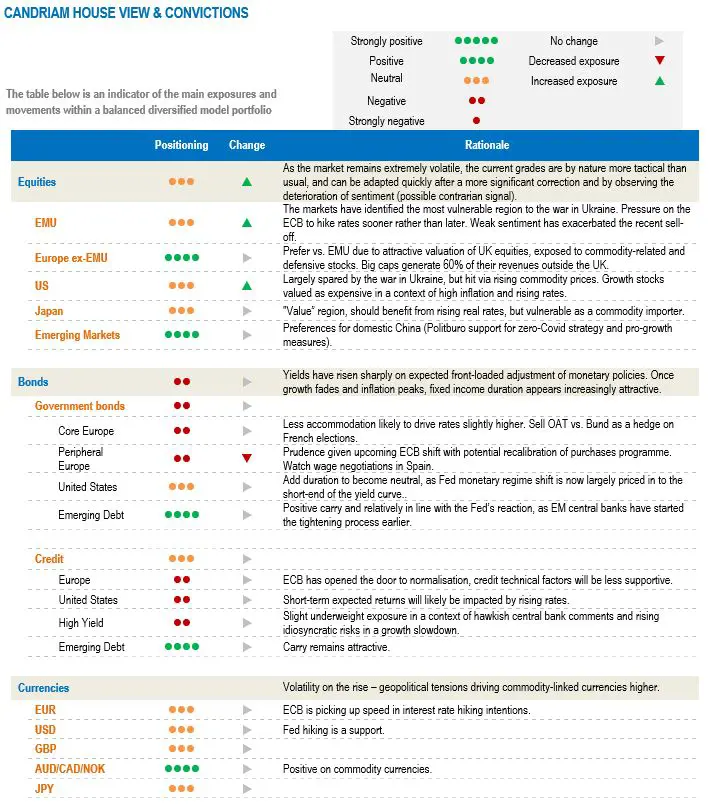

The reasons for a prudent allocation have not changed in recent weeks: facing high inflation, central bank rhetoric and policy tools have triggered a tightening in financial conditions while the global economic slowdown is now well underway, as the war in Ukraine and Covid-related lockdowns in China weigh on confidence and activity. Our Multi-Asset strategy is positioned to cope with “fat and flat” price ranges or “wide and volatile” markets. We explain our active tactical exposure management in this context, and keep an overall broadly balanced approach before positioning for the next stage of the cycle.

Monetary tightening has accelerated

As inflation remains stubbornly high and continues to surprise on the upside, central banks have tightened their policies almost everywhere.

- The Federal Reserve (Fed) has increased its funds rate by 50 bps, the most aggressive step since 2000. By the end of July, the reference rate is expected to rise by a further 100 bps, getting closer to the estimated “neutral rate” range of 2-3%. Furthermore, the start of its balance sheet reduction has been confirmed for June. Fed chair Jerome Powell acknowledged that “getting inflation down to 2% will include some pain”.

- The Bank of England (BoE) has set its key rate at 1.0% following a 25 bps hike on 5 May. At the same time, it has warned of a hard-landing to cure the inflation headache; the BoE expects double-digit inflation rates this autumn and a prolonged period of stagnation or even recession.

- The European Central Bank (ECB) has started to sharpen its rhetoric to prepare investors for a rate hike before the summer break. Clearly, the ECB is in a difficult position: with rising inflation and a low unemployment rate, it is facing mounting pressure to deliver some rate hikes. On the other hand, the impact from the war in Ukraine is materialising; consumer confidence has tumbled, while new disruption to global trade is curbing industrial activity.

- The Bank of Japan (BoJ) is the outlier. Governor Kuroda Haruhiko has confirmed that monetary easing must stay in place to support an economy still recovering from the pandemic. This stance is coming at a cost, as witnessed by the recent rapid weakening of the Japanese yen, adding to uncertainty.

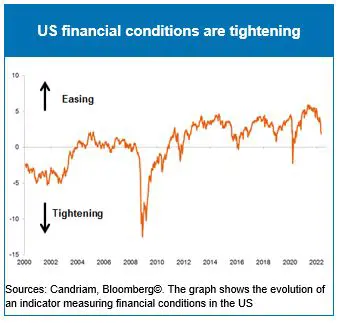

As a result, financial conditions (an aggregate estimate measuring the impact of credit conditions, wealth effects, exchange rates and interest rates) are tightening rapidly following years of accommodation.

We know from experience that the beginning of a Fed rate hike cycle is always a very delicate time and the 2022 episode is no exception to this rule. In addition, the past few months have added some new challenges for investors.

We are positioned for the slowdown

Six months ago, our central scenario didn’t include the possibility that Russia would start a war in Ukraine and that China would enforce severe lockdowns to fight a new Covid wave this spring. Therefore, the current tightening is taking place as headwinds from the war in Ukraine and a lingering pandemic have forced a downward revision of global growth of close to 1% since January.

