European equities: New historic high

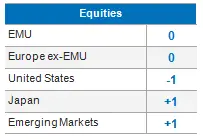

After the mild correction in September, global equity markets more than recouped these losses in October, ending the month on a new historic high. While Fed tapering, the Chinese Real Estate crisis, supply chain worries, lack of clarity on US fiscal support and increasing long rates were still important reasons for concern in September, the narrative significantly changed in October as investors were encouraged by strong Q3 results across sectors and regions.

At its October meeting, the European Central Bank (ECB) reiterated that it expected the current rise in inflation to be transitory. A decision on how to conduct asset purchases once the Pandemic Emergency Purchase Programme (PEPP) has ended was postponed until December. Economic growth in Europe is still suffering from a loss of momentum. This is most notable in Germany, where automotive sector weakness, driven by semiconductor shortages, is weighing on industrial output. It is worth noting that, excluding the auto sector, Eurozone industrial output forecasts are back above pre-pandemic levels.

At the end of the third quarter, economic activity was almost back to pre-crisis levels, down by just 0.5%. Some sectors, however, were still lagging behind the recovery.

The consumption gap is now almost closed, but the resurgence of new COVID-19 cases remains a risk.

The accumulated savings surplus, coupled with government measures, should help cushion the energy shock for households. Consumer sentiment appears to be holding up pretty well for the time being.

GDP (Eurozone) is expected to be relatively on-trend by year-end, up 5.0% on average in 2021 and 4.3% in 2022.

The ECB will remain accommodative to preserve favourable financing conditions, especially since its strategic review resulted in the adoption of a symmetrical inflation target of around 2%. Even so, tapering talks have started: what happens after the PEPP ends in March 2022 is still a big question mark!

In terms of style performance, over the last 4 weeks we saw Growth stocks outperform Value stocks, and Large Caps outperform Small Caps.

In terms of sector performance, over the last 4 weeks the top performer was the IT sector, while Energy and Financials, which performed well last month, took the biggest hit.

Regarding Price to Book vs. Return on Equity, we found IT to be very expensive, while Financials, Energy and Materials were still cheap.

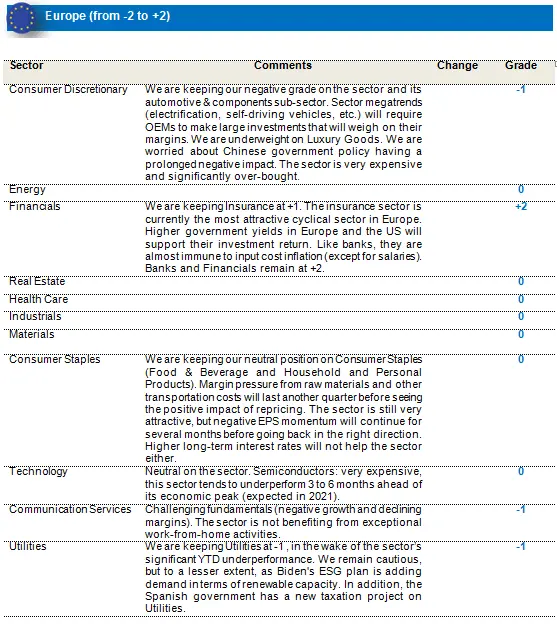

No change in our grades this month

- We are keeping our neutral position on Consumer Staples (Food & Beverage and Household and Personal Products). Margin pressure from raw materials and other transportation costs will last another quarter before seeing the positive impact of repricing. The sector is still very attractive, but negative EPS momentum will continue for several months before going back in the right direction. Higher long-term interest rates will not help the sector either.

- We are keeping Insurance at +1. The insurance sector is currently the most attractive cyclical sector in Europe. Higher government yields in Europe and the US will support their investment return. Like banks, they are almost immune to input cost inflation (except for salaries). Banks and Financials remain at +2.

- We remain negative on consumer discretionary. The sector is very expensive. We are more specifically negative on automotive and components, as sector megatrends (electrification, self-driving vehicles, etc.) will require OEMs to make large investments that will weigh on their margins. We are also underweight on Luxury Goods. We are worried about Chinese government policy having a prolonged negative impact. The sector is very expensive and significantly over-bought.

- We remain cautious on both telecom services and utilities.

US equities: above-trend GDP growth to continue in 2022

US economic activity continued to rise in the third quarter of the year, but at a more moderate pace. Despite waning industrial output due to tensions in the manufacturing sector, the ISM Services Index has reached an all-time high. Services consumption has continued to normalise with fading fiscal support, while goods consumption has started to decrease. Inflation, in the meantime, remains high. The unique nature of the crisis has created unusual tensions on the labour market, putting wage pressure on low-paid industries. Candriam expects consumer price tensions to linger before easing in 2022.

