European equities: positive performance for Small Caps and Growth stocks

August was a quiet month for continental Europe, with the European Parliament in recess and no announcements from the European Central Bank. Having started its reopening later, Europe is slightly behind the US and the UK on the road to normalisation. The spread of the Delta variant has caused cases in Europe to rise rapidly, denting consumer confidence, which fell in August. That said, Europe has now vaccinated over 70% of the population and hospitalisation rates have remained much lower than in previous waves. The pandemic prevented the economy from fully recovering during winter but activity rebounded and the “growth” gap continued to close in Q2. The latest monthly surveys remain at elevated levels but supply-side constraints are still impairing manufacturing production and the rebuilding of inventories.

August was a quiet month for continental Europe, with the European Parliament in recess and no announcements from the European Central Bank. Having started its reopening later, Europe is slightly behind the US and the UK on the road to normalisation. The spread of the Delta variant has caused cases in Europe to rise rapidly, denting consumer confidence, which fell in August. That said, Europe has now vaccinated over 70% of the population and hospitalisation rates have remained much lower than in previous waves. The pandemic prevented the economy from fully recovering during winter but activity rebounded and the “growth” gap continued to close in Q2. The latest monthly surveys remain at elevated levels but supply-side constraints are still impairing manufacturing production and the rebuilding of inventories.

As mobility normalizes, consumption should support growth in the coming quarters. We expect GDP to be close to trend by year-end, growing by 5.2% on average in 2021. Regarding Inflation, CPI has increased but a sustained acceleration seems unlikely as labour costs have little reason to become an issue. Labour shortages are creeping up in the same sectors as before the pandemic and the link with core inflation is pretty loose. However, inflation could last longer than some are expecting, mainly due to the repricing at consumer level which is not expected before 2022 and input costs that keep going up (shipping, building and raw materials, etc.). The ECB will remain accommodative to preserving favourable financing conditions, all the more so since its strategic review has resulted in the adoption of a symmetrical inflation target around 2%. Still, tapering talks have started: what happens after the end of PEPP in March 2022 is a moot point!

In terms of style performance, over the last 4 weeks, we can observe that Small Caps and Growth stocks have performed well. In terms of sector performance, over the last 4 weeks, the top performers were Technology and HealthCare, while Real Estate and Materials suffered the most. Regarding Earnings per Share, forecasts for 2021 and 2022 remain below pre-pandemic levels, except for Materials. There is more catching-up to await in Europe than in the US.

Despite a fairly high risk premium for equities compared to bonds, Forward P/E and Price-to-Book ratios remain high for the European Market. Financials, Energy and Utilities, however, look rather cheap.

In terms of P/B vs ROE, we can observe that Technology appears to be very expensive. On the other hand, Financials, Energy and Materials appear not to be that expensive.

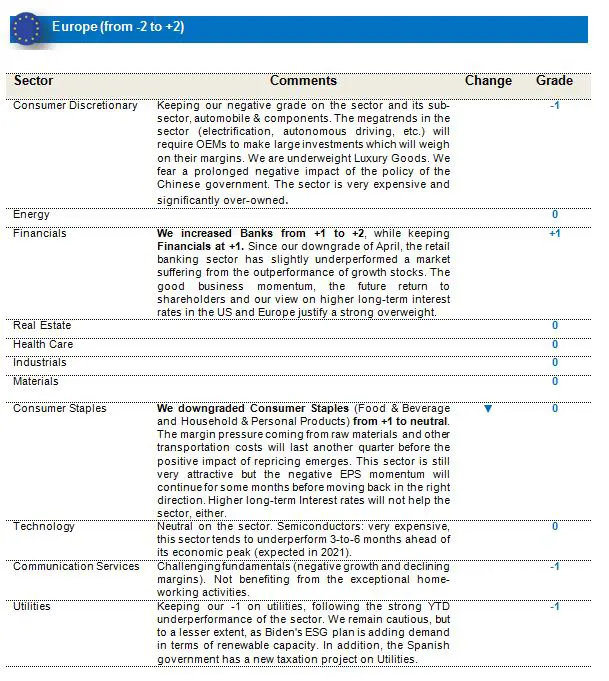

Downgrade for Consumer Staples and upgrade for banks

- We downgraded Consumer Staples (Food & Beverage and Household & Personal Products) from +1 to neutral. The margin pressure from raw materials and other transportation costs will last another quarter before the positive impact of repricing emerges. This sector is still very attractive but the negative EPS momentum will continue for some months before moving back in the right direction. Higher long-term Interest rates will not help the sector, either.

