European equities: economic activity data surprisingly resilient

Starting in record territory at the beginning of January, the global stock market corrected aggressively in tandem with rising interest rates. Increasing inflation fears, confirmed by a significantly more hawkish Fed stance, were the most important driver behind this worldwide correction. Unsurprisingly, this went hand in hand with a clear preference for value sectors/regions/stocks, to the detriment of growth sectors/regions/stocks.

Starting in record territory at the beginning of January, the global stock market corrected aggressively in tandem with rising interest rates. Increasing inflation fears, confirmed by a significantly more hawkish Fed stance, were the most important driver behind this worldwide correction. Unsurprisingly, this went hand in hand with a clear preference for value sectors/regions/stocks, to the detriment of growth sectors/regions/stocks.

In December, headline inflation rose, mainly driven by rising food and goods prices. However, energy prices and gas supply remain a key risk. December and January sentiment and economic activity data were surprisingly resilient against the backdrop of rising COVID infections across the continent. The European Central Bank (ECB) signalled that rates are unlikely to rise in 2022, but it remains flexible in its future policy.

We expect that in the likely case of a recovery in economic activity in the second and third quarter, a further tightening in the labour market will slowly push the ECB into a more hawkish policy stance. This could be supportive for the euro in the second half of the year. Eurozone equities should benefit from any further improvements in supply bottlenecks and a pick-up in economic activity.

GDP was more resilient in Q4 2021 than suggested by the fall in mobility. Activity is now back to its pre-crisis level. Nevertheless, services were affected by the Omicron variant, as highlighted by the fall in the January service PMI, particularly in Italy and Spain. Business investment should continue to rise as demand expectations remain favorable.

The improvement in the labour market should support household income and consumption.

Supportive EU-wide fiscal policy and the cautious rebalancing of national public deficits should allow GDP to grow by 4.2% in 2022 (eurozone). Given the strong increase in consumer prices, the ECB has turned more hawkish. It could taper its APP faster than previously expected once its PEPP comes to an end in March, which would open the door for a rate hike after the summer.

Rising energy prices are a downside risk to our main scenario.

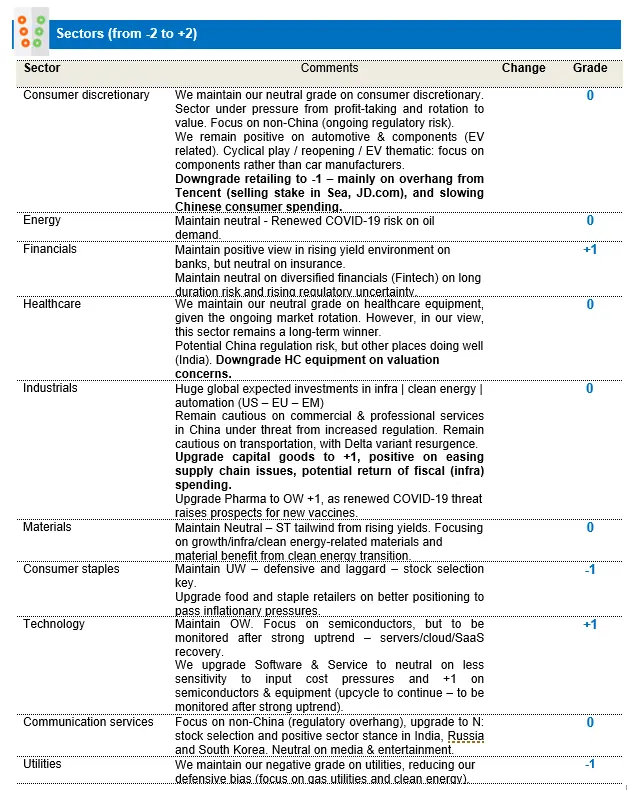

In terms of style performance, Value stocks have again outperformed Growth stocks over the last four weeks.

In terms of sector performance, we can see that IT stocks have again suffered the most over the last four weeks, with industrials, materials and consumer discretionary also negative. Conversely, communication services and energy performed very well.

