The month of August was marked by the highly awaited Jackson Hole symposium, at which Jerome Powell alluded to the beginning of tapering while still maintaining an overall accommodative stance. Bond markets generally remained fairly resistant to the announcements trickling from the conferences. Equities continued their march higher while economic data kept a softer tone and economic surprise indicators continued to move lower. On the COVID front, infections linked to the Delta variant have probably passed their peak in the US and Europe, following the path observed in the UK. The efficacy of the vaccination campaigns, in light of the limited number of breakthrough infections of the Delta variant, remains a welcome signal. It now remains to be seen how other variants will spread worldwide and how well acquired immunities will deal with them. In terms of bond-market performance, the US-German spread remained stable, at 169 bps, virtually unchanged during the month. US 10Y rates rose to 1.31% (+9 bps in August), while the German 10Y finished the month at -0.38% (+8 bps). IG credit indices were marginally negative on a total-return basis during the month, as spreads slightly underperformed, while European and US HY indices delivered respectively +0.55% and +0.34% in August, with spreads remaining well supported. On other asset classes, US Equities remained the best performers vs. European Equities during the month, with both segments posting positive returns. Oil prices saw a small decrease, with OPEC oil output rising in August to its highest level since April 2020.

Our activity cycle analysis continued to indicate a strong picture for the G4 countries, with almost all (except Japan) at the expansion stage. We take note of the small glitch seen over the month of August due to industrial production declining, although this does not call into question our overall positive view of the growth cycle. All countries are in the “inflation” portion of the cycle, with the US firmly entrenched in the phase. Regarding monetary policy, market focus was on the annual Jackson Hole symposium taking place at the end of August. Despite a few hawkish comments from non-voting FOMC members voiced in the days preceding the event, there were no major changes in the Fed’s communication regarding its path towards tapering. Chairman Powell insisted again on the transitory effect of the currently higher inflation and emphasized that the labour market was slowly recovering from the sanitary crisis. In his speech, Powell made it clear that he and the Fed would continue to discuss the right time to taper bond purchases and that it would depend on how the economy and the labour market performed in the 3rd quarter. The ECB delivered a fairly dovish press conference following its September meeting. Though a reduction in the Pandemic Emergency Purchase Plan was announced, it was deemed to be rather small (€10bn reduction), while the overall tone was fairly accommodative, with ECB chief Christine Lagarde also cautioning that the global spread of the Delta variant could yet delay the full reopening of the economy.

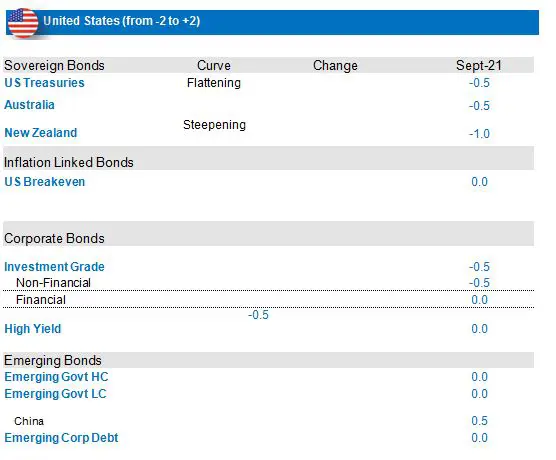

Maintaining a slightly negative stance on US rates and the dollar bloc

Better inflation data and an improving activity cycle are the main factors behind our short position in US rates. Core PCE numbers are higher in the US and the unemployment rate is moving lower, though we need more confirmation on that front. The job market seems to have recovered around 80% of what was lost in 2020, but the participation rate is a cause for concern, particularly among minorities in the US. Although recent NFP numbers were weak, we expect a catch-up in September. Inflation is giving cause for optimism and most components are participating in the increase. However, salaries/wages are the weakness, once again linked to employment. Low-skilled work is where employment has been generated, but that has not been followed in the high-skilled/salaried positions. We also take note of the slight decline in the US business cycle, where consumption is moving lower (retail sales & personal spending). Unemployment cheques have helped personal spending, but now that they are no longer in place, we are seeing some downside. On the market-positioning front, over the past two months, short positions on US rates have been reduced (on the 2-5 year portion, in particular) and investors are now long on the 10-year segment. In this more measured context, we maintain a reduced negative stance on US rates, preferring to move our short positioning focus to core-Eurozone.

