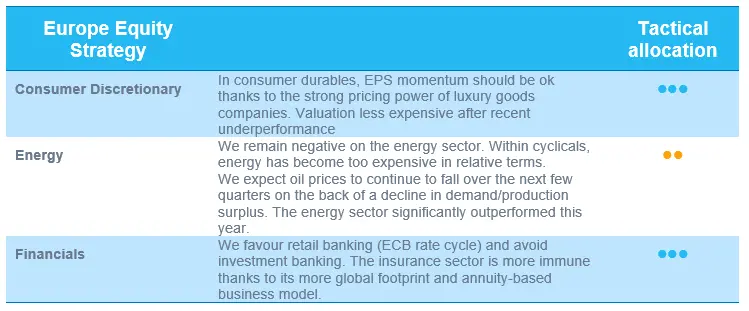

European equities: selectivity is key

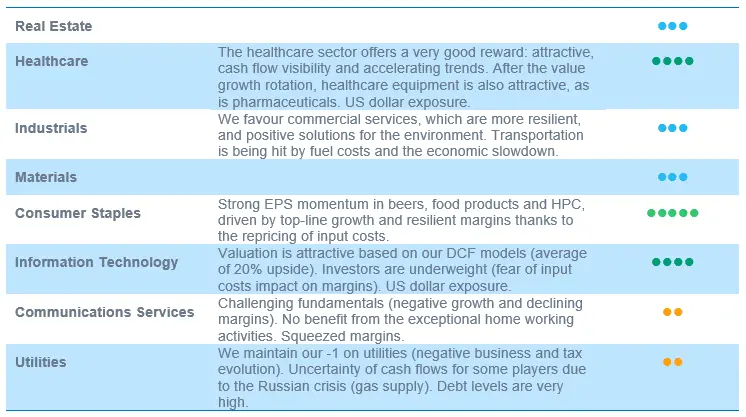

European equities have rebounded over the past four weeks. The rebound was mainly driven by value stocks that have outperformed growth stocks since the last Equity Committee. Energy was once again the strongest outperformer, followed by both financials and industrials. The defensive sectors, consumer staples and healthcare, were the main underperformers. Information technology and communication services also continued to underperform the broader European equity market.

European equities have rebounded over the past four weeks. The rebound was mainly driven by value stocks that have outperformed growth stocks since the last Equity Committee. Energy was once again the strongest outperformer, followed by both financials and industrials. The defensive sectors, consumer staples and healthcare, were the main underperformers. Information technology and communication services also continued to underperform the broader European equity market.

Despite the recent rebound, Europe remains an attractively valued region at 11x expected earnings in the coming 12 months. In addition, the eurozone continues to look like an attractive region in terms of valuation, being at the bottom of its historical range with 12M forward P/E at 10.

Earnings revisions

Earnings revisions remain slightly negative after the Q3 earnings season. Consensus expectations now expect earnings growth of 1.4% for the MSCI Europe©, which is broadly in line with the economic uncertainty in the region.

Energy and materials are the main negative contributors to this expected earnings growth, while utilities, consumer staples and communication services are contributing positively, together with financials. The latter has surprised on the upside so far this year, with a good performance and resilient earnings.

Expected earnings growth is higher in the eurozone than in Europe ex-EMU.

Regardless of whether we are overweight or underweight in a sector, more than ever in an economic slowdown, our watchword remains selectivity: strong discipline while picking stock.

US equities: strong market rebound following September sell-off

After the strong market correction in September, due to aggressive central banks trying to bring down stickily high inflation, US equity markets recovered in October. Despite high inflation and increasing interest rates being at the forefront of investors’ minds, they found some reasons for optimism. While the economic outlook continues to deteriorate, the equity market recovery since the end of September now suggests that a significant amount of bad news has already been priced in as we enter a seasonally positive equity market period.

Value stocks outperformed

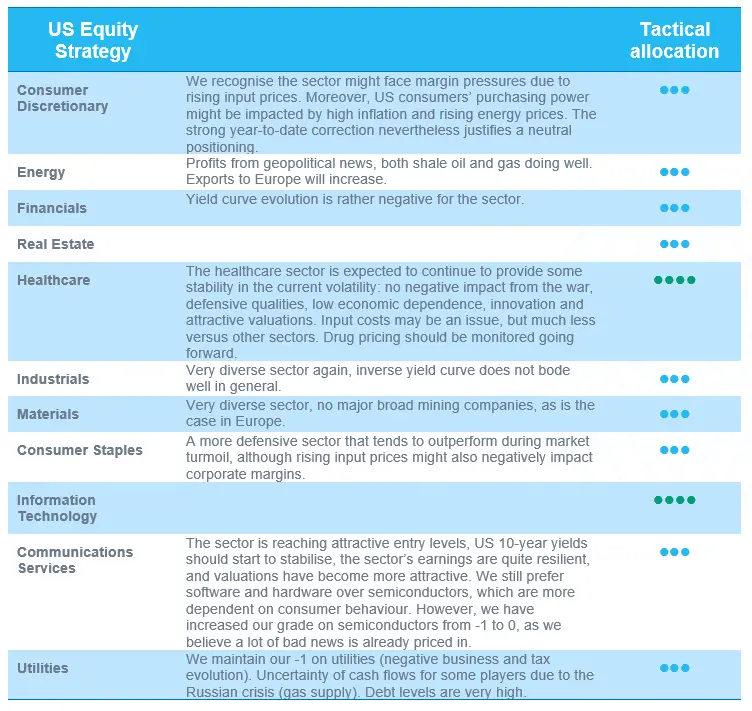

The US market rebound of the past few weeks was mainly driven by value stocks that outperformed growth stocks. From a sector perspective, energy was once again the strongest outperformer, followed by financials, industrials and materials. The defensive sectors, consumer staples and healthcare, also performed quite well during the market rebound, whereas consumer discretionary and communication services were the sole sectors to post a negative performance. Information technology also underperformed the broader market. Following the recent rebound, US 12-month forward price earnings are broadly in line with their historical average.

