Last week in a nutshell

- Preliminary data on euro zone headline inflation cooled. But core inflation - stripping out energy and food - increased from 5.6% to 5.7%.

- Both US and European consumer and business confidence indicators showed stability.

- Chinese retail sales swung back to growth while property investment continued to decline despite robust government support.

- Speakers from both the Fed and the ECB kept the door open to higher rates.

What’s next?

- The US job report will shed some light on the strength of the labour market. The market’s resilience is underpinning the economy.

- Global PMIs for key countries will help investors assess the next US Federal Reserve Bank’s interest rate decision as the institution aims for a soft landing of the economy juggling between re-establishing price stability and maintaining financial stability.

- In Europe, several key countries’ economic activity indicators are due (trade balance, factory orders, industrial production, and retail sales).

- On the geopolitical front, European Commission President von der Leyen and French President Macron will meet China’s leader, Xi Jinping. His stance on Ukraine has challenged ties with the Western world.

Investment convictions

Core scenario

- The action of the authorities to maintain public confidence in the banking system and the speed with which the current financial shock is resolved are key for our scenario.

- Reference interest rate hikes by central banks in March amid the banking turmoil show that there is no easy trade-off in ensuring both financial stability and price stability. We acknowledge that the risk of a more adverse outcome than our soft-landing scenario has increased as financial conditions are tightening.

- Considering both upside and downside risks in a rather binary situation, we stand ready to reduce risk in the case of complacent financial markets. On the other hand, a pronounced market sell-off would likely open new investment opportunities in the medium term.

- Credit remains a strong conviction for the start of 2023 since the carry that was reconstituted by the rise in yields in 2022 looks attractive. We are overweight Credit, including Emerging market debt.

- We expect emerging markets equities to outperform as valuation is relatively more attractive while Asia keeps superior long-term growth prospects vs. developed markets, given that China’s re-opening is very quick.

- In Europe, sentiment, labour market and consumption are holding up. With the re-opening of China, the region should likely resume its export growth.

- On a medium-term horizon, we expect Alternative investments to perform well.

Risks

- Financial stability risks have resurfaced recently and led the US to add liquidity into the financial system.

- The uncertainty linked to the financial shock and the potential credit restrictions along with central bank’s anti-inflation stance are capping the upside potential for risky assets.

- On the other hand, inflation is declining, and a slow but positive growth is limiting the market downside.

- As central banks become more data dependent, and the economy is still surprising on the upside, monetary policy could become more restrictive on both sides of the Atlantic.

- Among the upside risks, the Chinese re-opening is good news for domestic and global growth as long as there is no inflation spill over via a resurgence of commodity prices in the context of constrained supply.

Cross asset strategy

- Motivated by a less attractive risk/reward and a binary outcome on the economy given recent financial turmoil, we keep the neutral stance on overall equities applied in February.

- Within a neutral equities vs bond positioning, we have convictions in specific assets:

- In terms of regions, we believe in Emerging markets, as valuation is relatively attractive and there is room for a catch-up vs. developed markets.

- In the current environment, we prefer defensive sectors, such as Health Care and Consumer Staples while a pause in the Tech sector appears warranted.

- The Health Care sector is expected to provide some stability: No negative impact from the war in Ukraine, defensive qualities, low economic dependence, innovation, and attractive valuations.

- In addition, the current context continues to favour companies with pricing power, which we find in the Consumer Staples segment.

- In the fixed income space, we currently have a neutral duration positioning as most asset classes have an attractive carry.

- European investment grade credit is one of our strongest convictions. We also have exposure to emerging debt.

- We have exposure to some commodities, including gold and commodity-related currencies, including the Canadian dollar.

- In our long-term thematics and trends allocation: We favour investment themes linked to the energy transition and keep Technology in our long-term convictions. We expect Automation and Robotisation to recover in 2023, and a growing interest in Climate and Circular Economy-linked sectors (such as Industrials and Technology).

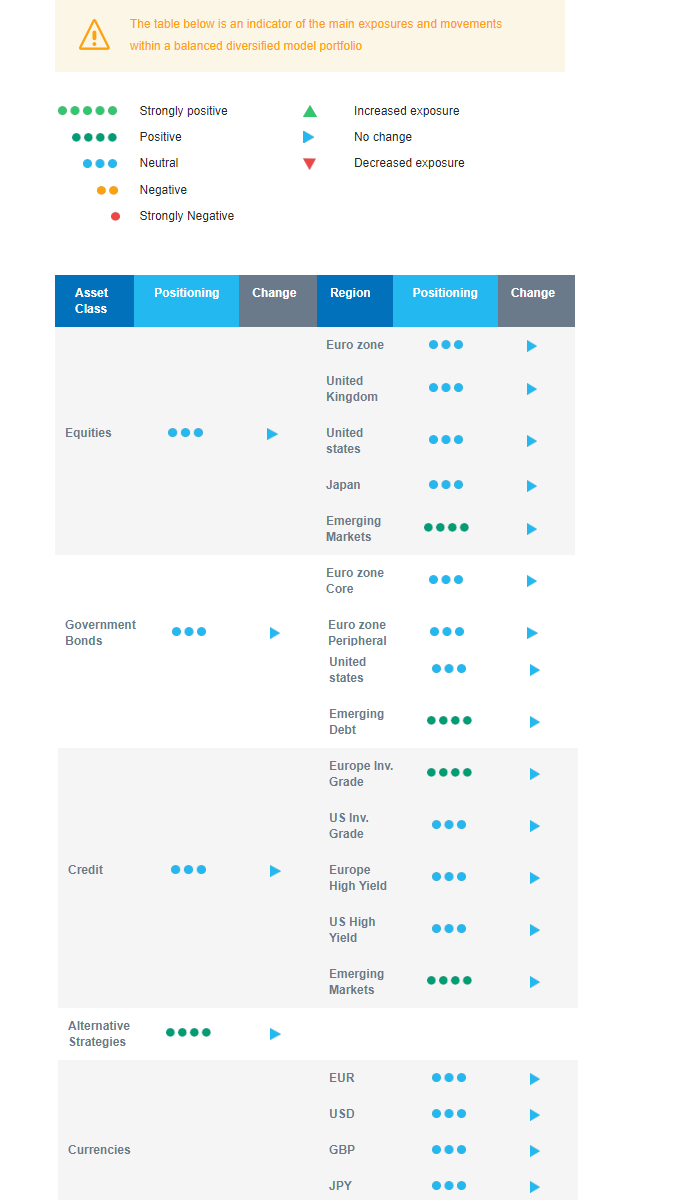

Our Positioning

Our current positioning is neutral equities and neutral on bond duration, with a preference for Emerging markets, pending an appeasement of the banking stress or a true investors’ capitulation.

Amid the heightened uncertainty, large caps have significantly outperformed small and mid-caps in March, creating a trading opportunity if the dust settles. We have built a tactical position in US small and mid-caps to seize the opportunistic odds of a short term catch-up of this segment.

On the fixed income side, we have a constructive view on Investment Grade credit. In the context of robust growth and the reopening in China, we remain allocated to some commodities.