Last week in a nutshell

- The Q3 GDP Growth showed better economic activity than expected in the United States and China. US Real GDP rose 2.6% annualized in the third quarter, two tenths above consensus and fully reversing the declines during the first half of the year. In China. after a postponement by around one week, China Q3 GDP has been released at 3.9%, six tenth above consensus.

- Both ECB and BoJ released their interest rates. The ECB increased its fund rates by 75 bps propelling the deposit facility rate to 1.5%. The ECB Press conference showed a slight softening of the ECB’s hawkish tone with clear flags that 75bp hikes will not necessarily be the norm. The BoJ left its current monetary policies unchanged including yield curve control (YCC), asset purchases, and forward guidance.

- After the second round of the elections Luiz Inácio Lula da Silva has been appointed President of Brazil. He gathered a majority of votes, beating the controversial incumbent Jair Bolsonaro.

- Q3 reporting season is running hot, with ~40% of companies having reported in both the US and in Europe, so far. Earnings growth is mixed in both regions with bad news coming from demand concerns, slowing EPS momentum and more pronounced pressures on margins. MegaCap Tech companies are biting the dust with a lack of guidance going forward.

What’s next?

- In the US, the Federal Reserve meeting will provide the new interest rates decision. After some less hawkish stances from the Bank of Canada and the European Central Bank, the next FOMC will be scrutinized for any less hawkish moves that could be interpreted as a possible future pivot by the Fed.

- The BoE will release its fund rates decision. Inflation has reached 10% in the UK and is one of the milestone issues Rishi Sunak, the new UK Prime minister, will have to cope with.

- Main countries will publish their composite PMI indices, while the US will publish their employment report and the unemployment rate.

- Earnings season will continue with 175 companies in the S&P500 releasing their Q3 earnings: 32% of Health Care and 47% of Materials companies will report.

Investment convictions

Core scenario

- The risks we previously outlined are starting to materialize and are now part of the scenario.

- Should we stop worrying about risky assets? Probably not, but, at current prices, we tactically added to our equity exposure, by becoming slightly overweight on the US and Neutral on the euro zone.

- We further note that sentiment, positioning, and market psychology also point towards a short-term uplift.

- As central banks are committing for even higher rates for longer, leading us to keep a slightly shorter portfolio duration.

- Nevertheless, following the sharp rise in interest rates over the past year, short-term rates anticipations, and hence long-term yields, appear now relatively well anchored following the most recent inflation data. We started adding fixed-income exposure to our portfolios via the US high yield segment.

- Inflation, while nearing a peak, is still at highs in the euro zone, hitting businesses, consumers, and ECB policymakers alike. The ECB has made it clear that the only path forward is higher rates.

- Our equity allocation reflects the conviction that European equities could also tactically benefit from a broad-based risk-on environment. With a longer-term view, high inflation, a hawkish ECB and a sharp slowdown in economic growth leading to substantial earnings downgrades remain a challenge.

- We expect emerging market equities in Asia to outperform as valuation has become attractive while the region keeps superior growth prospects vs. developed markets.

Risks

- Upside risks include that central bank actions are nearly priced for peak hawkishness and weak sentiment and positioning. Further, governments in Europe are adding fiscal aid as the energy crisis deepens, which could mitigate its negative impact.

- Downside risks would be a monetary policy error via over-tightening in the US or a sharp recession risk via a deeper energy crisis in Europe.

- The war in Ukraine is ongoing and signs of discomfort with Moscow are growing in the international community.

- The threat of COVID-19, and its variants, remain as the virus keeps evolving and spreading at various speed throughout the world.

