Real estate markets, and real estate investing, have felt ‘frozen’ for most of 2023. Property valuations are under pressure and refinancing is more difficult. Yet under the ice, investors and managers have been positioning for a warmer season.

Property under Pressure

With volumes plummeting due to the rapid rise in interest rates, transaction numbers in Europe are struggling to reach 20% of their pre-pandemic levels.[1] With the market starved of pricing information, over the last 18 months, valuers and appraisers have largely based property price estimates on interest rate changes. The scale and volatility of credit costs has meant that in most sectors, capitalisation rates have increased significantly, driving down appraised values. The magnitude of the mark-downs has been somewhat mitigated by the relative strength of the leasing/rental markets, and by indexation arrangements which have actually increased net operating income.

While prices have declined across the market, the magnitude has differed by sub-segment. Some segments are near a bottom, while others are likely to see further price declines.

Prime European central business district rental yields were about 4.5% for the first half of 2023, up 86 bps over the year-prior period, according to Savills.

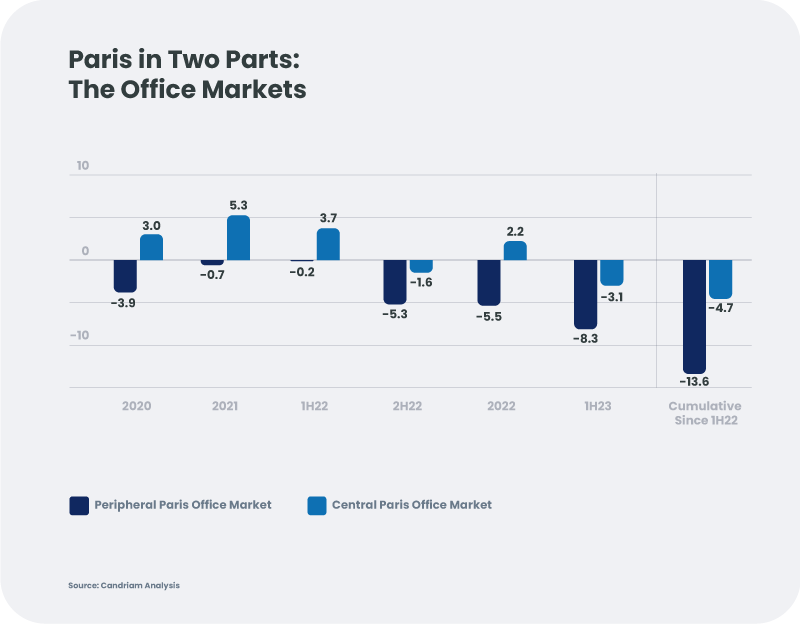

The recent Greater Paris office market has bifurcated, with Central Paris valuations declining in the mid-single-digit range, while peripherical regions have seen mid-double-digit declines since mid 2022, albeit from different base levels. Average net initial yields reached 6.5% in la Défense, while prime Central Paris business district assets reported rental yields of about 3%.

Retail landlords in Europe have faced greater property valuation losses than most other segments. Since the first half of 2022, valuations of prime shopping centres in continental Europe have declined only about -3%, while they have fallen about -15% since 2018 and now offer net initial yields of about 5.5% as of H1 2023.

Refinancing needs high, but lenders are shy

One result of the slow pace of transactions has been a surge in refinancing. Those in need of refinancing have turned to private capital sources in particular. Bank lending appetite has fallen dramatically while banking regulatory changes are biting. Issuers have responded to the lack of appetite for senior unsecured debt by offering security to banks.

