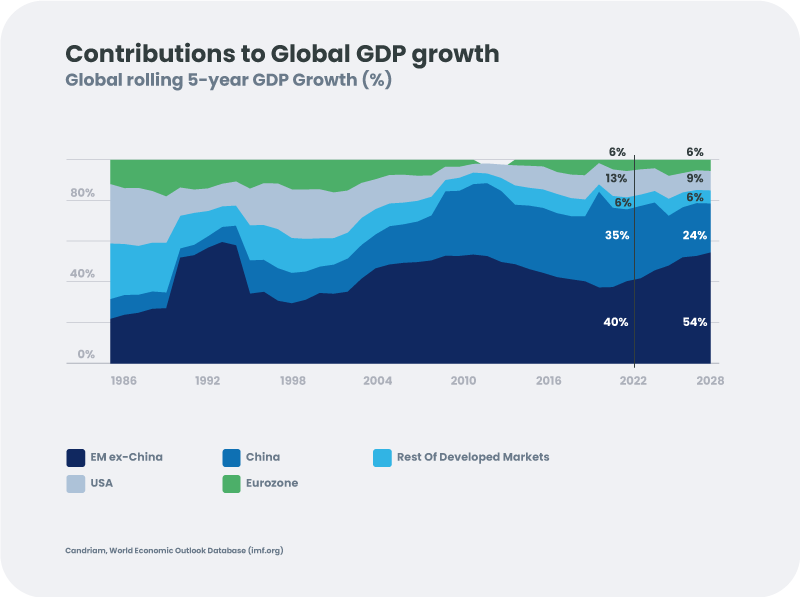

In an ever-evolving landscape marked by geopolitical tensions, the fore fronting of climate change, and a global economic reorientation, a discernible megatrend is unfolding. Growth is gradually shifting to developing countries outside of China, a shift intensified by demographic advantages and a changing global economic structure. While geopolitical rifts foster near-shoring, some developing nations face challenges as their once advantageous demographics now pose risks due to an aging population. The transformative impact of climate change and AI-driven automation further complicates the global economic equation.

The global trade cards are being reshuffled

The 90s witnessed the rise of the modern technological revolution, leading to the outsourcing and offshoring of production to countries with cheaper labor and more relaxed environmental standards. Reshuffling supply chains or “China plus one” strategies create opportunities for many other developing countries, especially in Mexico, India and South East Asia, where global corporates have started to invest in alternative supply chains.

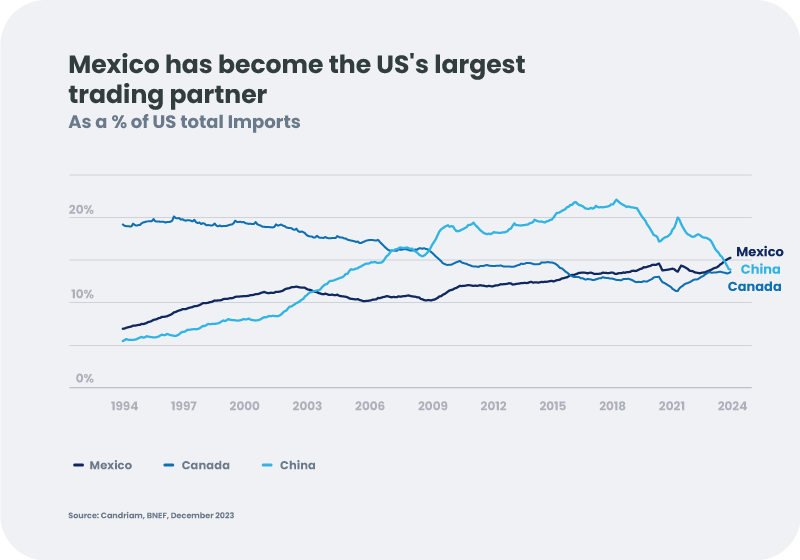

Mexico has emerged as an early winner given its geographic proximity to the US, and has already become the largest trading partner to the US. Back in Asia, supply chain diversification efforts are providing growth tailwinds for manufacturing and export driven companies in India – in sectors like Pharma, Biotech and Electronics manufacturing.

