Last week in a nutshell

- The US Consumer price index, a key inflation barometer, stood at 8.2% in September relative to a year earlier and above market expectations. The news was welcomed with mixed reactions: Overall, inflation appears to have peaked in June at 9.1% but core inflation hit a new high, at 6.6%.

- With US inflation declining more slowly than previously anticipated, the FOMC minutes revealed that higher rates were likely to stay in place. As the policy should help loosen the labour market and bring down prices, the minutes also brought some optimism.

- The best tool to fight runaway inflation in the euro zone is, according to ECB President Christine Lagarde, interest rate increases. The debate on reducing its €3.3Tn bond holdings is likely to be continued next year.

- On the political front, UK Chancellor Kwasi Kwarteng has been replaced by Jeremy Hunt. PM Liz Truss has yet to give details on how to implement the partial revision of her tax-cutting programme.

What’s next?

- Investors will increasingly focus on the Q3 earnings season. We expect releases from Netflix, IBM, Tesla, Bank of America, and Johnson & Johnson, among the bellwether names.

- China’s week-long 20th congress will conclude with the introduction of the next Politburo Standing Committee (PSC), an elite body that Xi Jinping has come to dominate. In Xi’s third term, security, state control of the economy, a stronger military, and growing pressure to seize Taiwan shall remain the main objectives. Chinese Q3 GDP and key economic activity indicators will be published as well.

- In the US, housing market indicators will be released in a context of cooling down home prices, particularly in cities in the west. Rising mortgage rates have shrunk households’ affordability.

Final inflation rates are due for key countries, including the UK along with its retail price index, PPI output and input amid a challenging political context.

Investment convictions

Core scenario

- The risks we previously outlined are starting to materialize and are now part of the scenario.

- Should we stop worrying about risky assets? Probably not, but, at current prices, we tactically add to our equity exposure, by becoming slightly overweight on the US and Neutral on the euro zone.

- We further note that sentiment, positioning, and market psychology also point towards a short-term uplift.

- As central banks are committing for even higher rates for longer, leading us to keep a slightly shorter portfolio duration.

- Nevertheless, following the sharp rise in interest rates over the past year, short-term rates anticipations, and hence long-term yields, appear now relatively well anchored following the most recent inflation data. We are therefore looking to add fixed-income exposure to our portfolios via the US high yield segment.

- Inflation is also at highs in the euro zone, hitting businesses, consumers, and ECB policymakers alike. The ECB has made it clear that the only path forward is higher rates.

- Our equity allocation reflects the conviction that European equities could also tactically benefit from a broad-based risk-on environment. With a longer-term view, high inflation, a hawkish ECB and a sharp slowdown in economic growth leading to substantial earnings downgrades remain a challenge.

- We expect emerging market equities in Asia to outperform as valuation has become attractive while the region keeps superior growth prospects vs. developed markets.

Risks

- Upside risks include that central bank actions are nearly priced for peak hawkishness and weak sentiment and positioning. Further, governments in Europe are adding fiscal aid as the energy crisis deepens, which could mitigate its negative impact.

- Downside risks would be a monetary policy error via over-tightening in the US or a sharp recession risk via a deeper energy crisis in Europe.

- The war in Ukraine is ongoing and signs of discomfort with Moscow are growing in the international community.

- The threat of COVID-19, and its variants, remain as the virus keeps evolving and spreading at various speed throughout the world.

Cross asset strategy

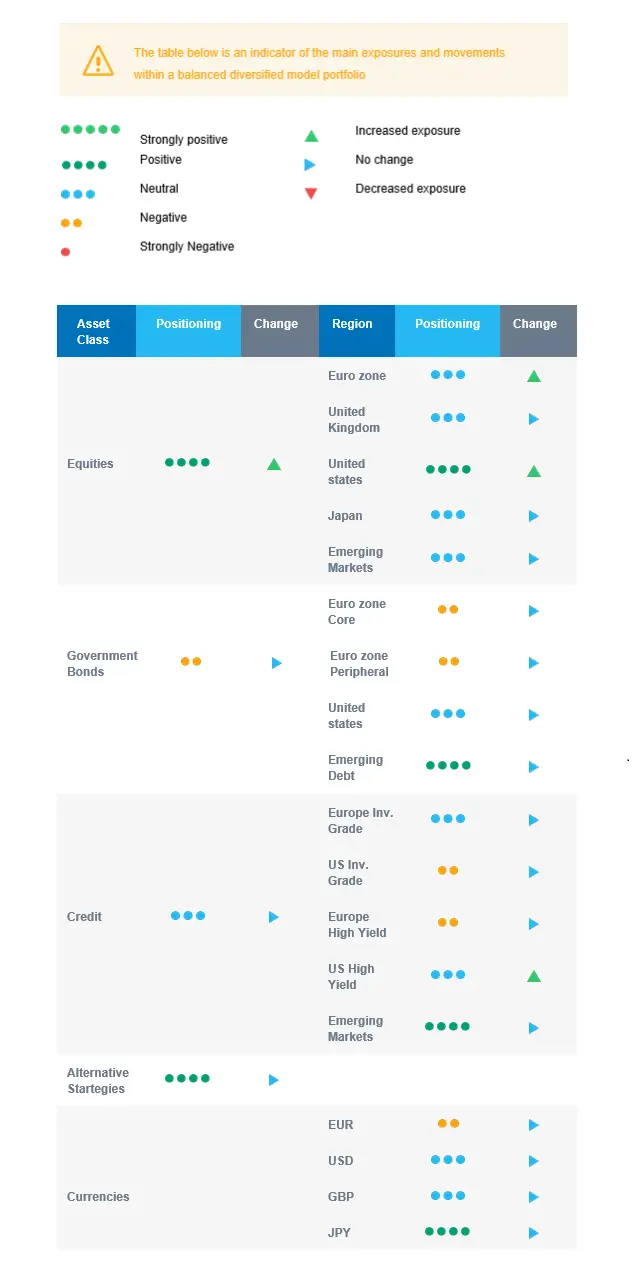

- Our multi-asset strategy has become more constructive on attractive price levels but remains nimble and can be adapted quickly:

- Neutral euro zone equities, with a derivative strategy in place.

- Neutral UK equities, resilient sector composition and global exposure.

- Overweight US equities, with an actively managed derivative strategy.

- Neutral Emerging markets, but positive on Asian Emerging markets, expected to outperform as valuation has become attractive while the region keeps superior growth prospects vs. developed markets.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure act as opposite forces for investor attractiveness.

- Positive on sectors, such as healthcare, consumer staples and the less cyclical segments of the technology sector.

- Positive on some commodities, including gold.

- In the fixed income universe, we have a slight short duration positioning.

- We continue to diversify and source the carry via emerging debt and US high yield debt.

- In our long-term thematics and trends allocation: While keeping a wide spectrum of long-term convictions, we will favour Climate Action (linked to the energy shift) and keep Health Care, Tech and Innovation.

- In our currency strategy, we diversify outside the euro zone:

- We are long CAD and JPY and underweight EUR.

Our Positioning

Global economic growth and inflation keep slowing down, but we now start to have positive surprises on growth and less upward surprises on inflation than at the beginning of the year. We have therefore tactically added to equities via the US and the euro zone to become slightly overweight. Regionally, our preferences go to Emerging markets and the US. On the fixed income side, we keep a slight short portfolio duration and upgraded our stance on US high yield debt to lock in an attractive carry. The asset class looks attractive with a buffer for defaults as its carry to volatility relative to equities. We remain allocated to commodity currency via the CAD.