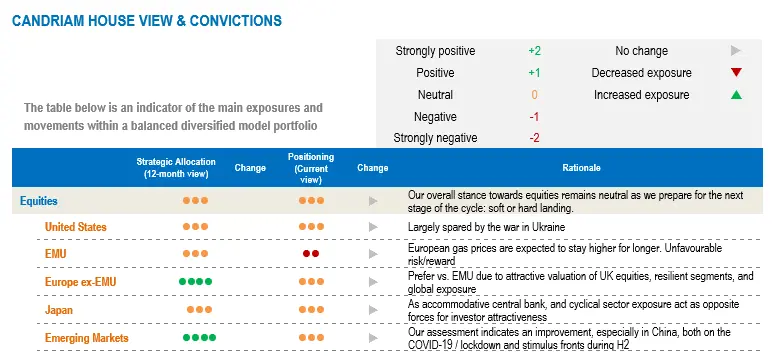

While inflation continues to surprise to the upside, growth dynamics have turned and continue to decelerate. Growth concerns are mainly affecting Europe, as energy prices remain an important inflation driver, while central banks are stepping up their tightening. The negative impact of the energy crisis could be mitigated, as countries are stepping up fiscal aid. Overall, we expect stronger downwards profit revisions in Europe than in the US, as the European equity market is more pro-cyclical, and we confirm our underweight stance on EMU equities. We also maintain a preference for US duration exposure over European, within an overall neutral portfolio duration.

Multi-asset performances reflect the rise in inflation and slowdown in growth

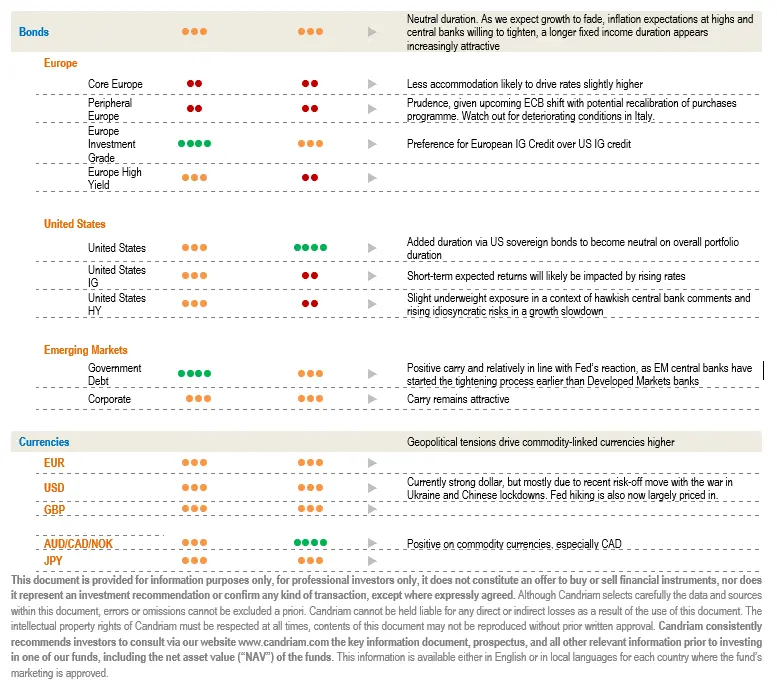

As we are heading into the year-end period, we have spent a moment analysing financial market performances as of end-August. Multi-asset performances reflect the shocks to energy supply, the rise in inflation and the slowdown in the global economy.

The multiple shocks of 2022 have impacted fear and hope regarding the business cycle and inflation outlook:

- First, the war in Ukraine has represented a significant hit to commodity supply and a major confidence shock in Europe, pushing inflation higher.

- Second, the frontloaded Fed tightening à la 1994 and the renewed Covid-related lockdowns in China are weighing on global activity.

- The last episode to impact performances was the strong warning against prematurely loosening policy issued by Fed Chair Jerome Powell.

Clearly, there are few winners in this challenging environment, and losers can be found everywhere except within energy commodities (note however that the price of oil also fell substantially over the summer months).

We note further that the years in which sovereign bond and equity investments both posted negative performances are relatively rare occurrences.

Growth concerns still dominate, inflation concerns are fading

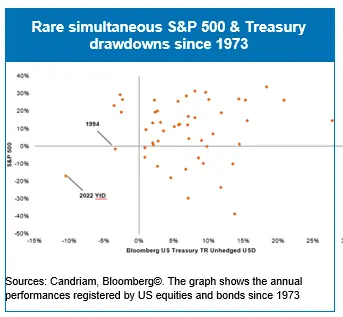

As we have already said, multiple shocks are hitting the global manufacturing cycle. Accordingly, the global cyclical slowdown is well advanced.

Hence, these developments come as no surprise, as the cyclical evolution is proceeding as expected and several countries are starting to experience a contraction in the manufacturing cycle.

