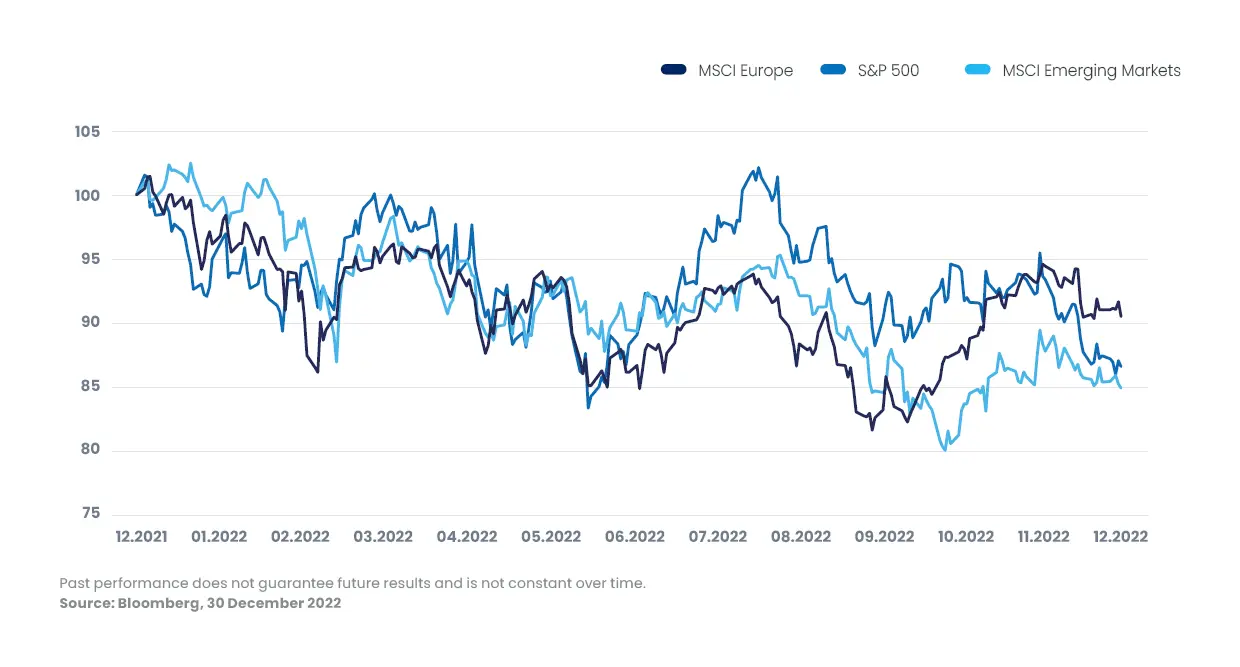

Despite a fairly significant rally beginning in October, European equity markets, battered by major outflows since the start of the crisis in Ukraine, recorded a correction over the year 2022 (-9.5%). Although European equities finished the year on a relative outperformance compared with the United States (-13.4%) and emerging markets (-15.1%)[1], the year was still a source of concern for investors, who are now asking questions about what may arise in 2023.

As we enter the new year, however, market sentiment is more optimistic than it was at the beginning of autumn 2022. Although the scenario continues to point towards an economic slowdown, investors are already looking forward to brighter skies on the way.

As we enter the new year, however, market sentiment is more optimistic than it was at the beginning of autumn 2022. Although the scenario continues to point towards an economic slowdown, investors are already looking forward to brighter skies on the way.

Figure 1: 2022 performances posted by the MSCI Europe, S&P 500and MSCI Emerging Markets, net return, base 100, in EUR.