Meanwhile, the House has passed a USD 1 trillion infrastructure bill, now on its way to President Biden’s desk to be signed into law. The agreement proposes USD 500 billion in new federal expenditure over the next eight years to upgrade highways, roads and bridges, and to modernise city transit systems and passenger railway networks. In addition, funding is set aside for clean drinking water, high speed internet and a nationwide network of electric vehicle charging points. It is one of the largest federal investment plans in recent decades.

Against this backdrop, Candriam’s economists expect around 5.5% growth in 2021 and 3.9% in 2022 (slightly revised downward). With regards to the Fed’s policy, the central bank is continuing to monitor inflation and stands ready to act if the price increase becomes a threat to the economy. Tapering has already started, but in order for the Fed to start hiking rates, further progress in the labour market is required.

Excellent earnings season

US markets had another good month in October, after a more risk-averse September. Growth caught up with value, with consumer discretionary and technology doing a lot to drive market performance. The excellent earnings season was a big support for markets. More than 80% of S&P500 companies that had reported at the time of writing beat earnings estimates in the third quarter. Earnings growth for these companies surprised on the upside by more than 10%, with earnings growth coming out at 41% year-on-year. Industrials did extremely well, as one of five out of eight sectors publishing double-digit growth.

As a result, full-year earnings projections continued to be revised upward. Consensus earnings growth expectations are close to 12% for the US market over the next twelve months, and not overly ambitious for 2022 with low double-digit expectations. Thanks to increasing earnings, valuations have remained quite stable, yet above their historic median. The US is still the most expensive equity market with a 12-month forward price-earnings of 21.8, compared to 18.3 for the global equity market.

No significant strategic changes

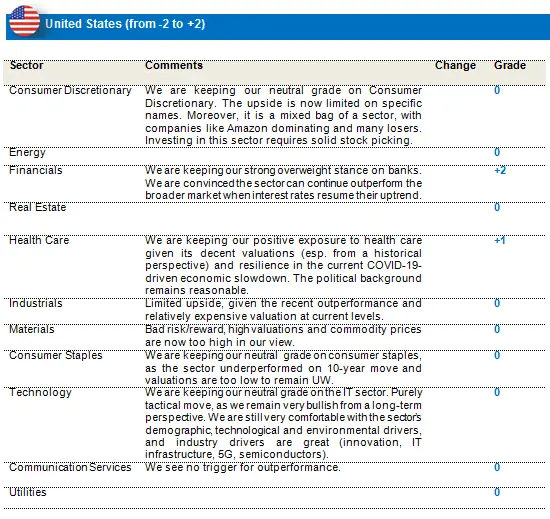

Against this backdrop, we made no strategic changes:

- We are keeping our strong overweight stance on banks. The sector’s recent resilience has us convinced it can continue to outperform in the coming months.

- We remain positive on healthcare. For us, this is clearly a GARP (growth at a reasonable price) sector and Biden’s healthcare plans are quite soft.

- We remain neutral on Materials. The risk/reward is bad, valuations are high and commodity prices are now reaching their short-term high in our view. Most commodity prices are above pre-pandemic levels.

- Despite good earnings, we are keeping our neutral grade on IT. 10-year yields are once again too low and should increase to at least 1.75%. However, this is a purely tactical call, as we remain very bullish on the sector from a long-term perspective. We are still very comfortable with the sector’s demographic, technological and environmental drivers.

- We are keeping our neutral grade on consumer staples. It is too soon to increase to an overweight, but low valuations justify a neutral weighting.

- We remain neutral on consumer discretionary. For us, this is clearly a sector in which stock picking is vital.

Emerging Markets post slight recovery with continuing regional divergence

October was a month divided into two distinct halves. MSCI EM Index started the month with a fairly strong rally, driven by positive earnings results and bullish guidance as a result of vaccination campaigns and higher commodity prices. Later in the month, however, EM equities lost most of the monthly gains due to: (1) US-China tensions (e.g. COVID-19, cyber security and chips); (2) further downgrades to China’s GDP growth. MSCI EM posted slightly positive returns (+0.9%) in October, but largely underperformed DM (+5.6%). EM CBs continued to tighten, with Russia (75bp), Poland (40bp), Hungary (15bp), Brazil (150bp), Chile (125bp), Peru (50bp) and Colombia (50bp) all hiking rates this month. Cyclicals (2.1%) did better than defensives (-0.5%), with consumer discretionary (7.0%) and communication services (3.3%) at the top of the sector rankings, and healthcare (-7.1%) at the bottom. Asia ex-Japan (Oct: 1.3%; YTD: -3.7%) recorded positive performances from all members except Korea (-2.3%) and India (-0.9%). China rose 3%. ASEAN had a positive performance, driven by Indonesia (8.3%) and Singapore (4.2%). EEMEA posted a gain, led by Russia (3.9%) and Saudi Arabia (3.0%) on the back of higher energy prices. Turkey (-0.6%) was dragged down by the continued depreciation of the TRY and the heterodox economic policy. LatAm was down again, due to Brazil (-9.1%) with unstable macroeconomic data and politics.

