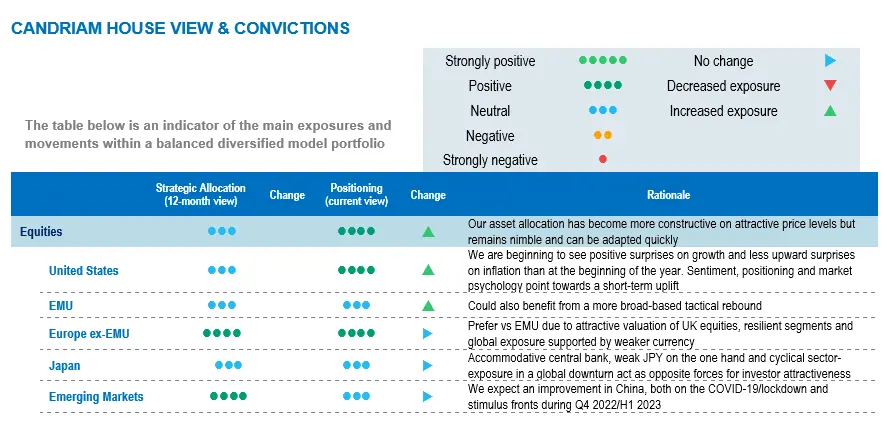

Short-term interest rates have been rising around the world over the past year as central banks attempt to fight inflation. This tightening during an economic slowdown has pushed leading indicators sharply down, pointing to manufacturing PMI troughs at around 45 points on both sides of the Atlantic in the coming months. We are not yet at the Fed’s pivot point, although ultimately central banks will likely have to strike a balance between the fight against inflation and the risk of financial instability. This will continue to generate volatility across all asset classes. Our analysis of investor sentiment, market psychology and technical set-up point to widespread pessimism and reveal depressed measures. This extreme configuration represents a buy signal and justifies a short-term market rebound. In this context, we have decided to tactically add US high yield and some US and EMU equities to the portfolio.

The next surprises in the Growth/Inflation mix

Global economic growth and inflation keep slowing down, although we are now starting to see positive surprises on growth and less upward surprises on inflation. Most countries are now moving from slowdown into contraction. For the first time since June 2020, the Global Manufacturing PMI has fallen below 50 points (49.8), while consensus recession probabilities in the next 12 months have risen sharply across all regions. The jury is still out on the scale of the contraction.

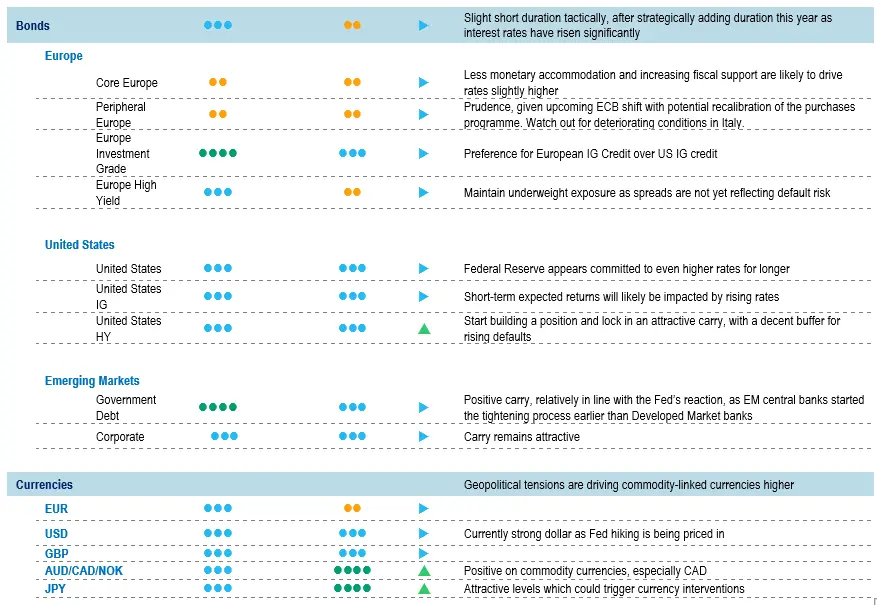

During this economic slowdown, global short rates around the world have risen for more than one year.

Sources: Candriam, Bloomberg©

This chart shows the evolution of weighted US, Euro, Japanese and UK 2-year interest rates

It is widely known that monetary policy acts with a lag. Most messages from central banks indicate that monetary policy tightening is not yet over, although global inflation appears to have peaked. We note that:

- Supply chain pressures are easing as shortages are turning into surpluses. Slowing demand is overwhelming residual supply chain disruption. Moving from undersupply of goods to oversupply could lead to downside surprises on inflation during the winter months.

- Manufacturing prices are easing in the US and in China. Manufacturing surveys point to a stabilisation in prices in the two largest economies. Furthermore, producer prices in China appear to be on a downtrend, hitting 0.9% yoy in September after peaking a year ago, at 13.5% yoy in October 2021.

- Household and market-based inflation expectations are easing. While market-based inflation expectations (10yr breakeven rates or 5yr breakeven rates) peaked six months ago on both sides of the Atlantic, the reversal in inflation expectations by US households is more recent but now appears to be under way.

