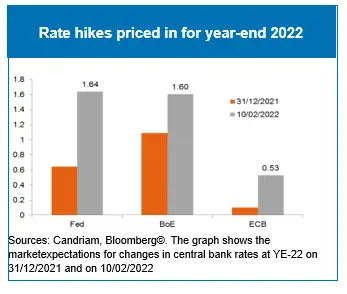

A spectre is haunting the financial markets – the spectre of inflation. All central bank powers have entered into a holy alliance to exorcise this spectre. Earlier this month, the European Central Bank (ECB) was the latest to join this alliance. While neither the Federal Reserve (Fed) nor the ECB have actually adapted their traditional or less orthodox monetary policy tools – i.e. interest rates or bond purchases – both have used their most precious tool to move financial markets: credibility in their forward guidance. In addressing the uncomfortably high inflation numbers during several speeches, central bank forward guidance has suddenly shortened investment horizons. As a consequence of this sudden shift, interest rates are rising and longer duration equities are the worst impacted.

The roadmap ahead

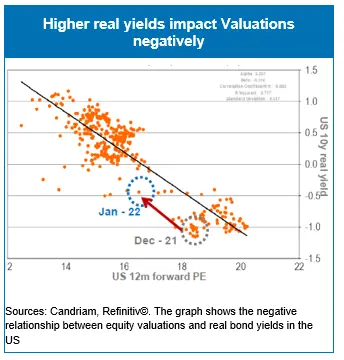

The road towards monetary tightening is paved with good intentions and is a delicate time for equities. The rise in (real) rates has already triggered a violent equity factor rotation from growth to value names, and there is room for the gap to widen, just as much as there is still room for rates to go up. This rise represents a headwind for growth stocks, as they have a longer duration.

Since the start of the year, rate hike expectations have been repriced sharply higher. In a tightening monetary environment, corporate earnings growth is another important driver for equity performance. Consensus analysts remained cautious regarding 2022 expectations, thereby providing a small cushion of safety in case margins or sales figures do not meet expectations. We note that the earnings season under way provides evidence for upward revisions on aggregate. However, the reports so far are not strong enough to offset higher interest rates.

It all comes back to investors’ anticipations of future monetary tightening put into the inflation-growth context. The Fed will aim to manage a soft landing for the US economy in the coming quarters. For the moment, growth remains sufficiently robust while labour markets are close to full employment, providing space to act. We will monitor signs of inflationary pressure on the supply side as well as on wages, but acknowledge that risks appear asymmetrically tilted to the upside.

Inflation on goods but not on services (yet)

In the US, the growth/inflation mix reflects a highly uncertain environment that could potentially lead to different outcomes: from the pleasant Reflationary Boom and Goldilocks, to the less pleasant stagflation or worse, slowdown or burst. Currently, inflation and economic surprises have been on the positive side. There is some evidence that inflationary pressures on goods are finally abating as supply constraints are easing. With the easing in manufacturing activity should come an easing in US core inflation. Whether services inflation takes over from goods inflation remains to be seen. If it does, it will add to an already challenging environment for policymakers and investors.

In the eurozone, economic and inflation surprises are also in positive territory. This high level of inflation has put increasing pressure on the ECB to communicate on its short-term intentions. Energy prices and the natural gas crisis have been the main triggers. Food inflation is also expected to remain high in the coming quarters.

Policymakers in the West are faced with the challenge of finding a balance in removing accommodation without disrupting markets and triggering a hard landing.

Dealing with uncertainty

As expected in our outlook for H1 2022, we have to deal with uncertainty while staying the course for a post-Covid world. Clearly, central banks’ forward guidance on their future reaction has added further uncertainty to the already existing uncertainty linked to higher-than-expected inflation. As a result, the investment horizon has suddenly shortened, leading to sell-offs in widely-held, long duration stocks. To cut a long story short, there will be plenty of occasions for financial markets to assess and re-assess the scenarios until the ECB (10 March) and the Fed (16 March) meet again to announce their actions.

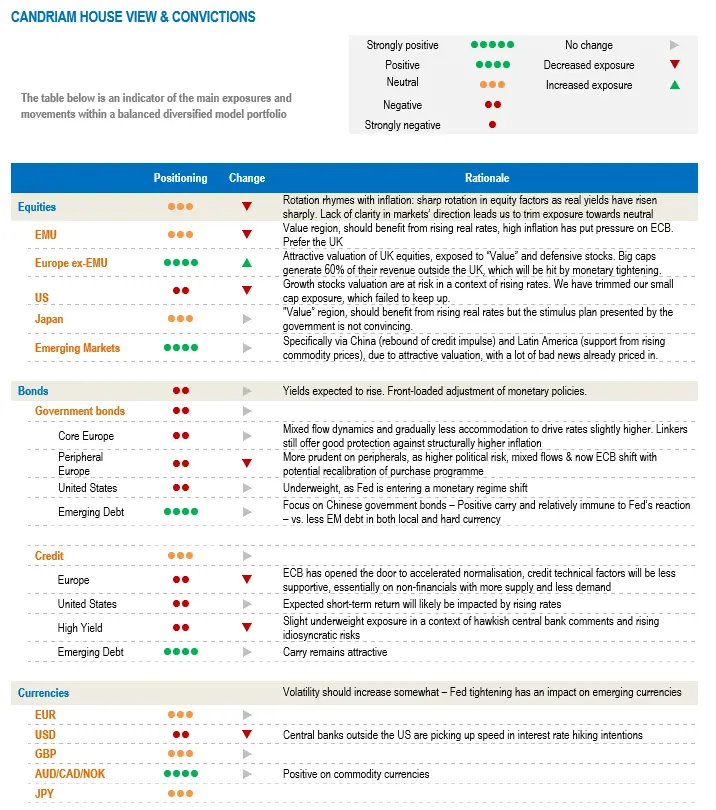

We expect financial markets to evolve without a clear direction until inflationary pressures abate and central banks’ communication succeed in stabilising markets expectations. Hence, both upside and downside risks remain. In this uncertain context, where inflation risks remain asymmetrically tilted to the upside, we are somewhat reducing our exposure to risky assets and adopting a more neutral stance towards equities, while maintaining a short duration bias.

Our current multi-asset strategy

Our strategy adjustments include a more neutral positioning on equities. This is achieved through a decrease in exposure to eurozone equities and US small and mid-caps. Meanwhile, UK big caps have yet again shown resilience in volatile markets. With their cheap valuation and sector exposure tilted towards our conviction to maintain exposure to Value factors, they find a more prominent place in our multi-asset strategy. We are maintaining our overweight stance on Emerging market equities, as we expect the Chinese authorities to ease policy on the one hand, and Latin America to benefit from the rise in commodity prices on the other.

In terms of fixed income allocation, our short duration remains a key cornerstone. We expect the 10y US yield to creep higher towards the 2.20%-2.50% range while the German 10y-Bund yield will escape negative territory and grind higher towards 0.50%-0.80% this year. Our strategy also maintains its diversification, via emerging debt and inflation-linked bonds.

In terms of long-term thematics and trends, our convictions are spread across Healthcare, Demographic Evolution and Consumption, Climate Change and Innovation. In the current environment, we favour the former, but setbacks on the latter thematics could provide attractive entry points.