The war in Ukraine has added new uncertainties for investors. The most immediate economic impact is an upward revision in inflation forecasts for this year to 5.0% and a downward revision in GDP growth forecasts to 3.4% for the Eurozone in our central scenario estimates. As a consequence, uncertainties, already on the rise due to the expected monetary policy tightening in the United States, have risen further. The invasion of Ukraine and the subsequent economic sanctions on Russia have caused us to be prudent in our allocations: the longer the conflict lasts, the more vulnerable the world economy becomes through a negative feedback loop. This has led us to position our portfolios in a broadly balanced way. Our Multi Asset strategy must cope with the new uncertainty and remain nimble.

A slowdown in global growth coupled with uncomfortably high inflation

The conflict between Russia and Ukraine has many consequences at several levels. It is without a doubt first and foremost a human tragedy for Eastern Europe. After more than two weeks of military conflict, its impact will likely be felt beyond Europe in terms of economy and geopolitics as it is re-defining the world order which has prevailed since the fall of the Berlin Wall.

While the global economy was pursuing its economic recovery from a global pandemic, boasting growth and inflation surprises on an upside that was, overall, supportive for risky assets, we are now in a much more complicated scenario.

The negative feedback loop of the conflict can be anticipated via different transmission channels:

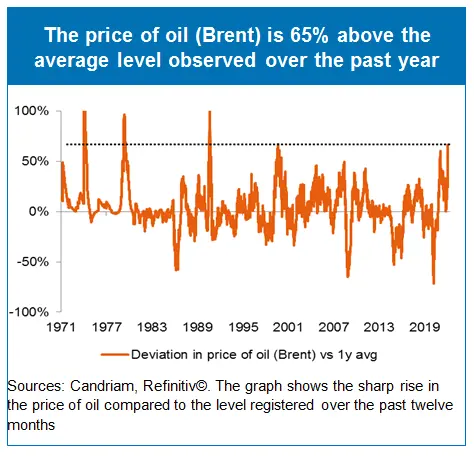

- Inflation, via a rise in commodity prices including the international trade of energy, materials and food, reducing households’ real disposable income and purchasing power and corporate margins;

- Economic growth, via the intermediate goods channel as gas is an input in the production processes of many firms, from producers of chemicals, basic metals, non-metallic minerals (glass, cement, ceramics, etc.) to food and beverages;

- Uncertainty, with the risk of an escalation in the conflict and a re-definition of the world order, leading to a hit to household and business confidence and elevated volatility on financial markets;

- Monetary policies of central banks adjusting their normalisation path as they face new challenges on top of Covid-related supply chain disruptions and tight labour markets.

Some sanctions have united the US, the EU and the UK in their common response. They include financial measures, such as freezing the assets of Russia's central bank, limiting its ability to access the equivalent of USD630bn of its reserves, and banning people and businesses from dealings with the Russian central bank, its Ministry of Finance and its National Wealth Fund. Selected Russian banks are being removed from the international financial transfer system SWIFT. A growing number of international companies have suspended trading in Russia or closed off brick-and-mortar stores. It is of note that up to now there has been no disruption of EU imports of energy products from Russia, i.e., no sanctions and no retaliation via further cuts in deliveries. Nevertheless, the spike in the price of oil is already uncomfortably high and has led to a significant rise in prices at the pump.

The consequences of the conflict will be felt on a global scale, and they increase the risk of stagflation, i.e., a slowdown in global growth coupled with uncomfortably high inflation. The vicious circle of disruptions in supply chain management and rising commodity prices is still on-going and the conflict adds substantial upside risk to inflation. The consequence is a change in economic policy instruments to tackle the crisis: as monetary policy tightens to tackle inflationary pressures, fiscal policy becomes the main tool to engineer accommodation over the coming quarters.

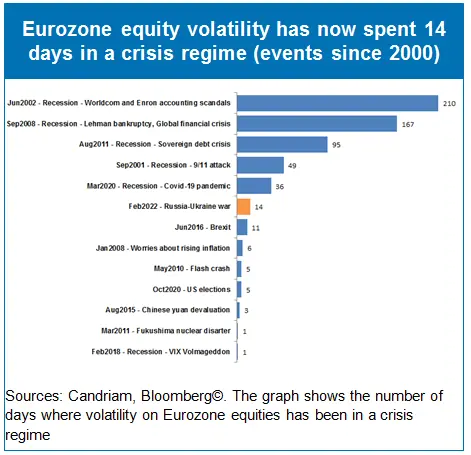

Equity volatility now in crisis regime

We have identified four regimes of volatility in the Eurozone stock market (V2X Index): the EURO STOXX 50 index has spent roughly 12% of the period since 2000 in the highest volatility regime, a crisis regime. We shifted to this regime 14 days ago. The current episode of turbulence has already lasted longer than most of volatility spikes experienced over the past two decades. Along with fundamental and technical analysis, we use these indications to assess the severity of the crisis on the stock market.

