European equities: Value stocks largely outperform growth stocks over past 4 weeks

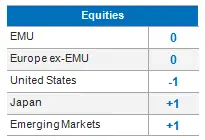

We finally observed a mild correction on the global stock markets in September, after seven positive months in a row. European equities also closed the month lower. Regarding the news, the European Central Bank (ECB) announced a reduction in the pace of its asset purchases but, in contrast to the Fed, was keen to stress that this was not the beginning of a process of tapering purchases down to zero. As the Fed and BoE set out on a path towards higher interest rates, the ECB looks likely to be left behind. The other main news from the Eurozone was the result of the German election, which, we believe, means that the eventual outcome is now unlikely to be a game-changer for German or European equities.

Supply-side constraints continue to weigh on the manufacturing sector and especially on car production. Mobility is back to pre-crisis levels in most EU countries, allowing consumption to gain some momentum. But, if sustained, the rise in the energy price could take a significant toll on household purchasing power.

GDP is expected to be close to trend by year-end, growing by 4.8% on average in 2021 and 4.3% in 2022. The ECB will remain accommodative to preserving favourable financing conditions, all the more so since its strategic review resulted in the adoption of a symmetrical inflation target of around 2%. Still, tapering talks have started: what happens after the end of PEPP in March 2022 is anyone’s guess!

In terms of style performance, over the last 4 weeks, Value stocks largely outperformed Growth stocks, while Small Caps underperformed Large Caps.

In terms of sector performance, over the last 4 weeks, the top performer was the Energy sector, while IT and Materials suffered the most.

Regarding Earnings per Share, forecasts for 2021 and 2022 remain below pre-pandemic levels, except for Materials and almost for Consumer Discretionary on the 2022 forecasts.

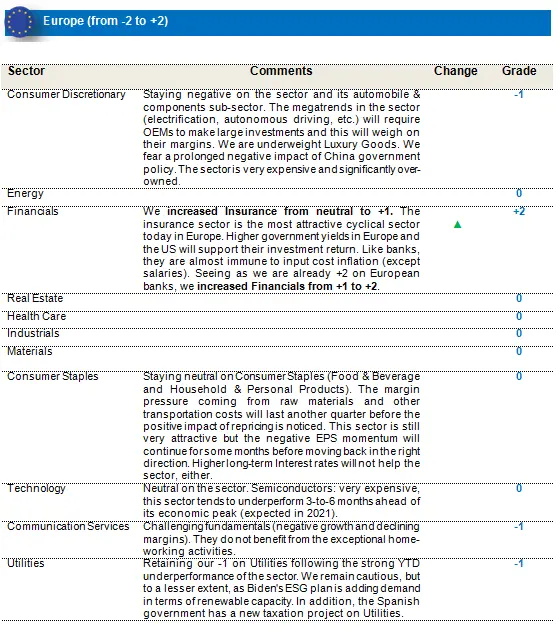

Increasing insurance from neutral to +1

- Staying neutral on Consumer Staples (Food & Beverage and Household & Personal Products). The margin pressure coming from raw materials and other transportation costs will last another quarter before the positive impact of repricing is noticed. This sector is still very attractive but the negative EPS momentum will continue for some months before moving back in the right direction. Higher long-term interest rates will not help the sector, either.

- Increasing Insurance from neutral to +1. The insurance sector is the most attractive cyclical sector today in Europe. Higher government yields in Europe and the US will support their investment return. Like banks, they are almost immune to input cost inflation (except salaries). Seeing as we are already +2 on European banks, we increased Financials from +1 to +2.

- Still negative on Consumer Discretionary, a very expensive sector. We are more specifically negative on automobile and components, as the megatrends in the sector (electrification, autonomous driving, etc.) will require OEMs to make large investments and this will weigh on their margins. We are also underweight Luxury Goods. We fear a prolonged negative impact of the Chinese government policy. The sector is very expensive and significantly over-owned.

- We remain cautious on both Telecom services and Utilities.

US equities: earnings per share forecasts are above pre-pandemic levels

In the US, the Federal Reserve (the Fed) announced that it would soon (probably in November) begin to slow the pace of its asset purchases, which are set to come to an end by around the middle of next year. The Fed also released its projections for interest rates over the next few years, with the central expectation now being for US interest rates to increase to 1.75% by the end of 2024. The pace of rate increases was faster than the market had been pricing in, resulting in a rise in Treasury yields in the days following the Fed’s September meeting, reversing the decline in yields from earlier in the quarter. Supported by strong consumption and investment, activity surpassed its pre-pandemic level in Q2.

