Last week in a nutshell

- The main events were the interest rates decisions by the 3 major central banks, the release of global manufacturing PMI’s and the addition of a strong 517K nonfarm payrolls to the US economy.

- The Fed, BoE and ECB met. They raised rates by 25bps, 50bps and 50bps respectively. Borrowing costs reached their highest level since late 2008.

- Global manufacturing activity slightly contracted but improved, underscoring the fragility of the economic recovery. Euro zone factories may have passed the trough.

What’s next?

- The UK will publish a series of estimated data on its GDP, and final ones on its trade balance, manufacturing production, investment, and construction 3 years after the UK’s departure from the EU.

- US preliminary soft data on current conditions, consumer sentiment and expectations, and inflation expectations will reveal how consumers view prospects for their own financial situation, and for the general economy.

- China will release its CPI and PPI reports.

- The Q4 2022 earnings season continues while the EU's ban on Russian oil product imports comes into effect. The impact on commodity markets will be monitored.

Investment convictions

Core scenario

- Our current economic scenario encompasses a deceleration in inflation and in economic growth, via a soft landing of the US economy in 2023. By the same token, we do not see a lower market low than the one seen last October but acknowledge a short-term stabilisation phase on financial markets.

- Credit is a strong conviction for the start of 2023 since the carry that was reconstituted by the rise in yields in 2022 looks attractive. We are overweight Credit, including Emerging market debt.

- We see equity markets moving within a broad range: limited to the upside by the actions of central banks, which will ensure that financial conditions do not ease too quickly if the economy is holding up well and supported by a faster monetary policy pivot if the economy is too hard hit.

- We expect emerging market to outperform as valuation has become more attractive while Asia keeps superior long-term growth prospects vs. developed markets, given that China’s re-opening is rather quick.

- The likelihood of the euro zone growth being severely hit by the natural gas crisis is lower thanks to warm weather. The labour market and consumption are holding up. Inflationary pressure lessened somewhat. With the re-opening of China, Europe should likely resume its export growth.

- In this environment, we expect the positive correlation between equities and bonds to decline and Alternative investments to perform well.

Risks

- Among the upside risks, the Chinese re-opening is good news for the domestic and global growth as long as there is no global inflation spill over via a resurgence of commodity prices in the context of constrained supply.

- Further, unseasonably warm temperatures have recently pushed natural gas prices lower, mitigating the negative impact of the energy crisis.

- Downside risks would be a monetary policy error via over- or under-tightening in the US or in the euro zone.

- Overall, inflation declines and a rise in growth at some point in 2023 is limiting the market downside. But we know that the central banks anti-inflation stance is also capping the upside potential for risky assets.

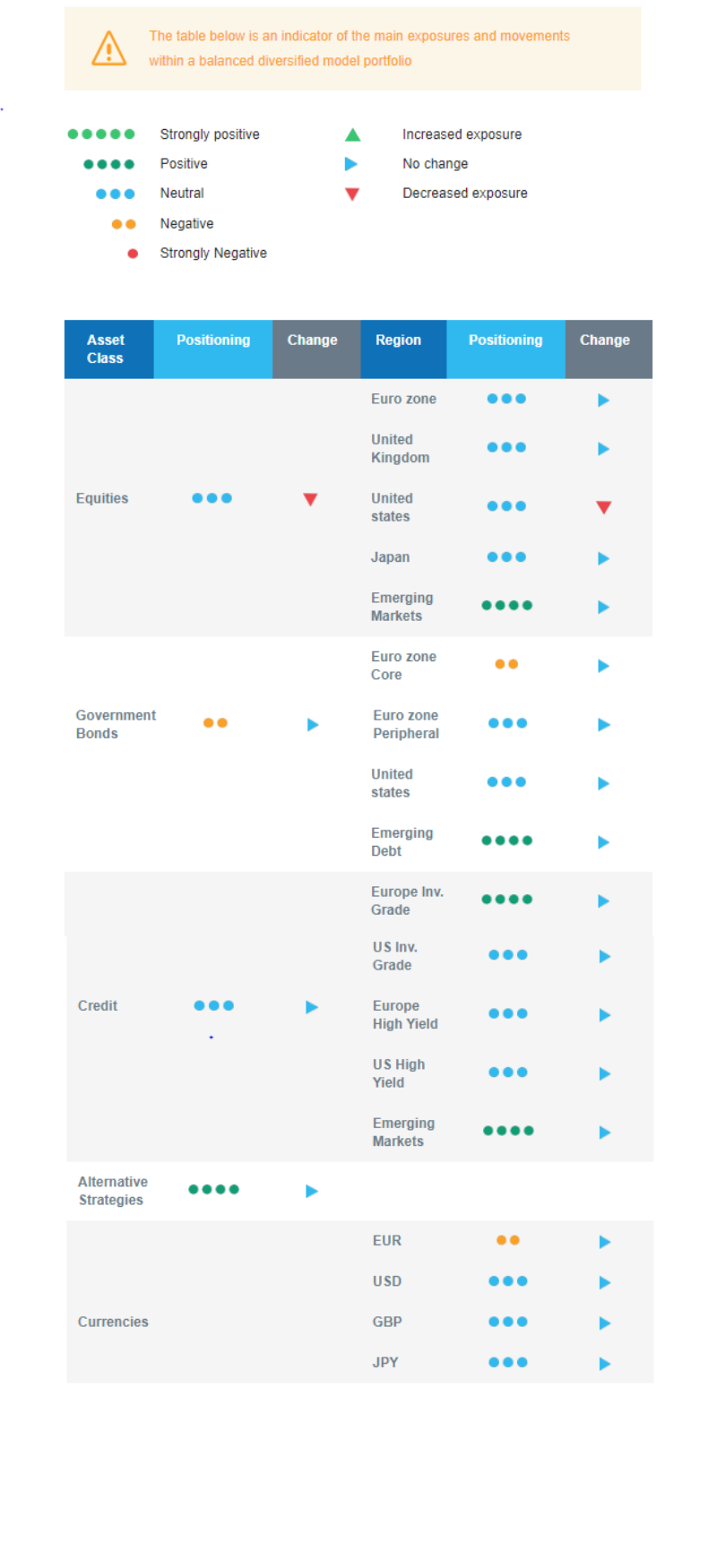

Cross asset strategy

- Our multi-asset strategy was constructive but now identifies signs pointing towards a stabilisation. With a lower risk/reward on the US equity market, we move to a neutral stance on equity, and US equity, at least in the short term. The strategy remains nimble and can be adapted quickly.

- We are neutral equities vs bonds. We have convictions in specific assets.

- In equities, we believe in the Emerging markets region, as valuation is attractive and there is room for a catch-up vs. developed markets.

- In bonds, most asset classes have an attractive carry. European investment grade credit is one of our strongest convictions. We also have exposure to emerging debt and global high yield debt. We have a slight short duration positioning via core Europe.

- In our sectoral allocation, we are positive on the less cyclical segments of the technology sector, such as robotics, software, and hardware, which are less dependent on consumer confidence.

- We have exposure to some commodities, including gold and the Canadian dollar, as a proxy.

- In our long-term thematics and trends allocation: We favour investment themes linked to the energy transition and keep Technology in our long-term convictions. We expect Automation and Robotisation to recover in 2023, and a growing interest in Climate and Circular Economy-linked sectors (such as Industrials and Technology).

Our Positioning

Our current positioning is neutral equities, with a preference for Emerging markets. On the fixed income side, we have a constructive view on investment Grade credit. We keep a slight short portfolio duration via EU core bonds. We remain allocated to some commodities.