Sources: Candriam, Bloomberg©

This chart shows the evolution of US household expectations of the US inflation rate in the next 5-10 years

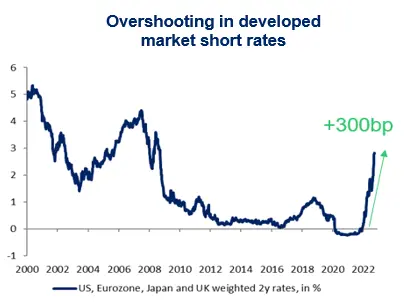

US short-term rate anticipations remain well-anchored

The US short-term rate anticipations remain well-anchored as the Federal Reserve members continue to indicate their willingness to increase the official rates, to bring the unemployment rate near to 4.5% over the next year.

The latest job report and CPI data for September certainly did nothing to change their minds. We note that the US 10yr bond’s nominal yield has been steadily increasing since 6 September. The move in real yields was the main explanation for this trend. Indeed, even after the higher than anticipated CPI data on 13 August, the 10yr breakeven rate has decreased slightly, confident in the Fed’s willingness to fight inflation.

Sources: Candriam, Bloomberg©

This chart shows the market-based expectations of the Federal funds rate until early-2024

US High Yield – Time to build a position in a multi-asset portfolio

Following the sharp rise in interest rates over the past year, short-term rate anticipations − and hence long-term yields − appear now relatively well anchored despite a volatile environment. We are therefore looking to add fixed-income exposure to the portfolio.

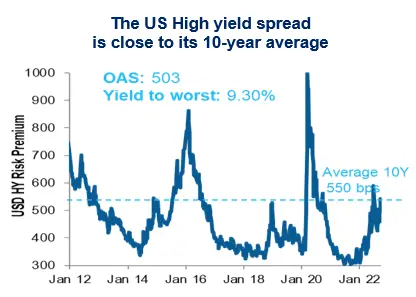

We think that US high yield is beginning to look attractive from a multi-asset perspective. With current OAS spreads above 500 bps, the average spread level observed over the past 10 years (550 bps) is now in shouting distance. According to our calculations, a 9.3% carry and a volatility of 7% observed over the past year are leading to an attractive risk reward. Finally, at current spread levels, the implied default rate is at 7%-8%, well above the current 1.4% level and expectations of 3% for 2023.

Sources: Candriam, Bloomberg©

This chart shows the evolution of US high yield OAS spread over US Treasuries over a 10-year period

US equities are priced for more than a soft landing

We have modelled EPS growth expectations for the US and for Europe, based on

- global PMIs,

- the US dollar trade-weighted index,

- the price of oil and

- the US 10yr yield.

Considering a 20-year relationship of these variables with 12-months forward profit growth, we find that profit growth expectations will have to weaken going forward. US EPS growth could be revised downward by 3% by the end of this year while European EPS growth could see a downward revision of -9%.

Of course, any escalation in the Ukraine war or a stronger-than-expected slowdown in the Euro economy could be an additional headwind. On the other hand, an easing of gas supply or improved news-flow from the war in Ukraine would be a strong support to the valuation, as the risk premium would shrink.

Sources: Candriam, Bloomberg©, Refinitiv

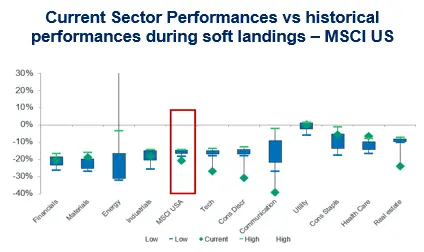

This chart shows the current drawdown of US equities and equity sectors compared to previous market downturns

Looking at data from the past quarter of a century, we have identified three soft landings and five equity bear markets in the US.

We note that, performance-wise, US indices are pricing more than a soft landing. Current performances of long duration sectors are indeed way below a soft-landing scenario, while most sectors integrate a severe deterioration. The (logical) exception to this panorama is the Energy sector, which is far from pricing a soft landing.

Should we stop worrying about equities? Probably not, but, at current prices, we are tactically adding to our equity exposure by becoming slightly overweight on the US and neutral on the Eurozone. In addition, sentiment, positioning and market psychology also point towards a short-term uplift, as shown below.

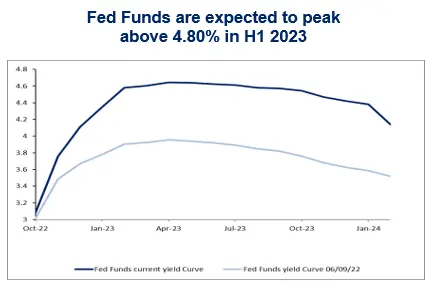

Pessimism, positioning and seasonality are now supportive

In addition to our fundamental analysis, we use a large number of technical and statistical data to assess and quantify the odds in favour of market reversals.

Among the pillars defining our approach of investor psychology, we note that any market rebound could be quickly exaggerated as extrinsic factors are very supportive. Notably, seasonality has become very supportive after a difficult September, while positioning appears extremely low.

Finally, our proprietary sentiment indicator has pointed towards extreme pessimism in recent weeks, which constitutes a buy signal from a contrarian perspective.

Sources: Candriam, Bloomberg©

This chart shows the evolution of a proprietary Sentiment indicator.