The Manufacturing PMI confirms that the pace of industrial activity has peaked, while supply-side disruptions are hampering inventory-rebuilding. The rebalancing of consumption towards services continues, whereas goods consumption has started to decrease. After a fast recovery, investment is slowing down, but high margins and robust demand should prevent too sharp a slowdown. GDP is expected to remain “moderately” above-trend in 2022 (+5.8% in 2021 and +4.3% in 2022), despite less ambitious fiscal plans. The unique nature of the crisis has created exceptional tensions on the labour market and this has induced wages pressures in low-paid industries. However, the high level of margins and accelerating productivity gains should limit the inflationary impact. The Fed does not seem too worried by inflation or by the increase in wages, but recognizes the progress made in the labour market: tapering will happen before year-end.

In terms of style performance, over the last 4 weeks, Value stocks largely outperformed Growth stocks. No major difference between Small and Large Caps.

In terms of sector performance, over the last 4 weeks, the top performer was the Energy sector, while Healthcare and Utilities suffered the most.

Regarding Earnings per Share, forecasts for 2021 and 2022 are above pre-pandemic levels.

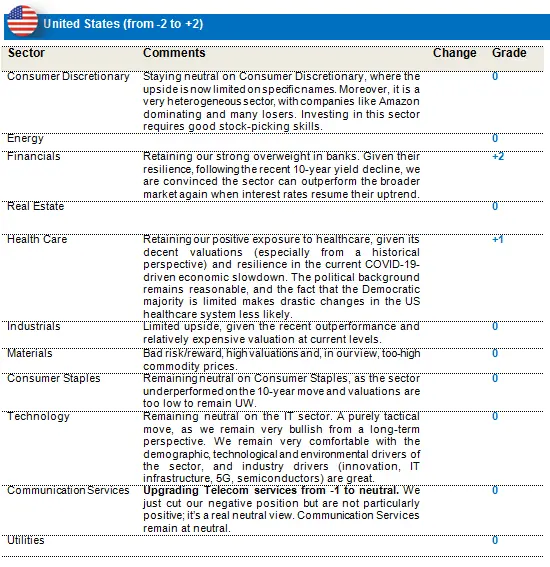

Telecommunication services from -1 to neutral

- We remain neutral Materials. The risk/reward is bad, valuations are high and commodity prices are now, in our view, reaching their short-term high. Most commodities prices are above pre-pandemic levels.

- Keeping our strong overweight on banks, whose recent resilience convinces us that the sector can continue to outperform in the coming months.

- Despite good earnings, we are staying neutral on IT. 10-year yields are too low and should increase to at least 1.75%. However, this remains a purely tactical call, as we remain very bullish on the sector - whose demographic, technological and environmental drivers we remain very comfortable with - from a long-term perspective.

- Staying neutral on Consumer Staples. It is too soon to increase to an overweight, but low valuations justify a neutral weighting.

- Upgrading Telecom services from -1 to neutral. Although we just cut our negative position, we are not particularly positive, and it’s a real neutral view. Communication Services remain neutral.

- Still neutral on Consumer Discretionary. For us, this is clearly a sector in which stock-picking is vital.

Emerging Markets post slight recovery with continuing regional divergence

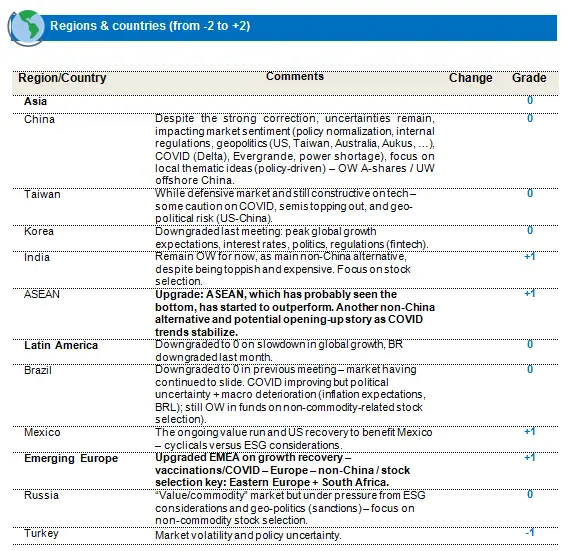

September was a difficult month for EM equities, with expectations of peaking global growth, indications of a faster-than-anticipated taper timeline from the Fed and fears of stagflation weighing on returns and reflected in a 4.2% (in USD terms) correction. The negative news out of China, this time on the financial difficulties of real estate group Evergrande and a looming power crisis, didn’t help the equities outlook for that region and resulted in a -5.2% (in USD) correction for the month.