Regarding Price-to-Book vs. Return-on-Equity, we can observe that, again, rather cheap sectors recorded the best performance, like financials and energy. Conversely, IT, which remains expensive, suffered the most.

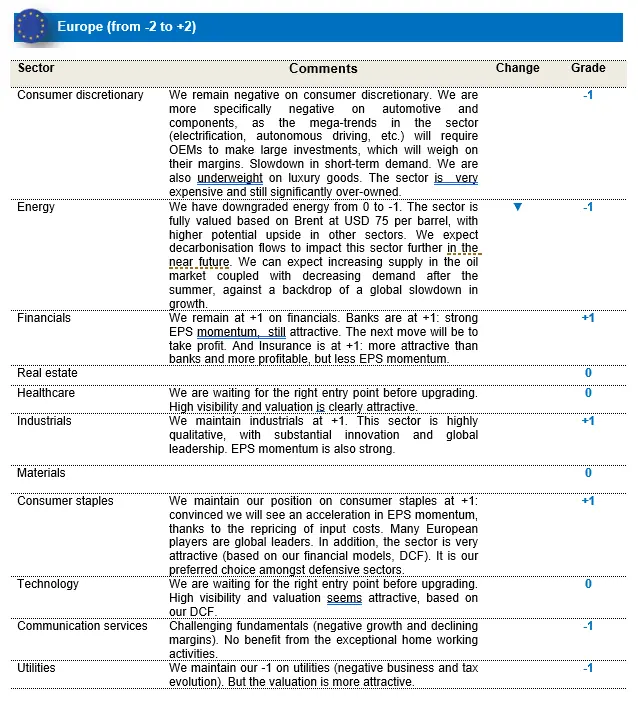

ENERGY DOWNGRADED

- We have downgraded energy from 0 to -1. The sector is fully valued based on Brent at USD 75 a barrel, with higher potential upside in other sectors. We expect decarbonisation flows to impact this sector further in the near future. We can expect increasing supply in the oil market coupled with decreasing demand after the summer, against the backdrop of a global slowdown in growth.

- We maintain our position on consumer staples at +1. We are convinced we will see an acceleration in the EPS momentum, thanks to the repricing of input costs. Many European players are global leaders. In addition, the sector is very attractive (based on our financial models, DCF). It is our preferred choice amongst defensive sectors.

- We maintain industrials at +1. This sector is highly qualitative, with substantial innovation and global leadership. EPS momentum is also strong.

- We remain at +1 on financials. Banks are at +1: strong EPS momentum, still attractive. The next move will be to take profit. Insurance is at +1: more attractive than banks and more profitable, but less EPS momentum.

- We remain negative on consumer discretionary. We are more specifically negative on automotive and components, as the mega-trends in the sector (electrification, autonomous driving, etc.) will require OEMs to make large investments, which will weigh on their margins. Slowdown in short-term demand. We are also underweight on luxury goods. The sector is very expensive and still significantly over-owned.

US equities: rough start to the year

Global equities dropped in the first month of the year. Investors were increasingly concerned about inflation, the Federal Reserve’s monetary policy tightening path and tensions in Eastern Europe. Developed markets ended the month more than 5% lower, with value outperforming growth stocks significantly. Energy benefited from rallying oil and gas prices, while financials were boosted by increasing US long-term yields. In this context, we have tactically downgraded the technology sector, which is being penalised by rising long-term rates, to neutral.

US economic activity accelerated significantly in the last three months of 2021. After a weaker Q3 due to the spread of the Omicron COVID-19 variant, real gross domestic product increased at an annual rate of 6.9% on the back of inventory rebuilding. In the meantime, supply constraints on goods are slowly easing, while business investments have no reason to decelerate, given a reasonable capacity utilisation rate (the percentage of an organisation's potential output that is actually being realised) of 76.5%. Consumption is also expected to hold up, supported by a further increase in demand for services, now that fiscal support is fading and spending on durable goods is weakening.