Commodity prices have jumped further, as Russia and Ukraine are major producers of agricultural products and mineral fuels. Moreover, social restrictions in China are adding to supply-side tensions.

In our central scenario for the US, the recovery progressively slows down to 2.5% GDP growth this year and 1.7% next year. We note the impact of various factors: higher rates, high inflation, a stagnating and volatile stock market and a negative fiscal impulse. The Federal Reserve will frontload its tightening while there are no clear signs of a coming deceleration in growth.

China is reaching the limits of its “zero-Covid” strategy. As highlighted by the latest PMI and the recent fall in consumer confidence, the rise in new Covid cases and the resulting social restrictions are curbing activity.

Despite the slowdown, authorities are reluctant to relax their policy and are very cautiously easing their monetary stance. In this environment, we continue to expect growth to be below the government target, and GDP to grow by 4.5% in 2022.

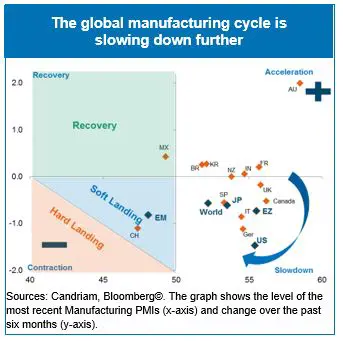

More broadly speaking, and in line with the trend of the two leading economies, most countries are now experiencing a slowdown in the manufacturing cycle as they face several drags:

- Supply chain disruption and rising commodity prices (war)

- Covid-related lockdowns in China and

- Tightening financial conditions

The global manufacturing PMI peaked a year ago and has clearly been losing momentum since August. Given the current backdrop, there are few catalysts to counter the current trend – the reopening is more favourable to services than manufacturing, and the stimulus in China has yet to be deployed in earnest.

Our current multi-asset strategy

As exiting the pandemic, entering the war and tightening monetary policies are acting together as a formidable business cycle accelerator, pushing the current state towards an end-cycle, navigating through the cycles has become the most important challenge for investors.

Our multi-asset strategy is well positioned for the current slowdown: we reduced our equity exposure in early February and are staying neutral on equities, with some exposure to commodities, including gold.

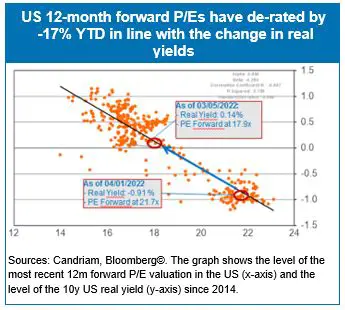

As expected, the rise in real yields has led to a substantial contraction in US equity multiples, leading us to close our tactical underweight towards neutral US equities. In a context of rising inflation and rates, growth stock valuations have been particularly at risk. While the de-rating may not have finished yet, we expect a less brutal movement than the one registered since the start of the year. Conversely, we are overweight on Emerging markets, specifically via China, where we expect an improvement both on the Covid/lockdown and stimulus fronts during H2.

Our overall stance towards equities is neutral, with “fat and flat” price ranges or “wide and volatile” markets. In our view, it is not reasonable to “guesstimate” whether the outcome of the current slowdown will end in a soft or hard landing.

While the longer-term outlook for equities is deteriorating, as revenues, margins and, ultimately, profits are being revised down due to high inflation (historically, inflation above 5% has led to weak equity performance), our active tactical portfolio management will explore investment opportunities, as the markets are moving fast and adjusting to the environment.

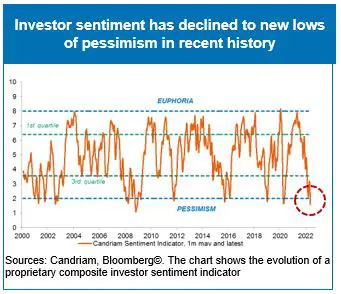

This means that tactically, equities could well benefit from short-term tailwinds, as sentiment and positioning have been hit substantially. Our proprietary measure of investor sentiment, a composite indicator based on seven different inputs, has fallen below the levels registered following the invasion of Ukraine in February this year to levels not seen since March 2020, when the Covid-19 pandemic started. Clearly, from a contrarian viewpoint, a lot of bad news is already priced in. Therefore, we are no longer underweight in any region in our portfolio.

As we expect growth to fade, inflation expectations at highs and central banks willing to tighten, we continue to think that a longer fixed income duration appears increasingly attractive, particularly via the short-end of the yield curve in the US. Furthermore, we are diversifying and sourcing carry via emerging debt.

In our currency strategy, we have exposure to the CAD, which plays its role as a commodity currency and, as a neighbouring economy, is less impacted by the strength of the US dollar.