We end the year on a sour after-taste with the discovery of the Omicron variant in South Africa, but as we head into 2022, our outlook is rather positive. As of November and until the end-of-month sell-off, the performances of financial markets reflect the recovery of the global economy, the gradual reopening and the surge in commodity demand. Winners of this powerful rising demand are not only commodities but also equities – with the exception of emerging markets equities. Losers are fixed income exposures, as bond yields are on the rise. Alternatives post a better performance than bonds. Is Omicron a game changer? Where will December, and more importantly Q1 2022, take us? And how can we best equip our strategy to cope with the changing environment?

Ending 2021 & moving into 2022

2021 has been an atypical environment for market participants if we compare our current situation to the last 100 years. 2020 saw a sharp, but short, recession with the global and brutal impact of the coronavirus while 2021 saw the sharpest rebounds ever measured until now.

2021 has been an atypical environment for market participants if we compare our current situation to the last 100 years. 2020 saw a sharp, but short, recession with the global and brutal impact of the coronavirus while 2021 saw the sharpest rebounds ever measured until now.

In that context, and with the assumption that Omicron is not calling into question our central scenario, the key financial drivers remain economic and inflation surprises, and too much of either one could potentially drive the global economy into a slowdown or stagflation. Indeed, the consequences of this atypical environment lie in the difficulty to assess where we currently stand in the economic cycle: are we in the middle of the re-opening? Or the middle of the economic cycle? Or at its end?

The pandemic has blurred the lines and in the short term, we will oscillate on the axes of economic and inflation surprises between the following quadrants:

- A reflationary boom - growth and inflation surprises on the upside

- Goldilocks - positive growth surprises but downside inflation surprises

- Stagflation - positive inflation surprises but negative growth surprises

- Slowdown or bust - growth and inflation surprises on the downside

with III and IV being the key risks to financial markets.

For any investor, the objective now becomes assessing as best as possible:

- How to read the current economic environment,

- Taking into consideration central banks’ ability to control the yield curve and the gradual tightening process between taming inflation without jeopardizing economic growth - the US Fed will be the precursor while the People’s Bank of China is expected to be last.

- Allocating to global equities, taking into account the strong dispersion in valuation observed between regions, sectors and styles

- While being mindful of the yields’ volatility spill-over into forex – especially seen in Latin American currencies, and overall in Emerging markets with the exception of the Chinese Yuan.

Equities have been spared so far but will be closely monitored. Previous hiking cycles have not triggered higher volatility if we look all the way back to 1994, but inflationary pressures make a difference in today’s assessment.

Risks to the scenario

We identify several risks that could derail our central scenario. First and foremost, the coronavirus infections, due to the Delta and more recently Omicron variants, and lower temperatures in the northern hemisphere underline the risk of a stop-and-go approach to economic restrictions. The mutating coronavirus should become endemic, as immunity is not steady and therefore needs a constant and full commitment to vaccination campaigns with booster shots and a new target: the younger population.

Second, supply side constraints are numerous and will last longer than expected. Inventories remain low everywhere and bottlenecks are weighing on manufacturing output. There is a lack of commodities, semi-conductors and labour force. A situation of extreme supply tension could also eventually impact not only economic growth but also corporate earnings’ growth.

Third, a brutal, faster-than-anticipated rate tightening in US financial conditions - if inflationary pressures increase and/or persist - could jeopardize the recovery.

Our credo

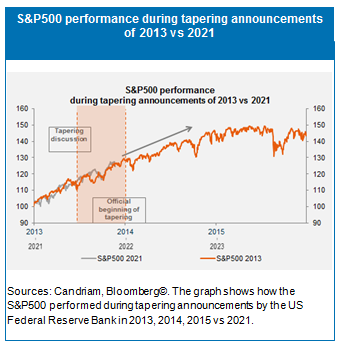

Taking into account the context and its challenges, and although we stand in an atypical cycle, with an unusual rapid upward adjustment, we still believe that the strong economic performance should continue into 2022 with growth of around 4% both in the US and in the Euro Area. The outstanding 2021 year-to-date equities returns do not exclude positive returns in 2022, even with an upcoming tapering in the US. Expectations of gross domestic product growth in 2022 are strong and do not reflect the sluggish earnings per share growth, which are still too sluggish. Equities should have the safety cushion they need to absorb stronger-than-expected margin pressures.