- We increased Banks from +1 to +2 but have kept Financials at +1. Since our downgrade of April, the retail banking sector - suffering from the outperformance of growth stocks - has slightly underperformed the market. The good business momentum, the future return to shareholders and our view on higher long-term interest rates in the US and Europe justify a strong overweight.

- We remain negative on Consumer Discretionary, a very expensive sector. We are more specifically negative on automobile and components, as the megatrends in the sector (electrification, autonomous driving, etc.) will require OEMs to make large investments which will weigh on their margins. We are also underweight Luxury Goods. We fear a prolonged negative impact of the policy of the Chinese government. The sector is very expensive and significantly over-owned.

- We remain cautious on both telecom services and utilities.

US equities: HealthCare and Real Estate on top

August economic data pointed to an economy that, while past the peak rate of growth, was still running hot, and concerns around inflationary pressures continued to build. August’s flash PMIs printed at 61.2 and 55.4 for manufacturing and services respectively, and the US headline consumer price index (CPI) delivered another bumper print of 5.4% year over year, its highest in a decade. Under the surface, however, core CPI fell marginally and pressure from a number of areas, such as used cars, which have driven inflation in recent months, appeared to be softening. On the other hand, the labour market went from strength to strength.

Supported by strong consumption and investment, activity exceeded its pre-pandemic level in Q2. Manufacturing PMI confirms that the pace of industrial activity has peaked while firms continue to face bottlenecks. Services PMIs remained at a pretty high level in August. Also, business investment, which has been pretty dynamic, should progressively slow down. Despite consumption being back on trend, the rebalancing towards services is still not complete. Also, the pace of savings accumulation sharply decelerated in Q2, but households were still far from drawing on their savings. The “whole” Build Back Better plan will take time to be voted and the impact on GDP growth in 2022 will be modest. Nevertheless, GDP is expected to remain “moderately” above trend in 2022 (+6.2% in 2021 and +4.3% in 2022). Inflation has accelerated but, without any self-reinforcing mechanism at play, this should prove transitory, although longer-lasting than some are expecting. The Fed does not seem too worried by inflation nor by the increase in wages, but recognizes the progress made in the labour market: tapering will happen before year-end.

In terms of style performance, over the last 4 weeks, we can observe that growth and defensive stocks have performed well, while it was more difficult for cyclical and value stocks. In terms of sector performance, over the last 4 weeks, top performers were HealthCare and Real Estate, while Financials and Consumer Discretionary suffered the most.

Regarding Earnings per Share, forecasts for 2021 and 2022 are above pre-pandemic levels. In terms of P/B vs ROE, we can observe that Consumer Discretionary appears to be very expensive, which is surprisingly not the case for Technology. On the other hand, Financials, Energy, Materials and HealthCare appear not to be expensive.

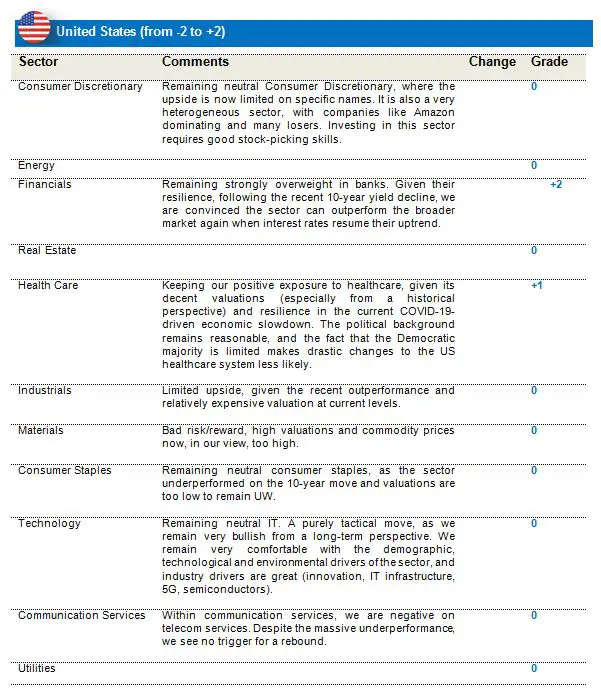

No significant strategic changes

- We remain neutral materials. The risk/reward is bad, valuations are high and commodity prices are now, in our view, reaching their short-term high. Most commodities prices are above pre-pandemic levels.

