European equities: Defensive growth sectors outperform

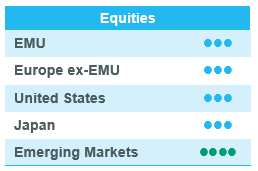

European equity markets continued their uptrend over the past four weeks on the back of positive economic surprises and a sharp fall in headline inflation as base effects in energy started to drag. The positive market trend was clearly driven by large caps and defensive growth sectors.

Utilities, healthcare and consumer staples were the strongest outperforming sectors over the past four weeks. The two weakest sectors over the past few weeks have been materials and energy. The latter was negatively impacted by a significant decline in Brent crude oil prices towards around $75/barrel.

Earnings Expectations & Valuations

In the meantime, the earnings season is very soon coming to an end, as more than 85% of all companies in the Stoxx Europe 600 have already reported Q1 results. According to JP Morgan data, 62% of these companies beat consensus revenue expectations, while 70% published higher-than-expected earnings with an average earnings surprise of 10%. As at 12 May, blended earnings growth came in at 3% year-on-year.

At sector level, earnings delivery shows considerable dispersion. Energy, materials, communication services and real estate are down double-digit, while five sectors, including consumer discretionary and staples, information technology and financials, reported positive earnings growth.

Financials surprised the market by 20%, with year-on-year earnings growth of 40%. In addition, guidance did not hold any surprises, while the sector, and especially banks, continue to become cheaper.

Considering the above growth previsions, valuations remain interesting. At only 12 times expected 12-month earnings, European equities clearly remain interesting compared to historical levels.

More defensive positioning

In this context, we are convinced that it continues to make sense to maintain a balanced approach with a defensive tilt. Cyclicals have become expensive, and the expected economic recovery is already priced in. As a result, we have made no significant strategic changes to our allocation over the past few weeks, as we still feel comfortable with our current positioning, which remains tilted towards more defensive growth sectors, such as consumer staples and healthcare. Both sectors have continued to outperform the broader market in recent weeks, and we maintain our +2 on consumer staples and +1 on healthcare in the current market environment.

We have also maintained our +1 on banks, favouring attractively valued retail banks that have published decent earnings and are attractively valued, while avoiding high-risk investment banks. We remain negative on energy. Our expectation of a further oil price decline has started to be realised, putting pressure on the sector’s absolute and relative performance.

US equities: Performance driven by mega caps

US equities continued their uptrend in April, as investors embraced decent economic data despite higher interest rates and a tightening monetary policy. A recent downtrend in headline inflation also supported market sentiment. Megacaps took the lead, benefiting from stable long-term interest rates.

Quality growth and defensives outperform

In the US, the trend remained clear over the past four weeks. Large caps clearly outperformed small caps, and growth outperformed value. From a sector perspective, the message was less clear, witness the relative outperformance of the consumer staples and utilities defensive sectors and the positive relative performance of more cyclical sectors, such as consumer discretionary and industrials.

Materials and energy were the worst performing sectors. The latter was negatively impacted by a significant decline in Brent crude oil prices towards around $75/barrel. Information technology and communication services were the best performing sectors over the month. Both were supported by stable long-term interest rates and decent earnings, although the outperformance mainly came from big companies, such as Microsoft, Alphabet, Meta Platforms and Nvidia. The two weakest sectors over the past few weeks were the financial sector and the industrials sector, unsurprisingly. The latter underperformed, as investors started to take into account the Fed’s expectation of a mild economic recession later this year as a result of the country’s banking crisis.

Decent Q1 earnings season

The Q1 earnings season is almost at its end. Almost 90% of S&P 500 companies have already published their Q1 results. Almost 80% of them reported a positive earnings surprise according to Factset Research, while 75% also realised higher-than-expected revenue growth.

Blended earnings ultimately declined by around 2%, marking the second straight quarter that the S&P 500 has had to report a decline in earnings. Earnings are thus broadly in line with the macroeconomic environment, where a soft landing remains the most likely scenario. Company guidance did not hold any major surprises either and also seems to be aligned with this scenario.

In this context, valuations do not seem excessive. The US market now trades at around 18 times expected earnings in the coming 12 months. This is broadly in line with the 20-year average, but slightly above the 10-year average.

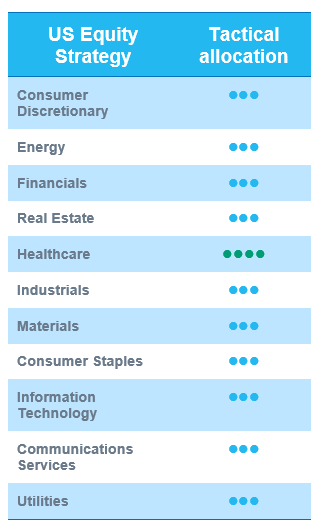

Keeping a balanced approach

For the time being, the market context seems to be slightly bullish on the back of interest rate stabilisation, greater visibility on the possible end of the Fed’s monetary tightening and valuations that are neither cheap nor expensive.

In this context, it appears logical to keep a balanced portfolio. As of today, we only maintain a +1 grade on the healthcare sector, which will outperform on the back of its defensive nature.