In this favourable economic environment, the labour market continues to tighten and employment continues to recover. As a result, wages are increasing at the highest pace in more than a decade. A very tight labuor market and high inflation figures have urged the Federal Reserve to gradually start hiking the Federal Funds Rate. Central bank Chairman J. Powell favours a gradual tightening, saying that a 50 bp hike in March is unlikely. However, the number of rate hikes priced in by the market has now increased to five in 2022. In this context, growth in 2022 should remain moderately above trend (3.9%) with higher inflation and rising energy prices as the most important downside risks to our main scenario.

The US earnings season is past halfway at the time of writing. Around 75% of all US companies, having already reported Q4 21 earnings, have beaten earnings growth expectations. The aggregated earnings surprise is close to 10%, which is more than decent, but less positive than in previous quarters. Materials and industrials are recording particularly strong earnings growth, with cyclicals faring much better than defensives this quarter.

Companies’ guidance is nevertheless also more cautious than in previous quarters, as earnings have now well recovered from the COVID-19 crisis, and analyst expectations are also moderate. Consensus expectations currently point to 8% earnings growth in the coming 12 months, which seems too cautious, taking into account the GDP growth expectations mentioned above.

If economic growth holds, we believe there is room for upwards earnings revisions. In this context, US equity market valuations have become a little more attractive at less than 20 times expected earnings, which is still above its long-term median, but for the first time in a long period, below one standard deviation.

Of course, as stated last month, the start of the Federal Reserve tightening cycle, and inflation and interest rate pressures result in more volatility.

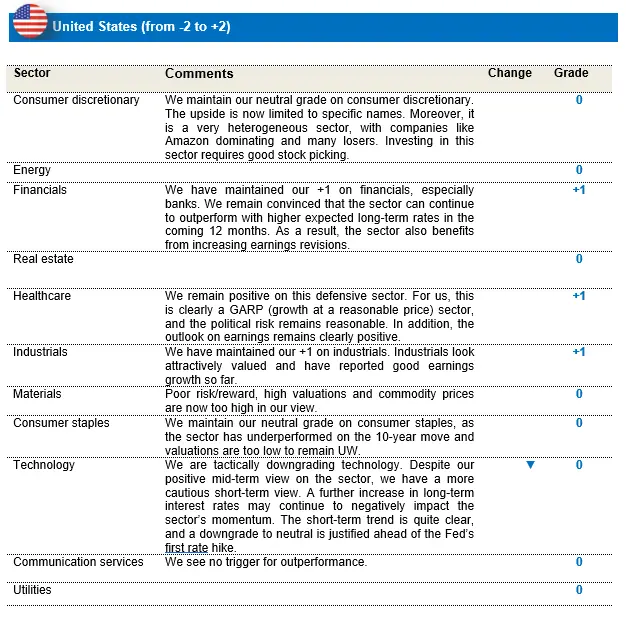

Tactical downgrade for technology

Equity markets have made a rough start to the year, and volatility is likely to continue for some time. Managing a diversified equity portfolio actively will be important. We expect the rotation between investment styles, such as value and growth, to continue. Currently, inflation is still high with more than decent economic growth, which is good for cyclical equity sectors. However, once the US central bank fights inflation and growth slows, the market will once again focus more on defensive, quality growth stocks. Structural growth stocks will then gradually return to the forefront. In this context, we have made no strategic changes, although we have tactically downgraded the technology sector:

- We have tactically downgraded technology to 0 from +1. Despite our positive mid-term view on the sector, we have a more cautious short-term view. A further increase in long-term interest rates may continue to negatively impact the sector’s momentum. The short-term trend is quite clear, and a downgrade to neutral is justified ahead of the Fed’s first rate hike. From a mid-term perspective, we still see a lot of value in the technology sector, which isn’t overly expensive. The sector continues to benefit from sequential economic growth, a slight cyclical aspect and the strong importance of innovative technology in many other sectors. In addition, several sub-segments, such as semiconductors, will benefit from a lengthened cycle on the back of current shortages.

