Last week in a nutshell

- European equities continued their rally on mild winter weather, high gas storage levels and lower gas and wholesale electricity prices.

- US consumer prices confirmed that inflation is continuing its sustained downward trend at 6.5% YoY vs. 9.1% at its peak last June.

- The preliminary US consumer sentiment survey showed that Americans are feeling increasingly upbeat about the economy as the labour market is strong and inflation expectations are falling.

- China reopened to the world last Sunday after three years of isolation, giving a fresh boost to Emerging market assets.

What’s next?

- US and China will release their estimate of the Q4 GDP growth rate while key countries will release PPI and CPI figures.

- The Bank of Japan is heading into its first monetary policy meeting, after raising the ceiling on long-term Japanese yields last month. The market has started to anticipate a policy shift.

- The Q4 2022 season is kicking off in earnest with reports from big US names. Analysts expect a rather weak season amid macroeconomic headwinds, monetary tightening, and labour shortages.

- The World Economic Forum's annual meeting will give ECB President Christine Lagarde, among other decision makers, an opportunity to detail her thinking. The meeting has a self-proclaimed goal of tackling the climate emergency and other “ongoing crises”.

Investment convictions

Core scenario

- Our current economic scenario encompasses a deceleration in inflation and economic growth but without a severe recession and we do not expect to see a lower market low than the one seen last October.

- We see equity markets moving within a fairly broad range: limited to the upside by the actions of central banks, which will ensure that financial conditions do not ease too quickly if the economy is holding up well and supported by a faster monetary policy pivot if the economy is too hard hit. Hence, we have a constructive positioning - i.e., overweight equities - but with a controlled risk budget.

- We expect emerging market and US assets to outperform as valuation has become more attractive while Asia keeps superior long-term growth prospects vs. developed markets.

- The likelihood of the euro zone growth being severely hit by the natural gas crisis has decreased thanks to warm weather. As labour market and consumption are holding up, we expect European assets to show resilience.

- Regarding bonds, the carry that was reconstituted by the rise in yields in 2022 looks attractive. The deceleration in inflation should lead to a drop in volatility on bonds, allowing for an easing of volatility on other asset classes.

- Central banks are slowing the pace in monetary tightening, aiming for a final target rate to be reached in 2023. As inflation expectations continue to decline and bottlenecks are easing, the focus is shifting towards growth while maintaining financial stability.

- In this environment, we expect the positive correlation between equities and bonds to decline and Alternative investments to perform well.

Risks

- Among the upside risks, we note that the Chinese re-opening in 2023 would be a substantial support for the global economy.

- Further, unseasonably warm temperatures have recently pushed natural gas prices lower, mitigating the negative impact of the energy crisis.

- Overall, inflation declines and a rise in growth at some point in 2023 is limiting the market downside. But we know that the central banks anti-inflation stance is also capping the upside potential for risky assets.

- Downside risks would be a monetary policy error via over-tightening in the US or in the euro zone.

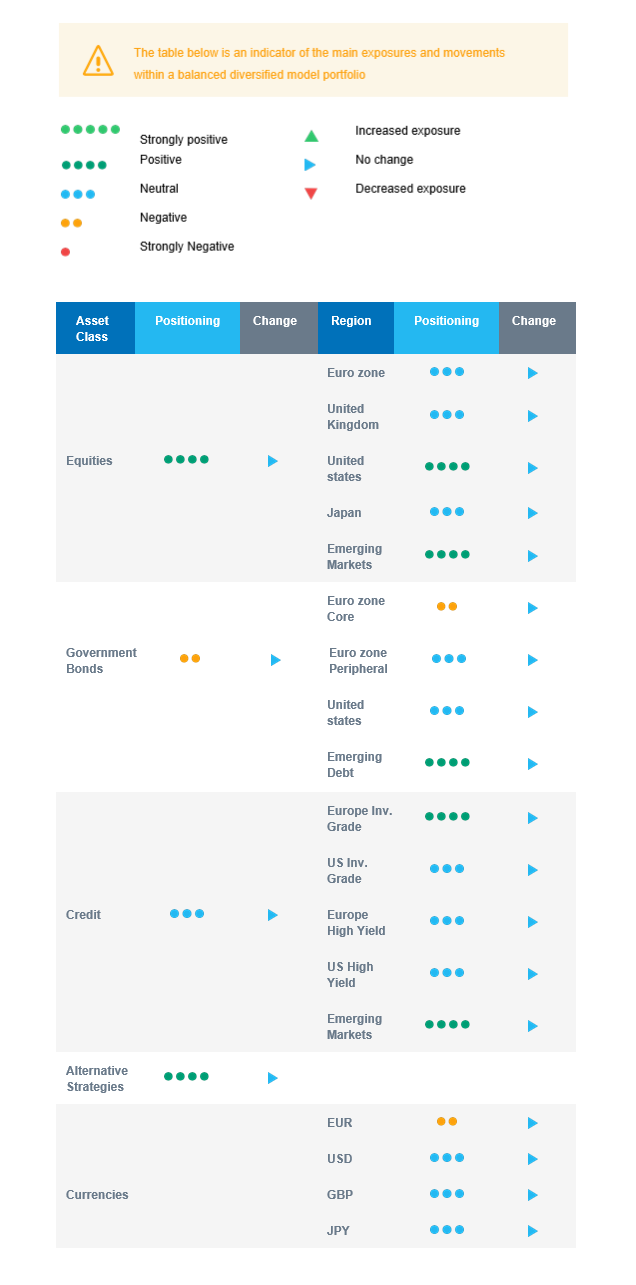

Cross asset strategy

- Our multi-asset strategy has remained constructive and overweight equities on attractive price levels since October. It is nimble and can be adapted quickly. Further, we currently have few strong regional convictions:

- Neutral euro zone equities, keeping the exposure.

- Neutral UK equities, diversified sector composition and global exposure.

- Overweight US equities, as our soft-landing scenario is unfolding.

- Overweight Emerging markets, as valuation has become attractive and there is room for a catch-up vs. developed markets.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure usually act as opposite forces for investor attractiveness.

- Positive on sectors, such as healthcare, consumer staples and the less cyclical segments of the technology sector.

- Positive on some commodities, including gold.

- In the fixed income universe, we have a slight short duration positioning via core Europe.

- We continue to diversify into European investment grade credit and source the carry via emerging debt and global high yield debt.

- In our long-term thematics and trends allocation: We favour investment themes linked to the energy transition and keep Health Care, Tech and Innovation in our long-term convictions.

- In our currency strategy, we diversify outside the euro zone and are long CAD.

Our Positioning

Our current positioning is overweight equities with a preference for Emerging markets and the US, followed by European markets. On the fixed income side, we keep a slight short portfolio duration via EU core bonds. We have a constructive view on credit, including high yield. The latter looks attractive with a sufficient buffer for defaults. We remain allocated to commodity currencies via the CAD.