In terms of performance, US govies delivered positive performance over the past month as US assets generally generated better performance than European ones, with Equities and High yield leading the charge. Amongst G10 Sovereign rates, it was interesting to see the dollar bloc delivering sturdy returns (Australia, New Zealand), though European core and peripheral markets also posted positive performance (with Italy and Portugal leading the way. On breakeven markets, the picture was slightly weaker than the past few months, when performance was quite positive (for both the European and US markets, with a rise in real rates over the past month. On Credit markets, during a broadly positive month, Contingent capital and insurance sub were the best performing segments. On currencies, the Turkish lira and Mexican Peso were both strong performers, while the South African Rand delivered negative returns. Emerging Debt markets took advantage of lower US rates to post positive performance both on the Hard as well as Local currency asset classes.

Our activity and inflation cycle analysis continued to indicate a strong rebound of the Eurozone, which has now entered the expansion phase alongside the US, while Japan and UK remain in recovery. In term of monetary policy, it is interesting to note the surprising increase in MBS bought by the Federal Reserve as part of its QE program. Following the June FOMC, we also can see the buildup in expectations of rate hike between now and December 2022, market participants are pricing 1 full rate hike (of 0.25%). We have also observed a bull-flattening of the US curve, with the short end staying relatively stable in light of the growth and inflation profile in the US. The general picture points to increase in inflation, though we do note that the wage segment remains to be confirmed. In terms of labour markets, we see a beginning of improvements, especially in certain portions of the US (namely states that are opting out of the job insurance programs). We expect also to see some increase in inflation that comes specifically from an increase in wages from the generally “low-wage” jobs that are seeing a lack of labour availability. This in turn could lead to an increase in real yields in the US as well as higher rates in the longer term. The Oil prices have seen a sharp increase and in absence of an agreement amongst OPEC members on increase in supply, we expect oil indices to remain at elevated levels. On the covid front, the delta variant appears to be taking over in Europe as well as some other parts of the world, with the UK in particular seeing a strong pick-up in number of cases. While some regions are opting for partial lockdowns, the vaccine programs do seem to be keeping the death rates a low levels and a full lockdown does not seem to be on the table.

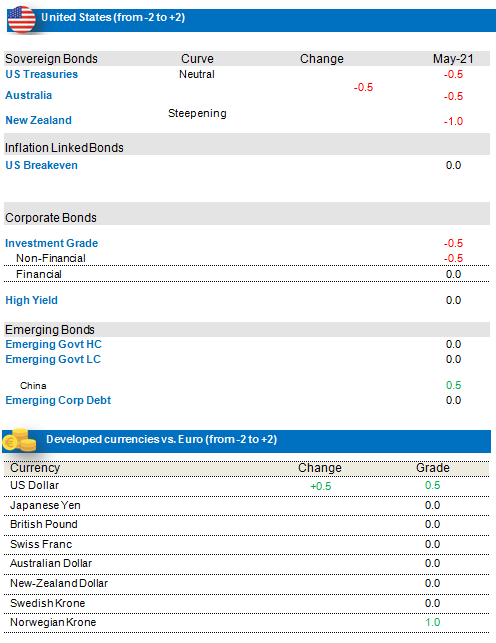

Maintaining a negative stance on US rates and dollar bloc

Overall, across developed markets, we expect a general rise in rates on the back of better growth, inflation and low valuations. The return of growth and inflation are welcome in the US, and could continue on the back of the fiscal stimulus proposed by the Biden administration. On the inflation front, it is the housing (which has been strong over the past months) and the expectations pillars that are the main drivers, while future up-tick in wages could also contribute. We expect the Fed to start preparing markets for a tapering in the second half of 2021 (perhaps at Jackson Hole), as unemployment rate and inflation expectations progress towards FED Committee goals. An overheating housing market and excess liquidity in the monetary market may lead to some earlier tweaks with regard to its asset purchases, especially MBS purchases. In this context, we expect US rates to continue to move upwards and maintain our negative view on US rates.

Our negative exposure to New Zealand rates continues on the back of more positive economic data, tapering of monetary support in the form of scale backs in central bank asset purchases. We expect the curve to further steepen in the near term. With the Reserve bank of Australia delivering a rather hawkish stance, we have moved to a negative stance on Australian rates. We also hold an underweight on Canadian rates, with a central bank that has already announced tapering of its QE program, and could further taper purchases over the next months.

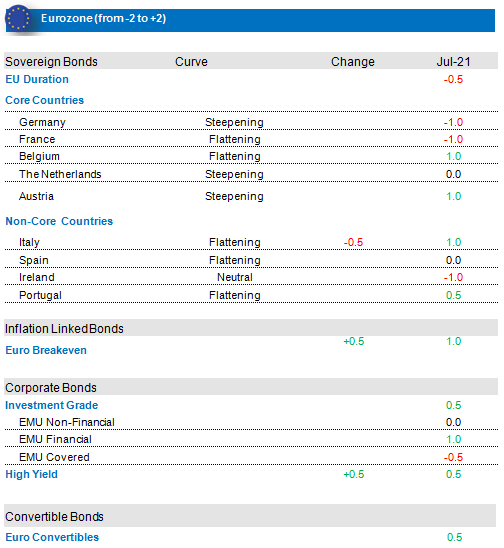

Still a positive view on Non-Core Euro-zone rates, but some profit taking on Italy

In Europe, the ECB kept its policy unchanged (as was widely expected) and net purchases under the PEPP over the coming quarter will continue to be conducted at a significantly higher pace than during the first months of the year. We notice that the central bank has registered the highest weekly PEPP pace in over a year, in spite of better macro-economic and inflation data. We will continue to monitor the APP/PEPP program, specifically with regards to certain countries where we are close to the APP bond buying limits (Netherlands, Portugal). Supply dynamics are a positive over the summer as a result of negative net flows for most core as well as non-core countries.

