zone headline inflation appeared to have peaked. Preliminary November CPI estimates of several EU countries will help to fine-tune this assessment.

What’s next?

- As we enter the final month of the year, a rich combination of data stemming from the US labour-market, euro zone inflation and key flash GDP growth rate is expected. The data should contribute to investors’ assessment of the global economy.

- In the US, Federal Reserve Chairman Jerome Powell will speak at an event and the central bank will release its Beige Book. Investors will look out for additional hints for the next FOMC on December 14th.

- China will publish its November manufacturing PMIs. While the country has dealt with strict lockdown measures, majorly impacting the economy and people's lives, expectations are for an “optimistic” slight drop.

- OPEC+ (including Russia), will meet in Vienna. Committed to balance global supply and demand of oil, the alliance may announce an additional output cut as Chinese demand could be reduced again on recent lockdowns and the Western price cap on Russian oil may cause minimal, if any, financial damage to Moscow.

Investment convictions

Core scenario

- Our asset allocation has become more constructive on attractive price levels back in October and is now getting support from improving fundamentals.

- In October, our analysis on investor sentiment, market psychology and technical set-up pointed to widespread pessimism, revealing depressed measures. This extreme configuration was a buy signal.

- In November, we follow the more positive developing trend on equities but with a controlled risk budget. Returning buyback flows, short covering, and positive seasonality may very well give a tailwind. We keep a constructive, overweight equities, positioning into year-end.

- Central banks must strike a balance between the fight against inflation and the risk of financial instability. Hence, the next hike could be smaller but the terminal rate in 2023 could be higher than expected some months ago.

- Following the sharp rise in interest rates over the past year, short-term rates anticipations, and hence long-term yields, appear now relatively well anchored. We started adding fixed-income exposure to our portfolios via the high yield segment.

- We expect emerging market assets in Asia to outperform. Valuation has become attractive while the region keeps long-term superior growth prospects vs. developed markets.

Risks

- Upside risks include that central bank actions are nearly priced for peak hawkishness and weak sentiment and positioning. Chinese re-opening in 2023 would be a substantial support for the global economy.

- Further, governments in Europe are adding fiscal aid as the energy crisis deepens, which could mitigate its negative impact.

- Central bank anti-inflation stance is capping upside.

- Downside risks would be a new, harsh Covid-related Winter lockdown in China, a monetary policy error via over-tightening in the US or a sharp recession risk via a deeper energy crisis in Europe.

- Overall, an inflation decline and a rise in growth at some point in 2023 is limiting the market downside.

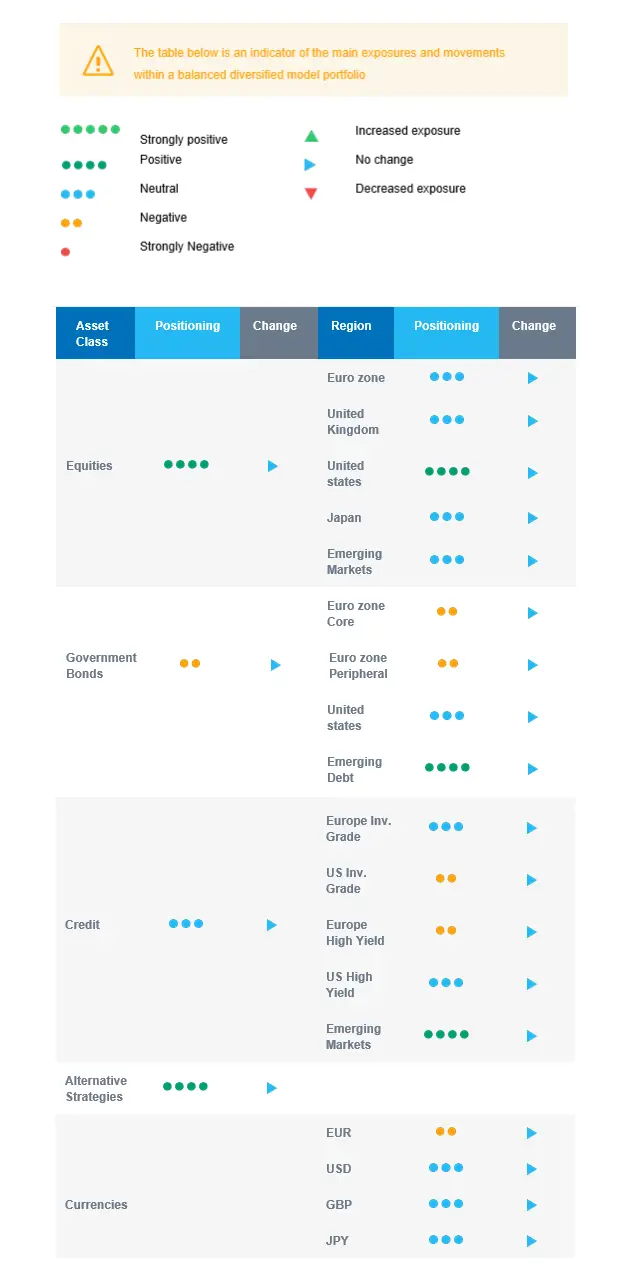

Cross asset strategy

- Our multi-asset strategy has become more constructive and overweight equities on attractive price levels but remains nimble and can be adapted quickly:

- Neutral euro zone equities.

- Neutral UK equities, resilient sector composition and global exposure.

- Overweight US equities.

- Neutral Emerging markets, but positive on Asian Emerging markets, expected to outperform as valuation has become attractive while the region keeps superior long-term growth prospects vs. developed markets. In the short term, there is room for a catch-up vs. developed markets.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure act as opposite forces for investor attractiveness.

- Positive on sectors, such as healthcare, consumer staples and the less cyclical segments of the technology sector.

- Positive on some commodities, including gold.

- In the fixed income universe, we have a slight short duration positioning.

- We continue to diversify into European investment grade credit and source the carry via emerging debt and Global high yield debt.

- In our long-term thematics and trends allocation: While keeping a wide spectrum of long-term convictions, we favour investment themes linked to the energy transition and keep Health Care, Tech and Innovation.

- In our currency strategy, we diversify outside the euro zone:

- We are long CAD and underweight EUR.

Our Positioning

Global economic growth and inflation keep slowing down, but we register positive surprises on growth and less upward surprises on inflation. Our current positioning is overweight equities with a preference for US and Asian Emerging equities. As European markets continue their upward trend, we took some profits on euro zone equities and slightly increased the allocation to Emerging equities. On the fixed income side, we keep a slight short portfolio duration and have an improving view on credit, including high yield. The latter looks attractive with a sufficient buffer for defaults. We remain allocated to commodity currencies via the CAD.