Market Review

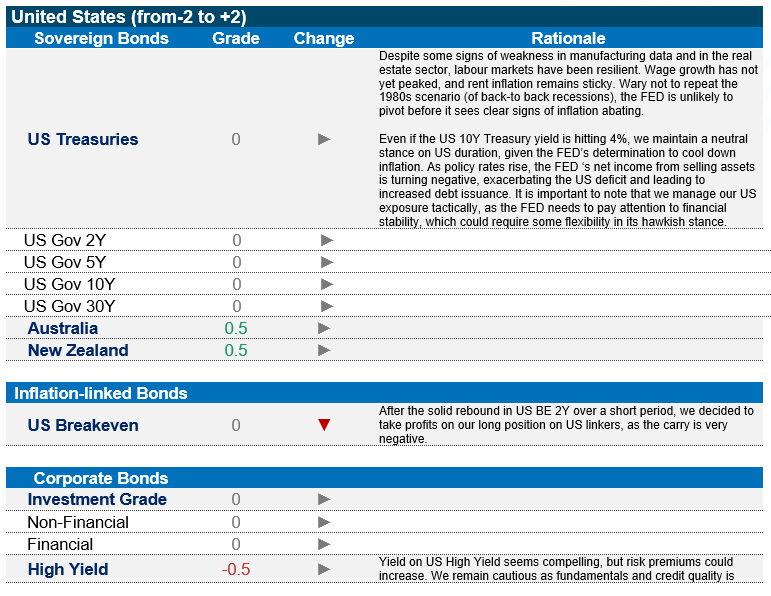

After registering losses in August, there was no reprieve for fixed income investors in September. All major asset classes posted negative returns, with the biggest falls coming in UK gilts. Relatively speaking, US Treasuries fell the least, with other asset classes, including EMU government bonds, USD corporates and EUR corporates falling in between these extremes. As expected, global growth is declining, albeit with surprisingly resilient labour markets. Inflation remains very high, and central banks continue to make hawkish statements. However, the market turmoil seen in gilts raises important questions about the balancing act central banks may have to implement to achieve competing aims – fighting inflation while still ensuring financial stability. Although the immediate trigger for this rout was the UK government’s fiscal policy announcement, the episode raises important questions about central banks’ capacity more generally to implement quantitative tightening.

Over the past few months, central banks have been aggressively and indiscriminately pursuing hawkish monetary policies. However, their capacity to further implement quantitative tightening may prove to be limited in light of the risk to financial stability that we have seen recently. By themselves, these risks do not yet signal a dovish pivot, but investors should pay close attention to central bank declarations and indicators of financial instability, as this will no doubt be a key point in their decision-making.

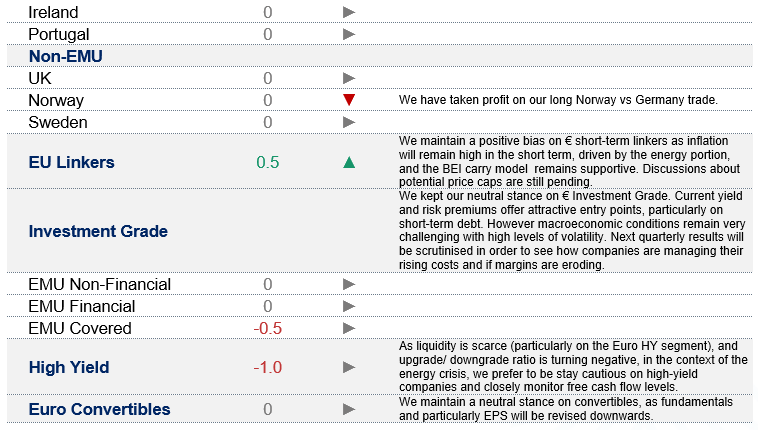

Treasuries: No FED Pivot in sight

US 10Y Treasury yields hit 4%, breaching an important technical barrier. With both hard and soft inflation indicators coming back down, can we expect a dovish pivot with an attendant rally in Treasuries? We believe that it is too soon to make this call. Wage growth has not peaked, which indicates that the Fed is likely to maintain its hiking bias to avoid second-order effects of increasing wages being pushed back into higher producer and finally consumer prices. We can also expect the US Treasury to increase its issuance volume, as rising yields are weighing on the Fed’s P&L. As its own holdings lose value, the remittances it sends to the Treasury – which previously were able to finance a part of the deficit – are now negative, meaning issuance will need to be greater than the deficit itself. In this context, we continue to hold a fundamentally neutral view on US duration.