Overall, cyclical indicators, both on economic activity and inflation are still supportive for the economic recovery, which is further supported by the global recovery. Macro data are surprising on the upside. Survey data continue to improve with strong economic confidence and PMI which are exceeding expectations. Meanwhile vaccination programs are accelerating and with countries increasingly easing lockdown measures, the European recovery is picking up speed.

We maintain a small negative view on core Eurozone rates given their expensiveness. Growth and inflation dynamicss should push core rates moderately upwards despite the still very accommodative monetary policy.

While still positive on non-core, we have reduced our allocation to Italy, in line with our sell-discipline as we aimed to partially take profits as spreads reached the 100 Bps level. We remain positive on the country, which remains our preferred non-core market, but should spreads continue to tighten, we would take further profits.

We maintain a positive stance on EU breakevens. For the second half of the year, we expect increased levels of inflation which doesn’t appear to be priced by the markets even if we adjust for seasonality and the overall inflation cycle does seem to be positive. The strategic review of the ECB should also be supportive for inflation. Furthermore in light of ournominal rate expectations, and positive carry offered on short-term linkers we maintain this allocation, with a BEI-target of 1.4% on 5 year linkers.

Currencies: Long USD, Long NOK, Small Long Position on MXN

While our framework does point to a negative view on the dollar, we are currently holding a tactically positive positioning on the greenback. Historical data shows that our current scenario of higher real yields and break-evens moving lower coincides with a rise in the US dollar. Furthermore, the greenback remains a safe haven currency and hence could be an interesting hedge (during the traditionally illiquid month of August) in case we see turbulence/risk-off sentiment in markets over the summer. Technicals are also fairly interesting as the positioning on the US dollar is also close to neutral (though increasing recently).

We maintain our long NOK. The Norges Bank has adopted a hawkish stance on the back of output gap turning positive and the risk of financial imbalances due to low interest rate policy, paving the way for a potential hike in rates by the end of the year.

We also hold a constructive position (though slightly weaker) on the Mexican Peso. The leftist party Morena (of president ALMO) lost its qualified majority in Congress, which will prevent the ambitious reforms that would have hurt the government balance sheet. Furthermore, the US-Mexico- Canada agreement being concluded and Biden being now in power now bodes well for the manufacturing sector in Mexico, especially given the strong US recovery.

Credit: Favouring European Investment Grade & convertibles

Fundamentals are very supportive for credit markets as second quarterly earnings are expected very strong and leverage is decreasing. Default rates are decreasing while we see more upgrades than downgrades and rising stars are outpacing fallen angels. In terms of risk appetite, sentiment is extremely bullish though momentum appears to be more neutral after the strong recent rally. The ECB backstop continues to be present (as confirmed during the last ECB meeting) and will be a strong source of support till year end as we do not expect any change in QE. Positioning on credit markets is moderate (still not at previous highs), while seasonality is very supportive with less supply as we enter the period of publication of results.

EU IG: We maintain a slightly positive outlook for the European Investment Grade segment with a large preference for financials vs non financials. Though issuance is lower in IG, the ECB backstop is still a of support till year end. However most of the spread compression is behind us, only carry remains and risk reward is less favourable. We expect more specific risk with some merger & acquisition as companies have lots of cash and business cycle is entering in expansion. Financials are helped by the high level of core equity tier 1, and the non-performing loans are at low levels and provisions are very low. Subordinated debt (including AT1s) in the financial sector remains attractive vs. Senior debt.

EU HY: After a widening of the basis, we are moving to a positive stance on Euro HY (cash bonds) as we expect less supply in July and due to the carry the asset class offers. BBs vs BBB are still attractive with potentially more rising stars. It is important to note that more than 70% of the high yield market is rated BB. B markets do appear expensive.

US IG. & US HY: We hold a negative outlook on US IG. US credit appears to be the most expensive credit market from a valuations stand point. Furthermore, with the next move of the FED expected to be more on the hawkish side, the monetary support should be lower than in the past. Finally, in terms of rating drift, we continue to see more downgrades than upgrades in the US Credit markets. Though our earnings expectations on US Credit remain strong, we believe that the balance sheet recovery has been fully priced and we take note of the reappearance of M&As and slightly more aggressive supply dynamics (resulting in longer duration) on the investment grade front. In this context, we maintain an underweight positioning on US IG, while staying neutral on the US High yield front.

Finally we think € Convertibles should benefit from positive dynamics such as the coordinated action from EU Next generation recovery fund ( recently ratified by EU members),more positive surprises in Q2 quarterly results and better visibility as herd immunity will be reached.. Inflows are more supportive for Europe than in US.