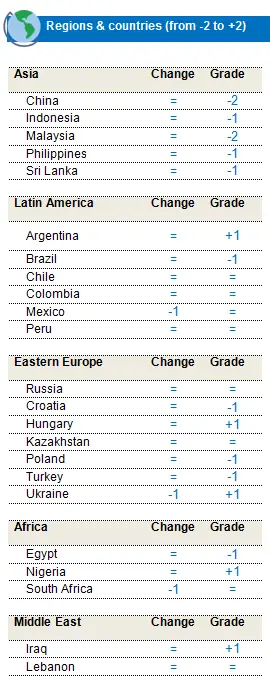

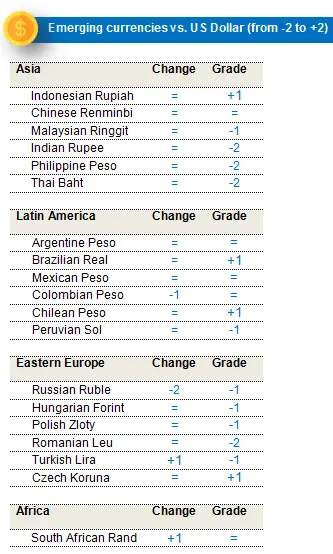

Policy normalisation has come to the forefront over the past few weeks, dominating the headlines and markets across the globe. While the news was expected throughout the entire second half of last year, Jerome Powell yet again provided a pivot and delivered a clear hawkish signal to the market. By reiterating the “transitory” nature of inflation previously advocated, the Fed has explicitly and deliberately chosen to exhibit a hawkish stance, with a dot-plot that now indicates 3 rate hikes in 2022. This sentiment was echoed across the Atlantic as the ECB announced the tapering of its asset purchase program (PEPP), which is expected to end in March of this year, although rates will remain unchanged in 2022. The Bank of England, on the other hand, implemented a rate hike of 25bps under the persistent pressure of thirty-year record levels of inflation, while the Bank of Canada is also expected to follow suit. Emerging central banks were not to be outdone either, having already implemented tightening policies over the past few months. Eastern European countries (the Czech Republic for example) and Latin American policy-makers (Mexico, Brazil) continued with rate hikes. In this context, global bond markets have come under pressure since December 2021, with sovereign and credit markets posting negative performances. Core rates, represented by US T-Bonds and German Bunds saw sharp upticks, matched by peripheral sovereigns, led by Portugal and Ireland. Dollar-denominated spread products also suffered as emerging markets and US high yield delivered negative returns over the past month. On the credit markets, all sectors were in negative territory, with defensive sectors affected the most (Telecoms, Healthcare).

What appears to be clear is that central bank policy is likely to be the lynchpin going forward as far as bond markets are concerned. Policy makers and their actions will remain as important during the hawkish phase as they were during the dovish phase. Markets have grown so used to central bank support over the past few years (in fact since 2012) that any tightening, or the threat to do so, has been accompanied by a significant increase in volatility, which is again likely to be the case in 2022. This year however, markets are likely to be more vulnerable as tightening currently being implemented across the globe is taking place against the backdrop of the Omicron variant spreading and waning fiscal support. Political risk is also present as the mid-terms in the US and general elections in France and Italy could be of vital importance and add to uncertainty, along with the conflict in Ukraine (where the US and Russia appear to be sparring), omnipresent trade wars and the continued fall-out from Brexit. Ever-increasing inflation is the primary driver of the much talked about hawkish stance adopted by the central banks, which can hardly be ignored. Clearly, this factor appears to have further to run, driven chiefly by the continued rise in commodity prices. However, it is once again important to note that the surge in inflation is something that the central banks cannot control or have little influence over, as it is driven more by supply crunches and commodity prices than by demand and consumption. This once again adds to the list of elements that could lead to a policy error, which again reinforces the possibility of higher volatility in the markets.