The shifts in economic and inflationary regimes will call for a dynamic equity allocation. As we prepare for Q1 2022, inflation should peak and bottlenecks should start to ease. We will focus on value and risky assets until growth shows resilience and inflation decelerates.

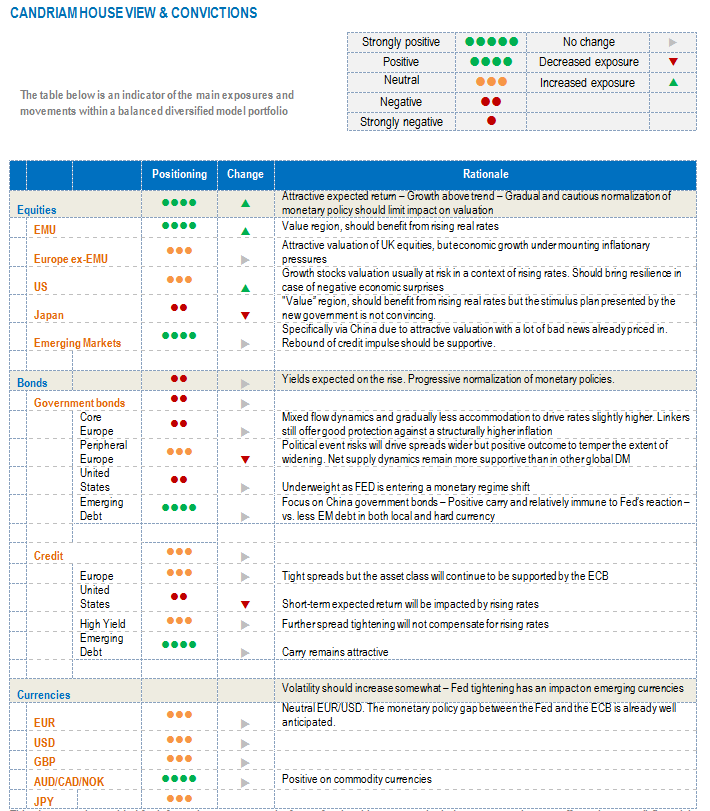

Our current multi-asset strategy

As we are about to start Q1 2022, we keep a positive outlook on risky assets. Hence, between equities and bonds, we choose equities.

Our regional equities breakdown favours European equities as well as Chinese equities. Chinese equities experienced their “bust” in 2021: the index has just gone through the sharpest, fastest, negative relative performance vs. MSCI World since 2008 bringing Chinese equities from their highest to lowest relative valuation in five years, thereby limiting the risk of negative surprises. We upgrade our outlook on US equities from underweight to neutral as we strive for a balanced approach. As we move forward, there may be temporary setbacks in the contradictory interpretation of the environment by investors. US equities will have a competitive advantage in a goldilocks situation, or relatively speaking, in case of a slowdown. On the other hand, they may suffer if real rates rise, and not just nominal rates.

In terms of sector allocation and exposure to specific long-term thematics, we favour a tactical approach with financials, materials and energy – assuming that Q1 sees inflation peaking and bottlenecks easing – and in our core long-term thematics, hold tech & innovation, healthcare and climate.

In our fixed income allocation, we remain underweight on duration and underweight on government bonds with the exception of a neutral stance on peripheral European debt and positive stance on China government bonds. China government bonds have performed quite well and should continue to do so. The People’s Bank Of China is one of the only central banks likely to ease its policy over the coming months, targeting small and mid-size enterprises, the green economy, the real estate sector and eventually cut the Required Reserve Ratios. Those measures are likely to support the asset class. Lastly, we remain neutral on European corporate bonds. Spreads are tight but the asset class will continue to be supported by the European Central Bank. The recent spread widening does not challenge our view. We keep an underweight on US investment grade corporate bonds because in the short term, expected returns will be impacted by rising rates. Same for high yield debt. The rising rates will not compensate for the spread tightening.

Our currency strategy only highlights commodity ones and that includes the Norwegian Krone.

To add some hedges to our strategy and get through the next phase, we use alternative strategies that bring a source of uncorrelated returns and rely on optional strategies to benefit from their convexity.