After a bruising first 10 months in 2022 that saw fixed income investors suffering near-record losses in most asset classes, November offered the first true relief of the year. All asset classes posted solid positive returns, although emerging hard currency and global investment grade lead in terms of performance. EUR and US government bonds came in with respectable performances of above 4%.

The risk-on environment was spurred by many signs indicating that the worst is probably behind us in terms of inflation and most economies will soon enter a period of disinflation. Markets are anticipating a pivot from central banks.

A look at credit asset classes seems to underscore this belief. With its particularly high sensitivity to higher financing costs, Property has suffered the largest losses year to date but recovered most in November –some way ahead of the runners-up. While Credit performed well across the quality spectrum, Investment Grade was particularly strong – somewhat compressing the wide gap in yields seen recently and bringing them closer to typical norms.

The perspective of a soft landing in the US is solidifying

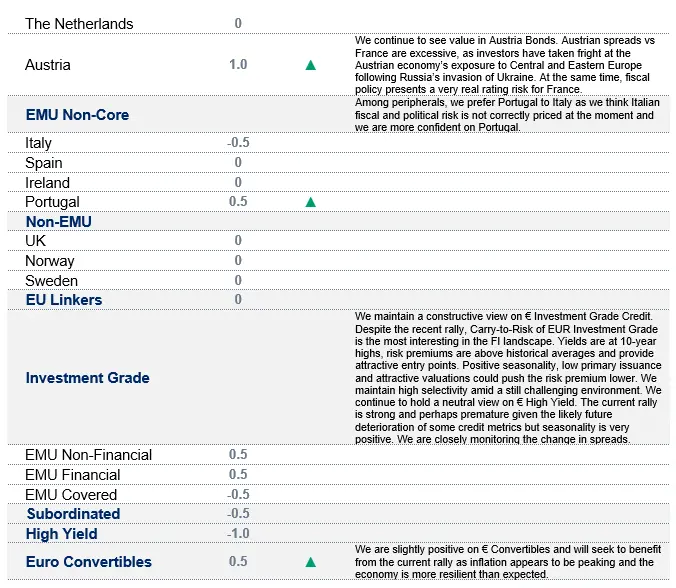

The current US monetary tightening cycle is, in many ways, unprecedented. The Fed has hiked rates approximately twice as quickly as during other recent cycles and, perhaps more importantly, starting from a much lower level. So far, the economy is proving surprisingly resilient: the Purchasing Managers’ Index surprised on the upside and is still above 50. Nonetheless, the lag in follow-through of monetary policy to the real economy does present a downside risk.

At the same time, most indicators are pointing to a turnaround in inflation. The drivers behind this year’s spike are all turning around again and will likely be negative or neutral in 2023. Crucially, wage growth has also decelerated. As the tightening cycle comes closer to its terminal rate we expect that the curve should re-steepen. The deficit and projected issuance is a mixed picture for 2023: while the budget deficit will be lower, as QT runs out, the Treasury will need to turn to markets for a greater proportion of its funding. As over 50% of issuance will likely be in T-Bills, the impact in terms of pressure on rates should nevertheless be mitigated.

Eurozone inflation is showing signs of coming under control

Europe is showing signs that inflation is finally peaking. While wage growth will likely remain high, the critical element of energy prices is showing a turnaround in dynamic. Some countries that had seen particularly high inflation such as the Netherlands are showing a clear trend reversal. From here on, we no longer see support for linkers as carry also begins to deteriorate.

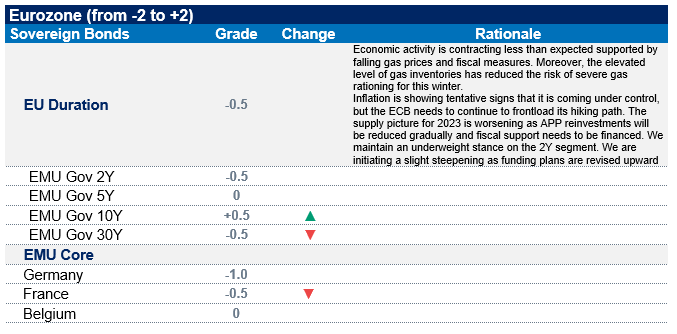

Nonetheless, the eurozone is clearly less advanced in monetary tightening than the US, which leads us to maintain a relative preference for US rates and an underweight on EU duration.

That said, we see clear Relative Value opportunities between EMU issuers, driven by idiosyncratic factors beyond core vs non-core. Austrian spreads vs France seem particularly excessive as we believe that investors have taken excessive fright at the Austrian economy’s exposure to Central and Eastern Europe following Russia’s invasion of Ukraine. At the same time, fiscal policy presents a very real rating risk for France. Similarly, among non-core countries, while we believe Italian fiscal and political risk may not be appropriately priced at the moment, Portugal, Spain and Ireland are showing a much better picture in our view.