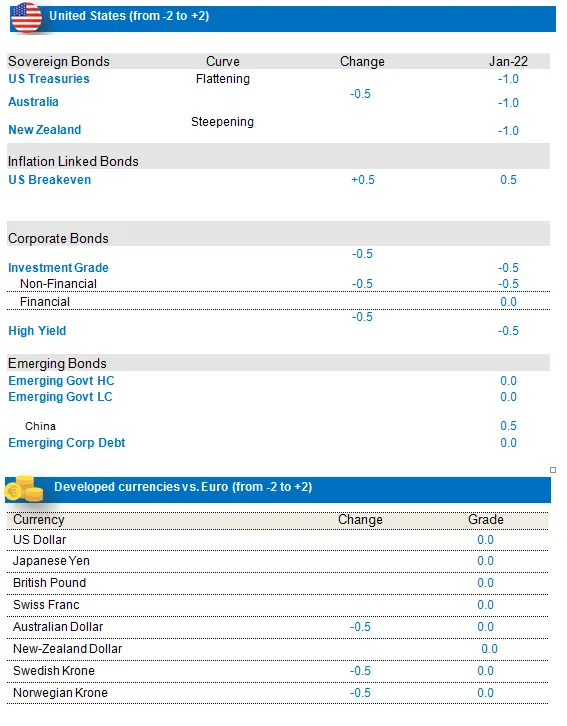

Maintaining a negative stance on US rates

The business cycle has been slowing in the US over the past month, mostly as a result of a slowdown in the consumption component (retail and wholesale sales), which appears to be reverting to its mean. The discernible silver lining however is that the decline in the business cycle appears to be at an end, as the diffusion index and the rate of improvement among the various components of the cycle are gathering pace. There is therefore a very low probability of the cycle moving back to the “repair” stage. Labour markets are holding up strongly, with increasingly lower unemployment rates. The inflation cycle, which was until now highly robust, appears to be peaking, with the housing component being the weakest link. However, we note the strong improvement in wage inflation, which is one of the most important components that we focus on. The Fed has marked its policy to market, with the median Fed fund rate for 2022/2023 matching the forward Fed fund rate. The market is now pricing-in 3 hikes for 2022 (in March, June and September) with policy front loading. In this context, we are maintaining a short position on US rates (5 Y & 10 Y). We note however that there are risks to this position that we aim to monitor very carefully. Effectively, a policy error (sharply lower accommodation) could have negative effects on the US economy, while the impact of COVID-19 variants could be exacerbated in the context of a lack of monetary support.

We are maintaining our negative view on New Zealand rates on the back of more positive economic data and monetary support tapering, in the form of scale-backs in central bank asset purchases. In Australia, the central bank has given its pre-commitment to the new tapered QE rate holding until February 2022. In this context, we also have a negative view on Australian rates. However, we do see some potential for a relative value trade involving a long position in New Zealand and a short position on Australia on the 10-year segment. The Australian economy appears to be on track to benefit from re-opening, low unemployment and high savings rates. On the other hand, New Zealand has already begun the rate hike cycle, much of which has already been priced into the curve. There is also a wide spread in the trade that supports the valuation argument.

We also took partial profits on Australian break-evens, which performed well. We expect the increase in rates to be driven by real yields going forward. We believe that US break-evens offer better value and we have therefore increased our allocation. The inflation cycle is very strong in the US, and the potential on the front end is sufficiently strong to provide protection against any upturns in real yields.

