Last week in a nutshell

- The UK was subject to political and financial turmoil with the resignation of Liz Truss after the shortest-lived mandate as prime minister. Her economic plans were rejected, hitting the GBP and pushing up borrowing costs, forcing a U-turn under a new finance minister.

- In China, Xi Jinping has been chosen to step into a norm-breaking third term in power, with the potential to rule for life, besides being head of the Chinese Communist Party, the state, the armed forces, and several many committees. The challenges remained due to further COVID-19 lockdowns and ties between Beijing and major global powers under strain.

- US home sales and new home construction dropped in September as mortgage rates keep climbing. Data show it is getting harder to sell a home and even harder for aspiring homeowners to buy one. Because inventory is still tight, prices have held steady so far.

- Final inflation rates for Canada, the euro zone, and the UK exceeded forecasts amid a challenging political context. In the UK, the consumer prices index rose to 10.1% in September, returning to double digits after a slight dip to 9.9% in August.

What’s next?

- Global growth and inflation data will be in the spotlight - as usual - with the publication of Q3 GDP and flash PMIs in the US and Europe, the PCE for the former and October CPIs for the latter.

- As inflationary pressures remain sticky, the ECB and the BoJ decisions amidst the global tightening cycle will contribute to get a better picture of major central banks policies.

- The Q3 2022 earnings season continues with the release of the figures of 46% of the US market capitalisation, among which big tech names, oil majors, leading automakers, staples firms as well as the likes of Google, Microsoft, Apple and Amazon.

- Brazilians are called to the polls for the presidential run-off elections. Since winning the first round earlier in October with 43% and 48% of votes, right-wing populist Jair Bolsonaro and former leftist president Luiz Lula da Silva, have been in a tight race.

Investment convictions

Core scenario

- The risks we previously outlined are starting to materialize and are now part of the scenario.

- Should we stop worrying about risky assets? Probably not, but, at current prices, we tactically add to our equity exposure, by becoming slightly overweight on the US and Neutral on the euro zone.

- We further note that sentiment, positioning, and market psychology also point towards a short-term uplift.

- As central banks are committing for even higher rates for longer, leading us to keep a slightly shorter portfolio duration.

- Nevertheless, following the sharp rise in interest rates over the past year, short-term rates anticipations, and hence long-term yields, appear now relatively well anchored following the most recent inflation data. We started adding fixed-income exposure to our portfolios via the US high yield segment.

- Inflation, while nearing a peak, is still at highs in the euro zone, hitting businesses, consumers, and ECB policymakers alike. The ECB has made it clear that the only path forward is higher rates.

- Our equity allocation reflects the conviction that European equities could also tactically benefit from a broad-based risk-on environment. With a longer-term view, high inflation, a hawkish ECB and a sharp slowdown in economic growth leading to substantial earnings downgrades remain a challenge.

- We expect emerging market equities in Asia to outperform as valuation has become attractive while the region keeps superior growth prospects vs. developed markets.

Risks

- Upside risks include that central bank actions are nearly priced for peak hawkishness and weak sentiment and positioning. Further, governments in Europe are adding fiscal aid as the energy crisis deepens, which could mitigate its negative impact.

- Downside risks would be a monetary policy error via over-tightening in the US or a sharp recession risk via a deeper energy crisis in Europe.

- The war in Ukraine is ongoing and signs of discomfort with Moscow are growing in the international community.

- The threat of COVID-19, and its variants, remain as the virus keeps evolving and spreading at various speed throughout the world.