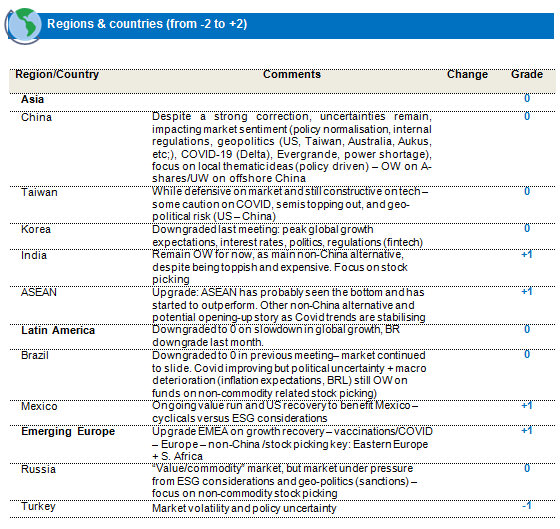

Regional ratings change: No change, but turning more positive on China.

China- Neutral stance maintained

- We are more positive on China: (1) slowdown is nearing an end and (2) potential for improved relations with the US on trade (Summit before year-end) and (3) climate cooperation.

- China tech stabilising; but very volatile. Alibaba still on a downtrend. Naspers and Meituan doing a bit better.

- Targeted tightening in real estate, while avoiding systemic risks; some speculation as China is loosening controls on bank lending. Market has also welcomed reports Evergrande has again averted default for now.

- China export engine doing well – record trade surplus

- Most investors are still UW on China = turnaround could lead to significant inflows

- Valuations more attractive

- Keeping exposure preference via onshore/A market and avoid offshore/ADRs on de-listing risk

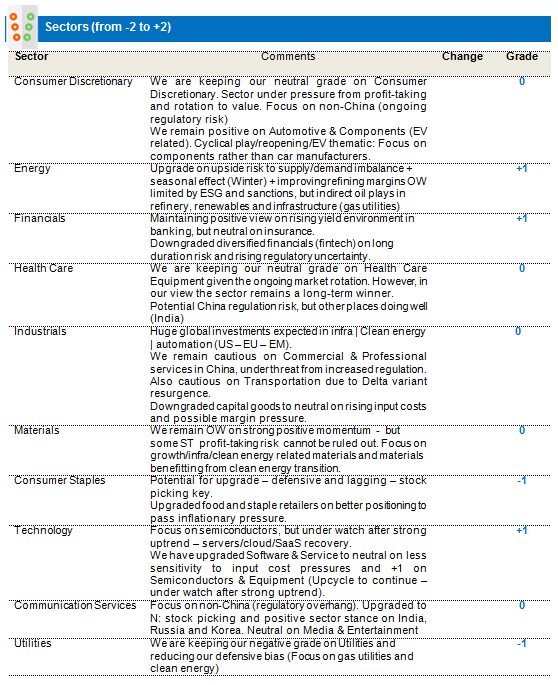

Sector Ratings Change:

Materials downgraded to neutral (0): tactical move. Still like structural demand growth in copper and lithium (electrification theme). Sector tends to perform poorly in the absence of large stimulus in China.

We are keeping our neutral grade on HealthCare. Sector could potentially be subject to regulatory risk in China, however we continue to see growth trends elsewhere in the sector. Long-term positive view on the sector maintained, but selective given near-term regulatory risk in China. Heavily discounted already, so some opportunities arising now.

We are maintaining our overweight stance on Semiconductors & Equipment based on strong positive supply/demand momentum - but some ST profit-taking after strong performance cannot be ruled out. Less positive on memory semiconductors (Korea) in near term than for processing semiconductors (Taiwan).

On a YTD basis, emerging markets driven by (among other things) concerns over slowing growth in China, expectations of tightening liquidity conditions and a generally stronger dollar, and lagging developed market returns. Much of the uncertainty is reflected in the high equity risk premium for Chinese equities and those parts of EM regions tied to Chinese growth. While we remain more positive on the region’s recovery in the longer term, we are maintaining a cautious stance on China by shifting our exposure to companies that are aligned with, and critical to, the common prosperity thematic in China. Outside China, we have added exposure to regions that promise clearer recovery prospects in the near-to-mid-term, including some structural growth names in Emerging Europe, ASEAN, India and Mexico. Overall, the portfolio is maintaining a balanced approach between quality and sustainable growth names, beneficiaries of long-term structural trends in EM plays, and resilient to short-term volatility expectations.