November was dominated by the Omicron variant that originated in South Africa, resulting in travel restrictions and bans across the globe. This added to the already existing Delta variant, which was spreading across countries and leading to curfews and partial lockdowns, and temporary disruption in markets. Indeed, equity markets registered a strong negative performance in November, as did risky assets on the fixed income front, with EM debt and High yield being the most impacted. Conversely, safe haven assets such as core rates delivered positive performances, while in Europe, peripheral sovereigns showed some resistance. Within the credit sector, covered bonds were the best performers, while subordinated debt and contingent convertibles suffered the most. Oil prices saw a sharp downward movement on the back of the threat of coordinated oil reserve sell-offs by certain countries, while OPEC+ members agreed to stick to their policy of increased output. Despite this development, inflation data remained fairly sturdy over the month, with strong CPI prints across developed markets. What however was notable was the growth momentum, which appeared to slow down across G4 countries.

Against this backdrop, central bankers in the US, EU and the UK finally formalised the tapering of their respective QE programmes, indicating that lower monetary support could be expected on the back of stronger inflation and employment data. We expect this support to continue diminishing as we head into 2022, as inflation is no longer deemed to be transitory and there is a real risk of a surge. Despite strong inflation and employment numbers, we cannot ignore the Covid variants that are causing some distress to the overall outlook. It is worth noting that monetary policy stance is gaining importance, as markets hang on every piece of rhetoric and information emanating from central banks. There have been plenty of surprises along the way, with the BOE deciding to keep rates unchanged and Jerome Powell yet again providing a pivot by “retiring” the notion of transitory inflation. With markets having grown so reliant on monetary support, such changes in tack are bound to be subjected to strong scrutiny and could generate significant volatility. Additionally, an unexpected turn or policy mistake could have significant impact in the current context, where in spite of overall strong data, uncertainties still remain in the form of supply chain disruptions, the slowdown in China, and elections in Europe, to name but a view.

The recent outbreak of the Omicron variant and the strong measures taken by countries to restrict travel and reinforce their anti-Covid measures will certainly have some impact on the economy and growth figures. While it is very difficult to predict the arrival and impact of Covid variants, it will be extremely important to manage the resulting volatility. The aforementioned risks combined with lower monetary support are likely to exacerbate uncertainties on markets, which will probably be marked by volatility and dispersion. In such an environment, selectivity and active management will be key.

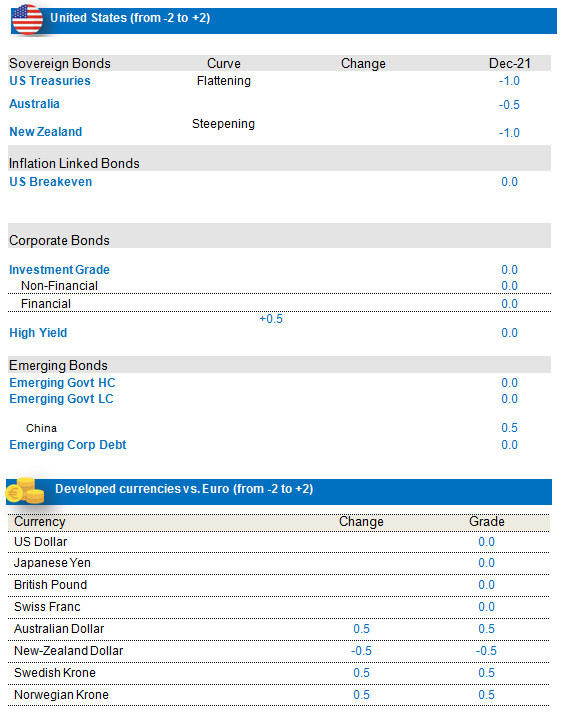

Maintain negative stance on US rates and dollar bloc

The business cycle has been slowing in the US over the past month, mostly as a result of a slowdown in the consumption cycle (retail and wholesale sales), though the labour market does indicate lower unemployment rates and increased participation levels. The inflation cycle has remained very strong, supported by all segments and with labour markets (wages) now contributing to the upturn. This latest development has probably contributed to the hawkish pivot of the Federal Reserve, which decided to “retire” the word transitory from its characterisation of inflation. As a consequence, the market has brought forward rate hike expectations in 2022 and 2023, with no more hikes priced in thereafter, in a context where the risks of persistently higher inflation could become a political liability for the FED. Tapering is now expected to end during Q2 2022 and rate hikes to follow shortly after. This has led to a flatter US curve, with the longer end moving lower. On the market positioning front, we have seen some short covering on the lower end of the US curve. In this context, we maintain a short position on US rates (on 5Y & 10Y).We note that there are risks to this position, which we will monitor very carefully. Indeed, a policy mistake (sharp lower accommodation) could have negative effects on the US economy, while the impact of Covid variants could be exacerbated in an environment of no monetary support.

We maintain our negative view on New Zealand rates, on the back of more positive economic data and the tapering of monetary support in the form of scale backs in central bank asset purchases. In Australia, the central bank has given its pre-commitment to the new tapered QE rate holding until February 2022. In this context, we also hold a negative view on Australian rates.

We also took partial profits on Australian inflation-linked bonds, which performed well. We continue to hold a small position on the segment, as inflation continues to experience a significant rebound and could continue to move higher. QE in Australia did not include inflation-linked bonds and therefore tapering should not have the same negative technical impact.