- We have maintained our +1 on financials, especially banks. We remain convinced that the sector can continue to outperform, with higher expected long-term rates in the coming 12 months. As a result, the sector also benefits from increasing earnings revisions.

- We have maintained our +1 on industrials. Industrials look attractively valued and have reported good earnings growth so far.

- We remain positive on the more defensive healthcare sector. For us, this is clearly a GARP (growth at a reasonable price) sector, and the political risk remains reasonable. In addition, the outlook on earnings remains clearly positive.

- We remain neutral on materials. The risk/reward is poor, valuations are high and commodity prices are now reaching their short-term high in our view. Most commodity prices are above pre-pandemic levels.

- We maintain our neutral grade on consumer staples, justified by low valuations.

- We remain neutral on consumer discretionary. For us, this is clearly a sector in which stock picking remains vital.

Emerging Markets: Better performance than developed markets

January was a volatile month for global equities as markets came to terms with a more hawkish stance from the US Fed and other central banks in their quest to tackle to inflation pressure. As a result, MSCI AC World ended lower by almost 5% in one of the worst January performances, with a pricing expectation of 5 rate hikes this year. The sudden shift in monetary stance had a much worse impact on the longer duration equities.

Emerging markets ended in the negative territory, but did outperform the DM on a relative basis. The index heavyweight China, while still lower by 3% for the month, showed early signs of recovery, with the expectation of monetary easing to stabilize consumption and support growth. Taiwan was also relatively resilient (limiting losses at 2% for the month), as the semi-conductor giant TSMC delivered robust results. Still within Asia, Korea was the biggest drag (ending lower by as much as 10.2% for the month), despite the relatively tighter stance from Korean central banks last year.

The bright spot in the EMs was LatAm, led this time by Brazil (+12.9%), where markets recovered after a severe sell-off last year, perhaps thanks to expectations of easing inflationary concerns and an eventual economic recovery. CEEMEA was also a strong performer for January, with markets like South Africa recovering decently following December’s sell off due to omicron concerns. The geopolitical conflict and rising tensions between Russia and Ukraine weighed on Russian markets, which ended the month lower by 9.1%.

In the commodities complex, Oil continued to creep higher, as the supply squeeze and geopolitical concerns pushed Brent Crude as high as USD 90. Treasury yields gained 27bps in January on rising energy costs, inflation and a more hawkish Fed.

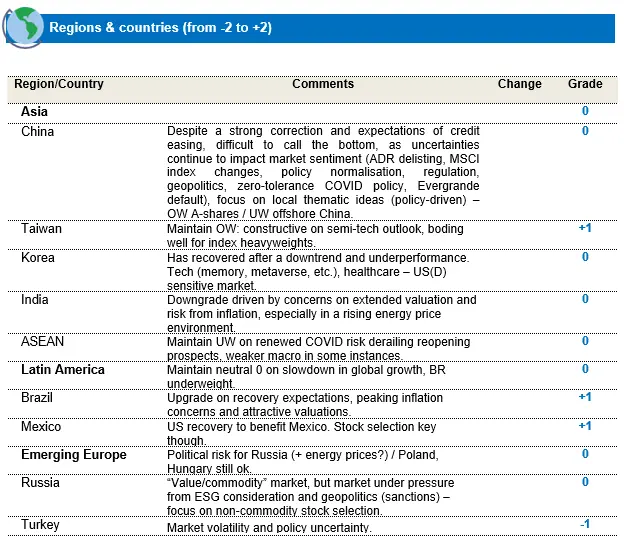

Changes to Regional views:

Downgrade India to neutral (0):

Downgrade driven by concerns on extended valuation and risks from inflation, especially in a rising energy price environment. After a strong performance over the last two years, Indian markets are losing momentum and the central bank remains supportive, raising the risk of falling behind the curve.

