European equities: Ending the year on a false note

European equity markets registered a significant rebound from the previous month. This was mainly driven by China’s decision to ease its zero COVID-19 policy. During this rebound, value clearly outperformed growth, and cyclicals took the lead. Cyclical value sectors, such as industrials, financials, consumer discretionary and materials, rallied strongly. Defensive sectors, such as consumer staples, healthcare and utilities, lagged.

While performance dispersion was considerable between value and growth, there was almost no difference in performance between large and small caps. Small caps no longer underperform, and we are indeed probably not far from an interesting moment to start accumulating small cap exposure. Long-term yields are close to a peak, the valuation premium versus large caps has almost entirely disappeared, and investor positioning is limited.

In this context, we are gradually becoming more positive on small caps, looking for a long-term buying opportunity. The only remaining uncertainties preventing us from becoming bullish are central bank tightening, and the need for more visibility on the economy and companies’ earnings momentum.

Earning expectations and valuations

At the start of the year, European expected earnings were further revised down. Investors now count on earnings growth of around 0% in 2023. Growth is mainly expected to come from financials and information technology, while expected earnings growth for both energy and materials is expected to be strongly negative this year.

With that earnings growth in mind, European equity markets still look quite cheap. They are still trading at the bottom of their historical range when looking at the 12-month forward price-earnings ratio of 12.

Stay balanced for now

We made no significant strategic changes, as we still feel comfortable with our current positioning. Consumer staples remain our most important conviction. Although the sector has underperformed during the market rebound and a weaker US dollar has weighed on relative performance, we are convinced of the valuation upside, the pricing power and positive earnings momentum of this sector.

In the meantime, we also maintain our +1 on information technology, our -1 on communication services and energy. The latter seems fully valued after the strong gain last year, while profit margins might be pressured by the ongoing energy transition towards renewable energy out of fossil fuels.

The only change we did implement is on an industry level. After downgrading insurance within financials to neutral at the end of November last year, we have now increased our exposure to banks (retail banks).

Finally, we remain convinced that stock picking will become even more important this year and EPS momentum will be key to generating alpha.

US equities: Unlike their European counterparts, US equities lost some ground in December

Global equities ended the last month of 2022 on a false note. Despite inflation across many parts of the developed world, notably the US, continuing to moderate further in December, a still decisively hawkish Fed weighed on market sentiment. US equities underperformed other developed markets, dragged down by the Nasdaq.

Growth has underperformed

Unlike their European counterparts, US equities lost some ground in December. There was no clear performance dispersion between large and small caps. The more difficult year-end was mainly due to the weak performance of growth sectors, such as information technology and consumer discretionary. Value and more defensive sectors, such as utilities, healthcare and consumer staples, outperformed the broader S&P 500.

Since the beginning of the year , US equities have continued to underperform other developed markets, but sector performances don’t show the same picture.

Materials, communication services, financials, consumer discretionary and industrials have taken the lead so far, while energy and healthcare are the sole sectors to have put in a negative performance so far. Investors are clearly targeting last year’s losers and taking some profit on the winners, although it is way too soon to draw any conclusions.

Earnings expectations and valuations

At the start of the year, US expected earnings were further revised down. Investors now count on earnings growth of around 4% in 2023. This sounds reasonable. Growth is mainly expected to come from consumer discretionary, industrials and financials.

With that earnings growth in mind, US equities don’t look overly expensive, trading at a less than 17 times expected earnings.

Stock picking is key

Equity investors are starting to count on a soft landing for the US economy, as the recent rebound of cyclical sectors illustrates. Leading indicators are indeed pointing in that direction, although it is too early to draw any conclusions. If that scenario should start to materialise, it would prompt us to start investing a little more in cyclical sectors such as industrials and information technology. For now, we have only decided to increase our exposure to some selective qualitative names in the industrial sector.

In any case, given the lack of short-term visibility, it is best we don’t make any big strategic changes at the moment. Whatever the sector, stock selection will be key to generating alpha during this economic slowdown.

Emerging equities: Second month of relative outperformance vs global equities

Emerging markets continued to decline in December, by -1.6% in USD terms, but posted a second month of relative outperformance versus global equity markets (MSCI AC World© declined by 4%).