Currencies: long position on NOK & SEK vs EUR

Following the risk-off episode related to the Omicron variant, both the NOK and the SEK have been sold off quite strongly, thereby recreating value on the segment. This is particularly the case because the economies have strong outlooks, especially Norway, which is profiting from high oil prices. In this context, we hold a long position on these currencies, especially vs the Euro, where the central bank differential is advantageous.

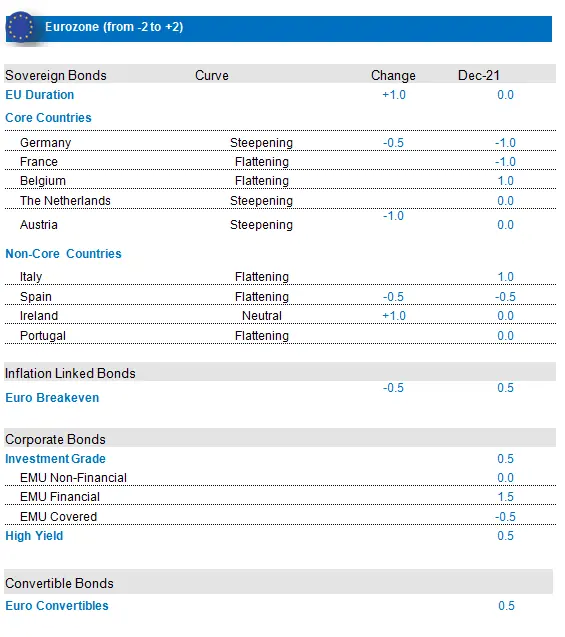

Short position on German rates, Reduced further our exposure on non-core countries

The overall framework appears to be less negative for the Eurozone than for other areas of the G10, primarily thanks to monetary policy and flow dynamics. The October ECB meeting was an interim session without concrete policy decisions. The ECB clearly flagged that those will come on 16 December, and made it clear that it continues to see the current spike in inflation as transitory.

Even if we are expecting a gradual transition in terms of monetary policy from the ECB, remaining more accommodative than its global DM central bank peers, a moderation in purchase program should be announced at the next meeting. An ending of the current PEPP program should be formally announced, only partially compensated by additionall purchases next to the current APP program of € 20 bn. a month.

Reinvestments will also gain in terms of importance. We see a negative cashflow picture, with most countries having a large portion of their supply targets already covered, which is supportive in relative terms for Euro Bond markets. We are monitoring investor positioning where long duration has stabilised, while non-core exposure has modestly decreased. Finally on the political front, the German chancellor Olaf Scholz of the SDP has finally been sworn in, but we except further uncertainty in Europe in light of the upcoming elections in France, Italy and Portugal. Overall, In the light of the improving growth and inflation numbers, we expect core rates to rise moderately especially given the tight valuations that they exhibit, thereby justifying our negative stance on Germany. However, we note the presence of the Delta variant and the spread of the Omicron variant has led to travel restrictions and curfews across Europe. In this context, we have bought back duration on core European Rates.

Non-Core/Peripheral markets continue to be supported by the ECB’s monetary policy and increased European solidarity. However, we also recognise that Spain is somewhat lagging in terms of economic recovery versus its peers, and valuations appear to be at fairly tight levels. As a result, after reducing our overweight on Italy and moving back neutral Portugal, we tactically turn underweight on Spanish sovereigns.. From a valuations perspective, we have noticed on the other hand a significant widening in the swap spread on Eurozone sub-sovereigns. We therefore have bought back exposure, decreasing our underweight stance on this segment in order to exploit this We maintain a positive stance on EU breakevens, though we did take some profits Mid-November, after their strong run. Inflations levels are rising and we expect the inflationary trend to remain high in H1 2022, despite some deceleration. Short term the carry on the long position, higher carry on the long position remains high, which is supportive for the asset class. Performance has been very strong YTD and most drivers remain positive. We hence remain positive on breakevens, specifically on the 5-year portion, taking into account valuations, ST inflation dynamics, carry, our breakeven model and monetary policy.

Credit: favouring European Investment Grade & convertibles

EU IG: We maintain a slight positive stance on € IG with a preference for financials. Some headwinds could challenge the current economic environment. As we reach a turning point in monetary policy and as inflation pressures could extend longer than anticipated, central banks could be forced to act sooner. Moreover, China’s regulatory policy and the Omicron variant could create uncertainty and derail the global growth trajectory. However, we continue to favour Euro IG credit within the Euro aggregate universe, as this segment should benefit from the ECB’s still (albeit less) accommodative monetary policy. However, dispersion is increasing among issuer profiles, as companies are acting differently at this juncture - some benefit from pricing power, other are consolidating their industry position by conducting acquisitions, while others are suffering as a result of growing costs. Selectivity is key, and we achieve this through our rigorous in-house bottom-up analysis. Financials remain an interesting asset class that is relatively immune to the supply crunch and the energy crisis. EU HY: this remains one of the preferred segments of the credit markets, taking into account lower duration risk, an attractive spread premium, still potential rising stars and an ECB seemingly one of the less G10 hawkish central banks. Heavy supply is now in the past and hence the technical environment is no longer a big negative factor, though it is important to note that the asset class is seeing some outflows. In this context, we hold a positive stance on the asset class, though once again we favour a high level of selectivity given growing dispersion, and we focus on defensive sectors such as telecoms, media and healthcare.

Finally we think EUR Convertibles should benefit from positive dynamics, such as coordinated action from the Next Generation EU recovery fund, and earnings growth. We note that the dynamic is less supportive, but European valuations are still attractive, certainly in a context of inflationary pressures.