Ever since the start of the COVID lockdowns, financial markets have enjoyed strong support of central banks. Governments in the US and Europe have also helped businesses to remain afloat, as well as to keep their employees on the payroll. Many companies took advantage of central bank liquidity to borrow more money to help with cash flow. And while we believe that the corporate bonds’ default rates have peaked, a withdrawal of monetary and fiscal support that, however gradually, will follow the end of COVID lockdowns. Combined with a recovery in business activity levels, this is expected to lead to a greater contrast between better and worse performing companies, which in turn will affect their chances of repaying debt. In this type of market, the most important question for investors will be how effective is their corporate bond strategy in differentiating between the winners and the losers.

As governments on both sides of the Atlantic confined their citizens, forced the temporary closure of many businesses, the impact was felt deeply across the global economy. Central banks responded by providing, once again, unprecedented measures to ease financial conditions and help liquidity. In response, both equities and corporate bonds (particularly high yield) recovered sharply. Governments across the globe provided strong fiscal stimulus to keep businesses afloat. As vaccine drives and de-confinement progresses, companies’ activity levels are normalising.

In the near term, a combination of these positive factors has led to an improvement in credit market fundamentals, with quarterly earnings strong and rising stars outpacing “fallen angels”(bonds downgraded from investment grade to high yield). In this context, we believe the default rates will to continue to fall and credit markets overall will continue to exhibit resilience over the coming few months. As macroeconomic recovery takes hold and inflation starts to rise, we expect the main central banks on both sides of the Atlantic to start tapering their quantitative easing programmes in 2022. However, we expect this to be done in a cautious, transparent and orderly manner, that is unlikely to lead to a sharp spike in rates or derail high yield markets. Valuations will remain the main challenge over the short term, although in a low yield environment, high yield markets still remain relatively attractive.

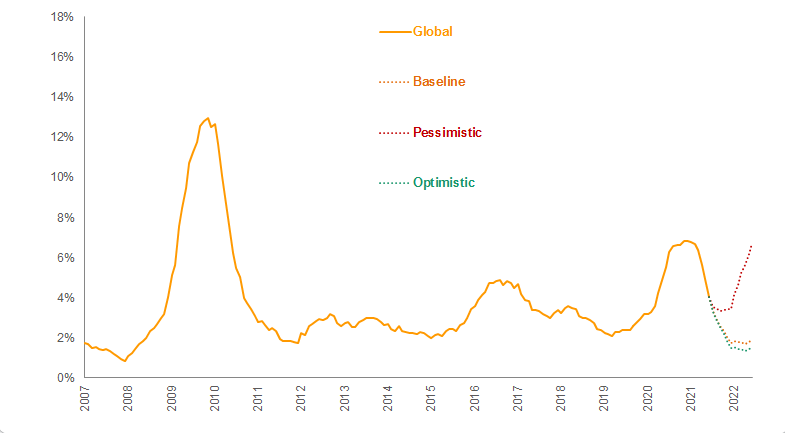

The defaults trajectory

We believe that default rated within the global bond markets have peaked and are expected to trend back towards their long term average. Our outlook for high yield over the next 12 months is constructive.

GLOBAL CORPORATE DEFAULT RATES – ROLLING 12-MONTH

Source: Moody’s, Candriam - Data as of 30/04/2021

The gradual withdrawal of central bank support is also likely to weigh on the liquidity of credit markets. As the central banks’ bond purchasing programmes fizzle out, market performance will increasingly be influenced by the idiosyncratic risks surrounding high yield issuers. This means that the state of their balance sheets should take over once again as the primary driver of performance. Furthermore, the acceleration of secular trends such as decarbonisation, de-globalisation and digitalisation over the past year has forced companies and whole sectors to alter their business models and bring in substantial changes in their supply chains. In this context, we expect some companies to succeed in their transition while others are likely to be left behind, resulting in material performance dispersion amongst sectors, industries and issuers.

With this context in mind, in the medium term, a high level of selectivity based on bottom-up research will be vital, while a detailed and complete understanding of risks, including ESG risks, is going to be very important for bond investors. Furthermore, in the context of low yields, an greater level of diversification and increased flexibility is key. Such a backdrop is ideal for our global high yield strategies that focus on the effective use of their flexible structures and the rigorous nature of their research to better focus on risks surrounding the high yield segment.

The vital question of investment approach

High yield fixed income, as an asset class, will play a particularly important role in investors’ portfolios in a low interest rate environment. Given the raised levels of volatility, which we believe are here to stay, it is extremely difficult for investors to determine entry and exit points into the asset class. So, rather than being a tactical asset allocation option in difficult markets, in these markets investors are more likely to continue to treat high yield as a core part of their portfolios.

Having access to a diversified high yield portfolio will be important both in terms of enhancing yield-to-maturity and the opportunities that can be exploited. Our high yield strategy employs a global and flexible approach, which allows us to invest not only globally but also, up to 20% of the portfolio, in off-benchmark issuers including investment grade, credit default swaps, options and total return swaps. We focus on liquid issuers that exhibit a certain level of transparency and frequency in reporting and are traded by a certain number of counter parties.

Our global high yield portfolios use an ESG-integrated investment approach. We mobilise ESG integration as an advanced risk assessment tool. In other words, we do not exclude any issuers altogether, but instead take into account ESG factors to define a more comprehensive picture about the risk profile of each high yield bond issuer.

To construct our portfolios, the investment team combines our credit research analysis and recommendation with a regular assessment of the macroeconomic outlook along with the high yield market analysis in terms of fundamentals, valuations as well as technical factors in order to construct concentrated portfolios that best reflect our views and convictions. This strategy aims to deliver attractive risk-adjusted performance regardless of market conditions. This approach is focussed on idiosyncratic risk, in order to invest in opportunities at the right price, backed by fundamental bottom up company analysis.

The investor needs to be aware of the following significant risks which are not necessarily adequately taken into account by the indicator:

- Credit risk: the fund is exposed to the risk of default of an issuer in terms of honouring the payment of coupons and/or the repayment of the amount borrowed. This risk is higher as the fund may invest in high-yield debt issues whose issuers are considered risky.

- Counterparty risk: The fund may use OTC derivative products and these may represent a counterparty risk, i.e. the inability of the counterparty to honour its commitments to the fund. This counterparty risk could be fully or partially hedged by the receipt of guarantees.

- Risk related to financial derivative instruments: their use implies risk associated with the underlying assets and can accentuate downward movements via the resulting leverage effect. Hedging strategies using derivatives may not be perfect. Some derivatives may be difficult to value under exceptional markets circumstances.

- Liquidity risk: the fund may invest in securities and/or market segments which may prove to be less liquid, particularly under certain market conditions, and it may therefore be the case that the securities cannot be sold quickly and at reasonable prices.

- Sustainability risk: refers to any event or situation in the environmental, social or governance domain that could affect the performance and/or the reputation of the issuers in the portfolio.The sustainability risk may be specific to the issuer, depending on its activities and practices, but it may also be due to external factors.

This document is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

Candriam consistently recommends investors to consult via our website www.candriam.com the key information document, prospectus, and all other relevant information prior to investing in one of our funds, including the net asset value (“NAV) of the funds. This information is available either in English or in local languages for each country where the fund’s marketing is approved.