Review of the first step of the waltz: central banks in the limelight

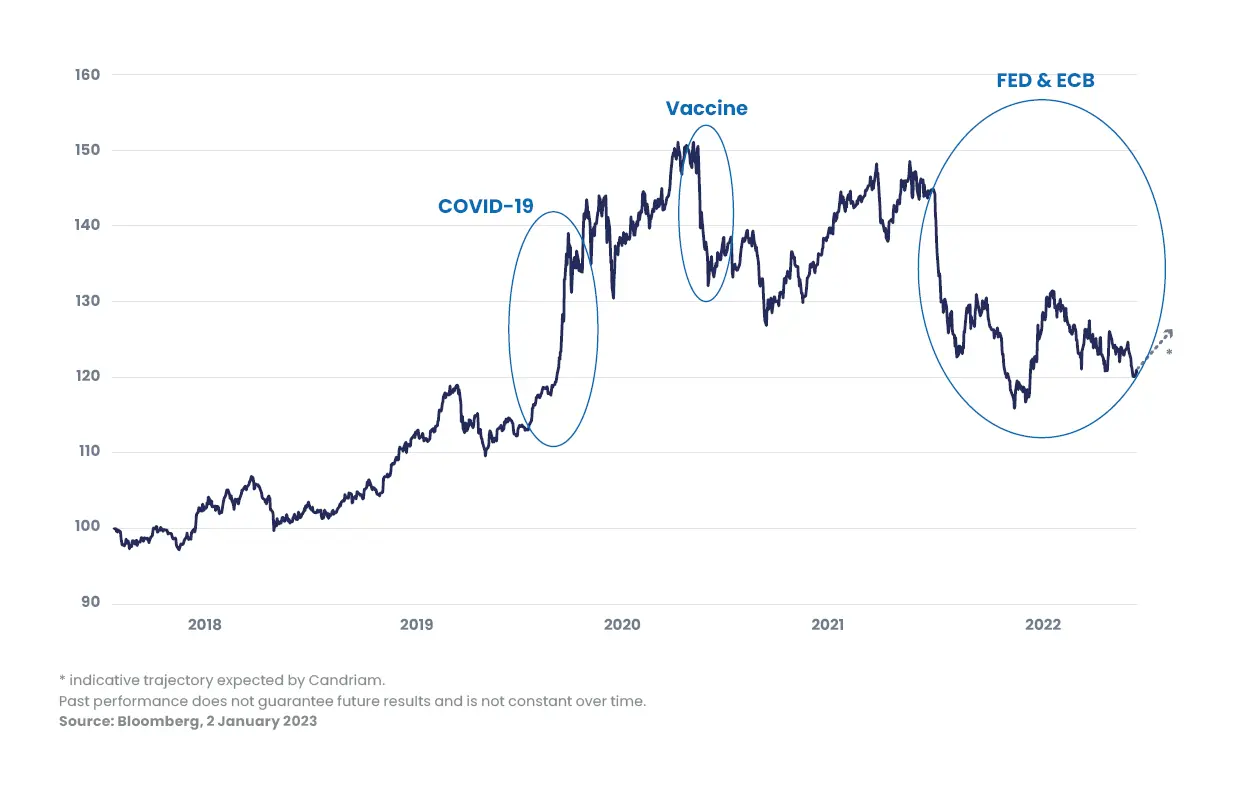

Following our article of July 2022, where we expressed our belief that European equities would move in a three-beat waltz, we can now take stock of first period: “the value phase”. As a reminder, we anticipated an increase in interest rates by central banks during this first phase, as well as a normalisation of long yields in line with long-term inflation expectations. This “rerating” of long yields had a negative impact on company valuations and especially on so-called Quality/Growth stocks, as a result of the drop in discounted future free cash flows[2] This lead the so-called “value” stocks to outperform.

Figure 2: Relative performance MSCI EUROPE GROWTH net return/MSCI EUROPE VALUE Net return, base 100, over 5 years.

- Growth stocks, which are characterised by higher profit growth, generally sell at higher valuations. The MSCI© Europe Growth index, designed to represent 50% of the market capitalisation of MSCI© Europe, is defined through the factor analysis of short- and long-term growth in earnings per share (EPS) and current growth and historical long-term growth in EPS and sales.

- Value stocks are characterised by a lower price relative to profits or assets. For the MSCI© Europe Value index, they are defined using a factor model of book value relative to price, long-term P/E* and dividend yields.

Inflation: a deceleration in sight

We believe that inflation has already passed its peak, at least in the United States, where we can already see some declines in monthly figures. Europe seems to be on the same path. We should therefore see this decline in inflation improving on both sides of the Atlantic this year. It would be unwise, at least in the US and in some segments, to completely rule out a risk of deflation by 2024.