Short position on German rates

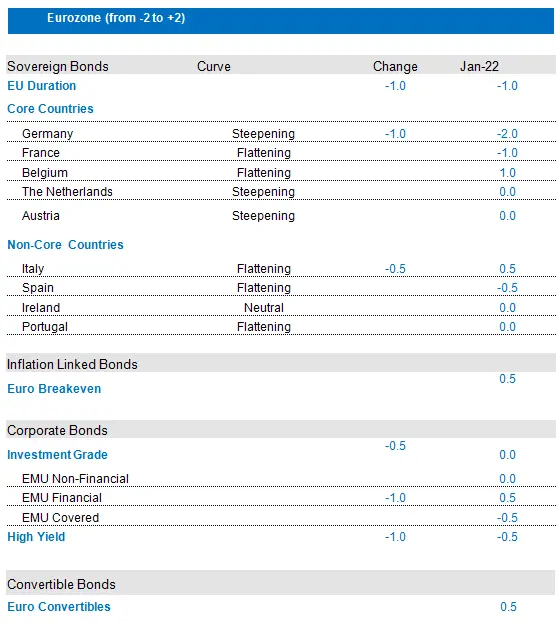

The overall framework is negative both in core and peripheral rates in the Eurozone. Regarding the monetary cycle, the ECB has already announced the tapering of its QE program, but clearly indicated that it would not be engaging in rate hikes in 2022. In terms of ECB forecasts, although there have been some adjustments, inflation is still indicated at below 2% in 2023. We are expecting heavy supply in the market, which will not be offset by a tapering asset purchase program, which is a negative factor for Euro Duration. In the light of the improving growth and inflation numbers, we expect core rates to rise moderately, especially given the tight valuations that they are currently showing, thereby justifying our negative stance on Germany. We are expecting episodes of spread volatility in the coming weeks in Italy as the presidential election approaches, with the outcome far from clear. The centre-right and centre-left do not have enough support to independently elect the President, therefore making an inter-coalition agreement necessary. Although we are positive overall in terms of the outcome, as we believe Mr. Draghi will continue to play a key role as a guarantor of continuity (either as PM or President), we nevertheless believe that volatility is going to remain high. We have significantly reduced our non-core exposure over the past quarter and we now have a neutral view on peripheral sovereigns. Weak technical factors, lower central bank support and rising political risk explain this prudent stance.

We are maintaining a positive stance on EU break-evens, although we took partial profits mid-November, after their strong run. Inflation levels have been rising sharply and we expect inflation to remain high in H1 2022, despite some deceleration. Short term carry remains high on long positions, which is supportive for the asset class. Performances have been strong over the past two months and most drivers remain positive. We therefore remain positive on break-evens, specifically on the 5-year portion, taking valuations into account and short-term inflation dynamics, carry, our break-even model and monetary policy. We are monitoring the position very carefully as there will be some deceleration in inflation due to technical dynamics, although overall inflation should remain relatively strong.

Credit: Neutral on Euro IG & Negative on Euro HY

EU IG: We now hold a neutral position in the asset class (from Overweight), although we maintain a preference for financials. Spreads tightened in December (roughly 10 bps) reaching 95 bps, which we consider stretched. As inflation pressures are high, we are at a turning point in monetary policy and central banks are increasingly hawkish, leading to a decline in major support for IG markets. Moreover the Chinese Real Estate sector and COVID-19 variants are generating further uncertainty, with the risk of slowing down the global growth trajectory. Dispersion and idiosyncratic risk are increasing amid issuer profiles as companies are acting differently at this juncture - some are benefitting from pricing power, whereas others are consolidating their industry ranking by making acquisitions, while some are suffering from rising costs. We see an increasing number of equity-friendly actions (dividends, share buy-backs, etc.) that are likely to negatively impact credit markets. Selectivity, through rigorous fundamental research, will be a key factor. Regarding Technicals, a combination of currently less favourable net supply and declining inflows into the Euro IG asset class should also put pressure on spreads. We also see break-evens as attractive in the financial segment, particularly on the short end.

EU HY: For the reasons referred to above (decreasing monetary support and deteriorating fundamentals) we have turned negative on this asset class. Spreads tightened 40 bps to 330 bps which are very low and we therefore consider the risk-reward to be relatively unattractive at this stage. Once again, we favour a high level of selectivity in the context of growing dispersion, and we favour active management.

Finally we think EUR convertibles should benefit from positive dynamics such as the coordinated action from Next Generation EU recovery fund, and earnings growth. We note however that although dynamics are less supportive, European valuations are still attractive, certainly in a context of inflationary pressures. We note that equity markets have been under pressure recently, but we believe that this is primarily a result of the asset class sector bias towards Technology. This of course is a risk that we need to monitor going forward.