Last week in a nutshell

- On the side-lines of the G20 summit in Indonesia, US President Biden and Chinese President Xi's held a meeting which underlined positive signs toward de-escalation. The decline in the geopolitical risk premium has been fuelled by the perspective of an upcoming follow-up visit in China by US Secretary of State, Antony Blinken.

- While COVID-19 restrictions are starting to ease in China, housing rescue finally arrived with a coordinated 16-points plan to support funding for sound developers and construction companies as the restriction on bank lending to developers can be temporarily eased. Emerging Market indices showed a clear positive reaction and should aim higher in the coming weeks.

- In the US, mortgage rates have decreased below 7% but are still up 350bp since the start of the year. As a result, housing starts and building permits continue declining and the NAHB Homebuilder sentiment index for November again surprised on the downside.

- The GBP weakened against the USD after the Chancellor of the Exchequer, Jeremy Hunt, announced the government’s fiscal plan. The autumn budget consists of higher income taxes on the profits of oil and gas companies and higher energy bills.

What’s next?

- Activity and sentiment-related data will be in the spotlight with the release of key countries’ flash PMI for the manufacturing and services activities as well as the EU consumer sentiment indicator.

- The US Federal Reserve Bank will publish the minutes for its FOMC held at the beginning of November. The most recent data point to signs of disinflation, but several Fed members warn against a Fed policy pause. Focus will be on their thinking about the terminal rate.

- Committed to contain the energy crisis fuelled by the war in Ukraine, the European Commission plans to propose a cap on natural gas prices. But some EU members promote the alternative of a faster inclusion of renewable energy instead.

- The US will celebrate Thanksgiving on Thursday followed by Black Friday, the kick off to the annual holiday season. The holiday shopping season begins amid consumer resilience despite painfully high inflation and rising interest rates.

Investment convictions

Core scenario

- Our asset allocation has become more constructive on attractive price levels and is now getting support from improving fundamentals.

- In October, our analysis on investor sentiment, market psychology and technical set-up pointed to widespread pessimism, revealing depressed measures. This extreme configuration was a buy signal.

- In November, we follow the more positive developing trend on equities but with a controlled risk budget. Returning buyback flows, short covering, and positive seasonality may very well give a tailwind. We keep a constructive, overweight equities, positioning into year-end.

- Central banks must strike a balance between the fight against inflation and the risk of financial instability. Hence, the next hike could be smaller but the terminal rate in 2023 could be higher than expected some months ago.

- Following the sharp rise in interest rates over the past year, short-term rates anticipations, and hence long-term yields, appear now relatively well anchored. We started adding fixed-income exposure to our portfolios via the high yield segment.

- We expect emerging market equities in Asia to outperform as valuation has become attractive while the region keeps long-term superior growth prospects vs. developed markets.

Risks

- Upside risks include that central bank actions are nearly priced for peak hawkishness and weak sentiment and positioning. Chinese re-opening in 2023 would be a substantial support for the global economy.

- Further, governments in Europe are adding fiscal aid as the energy crisis deepens, which could mitigate its negative impact.

- Central bank anti-inflation stance is capping upside.

- Downside risks would be a monetary policy error via over-tightening in the US or a sharp recession risk via a deeper energy crisis in Europe.

- Nevertheless, an inflation decline and a rise in growth at some point in 2023 is limiting the market downside.

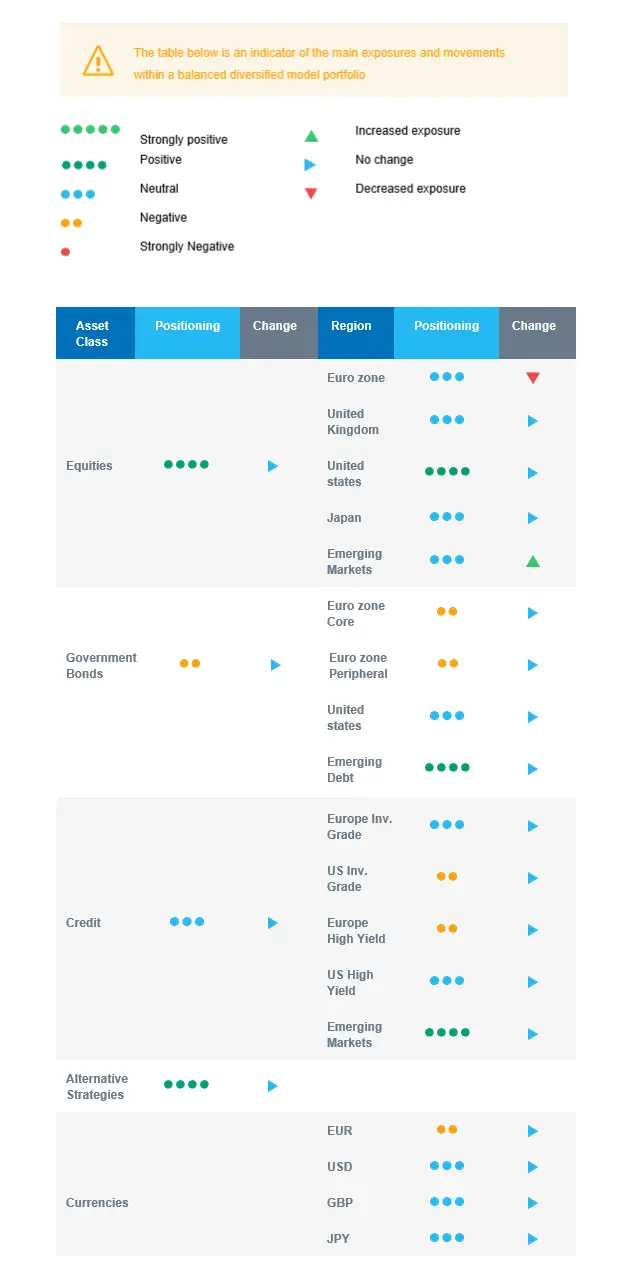

Cross asset strategy

- Our multi-asset strategy has become more constructive on attractive price levels but remains nimble and can be adapted quickly:

- Neutral euro zone equities.

- Neutral UK equities, resilient sector composition and global exposure.

- Overweight US equities.

- Neutral Emerging markets, but positive on Asian Emerging markets, expected to outperform as valuation has become attractive while the region keeps superior long-term growth prospects vs. developed markets. In the short term, there is room for a catch-up vs. developed markets.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure act as opposite forces for investor attractiveness.

- Positive on sectors, such as healthcare, consumer staples and the less cyclical segments of the technology sector.

- Positive on some commodities, including gold.

- In the fixed income universe, we have a slight short duration positioning.

- We continue to diversify into European investment grade credit and source the carry via emerging debt and Global high yield debt.

- In our long-term thematics and trends allocation: While keeping a wide spectrum of long-term convictions, we favour Climate Action (linked to the energy transition) and keep Health Care, Tech and Innovation.

- In our currency strategy, we diversify outside the euro zone:

- We are long CAD and underweight EUR.

Our Positioning

Global economic growth and inflation keep slowing down, but we register positive surprises on growth and less upward surprises on inflation. Our current positioning is overweight equities with a preference for US and Asian Emerging equities. As European markets continued their upward trend, we took some profits on euro zone equities and slightly increased the allocation to Emerging equities. On the fixed income side, we keep a slight short portfolio duration and upgraded our stance on high yield debt to lock in an attractive carry. The asset class looks attractive with a sufficient buffer for defaults. We remain allocated to commodity currencies via the CAD.