Decent earnings season

Overall, 85% of companies in the S&P 500 have reported actual results for Q3 2022. According to Factset Market Research, 70% of those companies have surprised the market on the upside. Earnings revisions remain negative and consensus expectations now point to around 6% earnings growth for this year and 2023. Expected earnings growth comes in particular from financials, consumer discretionary, industrials and technology, while earnings growth for both materials and energy is expected to be negative in 2023.

Maintaining a balanced approach

At this time, we are convinced that maintaining a balanced approach remains important. We have not made any strategic changes, and kept our +1 on healthcare, as the sector remains a rational choice on the back of its defensive characteristics: no negative impact from the war, low economic dependence, support from demographic trends and ongoing innovation, and attractive valuations.

We also kept our +1 on information technology unchanged, despite its underperformance over the past few weeks. We still have a preference for software and hardware, but decided to increase our grade on semiconductors from -1 to 0. The technology segment has had a clear reset and a recession is now priced in, while the Philadelphia Semiconductor Index has recently started to outperform the Nasdaq Composite Index.

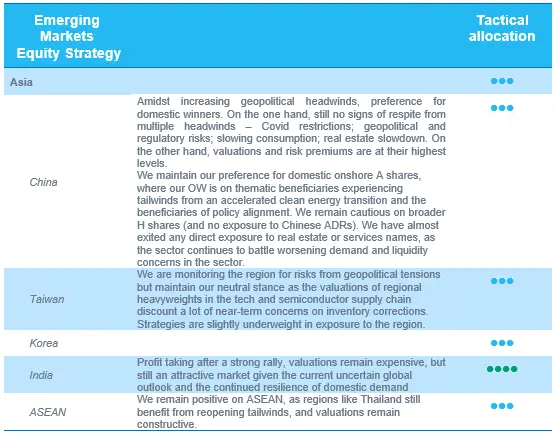

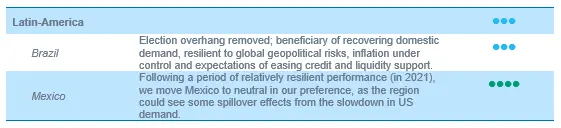

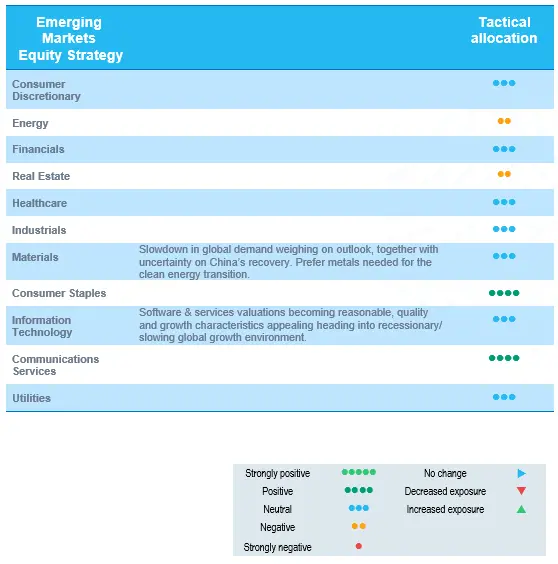

Emerging equities: still some volatility

Emerging Market equities posted another volatile month in October. After starting the month on a relatively stable note, EM equities soon became risk averse following the announcement of US restrictions on Chinese companies to access US semiconductor technology. This resulted in widespread corrections in Chinese and Taiwan tech and semiconductor names, following concerns on longer-term growth trajectories as a result of these restrictions. For Chinese equities, as the 20th Party Congress kicked off, investors looked for key policy directions in President Xi Jinping’s address. With few signs of pivoting away from the Zero-Covid policy and an increased focus on national security, investor sentiment grew increasingly cautious, triggering a further sell-off in equities. As a result, despite China’s 3Q GDP data coming in above expectations, Chinese equities ended the month down 17% (USD returns) for the month. Within Asia, South Korea outperformed, gaining 8.5% over the month, as buying interest emerged following oversold conditions in the prior month and expectations of South Korean companies benefitting from the US Inflation Reduction Act. India ended the month with slight gains (+2.5%) as corporate earnings broadly supported extended valuations. The bright spot in EM for October was LatAm, which gained 9.6% as both Brazil (+8.6%) and Mexico (+13.8%) posted positive returns for the month. In Brazil, following what was one of the tightest election races in the country’s history, Lula returned to power, and Brazilian equities showed resilience on the hopes of a recovery in consumption under his rule.

Changes to regional view

No changes in regional or sector view for this period.

In an environment of continued US dollar strength and fall-out risks from a meaningful slowdown in demand in the US and Europe, we remain cautious on the outlook for emerging market equities. The heightened geopolitical risks from the ongoing Russia-Ukraine war, tensions between North and South Korea, and US sanction risks on China further add to concerns. For China, EMs’ largest benchmark region, the uncertainty around the timing of a possible reopening continues to weigh on the region’s growth and recovery in consumer demand.

But these concerns are perhaps well reflected in the global positioning of EM equities, which is now around its lowest level in a long time. EM equities, for instance, now account for only 6-7% of total global equities.

In terms of strategy positioning, we maintain a balanced and well diversified exposure to sustainable growth names in EMs in a variety of clusters. We believe the underlying secular growth drivers for our portfolio companies should make them relatively resilient to headwinds from global recessionary and geopolitical risk.