As yields started to rise, tech-heavy Korea (and partly also Taiwan) came under some pressure, with Korea declining by 6.7% (in USD) for the month and Taiwan correcting by 4.4%. Within EM Asia, India and ASEAN remained relatively resilient, with India, driven by positive inflows and earnings-recovery expectations, ending the month flattish, at 0.5%.

Outside EM Asia, EMEA was resilient, posting 0.3% for the month, as higher energy prices helped the Russia and Middle East markets. LATAM suffered a significant correction, with commodities down and concerns over political uncertainty in Brazil reflected in LATAM correcting by 11.4% for the month.

In the commodities complex, oil (Brent crude) continued to creep higher, trading in a range in the vicinity of $78/bbl while the strong iron ore correction was driven by the softening commodity demand from China. A basket of EM currencies declined by 1% against the dollar as tapering expectations lifted US treasury yields.

We upgrade ASEAN, EMEA, remaining neutral on Asia and LATAM

ASEAN: Region is seeing a pick-up in vaccination rates and reopenings in a number of ASEAN countries. Individual factors also assisting – economic recovery from higher energy, commodity prices (Indonesia), political stability after a long time (Malaysia) and the promise of an eventual economic reopening (Philippines and Thailand). Valuations are still attractive and the beneficiary of supply-chain diversification and a non-China alternative in Asia. We are upgrading to positive (+1).

EMEA: Upgrading the region on prospects of sustained economic growth driven by encouraging vaccination numbers, little dependence on China growth, and countries including Russia benefiting from higher energy prices and attractive valuations.

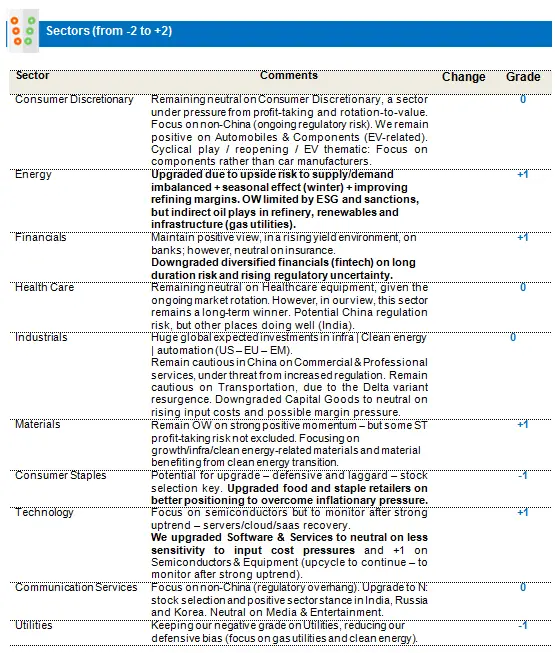

Energy upgraded to positive (+1): We upgraded energy, driven by a combination of strong seasonal demand expectations, an economic reopening creating demand-pull, and supply-side discipline driven by increased ESG awareness amongst large players. We still prefer to have exposure to more green energy and sustainable energy transition enablers, and slightly less on the leverage indirect plays on services, infrastructure (gas utilities) and equipment side.

Capital goods downgraded to neutral (0): Downgrade on possible rising input costs and resulting margin pressure. Remaining neutral, in view of the possible return of infra (fiscal) spending in China and the US.

Food & Staples Retailers upgraded to positive (from 0 to +1): Upgrade driven by sector’s ability to tackle inflationary risks.

Diversified Financials downgraded to neutral (from +1 to 0): Downgrade driven by valuation risks (on long duration fintech plays) combined with rising regulatory requirements on fintech. Prefer banks to fintech/diversified financials, in an environment of tapering and rising yields.

Software & services upgraded to positive (from 0 to +1): Less sensitivity on input pricing and beneficiary of foreign currency (developed) exposure.

Real estate downgraded to negative (from 0 to -1): Downgrade driven in the sector by the large China real estate component, which is undergoing a regulatory overhaul and in which depressed sector sentiment is expected to linger for some time.

We remain overweight (+1) on Materials, on expected strong long-term supply/demand support. However, the focus is primarily on materials, which is benefiting from the structural demand uptrend from the clean energy transition (EV-related materials, for instance).

Remaining neutral in Healthcare, a sector that could potentially be at regulatory risk in China. However, we continue to see growth trends elsewhere in the sector. Long-term positive view on the sector maintained. However, it is selective, given the regulatory near-term risk in China.

Remaining overweight in Semiconductors & Equipment, based on the strong positive supply/demand momentum. However, some ST profit-taking after a strong performance is not excluded. Less positive on memory semiconductors (Korea) in the near term than on processing semiconductors (Taiwan).