We note that exiting the volatility crisis regime after too long a period has been followed by an economic recession in the Eurozone.

Clearly, while the impact of the conflict will be felt in the US, Asia and Europe, the latter is more sensitive, given its dependence on oil and gas imports from Russia and its proximity to Ukraine. This explains the contrast in regional equity performances, with the EU being the most vulnerable.

Market sentiment is being hit by the prospect of tighter monetary policies and recent geopolitical developments, but investor positioning has not yet shifted towards extreme pessimism. In terms of mutual fund flows, some pockets are under pressure, such as credit markets, which registered their ninth straight week of big outflows from IG and HY bonds, and European equities which have been hit by their biggest outflows of long-only mutual funds ever registered (USD20bn in the past 2 weeks).

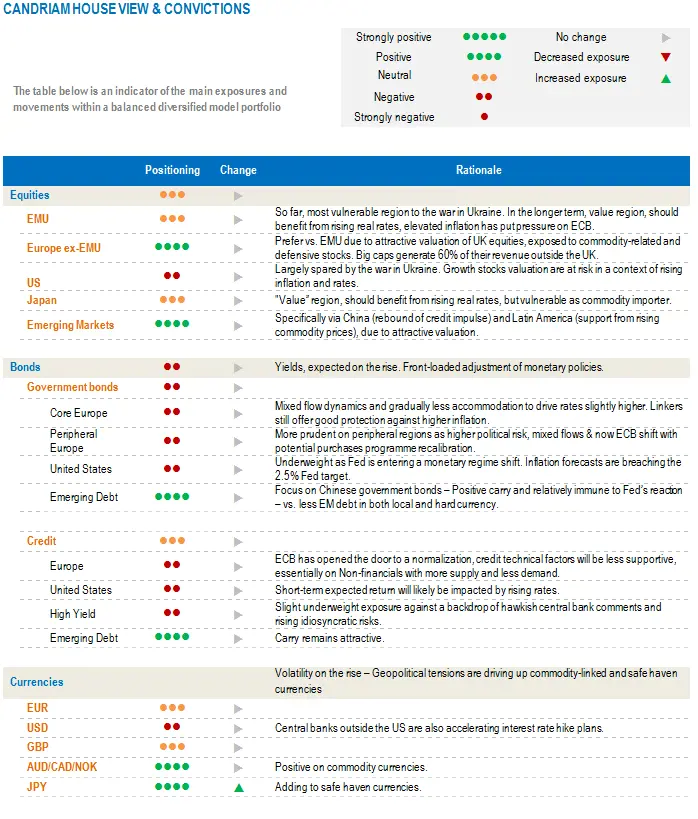

Our current multi-asset strategy

Significant fluctuations in inflation and economic data currently require a balanced asset allocation, which can be adjusted dynamically. Our multi-asset strategy has started to take into account the “stagflationary” trends and a regime of high volatility. Our message emphasizes the need to be cautious and patient.

We will stay with neutral equities, with some exposure to commodities, including gold. We are hedging with derivatives in place to protect some of our US equity exposures and are positioned to participate in a potential rebound in exhausted European equities.

Historically, a context of positive inflation surprises with negative growth surprises will be supportive for real assets, but may be challenging for financial markets as central banks are starting to address this issue. High quality / Low risk stocks as well as the Healthcare and Energy sectors have typically outperformed in that configuration.

As a result, we are focusing on strengthening our exposure to defensive sectors and quality stocks among healthcare, materials, energy and industrials, which are set to benefit from the political response to the rise in commodity prices, in particular via bond issuance for energy and defence spending in the European Union.

We can therefore confirm the exposure to growth-contributing long-term thematics that will benefit from capex dedicated to developing new sources of sustainable and clean energy.

The current inflation backdrop explains why our allocation to fixed income continues to focus on a short duration, and a diversification among inflation-linked bonds and sourcing the carry via emerging debt.

In our currency strategy, we have exposure to CHF, JPY and USD, which play their safe haven role.