Planet Metaverse: Searching for a place to land?

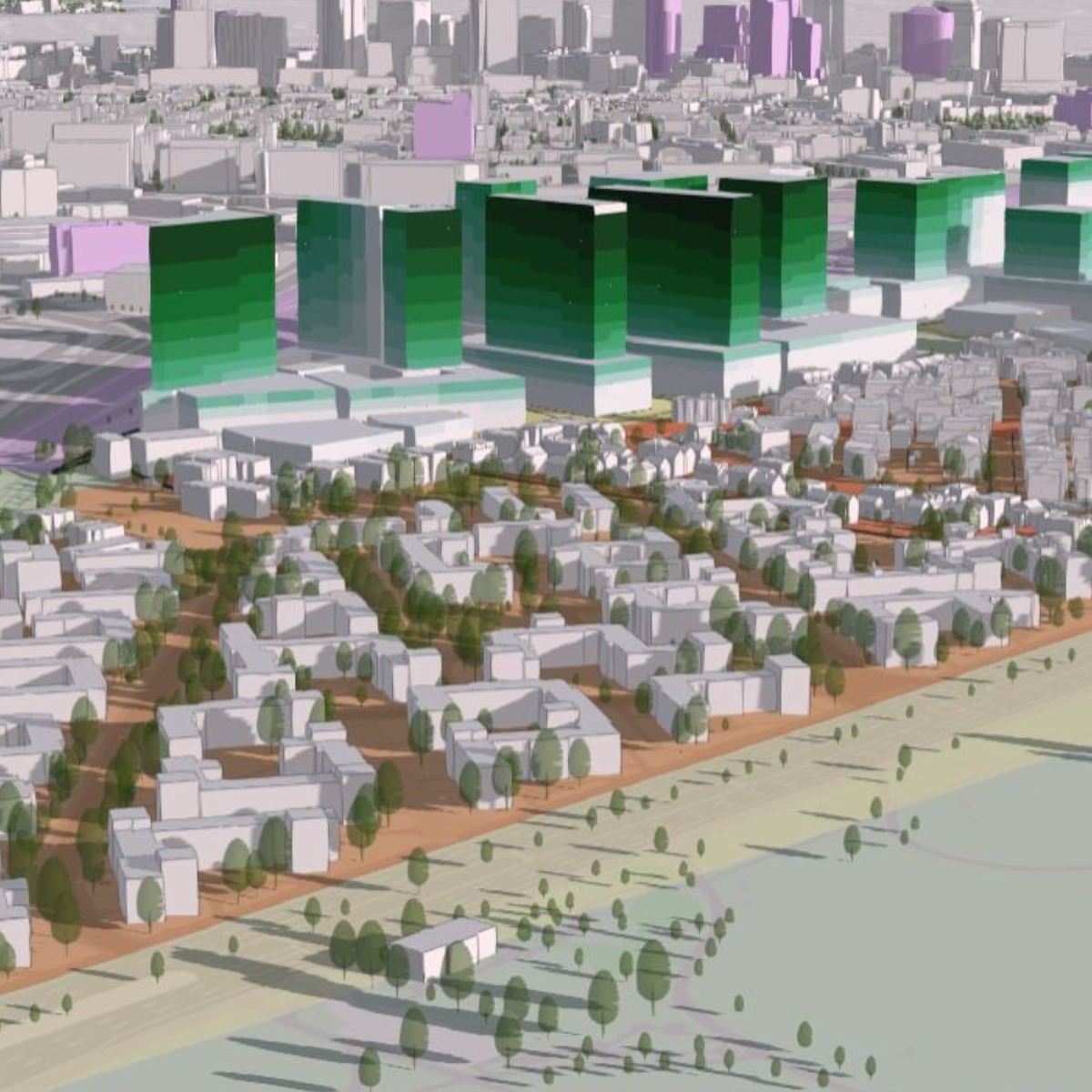

The Metaverse. The substitution of reality with the imagined – transporting the participant literally into a whole new world – will become possible for all kinds of products and services.

It is nothing short of a new technological revolution.

Driven by edge supercomputers, high-performance computing, new storage and connectivity capabilities, as well as the latest advances in data and content security.

The innovations that are bringing the Metaverse to life will open radically new dimensions for education, healthcare, media, entertainment and retail.

As the new technology is increasingly taken up by different sectors of the economy, this new market is expected to reach between USD 5 trillion[1] and USD 8 trillion[2]. It will be big and very diverse.

But here lies investors’ main challenge. The Metaverse can be used in all kinds of different ways – depending on the types of underlying products and services marketed - and with very different outcomes.

There are already concerns about the boost this technology can give to gambling, the echo chambers of extremism and political manipulation, and unlawful use of personal data. So how can investors navigate this exciting market without getting stuck in some nasty controversy?

It is easy to imagine that new technology brings light, peace and prosperity everywhere it goes. The reality can be very different. That is why Candriam’s new Meta Global Equity strategy’s distinctive approach centres around those areas where we are comfortable with how the Metaverse is going to be used:

The main risks of the strategy are risk of capital loss, ESG investment risk, equity risk, currency risk and ESG Investment Risk.

The non-financial objectives presented in this document are based upon the realisation of assumptions made by Candriam. These assumptions are made according to Candriam’s ESG rating models, the implementation of which necessitates access to various quantitative as well as qualitative data, depending on the sector and the exact activities of a given company. The availability, the quality and the reliability of these data can vary, and therefore can affect Candriam’s ESG ratings. For more information on ESG investment risk, please refer to the Transparency Codes, or the prospectus if a fund.

Get information faster with a single click