The recovery was led by China, where an earlier than expected reopening, policy support to stabilise the property market and receding regulatory pressures for tech and platform companies helped Chinese equities post a strong rebound in December. While the rather defensive onshore A share markets consolidated (with the CSI300 up 0.5%), offshore equities posted strong gains, with the HSI index up 6.4% in December. The rest of EM Asia remained under pressure, as the Fed maintained its hawkish instance, and concerns about global tech and the semiconductor slowdown continued to weigh on the performance of heavy benchmark weights in Taiwan and South Korea. India corrected by 5.4%, as domestic demand slackened after a seasonal peak and export activity remained lacklustre on global cues.

EM EMEA saw some relative recovery led by Poland (+7.5%), as energy prices corrected and recessionary fears receded. Conversely, LATAM couldn’t avoid a correction for the month (ending down by 4.7%), dragged down by Brazil, where concerns around Lula government’s new spending plan continued to weigh on market performance.

In commodities, a softening dollar (the dollar index corrected by 2.3%) and China reopening expectations provided some support to metals, with iron ore (+16.7%) and steel (+9.8%) gaining over the month. Oil prices, however, remained flat, ending the month close to US$85/bbl (brent crude), as global recessionary fears offset any gains from China’s reopening.

Outlook and drivers

2022 proved to be a year of many unknowns and headwinds for emerging markets – from an unprecedented Covid situation in China to witnessing one of the fastest rate hiking cycles from the FED. The strategy broadly followed a cautious approach in navigating these uncertainties.

As we now move into 2023, we are becoming more optimistic of an EM recovery, led primarily by China. Not only has China surprised positively in past two months in a swift turn away from the zero Covid policy to a sequential reopening, it has also delivered on policy measures to stabilise real estate markets and revive the demand in consumption. This makes us hopeful that EMs are positioned to take back the growth baton in 2023.

Other factors which were a headwind to EM performance last year, like the strengthening USD, are more likely to recede following peaking inflationary pressures. Amidst the optimism, we are however mindful that global liquidity continues to shrink and that global central banks might disappoint markets on pivot expectations, maintaining a risk-off environment for equities.

We thus continue to hold a balanced portfolio positioning, while increasing selectively to our China exposure and trimming our India, ASEAN and Brazil holdings slightly. More broadly through, the strategy’s exposure remains unchanged, as we maintain a selection of reasonably priced sustainable growth companies in EMs benefitting from thematic tailwinds in a number of growth clusters.

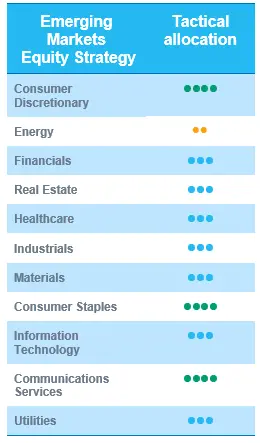

Positioning for recovery

We made no changes to our regional or sector views for the month. However given that we are now more optimistic for an EME recovery in 2023, we made slight changes to our preference, moving from a defensive tilt to reopening/recovery beneficiaries. This is especially the case for our China exposure, where we have changed our preference from China A shares to Hong Kong shares, on the back of the cyclical reopening recovery. In this light, consumer discretionary and consumer cyclicals in particular become appealing, given depressed valuations and leverage to economic recovery. Most headwinds for China from last year have turned to tailwinds or at least subsided, which makes ADRs appealing on a relative basis.

For ex-China, we downgraded India (to neutral) last month, and while the market is consolidating, we are focusing on names that benefit from top-down growth clusters in the region. Similarly for ASEAN exposure, we believe Indonesia could tactically remain under pressure from flow rotation to China, but we maintain exposure to thematic names.

For other North Asian markets, we maintain neutral on Taiwan and Korea, even as the markets could benefit from China’s recovery. However, their large tech and export dependence prevents us from upgrading these regions, while being selective in stock picking.

For Brazil, given the recent disruption on the political landscape, we are more cautious in our selection, but as the markets have already priced in these concerns to a large extent, we maintain a low conviction view for an eventual recovery in the region at some point.

In terms of sector preferences, we are not making any big changes this month. Following last month’s upgrade of consumer discretionary, mainly as China’s reopening plays out, we continue to maintain this view.