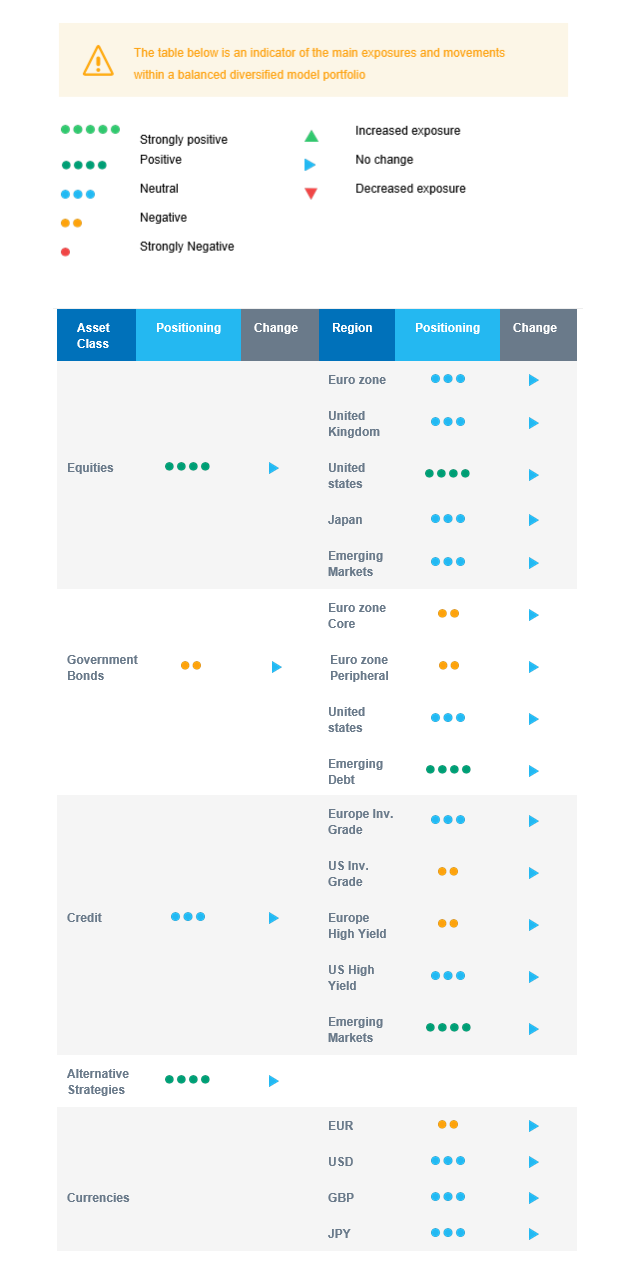

Cross asset strategy

- Our multi-asset strategy has become more constructive on attractive price levels but remains nimble and can be adapted quickly:

- Neutral euro zone equities, with a derivative strategy in place.

- Neutral UK equities, resilient sector composition and global exposure.

- Overweight US equities, with an actively managed derivative strategy.

- Neutral Emerging markets, but positive on Asian Emerging markets, expected to outperform as valuation has become attractive while the region keeps superior growth prospects vs. developed markets.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure act as opposite forces for investor attractiveness.

- Positive on sectors, such as healthcare, consumer staples and the less cyclical segments of the technology sector.

- Positive on some commodities, including gold.

- In the fixed income universe, we have a slight short duration positioning.

- We continue to diversify and source the carry via emerging debt and US high yield debt.

- In our long-term thematics and trends allocation: While keeping a wide spectrum of long-term convictions, we will favour Climate Action (linked to the energy shift) and keep Health Care, Tech and Innovation.

- In our currency strategy, we diversify outside the euro zone:

- We are long CAD and underweight EUR.

Our Positioning

Global economic growth and inflation keep slowing down, but we now start to have positive surprises on growth and less upward surprises on inflation than at the beginning of the year. We therefore tactically added to equities via the US and the euro zone to become slightly overweight. Regionally, our preferences go to Emerging markets and the US. On the fixed income side, we keep a slight short portfolio duration and upgraded our stance on US high yield debt to lock in an attractive carry. The asset class looks attractive with a buffer for defaults as its carry to volatility relative to equities. We remain allocated to commodity currency via the CAD.