In terms of performance, we continue to see strong returns from equity markets vs government bonds (especially European sovereigns). Amongst G10 sovereign rates, the US delivered a positive performance (0.86%), whereas peripheral sovereigns, with -0.87%, were the weakest. On European govies, we note the underperformance of Italian sovereigns (vs Spain and Portugal) over the 1-3-month horizon, though, over the longer term (6M-1Y), Italy still remains the best-performing peripheral. On linkers and break-evens, US linkers delivered the strongest performance over the 1-month and year-to-date periods. On corporates, a flattish performance was witnessed, but with an outperformance of financials vs non-financials. Finally, on currencies, the dollar bloc (AUD, CAD) did well, alongside the NOK, while the Turkish Lira ,the Yen and the US Dollar suffered.

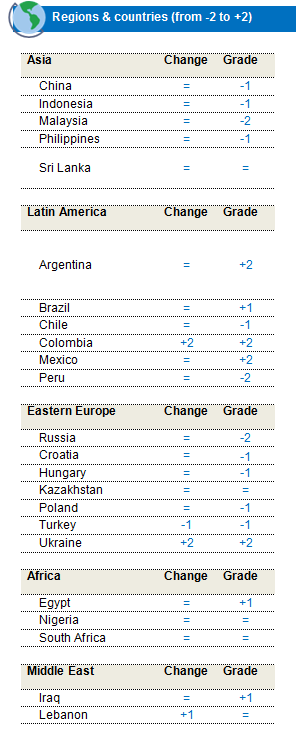

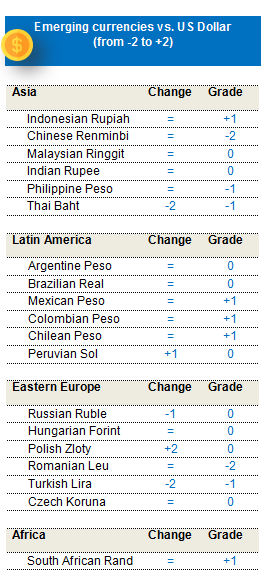

Our activity and inflation cycle analysis shows a clear turning point for the G4 countries, with the US entering the expansion and inflation stages, while others remain in the recovery and reflationary phases. In terms of monetary policy, which we believe will be the most important factor in 2021 (as we appear to be at a turning point in the cycle), we expect, over the next 18 months, to see some tapering as the central bank purchase programmes decrease progressively This will, of course, have an impact on bond yields and credit markets, as we expect communication on tapering in the second half of the year, starting in 2022 and followed later by the hiking cycle. The Bank of England and Canada have already announced tapering, and we expect the Fed and the ECB to start tapering in 2022 (PEPP will not be extended beyond March 2022), while rate hikes are expected in Q1 2023 and 2024 respectively as the ECB will take longer to adjust. We note from past experience that the announcement of this tapering will have an impact on risky assets - particularly EMD markets - and we aim to monitor this very carefully.

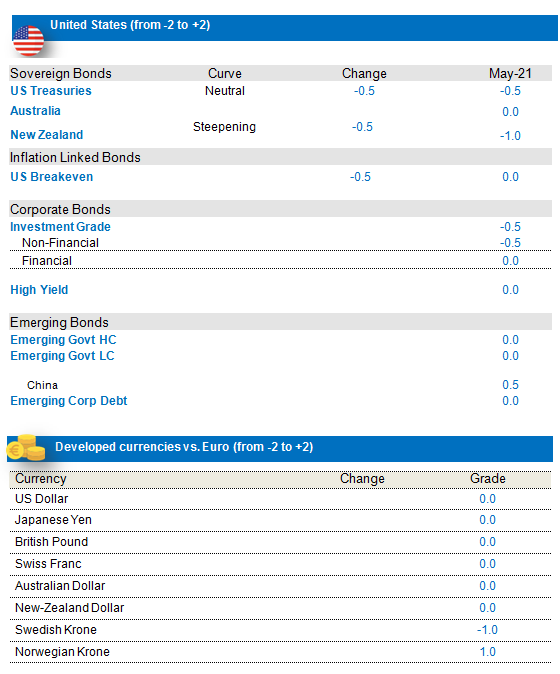

Negative stance on US rates; profits on US break-evens

The return of growth and inflation are welcome in the US, and could continue, on the back of the additional fiscal stimulus that will be proposed by the Biden administration. As explained earlier, we expect the Fed to start preparing markets for a tapering in 2H 2021, as the unemployment rate and inflation expectations progress towards FED Committee goals. In this context, we expect US rates to continue to move upwards. However, we have reduced this stance on the back of a lack of impetus. Economic surprises are close to expectations, vaccination programmes are saturating and fiscal measures have already been announced. Lastly, though US linkers continue to offer an attractive carry, we note that valuations at the front end of the curve are becoming stretched. We believe the headline inflation will help this exposure, as will the evolution of commodity prices, but we took profit on the trade, as much is already priced in, and prefer to play the reflation trade via Euro linkers.

Our negative exposure to New Zealand rates continues, on the back of some positive economic data, the tapering of monetary support in the form of scale-backs in central bank asset purchases, and a less attractive carry. We expect the curve to further steepen in the near term.

We also hold an underweight on Canadian rates, with a central bank that has already announced tapering of its QE programme and which could further taper purchases in June.