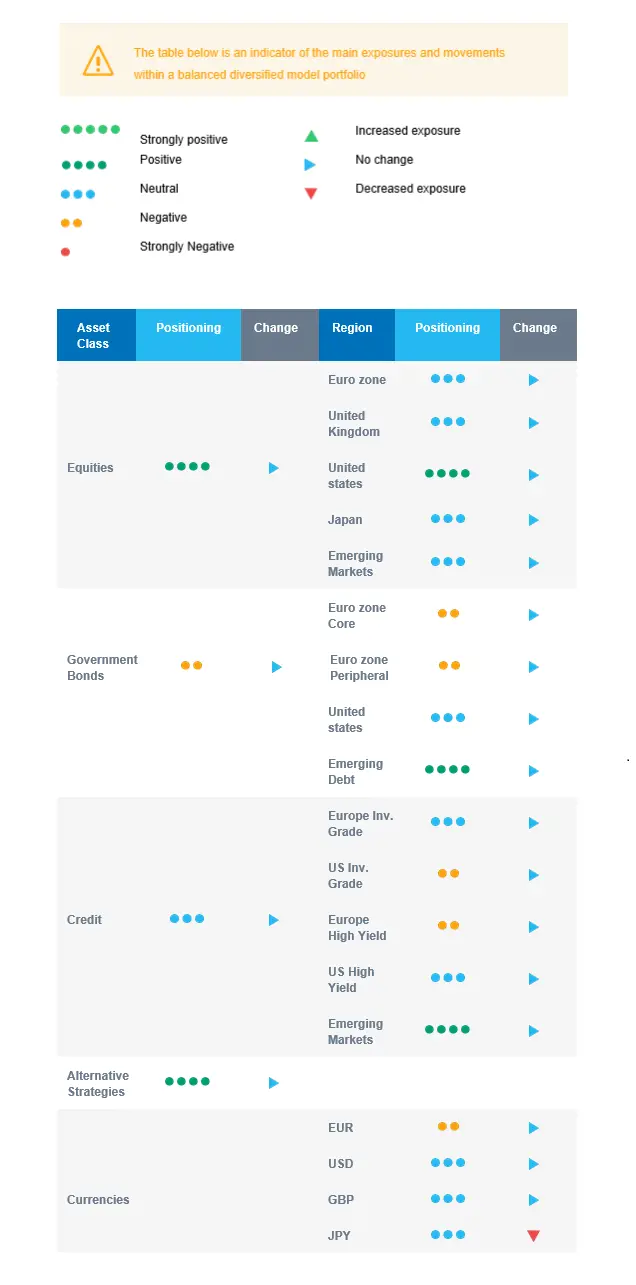

Cross asset strategy

- Our multi-asset strategy has become more constructive on attractive price levels but remains nimble and can be adapted quickly:

- Neutral euro zone equities, with a derivative strategy in place.

- Neutral UK equities, resilient sector composition and global exposure.

- Overweight US equities, with an actively managed derivative strategy.

- Neutral Emerging markets, but positive on Asian Emerging markets, expected to outperform as valuation has become attractive while the region keeps superior growth prospects vs. developed markets.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure act as opposite forces for investor attractiveness.

- Positive on sectors, such as healthcare, consumer staples and the less cyclical segments of the technology sector.

- Positive on some commodities, including gold.

- In the fixed income universe, we have a slight short duration positioning.

- We continue to diversify and source the carry via emerging debt and US high yield debt.

- In our long-term thematics and trends allocation: While keeping a wide spectrum of long-term convictions, we will favour Climate Action (linked to the energy shift) and keep Health Care, Tech and Innovation.

- In our currency strategy, we diversify outside the euro zone:

- We are long CAD and underweight EUR.

Our Positioning

Global economic growth and inflation keep slowing down, but we now start to have positive surprises on growth and less upward surprises on inflation than at the beginning of the year. We therefore tactically added to equities via the US and the euro zone to become slightly overweight. Regionally, our preferences go to Emerging markets and the US. On the fixed income side, we keep a slight short portfolio duration and upgraded our stance on US high yield debt to lock in an attractive carry. The asset class looks attractive with a buffer for defaults as its carry to volatility relative to equities. We remain allocated to commodity currency via the CAD and sold our exposure to JPY.