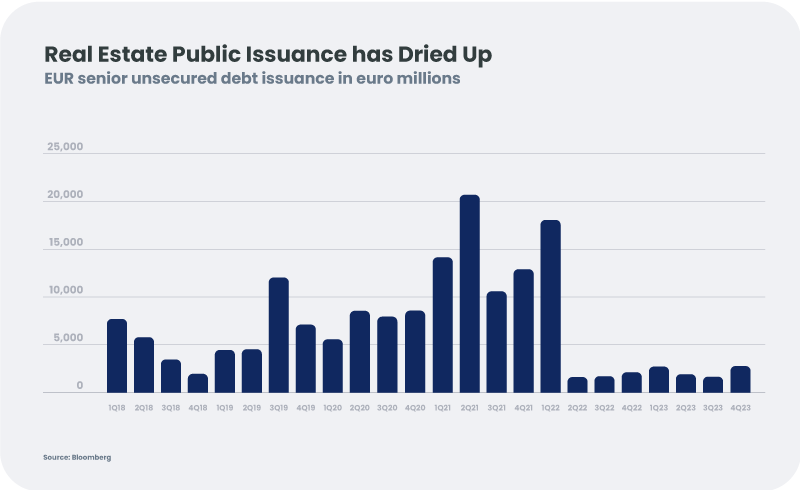

As to publicly traded debt for refinancings, the senior bond market had been virtually closed to most real estate issuers since the second quarter of 2022, as shown in the graph. We have recently seen some ‘green shoots’ – a few large issuers such as Covivio and Unibail-Rodamco-Westfield have returned to the primary market, with investors showing strong appetite for these new issues.

With such large refinancing needs, the priority has shifted to cash preservation including dividend cuts, postponing calls of hybrid debt, and asset disposals.

Fundamentals – Looking to the Long Term

Long-term factors are supporting operating performance of the sector. Rents are beginning to turn up in Europe, and vacancy is down. For those managers with the best space, such as strong “green” credentials, good amenities, and location, the occupier appetite is robust and rising. Indexation clauses in leases and low levels of vacancy in high-quality assets have supported rents and, in some sectors, we have seen significant growth in incomes. This has reduced the impact of higher capitalisation rates, and valuations of properties are beginning to stabilize.

German residential market fundamentals are at their strongest point for decades – a surprise for some. Europe’s largest market (in terms of investment) is experiencing its greatest supply/demand mismatch in at least a generation. Ask the tenants seeking a home; they are facing ultra-low vacancy rates. Lower supply, constrained both by higher construction and financing costs, is insufficient to meet increased demand from strong demographic trends, increasing the ‘gap’ in the German housing market.

Office space has been disrupted by the work-from-home trend, with tenants seeking sustainable buildings, and generally “better square meters”. This flight to quality has resulted in prime assets being more resilient than secondary assets.

Logistics assets continue to enjoy strong demand, albeit normalizing after pandemic surge. The lack of appropriate locations, difficulty in obtaining building permits, E-commerce growth, and the appetite for supply chain onshoring should continue to drive growth over the longer term.

Shopping centres, along with other brick-and-mortar retail, have long suffered from E-commerce, followed by the pandemic. Valuations were cut even before interest rates began to rise. European shopping centre fundamentals are benefitting from the post-pandemic recovery, and with higher rental yields than other segments, they are less sensitive to higher interest rates (as long as operational performance continues).

Capital markets

With capital structures squeezed, well-capitalised real estate investors sense an opportunity. A handful of key players have raised capital, so there is significant funding in place for investment across a range of real estate segments. Further, some real asset owners with higher risk appetites are considering returning to some sub-sectors which were highly-leverage during the last leg of the upcycle, particularly in Germany and Sweden, and we are already seeing significant recapitalisation opportunities.

The wisest real estate companies took advantage of the low interest rates to extend their maturity profiles at very low cost. In the new interest rate environment the focus has shifted to net leverage and interest coverage ratios.

This could translate into opportunities for several investment asset classes. Equity markets have severely penalized real estate companies, making some of those with lower leverage and/or longer debt maturities attractive. All the better if companies have sound operations with free cash flow.,

In publicly-traded debt, yields of 5%-6% combined with more typical levels of issuance could make 2024 a pivotal year especially if interest rates stabilize and transactions rebound. This type of environment should favour high-quality issuers with healthy balance sheets and good operating performance.

We see an opportunity for private capital, especially if real estate values are near their floor. The combined effect of rates and spreads has lifted the potential returns on senior secured loans to “equity-like”. It is very rare for European private debt investors to be both paid this well and to have such an open playing field to work on.

This market is no longer cold as ice.

Conclusion

While the real estate market may still seem ‘frozen’ as we head into winter, key players are not hibernating. The sector offers opportunities for risk-aware participants. Capital providers and investors can now use the uncertainty and volatility of the last two years to their advantage, providing they do their homework.

Is 2024 the year in which the “freeze” turns into the ‘thaw’?

This communication is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

[1] Real Capital Analytics.