Vastly different interest sensitivities around the world

In a rising rate environment, the property market is typically where effects first flow through into the economy. Given different home ownership rates and how mortgages are structured, the immediacy can be vastly different by country. Norway, the UK, Australia and New Zealand have the highest mortgage sensitivity while it is lowest for Germany and France. The BOE, RBA and RBNZ will be keenly aware of this and, all else being equal, should give a more dovish inflection to their policy decisions. In the UK in particular, we see a chance that market expectations for the terminal rate are too high and that the BOE will back off before it is reached. This could lead to opportunities to arise on the short end of the gilt curve in the coming months.

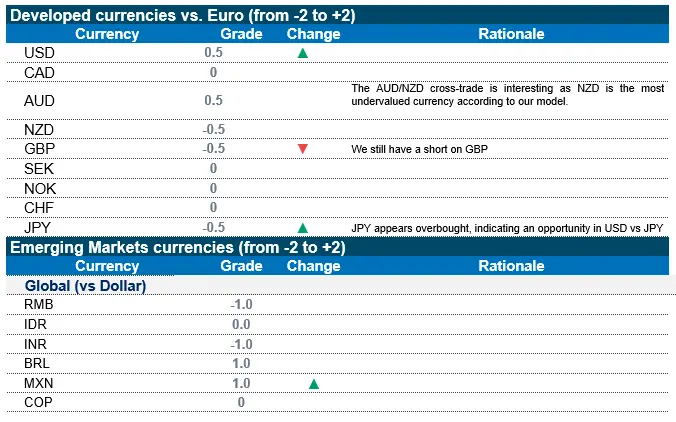

Opportunities in currency markets

A differing pace of central banks’ pivoting could also lead to dislocations in Forex. At this point, we are long on AUD vs NZD, as the RBA has been earlier in its dovish pivot than the RBNZ. While this goes somewhat counter to the currency effects that can typically be expected from central bank policy, the more cautious RBA hiking cycle could lead to less economic damage in Australia than New Zealand. This would compound an imbalance that is already very evident – Australia’s external position is very strong whereas New Zealand’s is very weak – with Australia consistently running current account surpluses since 2019 while New Zealand will post a 7% deficit this year.

On the other hand, we expect that a more dovish than expected BOE policy could lead Sterling to underperform. More generally, the UK economy continues to struggle more than most of its continental European counterparts, under persistent stagflation headwinds and fiscal austerity.

For technical reasons, we are also implementing a short JPY vs USD in certain strategies, as JPY appears very overbought at the moment. This position may also act as a hedge to some positions in US Treasuries.

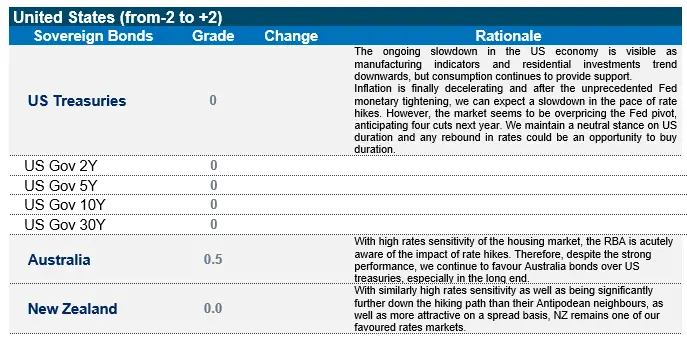

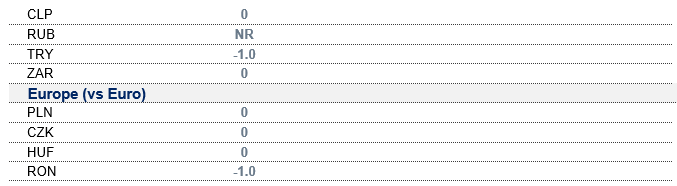

No clear trend but some opportunities in Emerging Markets

Following strong performance, we now feel that the CEE markets of Poland and Hungary are close to fair valuations. Czech yields have not moved as much and with a stable currency and the theme of slowing inflation holding there as well, we still see value in that market. In LATAM, Brazilian rates are offering very attractive real yields, as nominal yields of 13% are clearly in excess of inflation. Following attenuation of political risk after the recent election and what we see as relatively modest risks on fiscal policy, we are also constructive on this market.

European Investment Grade is still our pick in Credit

Our constructive view on European Investment Grade was profitable. The asset class delivered strong returns in November. That said, given that on a YTD basis we have seen a considerable spread widening even after the recent rally, we believe the segment still has some way to go as seasonality is very positive in December. The buffer remains substantial. On the other hand, US Investment Grade still appears richly valued, with little widening vs the beginning of the year.

In High Yield, on the other hand, we do not think that spreads vs higher quality credits are sufficient. While implied default expectations of around 8% seem excessive and a rise to historical averages of around 4% is more likely, ratings drift is clearly turning more negative. Supply should also turn more positive as HY issuance has been well below expectations YTD. We do prefer European High Yield to US High Yield, which is very expensive based on fundamental risk.

Strategy & Positioning