Emerging equities: Re-escalation of US-China tensions overshadowed the markets

The re-escalation of US-China tensions continued to overshadow emerging markets in April. Concerns have been raised about the Biden administration’s potential restrictions on Chinese investment, although US Treasurer Janet Yellen is attempting to revive the economic dialogue between Washington and Beijing. The banking crisis in the US was reignited by First Republic, spreading to more regional banks and raising concerns over the global financial sector. Federal Deposit Insurance Corporation (FDIC) intervened quickly to restore order, and the Fed continued to raise interest rates. Emerging Markets posted negative returns over the month (-1.3%), underperforming Developed Markets (+1.6%) by 2.9%. Asia suffered largely as a result of pressure on China, whilst LatAM posted gains following the release of some encouraging economic indicators.

Chinese market saw sell-downs by foreign investors, weighing especially on the internet sector, which made it the worst-performing market. The Chinese manufacturing PMI fell to 49.2, below 50 for the first time this year. However, the end of April marked the start of a five-day holiday in China to celebrate Labour Day. Leisure figures are encouraging, indicating a continued recovery. Taiwan and South Korea also suffered losses. In addition to geopolitical concerns over Taiwan, both export-oriented markets saw profit taking due to a slower-than-expected recovery in demand for semiconductors. Despite a hawkish decision in February, the Bank of Korea maintained the base policy rate as well as its overall policy stance. Indonesia and India, on the other hand, were the strongest markets in the region, following prior valuation retreats and an unexpected pause in the rate cycle in India.

Brazil and Mexico closed the month in positive territory. Brazilian President Lula da Silva visited China during the month, seeking new economic cooperation. Brazil’s confidence indicators rose during the month, and the CPI increased at a slower rate in March than in the previous month. Mexico’s retail sales fell, although demand data showed growth as private consumption grew. Chile was under pressure as the government sought to nationalise its lithium industry.

Gold rose modestly in April, owing to market turmoil prompted by fears over global financial stability and potential Fed intervention. The US Treasury yield fell 4 bps to 3.42%. Brent crude rose as a result of an OPEC production cut.

Outlook and drivers

The improving sentiment around China is attributed to the country’s reopening and the supportive policy climate. China’s manufacturing PMI data fell slightly below 50 for the first time this year, matching expectations of an uneven recovery path. The current competitive environment in the consumer retail sector may lead to a shift in sector leadership, potentially resulting in benefits for Chinese consumers. The current market scenario includes new secular growth themes such as digital/cloud roll-out for Chinese enterprises, advancement of high-end manufacturing, and integration of AI features by software and gaming giants.

The outlook for export-driven economies such as South Korea and Taiwan is expected to improve thanks to increased demand for Artificial Intelligence and memory semiconductors. Such catalysts should contribute to a sooner-than-expected recovery. South Korea is also poised to gain advantages from demand associated with the United States’ Inflation Reduction Act (IRA) and the EU’s transition towards clean technology.

In light of the possibility of continued market volatility in the near future, we have reduced the strategy’s risk exposure, while retaining its core thematic and sustainable growth exposure. The portfolio holdings demonstrate a greater capacity for sustainable growth and generate higher returns on equity when compared to the benchmark average.

Positioning for recovery

We make no changes to our regional views – maintaining an overweight on China, ASEAN and Brazil, while remaining neutral on other markets.

Regional views:

China maintain OW: Latest PMI figures confirm that China’s recovery continues to unfold. Recent policy announcements on enabling the digital transition, the reforms on State-Owned Enterprises and reassurance for private business were also positive. Market expectations continue to build on policymakers addressing cyclical concerns especially in the infrastructure and real estate sectors. However, geopolitical narratives continue to put a lid on valuations.

Brazil OW: Given the markets in Brazil in Q4, valuations remain attractive, and macro drivers are broadly supportive. China’s reopening could provide some tailwind to Brazilian equities.

ASEAN OW: China’s reopening is supportive for ASEAN countries such as Thailand (tourism recovery play) and Indonesia (commodity recovery play), and thus we maintain an OW in the region.

Mexico neutral: Despite tailwinds from the US nearshoring thematic, we remain neutral on Mexico, given the sharp rally we have seen in Mexican equities.

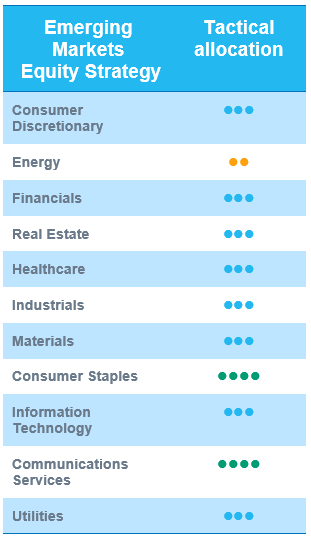

Sector and Industry views: Downgrade of Consumer Discretionary to Neutral

Following up on our recent update of a slower than expected consumer recovery in China, the consumer discretionary sector, which includes large China ecommerce names like JD.com, Alibaba etc., could continue to come under pressure, as they tackle challenges of weakening sentiment and increasing competition.

We continue to monitor the semiconductor sector (maintain neutral), where some support to demand from AI and cloud-driven investments could lead to a recovery earlier than anticipated.