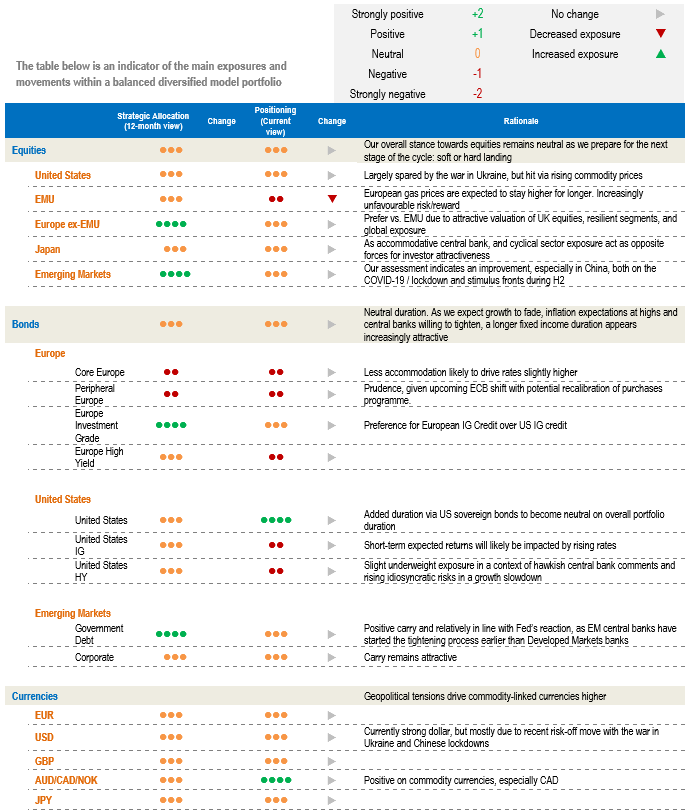

This year’s European summer heatwave and drought has the potential to worsen the current energy crisis, as river water levels have dropped significantly. Generating hydropower in Spain and Italy, cooling French nuclear plants, and shipping coal in Germany all become less trivial while the energy conflict between Europe and Russia risks further escalation. As a result of lower expected growth, our Multi-Asset strategy has downgraded European equities to slightly negative, while keeping an overall broadly balanced allocation between equities and bonds.

From inflation concerns to growth concerns

Inflation surprises and expectations appear to have peaked. Despite high inflation levels, observed and expected upward pressures appear to be diminishing. Inflation continues to surprise on the upside, but the dynamics have changed, and should fade over the coming months.

Out-of-control inflation now seems of secondary importance to the markets, witness the market reaction following the 9.1% print for June CPI in the US. Central bank credibility in inflation-fighting and growth concerns represent a tailwind for downward pressures on bond yields.

In addition, US macro surprises have turned negative, which is typically associated with falling US bond yields. Accordingly, duration assets appear to be bottoming out, leading us to keep an overall neutral duration exposure. We acknowledge that a new energy shock or a continuously strong labour market represent upside risks.

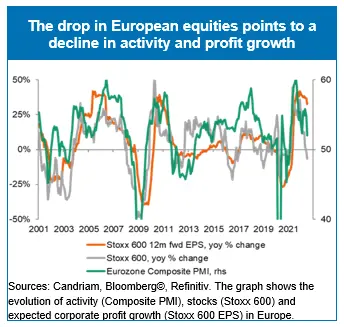

Downgrade EMU equities to slightly negative

For 2022, real yields remain the main trigger of equity performances, while EPS are still optimistic. While consensus EPS growth expectations are still strong, we can see the breadth of revisions rolling down. The recent fall in equities implies EPS growth close to zero and a contraction in the composite PMI in the coming months.

Valuations should no longer be a headwind for markets, while earnings growth is expected to be the next negative catalyst. The pace of negative revisions will depend on the scale of the slowdown. Equity markets are likely to reach a trough once EPS revisions are well underway.

European gas prices are now expected to stay higher for longer, as markets now anticipate more protracted disruption than in the immediate aftermath of the Russian invasion of Ukraine. Given the unfavourable risk/reward, we are downgrading eurozone equities to slightly negative.

