Precious metals, and gold in particular, have delivered a remarkable performance over the past three years, accelerating to a 65% appreciation in 2025.[1] This raises questions for investors: should they continue to increase their exposure in an asset that has risen so far, and so fast? What catalysts could prolong the trend? And what role should gold play within a diversified portfolio?

Protection or speculation?

The rise of the yellow metal can no longer be interpreted as a simple hedging move. Its traditional role as insurance against a more uncertain geopolitical backdrop has expanded to that of offering some asset class insurance. That is, equities and bonds once provided some diversification. As they become more correlated in volatile markets, gold now adds a decorrelated asset class, and hence diversification, to a portfolio. Now, it is gradually establishing itself as a genuine allocation choice.

- Central banks are reallocating their reserve holdings from dollars to gold. This could provide lasting support for the asset. This change appears structural, and not very sensitive to price.

- The macroeconomic environment has changed profoundly. Persistently low real rates, expansionary fiscal policies and growing questions about the sustainability of high public debt all strengthen the case for holding an asset that is independent of any sovereign entity. Gold is becoming a conviction asset and a natural balancing element in portfolios.

- The broadening of investment access, such as ETFs, ETCs, and similar products, allows a wider investor base, including retail, private wealth, and institutional. Investors no longer have to hold coins or bars.

We believe that recent moves are less reflective of speculation than a structural reallocation toward an asset that has become a strategic pillar. Today, gold combines two essential functions: a shock absorber in periods of stress, and a diversification engine in unstable markets.