Our negative exposure to New Zealand rates continues, on the back of more positive economic data and a tapering of monetary support in the form of scalebacks in central bank asset purchases. We expect the curve to further steepen in the near term. In Australia, despite the economic impact of the Delta wave, the RBA, having first decided to reduce its weekly purchase programme, ended up extending it by 3 months until February 2022. In this context, we maintain a negative stance on Australian rates. We also hold an underweight on Canadian rates, the central bank having already announced the tapering of its QE programme and likely to further taper purchases in the coming months.

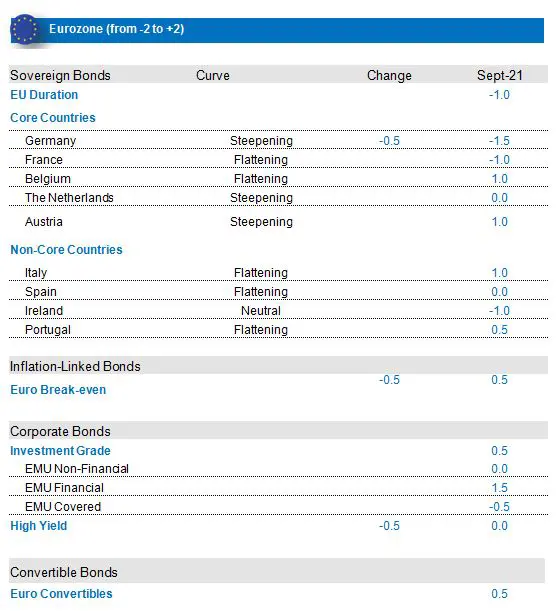

Increased short position on German rates and positive view on EUR break-evens

Strong ECB easing as well as fiscal support has led to a strong activity rebound that we expect to continue over the remainder of 2021 in the Eurozone. The September 9 ECB meeting delivered a dovish tone, with only a moderate reduction in the pace of PEPP purchases up to the end of the year. Although inflation forecasts were revised upwards, the rise in inflation is considered temporary, as inflation is expected to decelerate to respectively 1.7% and 1.5% in 2022 and 2023. The latest monthly surveys indicate confidence at elevated levels, though we cannot ignore the supply-side constraints that continue to hinder manufacturing production and inventory rebuilding. Inflation has increased substantially, though a sustained increase appears unlikely. Monetary policy remains very positive and the purchase programmes - supported by the PEPP, the APP and reinvestments - should remain at high levels. This will continue to be a driving force for technicals over the remainder of 2021, as net flows for Euro sovereigns, while mixed in the ST, will be negative in Q4. The flow picture for Euro sovereigns is also supported by EU issuance, which will also lighten funding pressure on sovereigns. In light of the improving growth and inflation numbers, we expect core rates to rise, especially given the extremely tight valuations that they exhibit, thereby justifying our increased negative stance, as we shift our shorts from US duration towards core-Eurozone rates. Non-core/ peripheral markets continue to be supported by the ECB monetary policy and increased European solidarity.

We maintain a positive stance on EU break-evens, through our long positions in France and Germany. However, in valuation terms, we have seen very good movements, and with EU break-evens now close to 1.8% (seasonally adjusted) for 10-year maturities, we have taken some profit on our long BEI position that we had increased over the summer. We are specifically focusing our reduction on the 10-year portion, which should benefit to a lesser extent from further inflation surprises. We are concentrating most of our overweight now on the 5-year segment, taking into account valuations, ST inflation dynamics, carry and monetary policy.

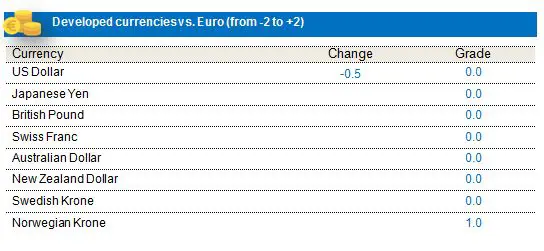

Currencies: Neutral EUR /USD and reduction in long NOK stance

We hold a neutral position on the greenback, though we continue to tactically trade the currency. Although our framework points to a negative view on the US dollar, historical data show that our current scenario of higher real yields and break-evens moving lower is coinciding with a rise in the USD. Furthermore, the greenback remains a safe-haven currency and hence could be an interesting hedge.

