The pandemic of 2020 has clearly shown that we can no longer ignore the economic and social costs of unbridled environmental decimation. Investors need to properly measure, assess and integrate environmental, social and governance (ESG) risks in their analysis and engage with a broad range of stakeholders to in order to mitigate them, writes Diliana Deltcheva, Head of Emerging Market Debt at Candriam.

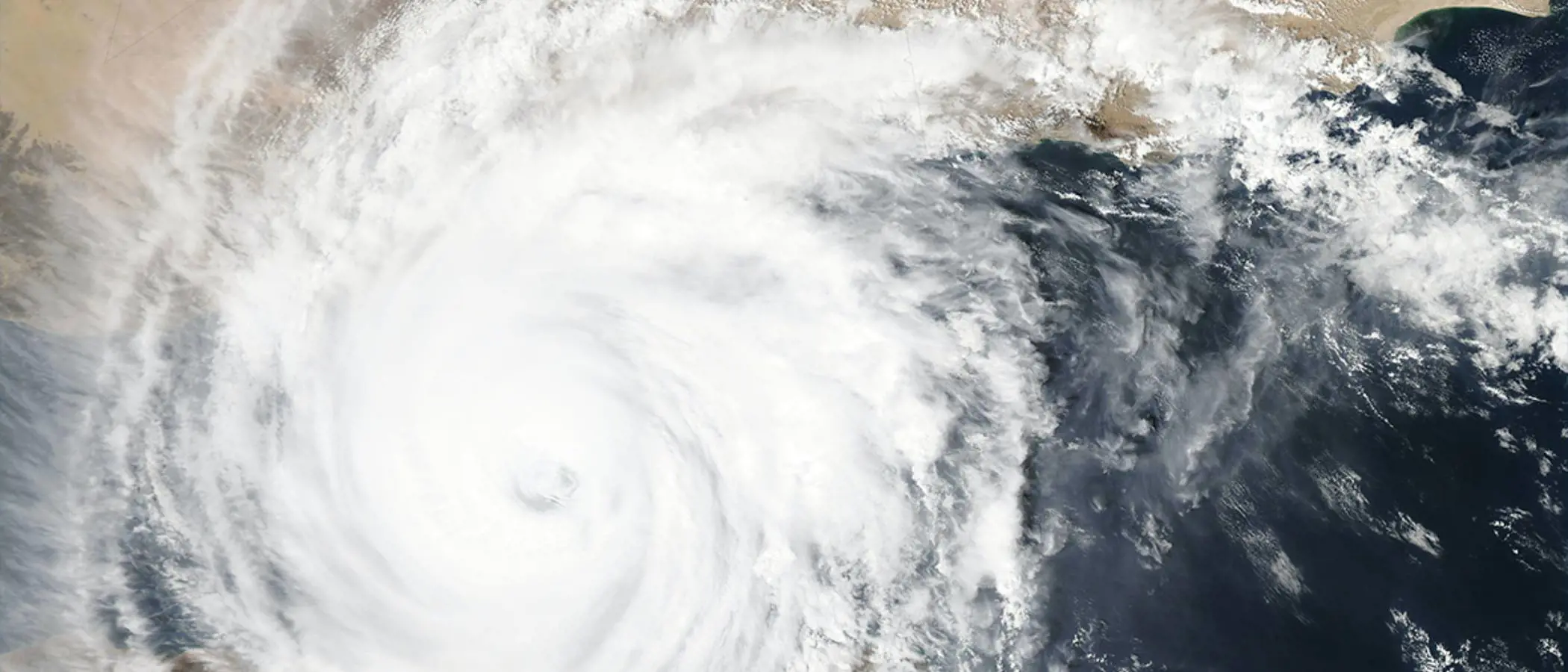

Investors were taught an important lesson in 2020 – environmental destruction comes with high economic and social costs. Scientists have conclusively linked deforestation, land use change, and habitat destruction with the transmission of diseases from wild animals to humans. In addition, the frequency of adverse weather events like floods, intense rain seasons, hurricanes and wildfires, has increased dramatically over the past decade, They are threatening the lives and livelihoods of millions of people globally. According to a report from the McKinsey Global Institute (published in August 2020), by 2050, 75% of the global capital stock at risk from flooding will be in Asia, with the Indian sub-continent and the coastal South East Asian territories expected to be hit the hardest. The science is clear that pandemics and adverse weather events will become the norm if climate change is not reversed.