- We have maintained our strong overweight on banks, whose recent resilience convinces us that the sector can continue to outperform in the coming months.

- Despite good earnings, we have maintained our neutral grade on IT. 10-year yields are too low and should increase to at least 1.75%. However, this remains a purely tactical call, as we remain very bullish on the sector from a long-term perspective. We remain very comfortable with the demographic, technological and environmental drivers of the sector.

- We have maintained our neutral grade on consumer staples. It is too soon to increase to an overweight, but low valuations justify a neutral weighting.

- We remain negative on telecom services. Despite the massive underperformance, we see no trigger for a rebound.

- We remain neutral on consumer discretionary. For us, this is clearly a sector in need of good stock-picking skills.

Emerging Markets post slight recovery with continuing regional divergence

The MSCI EM recovered in August, posting a +2.4% gain (in USD) following July’s correction. This happens to be the same as the 2.4% gain posted by the MSCI World, which continued to fare higher on strong earnings and global PMI data.

Regional performance remained varied. Chinese equities ended flat in August even as regulatory tightening continued to spread to specific sectors like healthcare but also due to the delta-variant outbreak inducing regional lockdowns in China.

Asia ex-China, however, performed relatively well, with India posting, for the month, a strong +11% gain, driven by extended fiscal support and corporate earnings recovery. Financials led the way in India. ASEAN markets (Philippines +11.2%, Thailand +11%) - driven by prospects of an eventual re-opening - supported the index as well.

Taiwan posted a decent 4% gain, as a recovery in semiconductor markets helped push the index higher. South Korea, on the other hand, slipped 1.3% for the month, with the Bank of Korea announcing a rate hike and prospects for memory semiconductors mellowing. LatAm had a muted month as well, with Brazil down 3.1% (as inflation pressure continued to creep higher in the region) and the Central Bank of Brazil remaining ahead of the curve with rate hikes.

Within the commodities complex, oil (Brent) slipped to $71.24/bbl on delta variant-induced mobility restrictions.

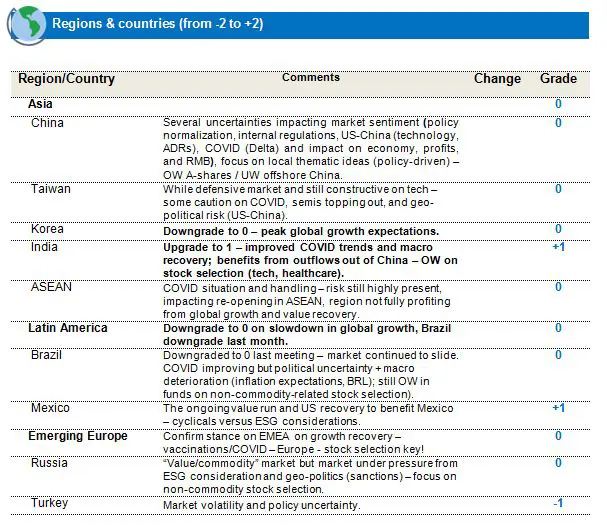

Rating changes (Regional)

Downgrading South Korea and LatAm; upgrading India

South Korea: Downgrade from +1 to 0 (Neutral) - Cyclical market very dependent on global growth expectations, which appear to be peaking. Central bank hinting at rake hikes and tightening monetary conditions. A big part of the index is related to memory semiconductors, which might be seeing some levels of normalization.

LatAm: Downgrade from +1 to 0 – As a consequence of last month’s downgrade of Brazil, we are moving to Neutral on LatAm.