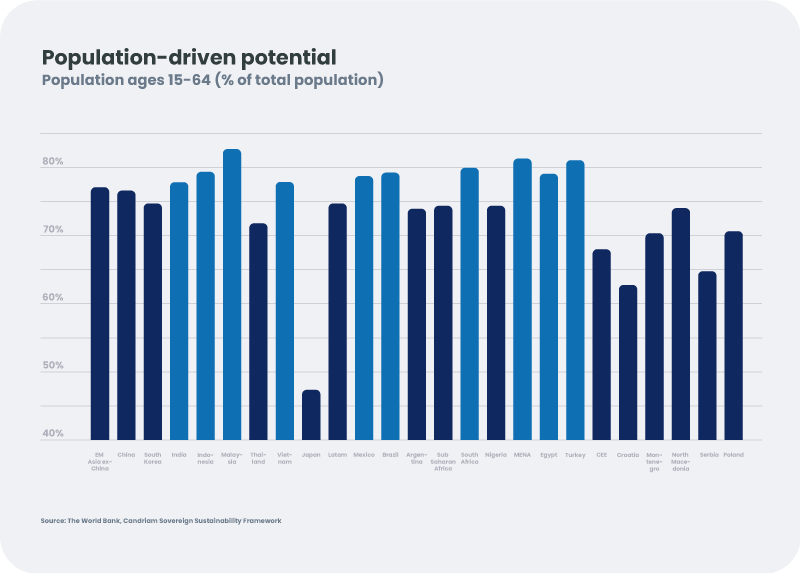

When considering the potential of each country to benefit from the new decarbonized global economy we need to consider population dynamics, and the country’s capacity to take an active part in the transformation and exploit new sources of demand domestically and more locally.

Demographic dividends are tilting in favor of new leaders in emerging markets

China has benefited from a substantial percentage of working-age individuals in its population for many years; however, it is now undergoing a demographic shift towards an aging population as it develops. To gain a clearer perspective, we must consider various factors that impact future demand growth. Our sovereign sustainability model provides additional insights into the growth prospects of each region and country. Adjustments to the working-age population figures are necessary to account for labor market conditions, including gender composition, labor force participation, sectoral profiles, and working conditions. Additionally, the influence of healthcare systems extends to those above working age and very young individuals. Moreover, when assessing potential, the proportion of young people in each country should consider the quality and availability of education. Countries such as India, Indonesia, and Malaysia are poised to perform more favorably in the future based on this metric.

New alliances in energy transition are opening growth avenues for emerging markets outside China

The world is transitioning towards new technologies driving the electrification of the global economy, with a spotlight on battery technology and semiconductors. Critical minerals like lithium, nickel, cobalt, graphite and manganese, pivotal for EV batteries, face concentrated supply chains, primarily dominated by Australia and China. Geopolitical considerations and policies in the US and EU aim to reduce dependence on foreign supply chains.

In terms of mineral extraction, diversification efforts can be made, particularly in graphite where Europe and Brazil hold substantial reserves. Improved geological surveys in emerging markets are crucial, along with advancements in recycling technology. Presently, China dominates battery cell production, but Korea and Japan play vital roles downstream. With supportive policies and geopolitical shifts, other developing countries are due to potentially catch up.

The EU/US energy transition aligns with partnering countries outside China, providing growth opportunities for other developing countries. Acts such as the EU Critical Materials Act[1] and US Inflation Reduction Act[2] lay the foundation for energy transition opportunities in countries like Korea[3], Indonesia, and Latin America.

Emerging markets ex China regions that are central to the AI technology value chain

The global semiconductor supply chain is dominated by Taiwan and South Korea, regions that have a high representation in emerging markets ex-China. A closer examination of the rich AI value chain in developing countries reveals their pivotal role in providing the essential infrastructure for the global AI gold rush, from semiconductor and hardware manufacturing hotspots in Asia to the emergence of innovative technologies like High Bandwidth Memory and chip-on-wafer-on substrate. As a result, these regions appear as key drivers of structural and technological developments across the AI supply chain, potentially promising substantial growth in the years ahead.

In conclusion, investing opportunities in emerging markets go well beyond China, and are at a pivotal moment. Favorable demographic dynamics, positive geopolitical shifts, and opportunities in energy transition and semiconductor supply chains may position these markets to lead global growth sustainably. It shouldn’t come as a surprise that emerging markets ex China are expected to be the biggest driver of global growth in the coming years. The execution and delivery on these growth opportunities will determine their role as significant contributors to global economic expansion. As the world looks towards them, these markets must rise to the occasion, navigating the path to sustainable and robust growth in the ever-changing global economic landscape.

This communication is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

[1] European Critical Raw Materials Act (europa.eu)

[2] Inflation Reduction Act, CHIPS Fuel Construction Boom With Intel, TSM and Samsung Key Players Investor's Business Daily (investors.com)

[3] EU and Republic of Korea - Green Partnership (europa.eu)