Upgrade Brazil to OW +1:

Following a sharp sell-off in Brazilian equities last year, we are seeing signs of a recovery in the market as valuations become attractive. Central bank rate tightening since last year could eventually be slowing going forward, as peak inflation concerns dwindle. Political stability expected, with Lula gaining political strength.

Regions with Positive view:

Taiwan: Maintain Positive view:

The region remains relatively better positioned from an earnings growth perspective versus other EM regions. As the risk of accelerated Fed tapering comes to the forefront, higher quality earning growth and supportive structural (cloud adoption) and emerging trends (metaverse) make us more constructive regarding the region. Continuing semiconductor tightness, despite slight normalisation, adding to the positive outlook for index heavyweights.

Mexico: Keep our Positive view:

The region is expected to continue to benefit from US recovery, supply chain diversification etc. We maintain our positive view, but remain selective.

Regions with Neutral view:

CHINA: Maintain Neutral view:

Our neutral stance on China remains unchanged, as we wait to see clearer signals of broader monetary support and credit easing. Unabated signs of consumption slowdown prevent us from taking a more positive stance on the region. Additionally, the restructuring requirement for a Chinese tech giant continues to keep technical pressure on China’s tech ecosystem – for instance, Tencent’s distribution of its stake in JD.com.

We also await more evidence of diminishing regulatory tightness before turning more positive. While expectation of monetary support and credit easing are gradually building in, it is likelier to be targeted support. MSCI Index changes concerning ADRs add to such concerns. China is maintaining its strict zero-tolerance measures to control COVID resurgence risks, probably at least until after the Beijing Olympics, which could continue to slow down some economic recovery during the period.

South Korea: Maintain Neutral view:

We maintain our neutral stance on South Korea, given the region’s strong correlation with global growth and exports, which might be nearing a peak. Upcoming political elections could also add to market volatility. A recovery in the memory semiconductor trend could, however, bode well for index heavyweights.

LATAM: Maintain Neutral view:

We continue to maintain our neutral stance on the region, with a relative preference for Mexico, while closely monitoring macro evolutions in Brazil.

Brazil: We continue to maintain our neutral stance on Brazil as we await clearer signals of any macro recovery. Despite depressed valuations, Brazil remains exposed to macro/ currency risks in the event of faster US tapering announcements.

ASEAN Maintain Neutral view:

Even though the region is showing reopening potential, we maintain our neutral view (downgraded last month) on concerns regarding Omicron and currency sensitivity to the tapering environment.

EM EMEA Maintain Neutral view:

While remaining constructive on a few EM EMEA regions including Poland and Hungary, we maintain an overall neutral view on EM EMEA, given geopolitical uncertainty in certain areas, peaking energy prices for Russia and South Africa’s recovery from the Omicron variant.

No changes for the month in sector ratings:

The rather sudden shift in the monetary stance from the Fed does call for caution in equity markets, especially as policy conditions have remained accommodative for a long time.

However fundamentals are little more optimistic for Emerging Markets, in the sense that China, the EM index’s heavyweight, had already embarked on a tightening spree since late 2020 and is now positioned to provide policy support if needed to spur growth, as indicated by the rate cut announced by PBOC earlier this month. This decoupling of US and Chinese economic cycles does support relative returns for EM equities after a muted 2021.

Yet we remain cautious in our positioning and have reduced exposure to longer duration equities that may continue to see a risk of derating as we enter the tightening cycle. At the same time, the portfolio has complemented with companies that have historically benefitted from a rising rate cycle, including adding to insurers and traditional financials in China, South Africa and Brazil. Additionally, at a regional level, we have taken a similar de-risking approach to reduce some overweight in India, where valuations were stretched and inflationary risk persisted on higher Oil prices, and allocating part of it to South Africa and Brazil, as these markets look promising on recovery prospects and risk reward. Given tensions between Russia and Ukraine, the strategy has largely reduced its exposure to Russian equities and has no exposure to Ukraine.

Overall, given the balanced portfolio positioning, we remain optimistic that the portfolio can navigate such periods of volatile equity returns.