India: Upgrade from 0 to +1 – Ongoing economic recovery from COVID, still-supportive fiscal policy, benefiting from the China supply chain and the commodity pull-back, which, in turn, is supportive of consumption. Cautious on valuations and so the focus is on stock selection.

Ratings unchanged from last month (Regional):

China - remaining neutral

While the near-term outlook remains clouded with regulatory uncertainty and policy risks, the long term remains an attractive market, and a discounted valuation is driving our neutral view on China.

Near term: Regulatory tightening continues to weigh on sentiment. On policy: continuation of the general easing and the accommodative policy, coupled with a targeted tightening stance. Given the tighter regulatory control, however, going forward, policy could be eased. China remains a policy-driven market – with near-term policy uncertainty reflected in a higher equity risk premium, not least in the index’s heavyweight tech sector.

Continue to prefer exposure via onshore / A market and avoid offshore / ADRs.

Brazil: Still neutral (downgraded last month), on views of commodities coming down, rising inflation trends and central-bank rising rates remaining in line with inflation.

We remain +1 on Mexico, which should benefit from the ongoing value run and US recovery. Incumbent losing qualified majority (2/3) in Congress (retaining single majority) reduces policy uncertainty. We confirm our upgrade to Emerging Europe from -1 to neutral on growth recovery – vaccinations/COVID – Europe – Commodities. However, stock selection remains key. We remain Neutral ASEAN, Despite some early signs of recovery, it is still too early to upgrade the region, which remains very varied in outlook, leading us to maintain our neutral stance.

We remain Neutral Taiwan. However, structural growth stories and deep cyclical tech geo-political risks are keeping us from going OW.

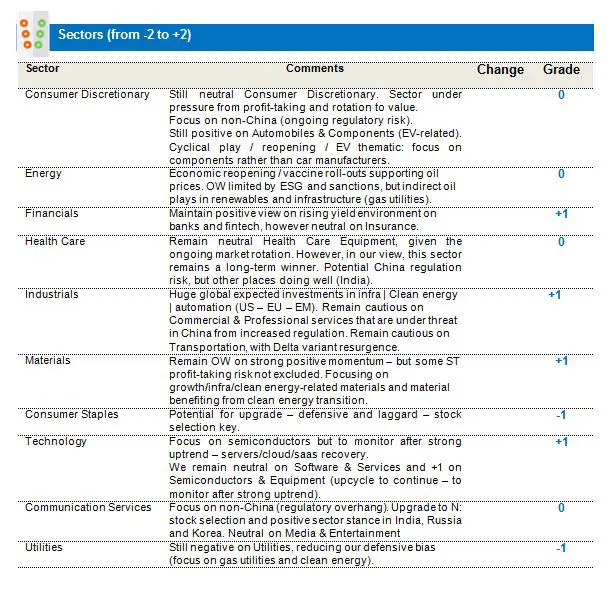

Ratings changed (Sector):

Commercial & Professional Services subsector in Industrials – downgraded to neutral (0 from 1): Cautious on China regulatory headwinds in the services sector.

Insurance (Financials): Downgrade to neutral (0 from 1), as subsector unlikely to benefit from rising yields in the near term.

We remain overweight (+1) on Materials on expected strong long-term supply/demand support - however, focus primarily on materials benefiting from the structural demand uptrend from the clean energy transition (EV-related materials, for instance).

Remaining neutral on HealthCare. Sector could potentially be at regulatory risk in China. However, we continue to see growth trends elsewhere in the sector. Long-term positive view on the sector maintained, although we are selective, given regulatory risk in the near term in China.

Maintaining overweight in Semiconductors & Equipment, based on strong positive supply/demand momentum - but some ST profit-taking after strong performance not excluded. Less positive on the memory-semiconductor subsector (Korea) in the near term than on the processing-semiconductor subsector (Taiwan).

In the near term, the outlook for EM returns is expected to be governed by factors that include announcements on the tapering of bond purchases by the Fed Chair, inflation expectations, regulatory developments in China and the pace of the economic re-opening. As we transition from early to mid-cyclical market recovery, we expect the focus to be on earnings-driven growth, which should also augur well for the strategy’s maintenance of a balanced approach involving high-quality sustainable growth stocks.