Direct Investing might be the ultimate investor/investee engagement. But it does not have to be private equity ownership. Private loan investors, too, often play a strategic role in the firms to which they lend, even holding Board seats. And good news – the Impact Investment category increasingly targets market or above-market returns.

Private Loan Investing: Two Paths to Impact

Private loans are often negotiated directly between the investment partnership and the borrowing firm. Often the borrowers rely on financial and strategic advice from the private debt investment managers.

This close relationship offers two possible paths to impact. First, the working relationship and dialogue between the investors and the business can lead these firms, which are often smaller companies, to a greater understanding of how to become more sustainable in their business practices or in their product offerings.

An even more profitable path – both in terms of impact and financial benefits – can be achieved with firms we think of as sustainable 'Pure Players'. As investors, we can directly guide these firms to specific environmental or social goals by tying interest rates to Key Performance Indicators. A second area where we can have an impact is 'evolving sustainability', with companies who are willing to explore more sustainable methods.

At Candriam, we solicit quite specific information. Our due diligence questionnaire is designed to collect the information we use in our proprietary ESG analysis models for Business Activities and Stakeholders. We use the information to prepare for our discussions with the company, and to design and agree on Key Performance Indicators (KPIs). The interest rate is linked to the KPIs, so it is important to both the company and the investor to design indicators which accurately reflect the impact made by the company.

Below, we present a case study of each of the two types. We being with Evolving Sustainability, because it is more familiar to sustainable investors.

Case Study of Evolving Sustainability – Pyrex

Business – Pyrex is a France-based manufacturer and distributor of tempered glass cookware products. This is an energy-intensive process, manufactured mainly using gas-fired furnaces, with a small number of electric furnaces.

Impact – It is important to encourage and reward sustainability among European industrial companies. The EU wishes to avoid 'importing' CO2 by purchasing goods manufactured in regions with high-emission energy. As nations tighten regulations, it is tempting to produce offshore. The shift of high-emissions production to less-regulated markets does not just move the problem. When production shifts from a region with natural-gas-generated electricity to a region with coal-generated electricity, the problem is worse for all of us. This 'imported' CO2 has been a tremendous problem for the EU over the last decade. On the Social side, industry within the region keeps a balance of employment and research. Affordable, low-emission cookware can reduce the use of plastic wrap and other disposables.

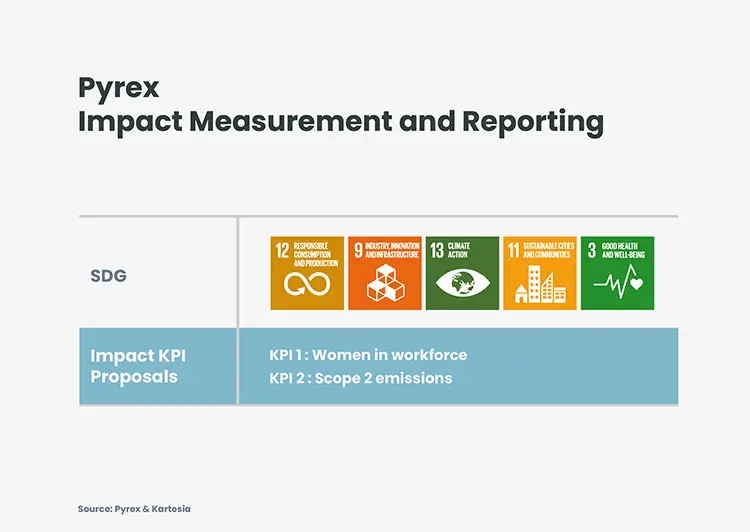

Supporting, informing, and encouraging this type of industrial company can generate societal benefits, both environmental and social. There is much work to be done on this measure across industrial sectors. Pyrex has the potential to contribute to multiple UN Sustainable Development Goals. While similar to engaging with issuers of publicly held securities, the closer ties between management and investor in these private loans can means greater trust, closer communication, and more rapid adoption of new practices.

Impact Reporting – One possible KPI, or Key Performance Indicator, would be the number of women in full-time employment (FTE). Our due diligence and analysis point to a lack of diversity as one of the points where some improvement could be achieved. Another potentially useful KPI would be Scope 2 carbon emission. That is, indirect emissions associated with the purchase of electricity, steam, etc. This would encourage both more efficient use of power, plus migration towards green power, and discourage purchase of electricity generated from fossil fuels.

Case Study of Sustainable 'Pure Play' – Eden Futures

Business – Eden Futures provides structured living services and support for adults with learning disabilities, autism, mental health, and other needs. Operating across central and northern England, their business model is to improve the lives of their clients by giving support and skills towards independence and a better quality of life.

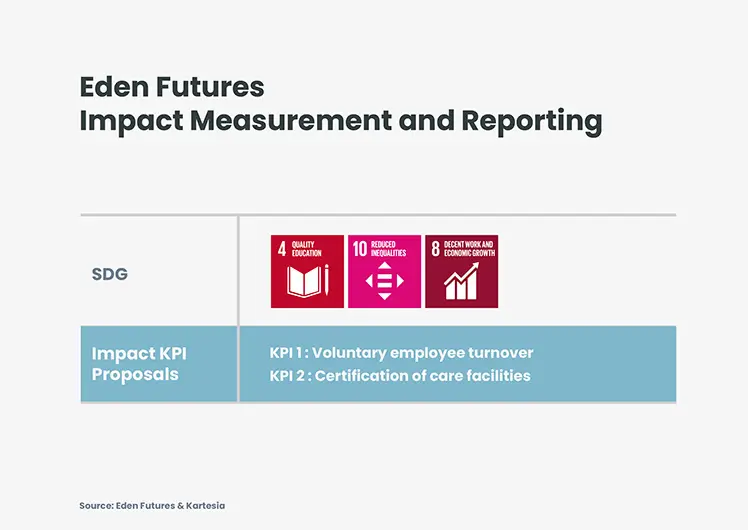

Impact – The business product and impact goal are one and the same for this firm. As a 'pure play', this is a case where the debt could be structured to link the KPIs to the interest rate. The borrower is rewarded with a lower rate if the agreed KPIs are achieved.

As is generally the case, KPIs must be carefully chosen and structured to encourage the intended result. For example, lower staff turnover indicates better care of and support for the clients, a measurable indicator of the impact goal. Lower staff turnover could also lead to better margins, better debt coverage, and a higher-quality borrower for the private debt investor.

Potential KPIs – Some measurable indicators under discussion include employee turnover, and certification of facilities. High-quality human capital is an important input, and the questionnaire solicits information on several aspects. Using a KPI based on employee turnover offers a numerical indicator of quality. Another potential KPI is regulatory certification by the English Care Quality Commission, both in number of units and the rating, which in this case includes a strong element of client opinion and assessment.

Is This a 'Win-Win'?

It is our Conviction that a material discount in the lending rate, matched by challenging impact targets and ongoing support, can be an effective incentive for meaningful impact – that is, measurable social and environmental improvements.

As private lenders receive illiquidity premiums, a max-50 basis point discount on the loan margin is not a hugely material give-up for the sustainable investor. It isa distinct incentive for a company to achieve the agreed societal impact.

In 2022, we will continue to assess and work in cooperation with impact borrowers in to help them enhance for financial impact results.