Based on Citigroup’s Economic Surprise index, growth surprises remain in negative territory, but improved in August. Inflation continues to surprise on the upside, but surprises have been easing since earlier this year.

Our medium-term outlook for the US is a gradual recovery once the landing is absorbed. In Europe, the handling of the energy shortage is more complex for the ECB and governments.

Central banks are reacting but need to do more, according to the markets

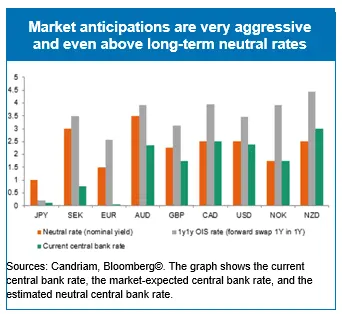

Investors estimate that central banks have further to go in the tightening cycle. Market anticipations, measured via the 1y-in-1y forward swap rate, are currently very aggressive, as they are even pricing in central bank terminal rates above (estimated) long-term neutral rates.

In other words, central banks have been reactive, as they did not want to see inflation expectations remaining too high. However, they need to do more to match the markets’ anticipations.

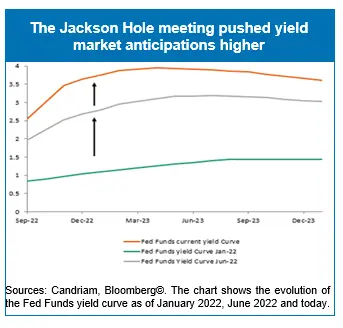

The central bank symposium at the end of August in Jackson Hole was an occasion to push bond yield market anticipations higher. The Fed pivot investors have been hoping for during the summer will likely not occur as early as expected.

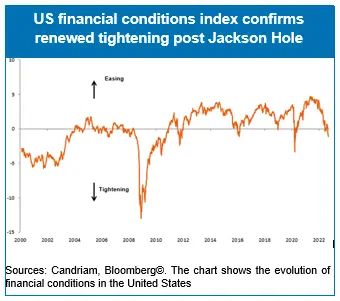

As a result, the expected Fed funds curve has continued to shift higher, and financial conditions are again tightening quickly following the Jackson Hole meeting. The meeting confirmed that central banks are on a mission to tighten financial conditions, hitting equity and bond markets alike, and dragging down the economy.

We therefore expect the Federal Reserve Bank and the European Central Bank to continue tightening over the coming months. In Europe, there seems to be a window to hike aggressively.

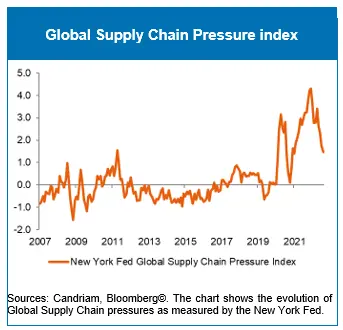

While financial conditions in the US are tightening again following recent central bank declarations, we also note that global supply chain bottlenecks have improved amid the economic slowdown.

A composite indicator built by the Federal Reserve Bank of New York, based on various different indicators, including the Baltic Dry Index (BDI) and the Harpex index, as well as airfreight cost indices, several supply chain-related components from Purchasing Managers’ Index (PMI) surveys, focusing on manufacturing firms across seven interconnected economies in China, the eurozone, Japan, South Korea, Taiwan, the United Kingdom and the United States point to a rapid easing in global supply chain stress.

To cut a long story short, inflationary pressures built up as a result of pandemic-linked excess demand for durable goods might well decelerate quickly as:

- delivery times and shipping costs improve,

- backlogs of electronic components return to long-run averages,

- and orders/inventory ratios have swung from historical highs (96th percentile in summer 2021) to historical lows (5th percentile).

Regional equity allocation: US vs. Europe

While our overall equity allocation is neutral vs. the benchmark, we have a conviction that US equities will outperform European equities.

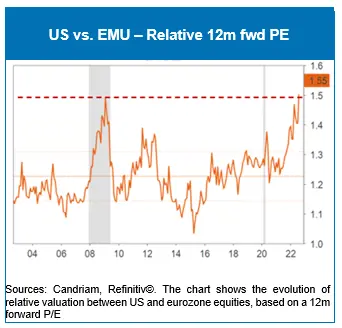

It is true that transatlantic relative valuations have hit the extreme levels last seen during the Great Financial Crisis.

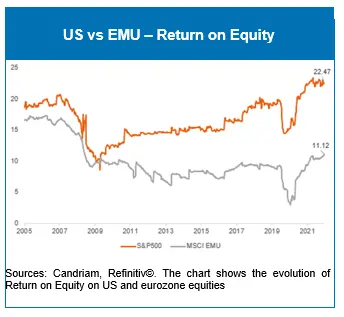

But while US equities are currently valued 1.55x European equities, their profitability appears twice as high. Return on Equity (ROE) has increased to 22.5 in the US, while it currently stands at 11.1 in the eurozone. This gap in profitability may well justify the gap in valuation between the two regions.

