Please note that your "Weekly Coffee Break" will not be released on 26 December 2022 and 2 January 2023, due to the Christmas holidays.

Next issue will be aired on 9 January 2022. Merry Christmas and best wishes for a happy and successful New Year!

The Weekly Coffee Break Editorial team

Last week in a nutshell

- In the US, the publication of lower-than-expected consumer price inflation was welcomed by investors. In November, the CPI stood at 7.1% YoY (vs. 7.3% expected), down from 7.7% in October and 9.1% in June.

- Market sentiment soured as the Federal Reserve, the European Central Bank, the Bank of England, and the Swiss National Bank hiked their respective policy rates by 50bps. 2022 will go down as the sharpest monetary tightening episode in more than four decades.

- The temporary stabilisation of energy markets and the expected decline in inflation has led to a second consecutive increase in the euro zone Composite PMI in December. Despite the rise to the highest reading since August, the overall message of a standstill in the region’s economy this Winter remains.

- The UK GDP grew by 0.5% in October in a surprising rebound, helped by the milder weather and consumer behaviour temporarily curbing the energy use. The job market remained tight while evidence of inflationary pressures persisted.

What’s next?

- Investors will continue to digest the hawkish central bank narrative, presented notably by ECB President Christine Lagarde. This confirms our view that investor focus will increasingly shift from inflation to growth in 2023.

- In the euro zone, Consumer Confidence and the German ifo business confidence indicators will be released. Measuring the level of optimism that households and corporates have about the economy, this will give indications for the first quarter of the new year.

- As growth concerns mount in the US, the releases of its housing market, consumer confidence and personal income data, as well on purchasing manager indexes will give investors a glimpse of the country’s condition.

- The Bank of Japan will be the last major central bank to meet in 2022. A change in the policy statement could give more flexibility to adjust interest rates instead of focusing on maintaining massive stimulus.

Investment convictions

Core scenario

- We have a constructive -overweight equities- positioning but with a controlled risk budget. Improving fundamentals are supporting the idea that the October extreme market configuration was a buy signal.

- We expect US and emerging market assets to outperform as valuation has become attractive while Asia keeps superior long-term growth prospects vs. developed markets.

- We have a portfolio duration slightly shorter than the benchmark. Along with central bank monetary tightening since last spring we have gradually increased our fixed income exposure duration, via the credit segments and continue sourcing carry from emerging market debt.

- Central banks are slowing the pace in monetary tightening, aiming for a final target rate to be reached in 2023. As inflation expectations continue declining and bottlenecks are easing, the focus is shifting towards growth while maintaining financial stability.

- Central banks will increasingly focus on lags on their significant monetary tightening already in place and the impact of the quantitative tightening.

- We expect Alternative investments to perform well in this environment.

Risks

- Among the upside risks, we note that the Chinese re-opening in 2023 would be a substantial support for the global economy.

- Further, governments in Europe are adding fiscal aid mitigating the negative impact of the energy crisis.

- Overall, inflation declines and a rise in growth at some point in 2023 is limiting the market downside. But we know that the central banks anti-inflation stance is also capping the upside potential for risky assets.

- Downside risks would be a monetary policy error via over-tightening in the US, a sharp recession risk via a deeper energy crisis in Europe or an unexpected new, harsh Covid-related Winter lockdown in China.

Cross asset strategy

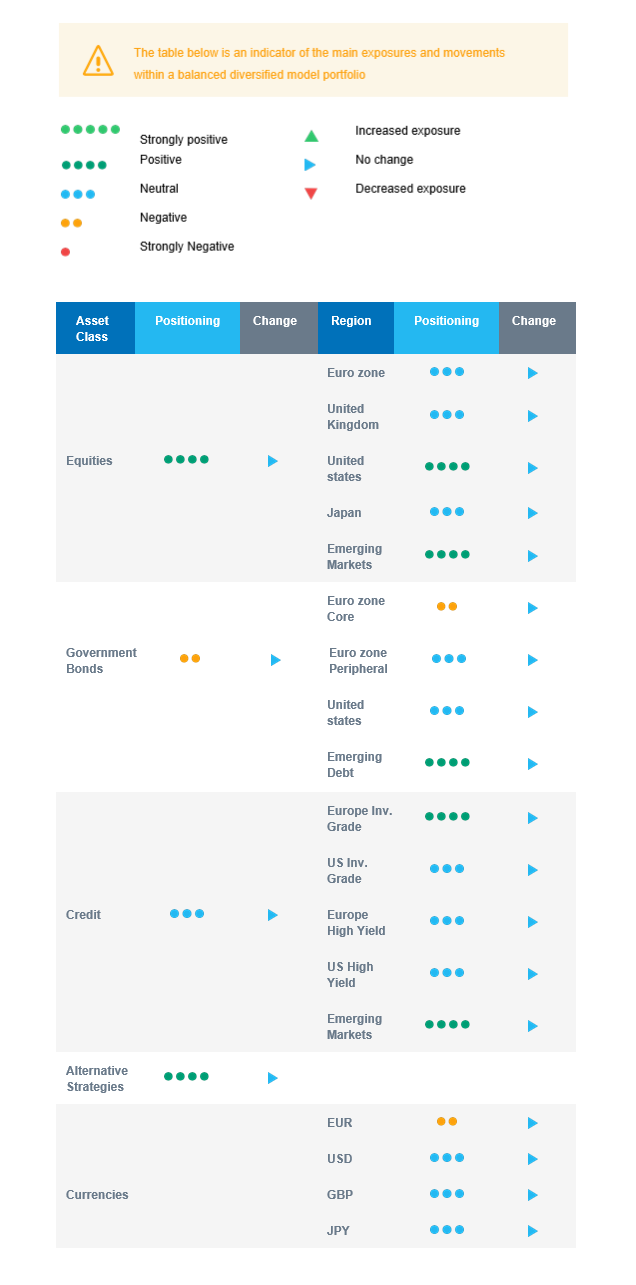

- Our multi-asset strategy has remained more constructive and overweight equities on attractive price levels since October but remains nimble and can be adapted quickly. Right now, we have few strong regional convictions as markets have rallied strongly in past weeks:

- Neutral euro zone equities.

- Neutral UK equities, resilient sector composition and global exposure.

- Overweight US equities.

- Overweight Emerging markets, as valuation has become attractive and there is room for a catch-up vs. developed markets.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure usually act as opposite forces for investor attractiveness.

- Positive on sectors, such as healthcare, consumer staples and the less cyclical segments of the technology sector.

- Positive on some commodities, including gold.

- In the fixed income universe, we have a slight short duration positioning.

- We continue to diversify into European investment grade credit and source the carry via emerging debt and global high yield debt.

- In our long-term thematics and trends allocation: We favour investment themes linked to the energy transition and keep Health Care, Tech and Innovation in our long-term convictions.

- In our currency strategy, we diversify outside the euro zone and are long CAD.

Our Positioning

Our current positioning is overweight equities with a preference for US and Emerging markets. On the fixed income side, we keep a slight short portfolio duration via EU core bonds. We have a constructive view on credit, including high yield. The latter looks attractive with a sufficient buffer for defaults. We remain allocated to commodity currencies via the CAD.