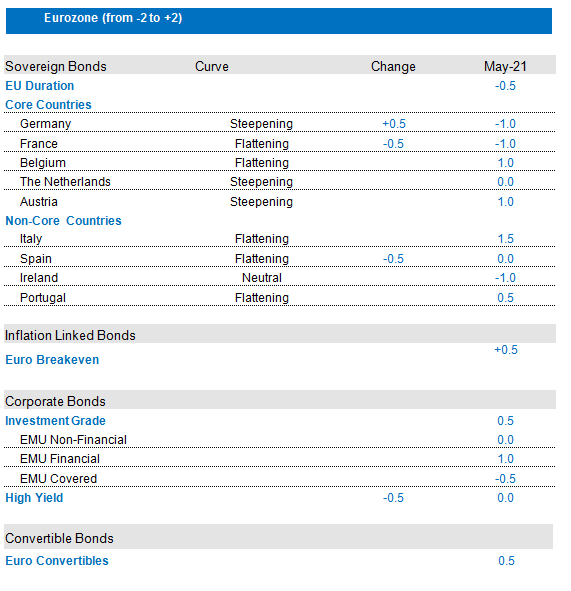

Underweight core Eurozone; lower allocation to Spain while positive on Italy

In Europe, on the back of the continued support of the ECB and the ratification of the Next Generation EU Recovery Fund, the economic recovery should pick up steam over 2H 2021 as the vaccination programmes advance at pace. The first issuance of mutualised EU debt, due in the second half of 2021, should further support the economy.

Overall, cyclical indicators, both on economic activity and inflation, are still supportive of the expected economic recovery. Macro data are surprising on the upside. Survey data continue to improve, with strong economic confidence and PMIs which are exceeding expectations. Vaccination programmes are accelerating and, with some countries easing lockdown, the European recovery is well underway.

On the duration front, we have moved part of our short-duration stance via the US towards the Euro, as we expect EUR rates to give up some of Q1 relative outperformance on the back of improvements on the economic, inflation and vaccination fronts, while valuations are starting to look more stretched. We therefore added a short position on the 30-year portion of the Euro curve, in line with our view that the EU recovery is catching up on the US and with our overall negative framework on core Eurozone markets.

Furthermore, while maintaining a favourable view on non-core countries, we took profit on Spain, preferring exposure to Italy and Portugal. Indeed, Spain has outperformed in relative terms in recent weeks while supply dynamics have been less supportive. Our positive stance on Italy is motivated by some interesting carry dynamics (resulting from the recent widening). We also note that, although the deficit is higher in that country, the overall supply picture is fine (despite increased issuance in recent weeks to finance the increased deficit) thanks to the central bank’s purchase programme, a strong increase in cash balance and contained foreign flows. On the policy front, Mario Draghi (head of the government) also announced a plan to implement ambitious reforms and investments that will be financed by EU funds (a programme in an amount of over €200 billion). This could bring in a growth element, further supporting our case for Italy, and help the country reduce debt. We are hence keeping our conviction on Italy.

We also hold a positive stance on Eurozone break-evens on the back of a recovery of the inflation cycle (in May and then over the second half of the year), the rising nominal rates and the positive carry offered on short-term linkers. We maintain this allocation, with a target of 1.4% on the 5-year.

Developed Market currencies: Neutral on USD, Long NOK vs. SEK

Our proprietary framework continues to point towards a negative view on the US dollar, on the back of twin deficits. With the global improvement in economic activity, the USD has lost its safe-haven status, with investors looking at some emerging currencies. On the other hand, nominal rates remain high and the FED is maintaining its patient approach. In this mixed context, we are keeping a neutral stance on the dollar.

We have maintained our long NOK/short SEK. Norges Bank has adopted a hawkish stance, on the back of an output gap turning positive and the risk of financial imbalances due to a low interest-rate policy, paving the way for a potential hike in rates by the end of the year. On the other hand, although the Swedish central bank has chosen a more dovish stance, even if the economy is recovering, inflation is still below the target.

Credit: Favouring European Investment Grade & Convertibles

EU IG: We remain positive on IG. Fundamentals are very supportive of credit markets, as quarterly earnings were very strong, with rising stars outpacing fallen angels. Sales improved in the first quarter, with, too, a strong improvement in earnings. Debt-to-Ebitda is decreasing, while operating margins are improving and cash remains at stable levels, providing a very strong overall picture. Financials are helped by the high level of core equity tier 1, while non-performing loans are at low levels and provisions much lower than last year. We have a preference for financials vs non-financials, on both fundamental and valuation aspects.

EU HY: We reduced our exposure towards a neutral stance on Euro HY, as supply is more abundant than on IG markets, essentially B names; such reduction should cap the spread-tightening on the segment. The less positive seasonality in May also contributed to tactically reducing our allocation.

US IG & US HY: We hold a negative outlook on US IG. Though our earnings expectations on US Credit remain strong, we believe that the balance-sheet recovery has been fully priced in and we note the reappearance of M&As and slightly more aggressive supply dynamics (resulting in longer duration) on the investment-grade front. In this context, we have maintained an underweight positioning on US IG, while staying neutral on the US High-Yield front.monthly

Finally, we think EUR Convertibles should benefit from positive dynamics such as the coordinated action from the EU Next Generation Recovery Fund and positive surprises/better visibility from quarterly results. US valuations are under pressure, as primary overflow is weighing on markets.