How should investors incorporate these environmental conclusions in their analysis and investment approach? Enhancing the credit analysis of sovereign and corporate issuers with ESG factors is necessary for effective asset management but it is unlikely to influence issuers’ attitudes. Therefore, to help affect change, we implement our ESG risk management alongside engagement with decision makers on how best to manage away ESG risk premiums from their cost of funding.

It is also about assessing all investment risks

Over the years, ESG risks have been more explicitly priced in asset valuations, forming an important part of the overall credit assessment of a country or company.

Our ESG sovereign assessment is based on the concepts of environmentally efficient development or strong sustainability. This is in recognition of the fact that, in the worst case scenario, climate change may be irreversible and should, therefore, be central in analysing sustainability metrics. Countries are evaluated on the environmental efficiency with which they create Economic, Human and Social wealth, equity and wellbeing.

Key to the concept is that countries can create various forms of capital that contribute to its development and the well-being of the people – human, social, or economic. In the process of this creation, they also use up natural resources and may sometimes cause irreparable damage to the environment. In creating well-being, more environmentally efficient countries will be more sustainable, and less environmentally efficient countries will be less sustainable, because they cannot use up a lot of natural resources and damage their environment to create a bit of well-being indefinitely. To reflect the concept, we multiply the Economic, Human and Social capital scores by the Natural capital score to arrive at a final ESG country score. Variables are selected and weighed on the basis of materiality.

More generally, our investment approach recognises that persistence of inefficiencies that create abundant investment opportunities due to market structure and a large number of country or liquidity or geo-political risk premiums. Our sovereign and corporate asset selection process fully integrates ESG considerations as we believe that a country or a company’s creditworthiness analysis is not complete if it primarily focuses on financial metrics. That is, investors need to be adequately compensated for the ESG and not only the financial risks they are exposed to when investing in countries or companies.

Our ESG country analysis is fully consistent with, and goes beyond, the seventeen UN Sustainable Development goals of 2015. We believe that the type of economic prosperity and development patterns which do not compromise future needs - that is, sustainable development - will ultimately reduce sovereign risks and enhance prosperity.

Engaging with governments

Next to identifying and integrating extra-financial risks in our investment analysis, we are continuously looking for opportunities to actively engage with governments and companies that have the decision making authority to alter their ESG risk exposure. We give preference to the engagement approach as we believe that change requires an inclusive and collaborative efforts on behalf of all stakeholders. A country or a company exclusion from the investible universe is only applied when engagement efforts fail to produce a desired ESG outcome. We may pursue engagement initiatives through a direct dialogue with an issuer or through various collective channels, including non-governmental organisations (NGOs) and industry associations. We believe that engagement fosters dialogue, collaboration and transparency and may be successful in addressing specific ESG risks and reducing a country’s cost of funding.

Deforestation have been one of the topics of our engagement. In October 2020, Candriam signed the Investors Policy Dialogue on Deforestation. We know that reversing deforestation may help normalise our climate and reduce the occurrence of adverse weather events. However, achieving it is a complex task. Agriculture and timber provide livelihoods for local communities and unless people are provided with alternative occupation, they will continue to earn their living by cutting down forests. The international community may need to offer support to developing countries that decide to tackle the issue and transition onto “greener” sources of income. This will not happen without a well-thought out, long-term, inter-governmental global strategy to remove the economic incentives behind this industry.

Simply excluding from our investment universe countries like Brazil and Indonesia, which have the worst scores on our deforestation metric, does not resolve the deforestation issue but ignores it. That is why we are instead engaging with both of these countries to underscore the funding risks they will be facing if they do not start moving towards a resolution of the deforestation problem.

With ESG factors becoming such a powerful influence on people’s lives around the world, their incorporation in the investment analysis is no longer optional. And it is not only about building a more sustainable world for the next generations. The experience of 2020 has demonstrated conclusively that without it we will not achieve investment returns that are both sustainable and attractive.