What are the key drivers to the performance of the biotech sector?

Of all the sectors praised to the heavens at the time of the dot-com bubble, the only firms to have truly lasted the course are biotechnology companies. There are good reasons for this.Currently, six of the ten best selling drugs worldwide are biotechnology drugs, including the No. 1 seller, anti-inflammatory Humira. The sector as a whole is also less vulnerable to generic competition due to its inherent scientific complexity and due to the necessity of holding costly clinical trials. Corporate activity is an omnipresent factor too as cash-rich companies bolt on smaller biotechs to boost overall growth rates.But what usually escapes most investors who are not experienced biotech specialists is that the major driver to performance in the sector is medical innovation.

What does this mean for investors?

Improved scientific instruments and a better understanding of the underlying causes of diseases are leading to big improvements in drug efficacy and innovation. These are the major drivers of individual share price performance.For investors, these characteristics result for example in a relatively low correlation between the performance of the biotech sector and the wider equity market. The vagaries of the broader economic cycle are, after all, largely irrelevant in the success or failure of drug development founded on many years of hard work in the laboratory.

And while there is certainly competition in some treatment areas, individual companies very rarely have exposures to precisely the same risk factors.

Biotech is therefore very much a stockpickers’ universe. But it is also one which requires huge specialist knowledge.

When is the right stage of drug development to invest in biotechs?

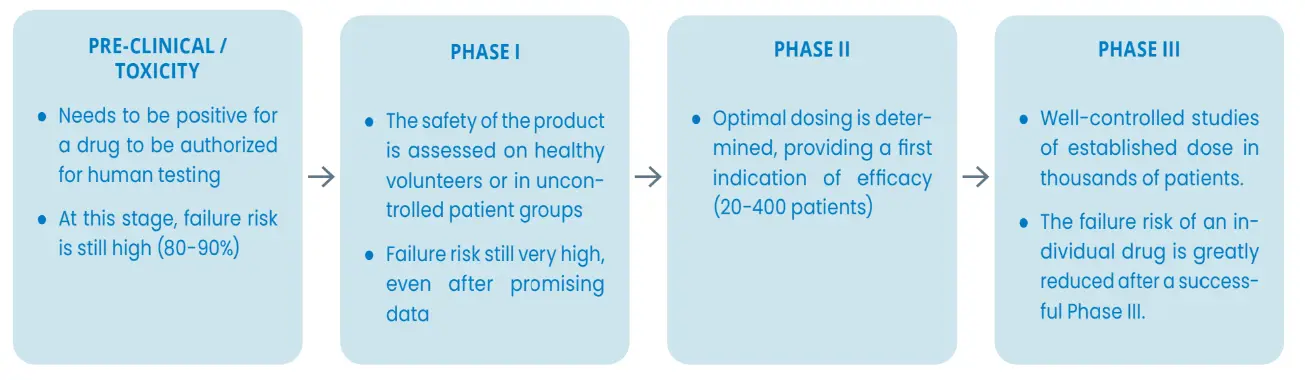

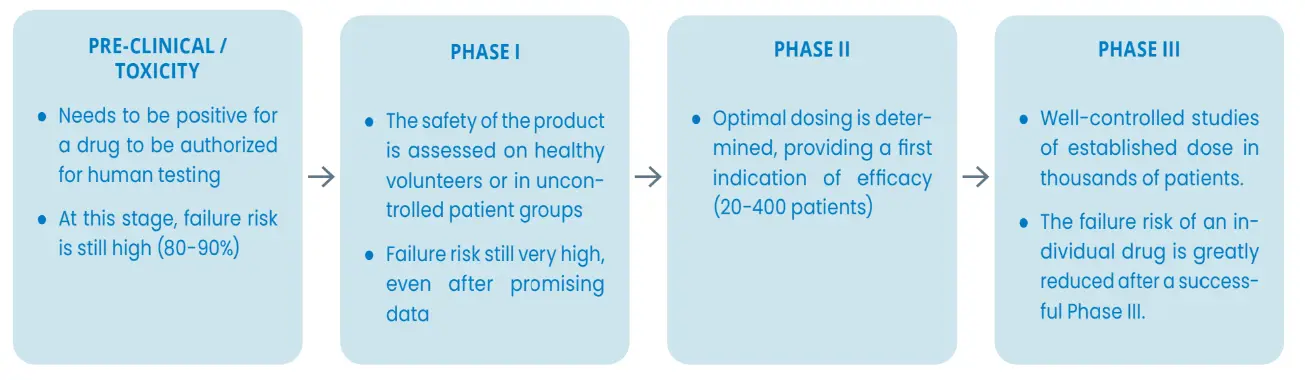

In the early stages, investment can certainly yield very high profits. However, these returns inevitably go hand in hand with a great deal of risk. At the other end of drug development, you are likely to miss the vast majority of the profit potential if you wait until all of the clinical development phases have been completed successfully.However, we believe that there is a “sweet spot” in the risk/reward trade-off that lies between these two extremes. This is after “Phase II” of a drug’s development has been successfully concluded.

What does successful stock picking in the biotechnology sector involve?

In-depth clinical assessments, much less the valuation models, are the critical factor in determining biotech company investment returns.

Drugs are are developed by doctors, approved by doctors at the regulatory bodies and they are prescribed by doctors.Thinking like a doctor and understanding the needs and processes followed by the medical profession are therefore the key elements to consistent alpha generation.(1) But this is a scientifically complex world which requires experience and a depth of specialist knowledge that cannot be quickly or easily assimilated.

What differentiates Candriam in mastering the inherent scientific complexity of this sector?

Since inception, Candriam’s biotech strategy has been managed by the same fund manager, and has always benefited from this dependable mix of knowledge and experience these past 20 years. Contrary to intuition the outcomes of clinical trials are not always binary, not always black or white. Interpreting the data requires a deep understanding of the disease settings and over the years we have been able to thoroughly develop this, with a healthcare team of 5 people, including 3 dedicated biotechnology analysts, one of whom is a manager, and two analysts with a PhD.

Does the strong performance of biotechs over the last few years mean the sector is now overvalued?

Many observers are now questioning whether the sector can maintain the strong performance of the last 5 years, even more so in the light of the political statements by Hillary Clinton and others on drug pricing in the US. We remain however positive on the sector as no politician wants to stop the huge innovation currently going on and hence we firmly believe truly innovative and efficacious medicines will always gather high reimbursement. Innovation never sleeps and especially in immune-oncology the progress has been spectacular recently.Against this backdrop and in the context of many biotech companies’ potential growth, valuations for the sector do not look unreasonable. As always, biotech remains an opportunity-rich universe for skilled stock pickers.