We held a long position on the NOK. Norges Bank has adopted a hawkish stance, on the back of the output gap turning positive and the risk of financial imbalances due to a low interest-rate policy, paving the way to a potential rate hike by the end of the year. However, the rate path and the good recovery by the Norwegian economy are quite well priced now and we prefer to take profit from the currency.

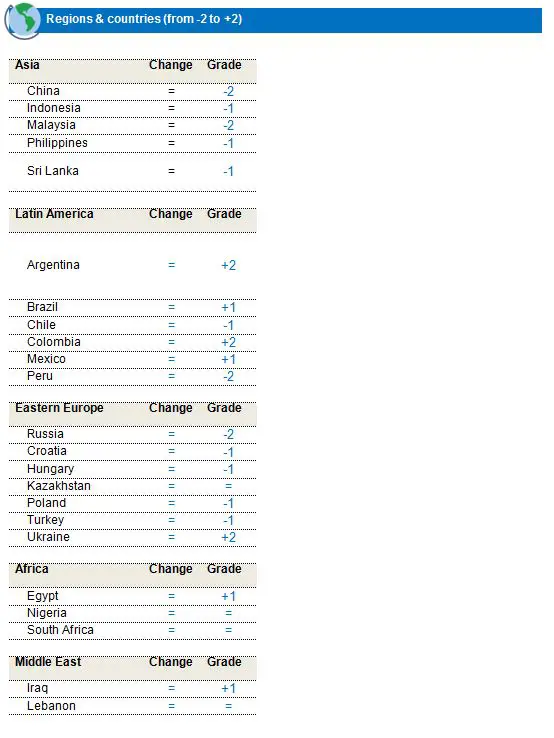

Credit: Favouring European Investment Grade & Convertibles

EU IG: We maintain a positive stance on EUR IG and a preference for Financials. The Q2 earnings season featured companies with a very strong capacity to restore their solvency profile, thanks to earnings generation and debt-profile management. Companies are using cash to optimize their liabilities structure and reshape their business models. But the pandemic is still present and some sectors, e.g., airlines, travel & leisure, are still far from their pre-crisis levels. Certain companies, like those in the automobile sector, are more cautious about the near term, as the chip shortage will last longer than expected and a raw materials price surge will put pressure on margins. Focus is now on equity remuneration (share buybacks, dividends, opportunistic mergers & acquisitions,…) and on green-transition financing. As dispersion between winners and laggards will intensify, selection remains key.

Technicals remained very supportive of EUR European IG credit. YTD, the net supply for non-fins has been negative (-€22bn) after the ECB bought €40bn through the Asset Purchase Programme (APP) and €12bn through the Pandemic Purchase Programme (PEPP). Taking into account inflation and economic and financing conditions dynamics, we can expect a moderation in PEPP purchases on average to €70bn up to the end of the year and probably no extension beyond March 2022, although the ‘gunpowder’ for the credit market is more through APP than PEPP!

In absolute terms, valuations are high but, with European real rates so deep into negative territory and a lack of supply, investors have no choice but to sustain their returns run. We have a preference for Financials, and particularly subordinated debt, that still offers a decent yield.

EU HY: On the other hand, EUR European High Yield is facing a less favourable technical environment. Year-to-date, High Yield net supply is positive by €57bn and could increase in the future. Syndication is facing a huge pipeline, with more than €35bn over the next eight weeks! And, taking into account current investor positioning, it could generate some indigestion in the market. After the good performance seen during the summer, we prefer to tactically reduce our exposure to Neutral, awaiting the eventual emergence of opportunities on names continuing to post improving fundamentals.

US IG. & US HY: We hold a negative view on US IG. US credit appears to be the most expensive credit market from a valuations standpoint. Furthermore, with the next move of the FED expected to be more on the hawkish side, monetary support should be lower than in the past. Though our earnings expectations on US Credit remain strong, we believe that the balance-sheet recovery has been fully priced in and note the reappearance of M&As and slightly more aggressive supply dynamics (resulting in longer duration) on the Investment Grade front. In this context, we maintain an underweight positioning on US IG. As US HY is also facing a huge supply pipeline, we have reduced our exposure to neutral.

Finally, we think EUR Convertibles should benefit from positive dynamics such as the coordinated action from the EU Next Generation Recovery Fund, the positive economic momentum and the Delta wave receding. Inflows are more supportive of Europe than the US.