'Impact' is an important word to define in investing – and a difficult concept to measure, report, and compare. In our private equity investing, we mean a company which was specifically founded with the purpose to create a measurable Societal impact – and for level of impact to be intimately related to level of profitability.

Case Studies in Impact Measurement and Management

The societal goals of 'Impact' funds of large, publicly-traded equities can be as broad as a portfolio of publicly-traded companies which limits the portfolio carbon emissions, perhaps using a data provider such as Trucost for measuring and reporting the portfolio footprint. This is new enough.

At the other end of the spectrum, one might invest in Impact companies which were founded with specific societal -- environmental or social -- aims. Companies which were actually founded with the purpose of addressing specific societal goals tend, at present, to still be small and non-public. And how do we measure very specific impacts, such as providing jobs for handicapped workers or developing technologies for green energy. Managing a fund of impact funds requires that we measure and monitor at multiple levels -- the underlying company, the private equity fund level and fund-of-funds portfolio level.

It took decades for the field of financial accounting to develop standards enabling companies to be compared across industries. How can we measure Impact? And how can we consolidate 'Impact' measurements across multiple types of businesses in a portfolio of companies?

We start with the 17 UN Sustainable Development Goals, which provide an internationally-accepted conceptual framework and are widely-used by sustainable investors.

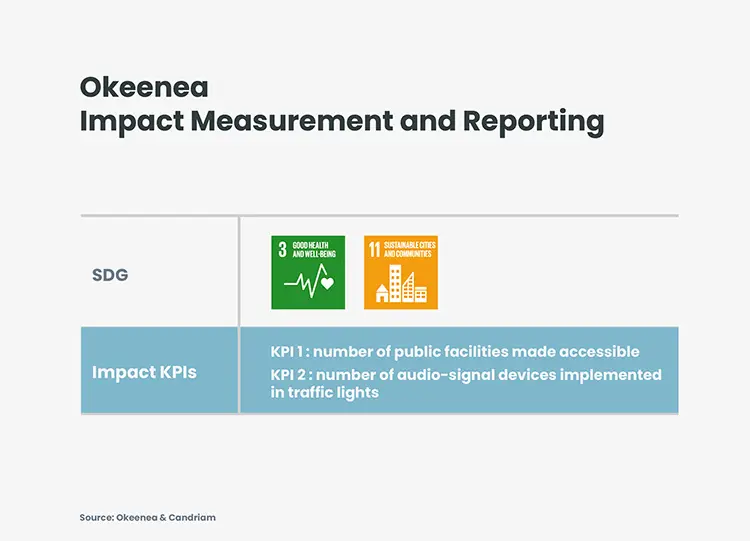

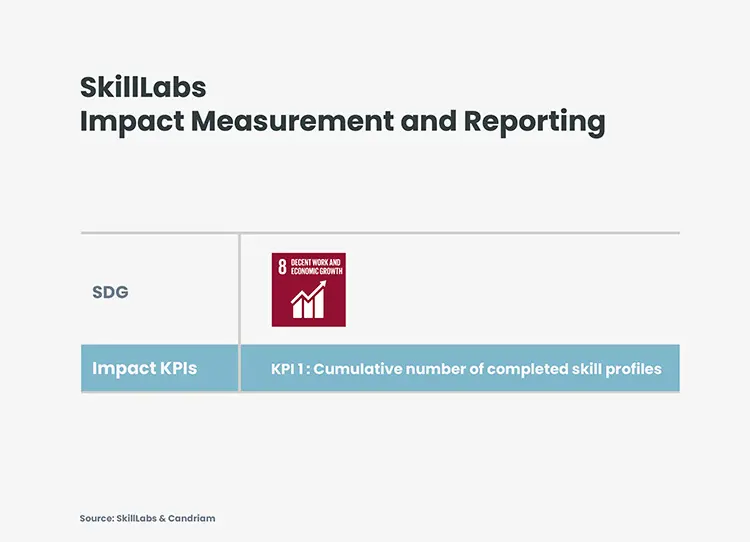

Each company reports quarterly on both measures, impact and profit. Portfolio companies and the private equity general partners agree on from one to three Key Performance Indicators (KPIs) tied to each company's particular business purpose. By holding seats on the impact committees for each fund in which we are invested, we take an active role. The KPIs are mapped to SDG targets. In turn, we group these into six thematic categories of SDGs.1 This allows us to generate fund level reporting of both impact results and financial results.

To illustrate, we describe two companies from two different impact funds.

Company 1: Okeenea

Business Purpose: Okeenea was founded to improve accessibility for the roughly 12 million people living with disabilities in France. More than one billion people worldwide – 15% of the population -- live with disabilities. Two-thirds have difficulty accessing transportation and public spaces. Mobility for the disabled is a major concern for citizenship, education, health, work, culture.

Products and Services: Okeenea combines new and digital technologies to create solutions for those with mobility limitations, and to make cities and services more accessible and safer for everyone. Products include triggered APS (Accessible Pedestrian Signals for blind pedestrians), sound beacons, and multisensory maps. In France, 20% of the population experience some form of disability.

Okeenea currently has four product lines, including audible signage for the visually impaired, building products for accessibility and compliance standards, connected digital solutions for 'inclusive' mobility, and an online distribution business for accessibility equipment.

Impact Reporting: Okeenea is now the French leader in accessibility. More than 200,000 APS have been installed in France. Projects have included the Paris airports, the Louvre museum, the ACCOR hotel group, the Paris RATP public transport system, and the French SNCF national rail system. These are being followed by installations in the five largest Russian train stations and the New York City Department of Transportation.

Company 2: SkillLab

Business Purpose: SkillLab was founded to help workers in marginalized communities such as refugees, migrants, and informal workers enter the workforce. Traditional forms of skill recognition often fail to demonstrate the capabilities of these workers. As a result, these populations can find themselves excluded from formal labour markets despite possessing employable skills.

Products and Services: SkillLab BV, based in Amsterdam, provides equal opportunities through partnership-enabled education and employment for all job-seekers. Based in Amsterdam, they focus on competencies rather than qualifications to help uncover unknown practical skills of vulnerable youth. They use unique matching technology to reduce inequalities based on gender, race and backgrounds for job seekers. The more skills profiles are constructed and completed, the more data is collected and the more precise and improved the matches. Current customers include the UN International Labour Organization (ILO), the City of Amsterdam and Springhouse. The company targets marginalized job seekers, such as displaced workers, refugees and informal workers. SkillLab won the Google AI Impact Challenge in 2019, which allowed them to further improve their algorithm and place refugees in jobs more effectively.

Impact Reporting: SkillLab's three-year target is to help 150,000 marginalised job-seekers. Covid-19 has reduced job opportunities and increased mobility challenges, which is likely to increase medium-term demand for more effective technology solutions for employment. So near-term, Covid-19 may cause some shortfall from plan, while medium-term, it could enhance the outlook for SillLab's services.

Next Steps

Investors are increasingly demanding responsibility and accountability from the companies in which we invest. Businesses actually founded with the intention of making a societal impact, whether environmental or social, are the purest form. As this new breed of company develops ways to measure and report impact, their experiences can help the broader financial world to adopt a formal system of impact accounting. It is our Conviction that we should bring our experience to help this happen.

1 Using the Cambridge Investor Leadership Group framework, these six themes are Basic Needs, Resource Security, Healthy Ecosystems, Climate Stability, Decent Work, and Wellbeing.