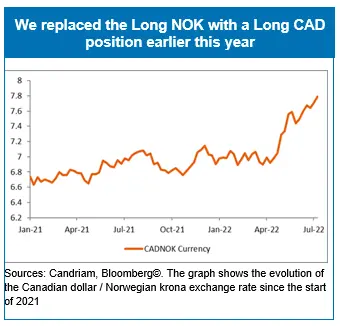

Update on the Canadian dollar

At the origin of the strategy, we decided to sell the Norwegian currency and to buy the Canadian dollar. Indeed, outside the USD, the Canadian currency has performed better than its G10 peers and the krona.

Regarding the US dollar vs. the Canadian dollar, yield spreads could be beneficial to the Canadian currency, but have not been so over the past few months.

Economic forecasts and surprises have not influenced the pair either, notably since April. The volatility in the fixed income space seems to be the true driver of the pair. The Bank of Canada’s decision will be key for this strategy. If crude oil prices rise, as the correlation is currently near 61%, the CAD could benefit.

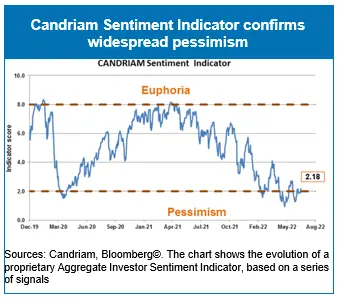

Candriam Sentiment Indicator

Our proprietary Sentiment Indicator is slightly improving, driven by better AAII Investor Sentiment and stronger readings among technical indicators (RSI). The indicator is above 2 points on a scale between 0 and 10.

A contrarian Bull signal was triggered on 10 June and is still active.

Our current multi-asset strategy

A broadly balanced allocation

Our exposure maintains an overall broadly balanced allocation before positioning for the next stage of the cycle, whether it be a soft or a hard landing.

Our overall stance towards equities remains neutral, and recent market trends confirm our assessment of “fat and flat” price ranges or “wide and volatile” markets.

Since this spring, we have gradually increased our fixed income exposure duration and have now a portfolio duration in line with the benchmark.

We expect alternative investments to continue to outperform traditional assets in a volatile environment.

Downgrade EMU equities

European gas prices are now expected to stay higher for longer, as markets now anticipate more protracted disruption than in the immediate aftermath of the Russian invasion of Ukraine. Given the unfavourable risk/reward, we are downgrading Eurozone equities to slightly negative.

The outlook for equities continues to deteriorate as revenues, margins and, ultimately, profits could be revised down due to high inflation and the economic slowdown.

Preference for healthcare, consumer staples and tech

The healthcare sector is expected to provide some stability amid the current volatility: no negative impact from the war, defensive qualities, low economic dependence, innovation, and attractive valuations.

The current environment favours companies with pricing power, which we find in the consumer staples sector.

Within the tech sector, software and services show less earnings risk, but are more dependent on the trend in long-term interest rates. We think that the rise in (real) yields is fading after impacting tech valuations heavily in H1. Furthermore, there is no particular reason why hardware would do worse than semiconductors or software. The tide will carry the whole boat.

We currently have a slight preference for the segments which are less cyclical and less dependent on consumer confidence. Semiconductors reveal higher earnings risk, but given the significant year-to-date correction, combined with positive reactions to the earnings announcements of Samsung and Micron, we assume that a lot of bad news is already priced in.

Overall Neutral Portfolio Duration

As we expect growth to fade, inflation expectations at highs and central banks willing to tighten, we continue to think that a longer fixed income duration appears increasingly attractive.

We added duration via US sovereign bonds to become neutral on overall portfolio duration, as the Fed monetary regime shift is now largely priced in at the short end of the yield curve.

We have a preference for European IG Credit over US IG credit.

We source carry from EM debt. Positive carry and relatively in line with the Fed’s reaction, as EM central banks have started the tightening process earlier than DM central banks. Headwinds are the Fed hiking cycle, USD robustness, deteriorating liquidity conditions and a weak flow picture.

Preference for commodity currencies

The US dollar has been very strong over the last few months. The risk-off move seems to be the main culprit, with the Russian-Ukrainian war and Chinese lockdowns.

Fed tightening has played a role, but its influence varies according to the currency. It will be worth watching central banks’ ability to meet market expectations.

We have a preference for commodity currencies (e.g. NOK, CAD, even AUD), which is expressed in the portfolio via the Canadian dollar.

If we enter a recession, the closer it is, the more the US dollar may weaken vs the yen, euro and CHF, if history is anything to go by.