Central banks: the end of the rate hike cycle

With our principal scenario of a significant increase in rates by the central banks having materialised, we now believe that base rates are likely to peak in the first quarter and remain at that level probably until the end of the year. We also note that various initiatives of central banks, primarily balance sheet reduction but also rate hikes, have fuelled the economic slowdown. In the US, we are already seeing, and will continue to see, a significant deterioration in the economic cycle, with on the one hand a sharp decline in residential real estate fuelled by the significant rise in the cost of home loans, and on the other hand a substantial impact on SMEs which, financed with very short term instruments, will be forced to lay off staff under the pressure of interest rates that are too high for them. These small companies, being mainly debt-financed and requiring more funding than larger companies, will have to cut costs and therefore staff. We will probably then see an acceleration of unemployment in the US over the coming quarters. This could, perhaps, lead to a deeper and more persistent recession than expected. Inevitably, Europe will be affected a posteriori by this major slowdown in the US economy.

Time for the second step: focus on defensive quality

Given the non-neutral impact of this firststep of the waltz on the US, as well as on the European economy, we will continue to see - in addition to the current pressures on margins - serious risks to revenues. Some companies will see a natural slowdown in terms of earnings, others will resist, and the big winners will be those that manage to benefit from acceleration in niche areas.

In this second phase, focusing on quality companies (strong balance sheets and profitability, strong value creation with free cash flow generation2, revenue stability) appears to be an interesting strategy to avoid earnings disappointments related to the economic slowdown. We therefore favour defensive stocks, with either an international or domestic focus.

In terms of sectors, consumer staples and healthcare equipment should, in our opinion, meet these requirements. A rigorous selection process is still essential in order to identify those stocks that will potentially surprise the market on the upside.

Moreover, companies that have a high degree of innovation could meet this need for visibility and structural growth by pulling ahead of the competition. A large number of these companies are exposed to niche areas, particularly in the sectors relating to the energy transition , new healthcare technologies, digitalisation and automation of the economy - sectors that we favour in our strategy that invests in innovation stocks.

This second step of the waltz is also likely to be accompanied by an easing of long rates in the US, in line with the slowdown in the economy. Indeed, long-term inflation expectations are expected to fall over the next 12 to 18 months - and Europe will most likely follow suit.

Finally, another element to watch is the gradual reopening of China, which could have an impact on commodity prices, especially LNG (liquefied natural gas), and thus on European finances. This could, in the very short term, support some cyclical consumer and industrial stocks with high exposure to China. However, this does not take away the problems of the real estate crisis and major debt, which China will have to continue to face in the coming years and which will have a definite impact on its growth potential.

Patience for the third step: the famous Fed “pivot”

For the timing of the third step of the waltz, the green light for cyclicals and small caps in particular, but also for the markets in general, we must first ask ourselves about the notorious “pivot” of the US Federal Reserve.

As a reminder, and as we wrote in our article mentioned above, we have found in the past that market developments, and particularly prices of cyclical stocks, anticipate the new phase of an economic cycle by 6 to 12 months. Just as Fed policy led to the economic slowdown and market decline, it will also be the trigger for the next economic up-cycle.

Flexibility in liquidity injection and the Fed’s change in tone - the “pivot”, i.e. the point at which the Fed ceases to raise rates - will give the green light towards a new cycle, the third beat of the waltz.

This significant change will depend, as the Fed has already stated, on two primary conditions: firstly, a significant drop in core inflation[3] towards 3% or even 2%, and secondly, the flexibility of the labour market and therefore a labour pool that will have to be much larger. This will inevitably involve a significant increase in US unemployment, of +1% or even +2%.

With all these factors having to come together, we therefore do not anticipate a Fed “pivot” until the second half of 2023, or even the end of the year. In the meantime, the first major challenge for this year will be to continue to accept some short-term adverse swings in the short term, as volatility, fuelled by various investor fears, is likely to remain at high levels. The second challenge will be to find the turning points that will allow us to position ourselves over the long term at attractive levels.

[1] Performances of net return indices, in EUR, as at 30 December 2022, source: Bloomberg. European equities: MSCI Europe, US equities: S&P 500, emerging markets equities: MSCI Emerging Markets. Past performance does not guarantee future results and is not constant over time.

[2] Free cash flow is the ability of a company to generate surplus resources.

[3] Core inflation is the change in the cost of goods and services, excluding food and energy