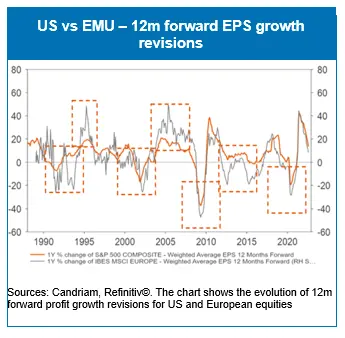

Turning to the near-term outlook, dynamics in European EPS typically enjoy a higher beta than US EPS during EPS revisions. Over the past 30 years, we have seen stronger earnings revisions in Europe than in the US. In a nutshell, compared to the US equity market, the European equity market is pro-cyclical, whether on the upside or on the downside.

If history is any guide, we should expect more downwards revisions on European equities than on their American peers. Note that this observation is made independently of any geopolitical implications in the current environment in terms of potential additional risk premiums.

To conclude, the balance of upside and downside risks confirm our tactical grades, and we prefer US to European equities.

Candriam Sentiment Indicator

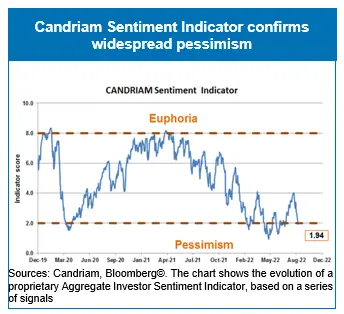

Our proprietary Sentiment Indicator has decreased over the week, falling below the threshold of 2 points (to 1.94 on a scale between 0 and 10).

This decrease has mainly been driven by technical indicators, e.g., weaker RSI and momentum.

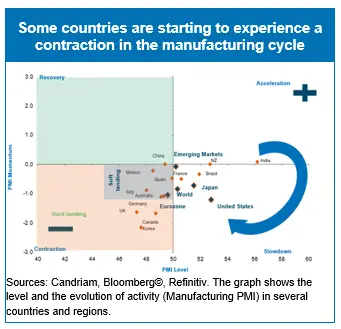

Our current multi-asset strategy

A broadly balanced allocation

Our overall stance towards equities remains neutral. Upside risks include the fact that central bank actions are nearly priced in for peak hawkishness in the US and weak sentiment and positioning in Europe. Further, governments in Europe are adding fiscal aid as the energy crisis deepens, which could mitigate its negative impact. Downside risks would be a monetary policy error via over-tightening or a sharp recession risk via a deeper energy crisis in Europe.

Our portfolio duration is in line with the benchmark. Along with central bank monetary tightening since this spring, we have gradually increased our fixed income exposure duration. Recent market trends confirm our assessment of wide price ranges with bouts of volatility.

We expect alternative investments to outperform traditional assets in this environment.

Underweight EMU equities, preference for Asia EM

Our allocation reflects the conviction that European equities are set to underperform in an environment of high inflation, a hawkish ECB and a sharp slowdown in economic growth. As a result, we expect more substantial earnings downgrades in the region than elsewhere. Given the unfavourable risk/reward, we have a negative stance on eurozone equities.

While the outlook for global equities deteriorates as revenues, margins and, ultimately, profits could be revised down, we expect emerging market equities in Asia to outperform, as valuations have become attractive while the region maintains superior growth prospects vs. developed markets.

Preference for healthcare, consumer staples and tech

The healthcare sector is expected to provide some stability: no negative impact from the war, defensive qualities, low economic dependence, innovation and attractive valuations.

In addition, the current context favours companies with pricing power, which we find in the consumer staples sector.

Within the tech sector, software and services show less earnings risk, but are more dependent on long-term interest rate trends.

We currently prefer segments such as robotics, software and hardware, which are less cyclical and less dependent on consumer confidence.

Overall neutral portfolio duration

With growth expected to fade, inflation expectations at highs and central banks willing to tighten, we continue to think that a longer fixed income duration appears increasingly attractive in the US.

We have a long duration bias via US sovereign bonds, as the more restrictive Fed monetary regime is now largely priced in.

This is offset by a short bias on European bonds. Therefore, we have a neutral overall portfolio duration.

We prefer European IG Credit to US IG credit.

We source carry from EM debt. Positive carry is relatively in line with Fed tightening as EM central banks have started their tightening process earlier than DM central banks.

Preference for commodity currencies

The US dollar has been very strong over the last few months. The risk-off move seems to be the main culprit, with the Russia-Ukraine war in Europe and lower growth prospects in Asia following Chinese lockdowns.

We have taken some profit on our long commodity currency exposure, but maintain a slight overweight, expressed in the portfolio via the Canadian dollar.