Over the last month, the investment environment has been influenced by the consequences of the Omicron variant and by central banks adopting more hawkish rhetoric. The strong economic performance should continue into 2022, with growth of around 4% both in the United States and in the euro zone, and close to 5% in China. We expect supply and demand will gradually rebalance in an above-potential growth context in major developed economies. As strong demand faces pandemic-related supply bottlenecks, tensions arise and are leading to higher prices. Hence, inflation is expected to remain uncomfortably high, at least during the winter months. In the current unbalanced context, investors must be reactive to benefit from market moves.

Inflation and growth are surprising on the upside

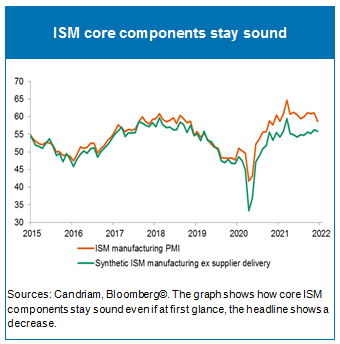

Nevertheless, the recovery continues and activity is well entrenched. Government lockdown measures are less severe than in the past, as the Omicron variant has not led to as many ICU hospitalisations as the Delta variant. Fed by buoyant labour markets and current fiscal plans, growth is therefore expected to remain above potential this year. Supply constraints will abate, as the ISM supplier delivery component already shows, meaning that the internals of the ISM remain robust.

Sources: Candriam, Bloomberg©. The graph shows how core ISM components stay sound even if at first glance, the headline shows a decrease.

China was a source of concern for investors last year, driving stocks down. That led to global discounts on their valuations as earnings growth held on. Facing a slowing economy and with next autumn’s political events in view, the Chinese authorities have decided to ease fiscal and monetary policies. The economy is beginning to react positively and should continue to do so. In contrast to those of other countries, Chinese yields are expected to fall. This will provide support for Chinese assets, both bonds and stocks.

Risks to the scenario

A risk to our central thinking is if growth potential is lower than its pre-crisis trend. Some figures may be disquieting, including the participation rate for +55 year- olds in the US, which is still much lower than in 2019. The current disorganisation of supply-side product lines could last longer than anticipated. A mix of monetary tightening and durable supply bottlenecks may lead to a brutal deterioration of economic and financial conditions, and trigger a premature recession. This would obviously be dangerous for risky assets. And we cannot totally rule out the possibility of a more concerning pandemic variant.

Our credo

We continue to see upside and downside risks for risky assets. We believe that the economic recovery will continue over the next few months, with GDP growth above 4% this year. Central banks, at least the ECB and the BOJ, are expected to remain more patient than their Anglo-Saxon counterparts. Even the PBOC is expected to relax its monetary policy. Then, aided by these divergent monetary policies, long-term yields are not expected to reach levels that can threaten the positive environment on stocks. However, this volatile context should lead to fast rotations between sectors and geographical areas.

In the medium term, we believe that the latest messages sent by the Fed (i.e. interest rate lift-off and balance sheet run-off) will condition performances over the year and that the reduction in liquidity is a major turning point. We remain alert about societal changes, green and equitable, which will have a durable impact on markets, moving investor choices and companies’ margins, depending on their ability to adjust.

Our current multi-asset strategy

Our macroeconomic and market analysis will continue to be guided by the development of economic and inflation surprises, and we will assess the reduction in liquidity driven by the Fed.

We are keeping the broad lines of our allocation unchanged compared to last month. On the fixed-income side, we remain underweight on government bonds, we remain slightly long on breakeven yields in Europe, as the central bank is expected to react very slowly to the inflation risk. This context should benefit the “value” sector, as well as European stocks. Moreover, we will be more opportunistic in managing hedges against inflation risk, banks and “commodity-like” exposures, as central banks, notably the Fed, are more aggressive than anticipated.

Otherwise, we short the US dollar currency, as the positioning seems to be very long. It did not react significantly to a more hawkish Fed and technically could go lower. We remain positive on some emerging markets, Chinese A shares, which could benefit from policy easing, Latin American stocks benefiting from the reopening of the economy and a lower US dollar, and the small caps sector.