Gold versus other diversifiers

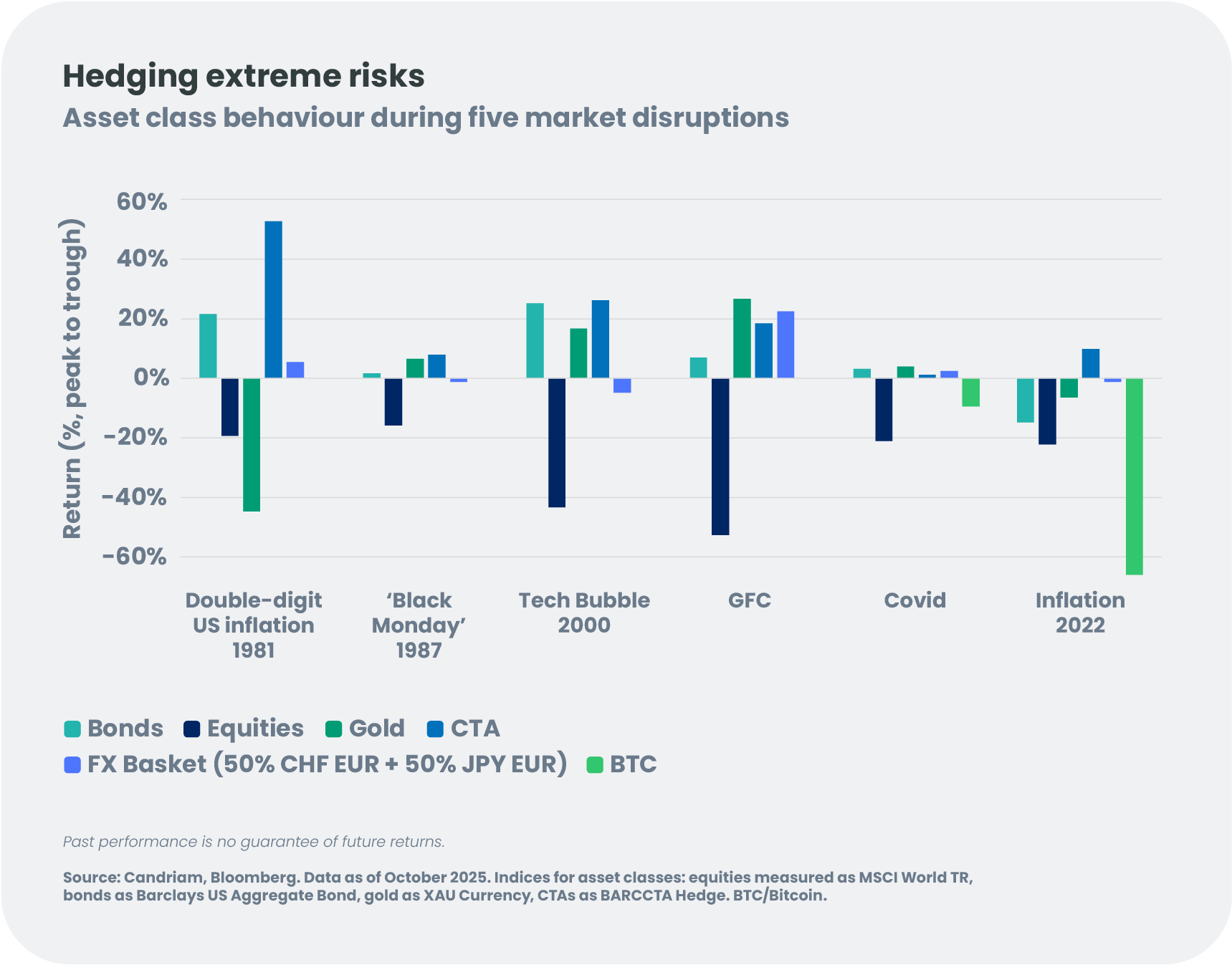

What about other traditional safe havens? They have followed mixed paths. Sovereign bonds have seen their diversifying power diminish as inflation returns and geopolitical tensions continue. The US dollar retains a central role for investment, but US fiscal deficit and the gradual diversification of investors away from the dollar continue to weaken its stability. The fallback currencies of the Swiss franc and the yen depend heavily on the domestic monetary policy choices of their individual governments.

Bitcoin, sometimes called ‘digital gold’, benefits from its finite supply but remains above all an opportunistic asset, strongly dependent on liquidity conditions. CTA[2] strategies, for their part, can provide useful diversification, particularly in directional phases or during extreme shocks.

In this fragmented landscape, gold stands out as one of the few assets that offers independence from sovereign risk, resilience in periods of recession, and a potential attractive risk–return profile.

How should investors protect portfolios in 2026?

These factors -– structural support, weakening of traditional hedges, increased need for diversification -– feed directly into quantitative analysis.

We examined two periods, a stable market regime from 1995 to 2017, and a period including more market disruptions from 2018 through 2025. We used a proprietary model to determine what in hindsight would have been the most desirable asset allocations under several different risk and return preference levels (that is, for several types of investors). This model allowed us to ask for a set of constraints ensuring sufficient diversification and preventing the model to offer merely theoretical portfolios that are unrealistic from a risk/return perspective, or difficult to implement in the market.

The key lessons learnt from this exercise were that an overweight of traditional assets, that is, bonds and equity, never provided the best risk-reward outcome in any year. In both types of long-term markets, extra value-added would have been generated almost exclusively by alternatives.

Between 1995 and 2017, equity markets and bond markets were generally decorrelated, and real interest rates were positive, rewarding traditional diversification. Gold appeared in the highest-return backward looking portfolio choices, but in an opportunistic way. CTAs added to diversification and historical portfolios, while safe-haven currencies were only modest contributors.

Since 2018, the change in the macroeconomic regime has led optimised portfolios to rely more heavily on alternative assets. Not just CTAs, but Gold has taken on a growing role, with ‘perfect hindsight’ allocations reaching more than 20% depending on risk/return objectives.

Gold has begun to perform not as a tactical asset, but as a structural component of risk-adjusted performance in an environment where traditional diversification has become less reliable. Of course, the past does not guarantee the future.

The renaissance for gold?

A gold revival appears underway: from a peripheral asset, data shows gold is becoming a strategic component of long-term allocations. Structural drivers including central bank purchases, macro instability and increased investment accessibility continue to enhance its appeal, while the limits of the equity–bond ‘duo’ are narrowing.

Optimisation exercises support this view: when performance targets are modest, the equity–bond combination is sufficient to reach the objective. Conversely, as higher returns are targeted, the gradual integration of gold and CTAs becomes essential to improve the risk–return profile.

The issue for 2026 is not whether to hold gold, but in what proportion to integrate it on a lasting basis – and, more broadly, to make use of other precious metals – as a defensive anchor and strategic component in a portfolio designed to navigate a more uncertain future.

[1] Goldprice.org, Dec 31 to Dec 31, accessed 7 January 2026. Past performance is no guarantee of future returns.

[2] Commodity Trading Advisor strategies, otherwise alternative investments such as trend-following strategies, mean-reversion strategies, systematic trading approaches, etc.