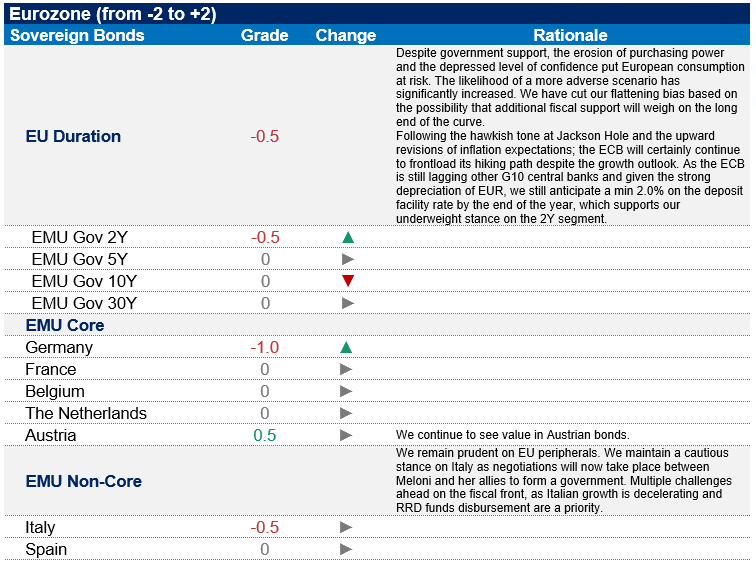

EUROZONE: Energy crisis continues to exacerbate inflation

Despite the slowing growth outlook, the ECB highlighted that further rate hikes are to come. The bank’s own forecast on inflation for 2024 is still above 2%, and it will remain in a hiking mood for as long as this remains the case. In the absence of signs of a sustainable downturn in inflation, we are compelled to maintain our negative view on the 2Y tenor of core eurozone duration. Growth metrics are certainly slowing in the eurozone, but additional fiscal support cannot be ruled out and could potentially support the long end of core eurozone curves – which leads us to hold a neutral stance on longer maturities.

The picture is similar for eurozone peripherals. From an individual country perspective, we remain prudent on Italy in particular, as risks are clearly concentrated on the downside. We do not expect outright fiscal carelessness from the new government under Giorgia Meloni, but there may be some amendments her cabinet wishes to make to the draft budget that the incumbent Draghi government submitted to the European Commission in light of election promises. We may also see an adjustment in the outlook from the major credit rating agencies. Technical factors could also push BTP yields higher in the coming months, as year-to-date issuance has been lagging and the Italian Treasury’s cash position is unusually low.

THE BOJ’s gamble

Japan may have finally succeeded in breaking out of its deflationary cycle, with most indicators – including wages – pointing higher. This is compounded by JPY weakness, leading the country – like the eurozone – to effectively import inflation in the form of higher energy bills. Nonetheless, core inflation is not yet at 2%, and the Bank of Japan may be tempted to continue to let inflation rise until it reaches that level before intervening. Given Japan’s very high debt-to-GDP ratio, there is of course a risk that rates rise to unsustainably high levels – indeed, the BOJ continues to intervene on the 0-10 year segment of the curve to keep yields under control. Even if the bank’s interventions continue to achieve their aim, this nonetheless leaves ample room for a steepening on longer tenors. As a result, we have taken a short position on long-dated Japanese government bonds.

Emerging markets: We remain cautious, but fed action less of a concern

The hawkish FED and a terminal rate of 4.5% now finally appear to be reflected in emerging market valuations, and the inflation cycle is therefore less of a concern than previously. External and macroeconomic factors however continue to be unfavourable to the asset class. The global economic slowdown will weigh on exports – leading us to revise our relative preference for commodity countries. China continues to present significant downside risks in its property market. Risk aversion in the market is still high and will not be supportive to EM issuance. Finally, the US dollar’s strength and uncertainty about the directionality vs. EM currencies makes taking positions in local currency debt difficult at the moment. However, specific opportunities can be found in currencies that have suffered this year and that are exhibiting stable fundamentals.

Credit: Attractive yields – but Some risks still not Fully priced IN

We maintain our defensive stance on credit and prefer quality. Valuations have become more attractive in terms of yields but on High Yield markets, risk premiums are still close to historical averages, while on EUR Investment Grade markets, we are reaching levels close to those seen during the peak of the Covid crisis. As a result, we prefer Investment Grade to High Yield on a relative basis. Overall, the macroeconomic environment remains challenging, and we are seeing signs of fundamentals coming under pressure. Credit quality drift is worsening – for High Yield, we now see more downgrades than upgrades. Firms’ free cash flow is expected to deteriorate. At current levels, we feel that spreads in High Yield markets are not yet adequately pricing in the risks firms face.

Strategy & Positioning