European equities: Recession risks remain high

Central banks’ commitment to bringing inflation under control, despite the inherent risks to the growth outlook, shook both equity and bond markets in August. While the summer brought historical droughts and heatwaves to many parts of the world, the global economy nevertheless continued to cool. All in all, the level of uncertainty about the outlook for the global economy remains high. This uncertainty is especially elevated in Europe, where after six months of war in Ukraine, there is no sign of a ceasefire, and where a recession seems increasingly likely this winter as the region’s energy crisis continues to intensify.

Central banks’ commitment to bringing inflation under control, despite the inherent risks to the growth outlook, shook both equity and bond markets in August. While the summer brought historical droughts and heatwaves to many parts of the world, the global economy nevertheless continued to cool. All in all, the level of uncertainty about the outlook for the global economy remains high. This uncertainty is especially elevated in Europe, where after six months of war in Ukraine, there is no sign of a ceasefire, and where a recession seems increasingly likely this winter as the region’s energy crisis continues to intensify.

The second half of the year looks more challenging. Although EU natural gas inventories reported in August were in line with the 10-year average, thanks to more liquefied natural gas imports and the reactivation of coal-fired power stations, the substantial reduction in gas flows through the Nord Stream 1 pipeline has pushed European energy prices to new highs.

Recession risks remain high, as shown by the weakness of the euro, which dropped to parity with the US dollar, and by the Flash eurozone composite PMI, which dropped further into contraction territory in August.

In Europe, Value stocks have outperformed Growth stocks over the past four weeks. In terms of market capitalisation, Small Caps suffered the most, seeing economic expectations and a EUR capitulating somewhat against the USD, breaking some downward resistance. In the end, the worst performers were Small Caps with a Growth style.

In terms of sectors, energy was the top performer, while consumer discretionary, IT and industrials suffered the most.

High beta stocks were the worst performers.

The eurozone still seems to be an attractive region in terms of valuation, being at the bottom of its historical range (12M forward P/E).

On average, earnings revisions have been quite positive in recent weeks, but the market seems to be anticipating several downward revisions in the future, mainly driven by expectations of downward revisions to economic growth in general.

We can also note a kind of correlation between the companies that have implemented the biggest downward revisions and those that have performed the worst (and vice versa).

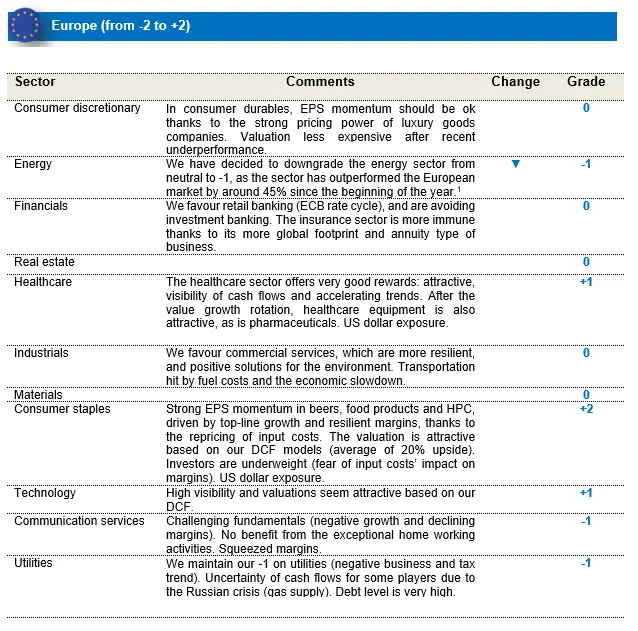

We have downgraded the energy sector (from 0 to -1) for Europe.

We have decided to downgrade the energy sector from neutral to -1 for the following reasons:

- Within Cyclicals, energy has become too expensive in relative terms.

- We expect oil prices to continue to go down in the next quarters. We expect a decline in demand, and even a production surplus.

- The energy sector has outperformed the European market by around 45% since the beginning of the year (MSCI Europe Energy Sector Index vs MSCI Europe Index as of 06/09/2022).

1 MSCI Europe Energy Sector Index vs MSCI Europe Index as of 06/09/2022

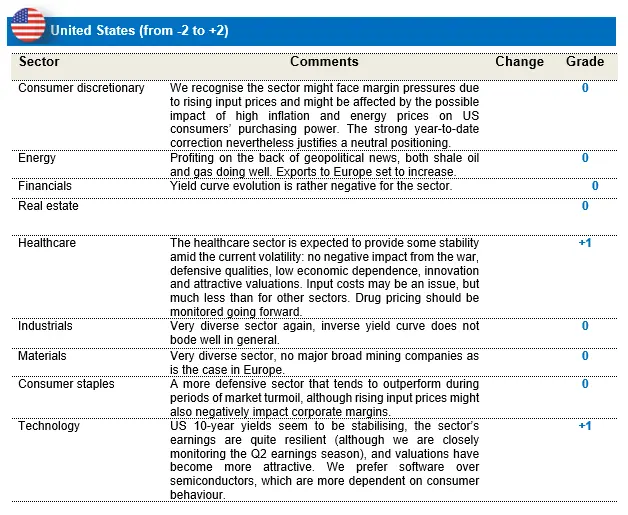

US equities: Investors relieved by earnings and stabilising yields

US equity markets had to give away some ground in August, after the strong July rebound. Investors were shocked by the central banks’ commitment to bringing down inflation at any price, even if that would potentially imply a significant deceleration in economic growth. While the global economy continues to cool down, there were some early sparks of hope in the US (consumer confidence and PMI new orders inflected slightly). Healthcare surprisingly underperformed in this environment (probably due to the Inflation Reduction Act, which stipulates a reduction in a number of drug prices over the coming years), while consumer staples continued to fare well. Once again, energy was the biggest winner.

Despite a decent second quarter earnings season, during which the market rewarded companies that surprised positively, earnings for the remainder of 2022 have been revised down. Earnings revisions were in particular visible in consumer discretionary, IT and communication services, while expected earnings for energy continue to be revised upwards.

Consensus expectations for earnings growth are settling at around 7.5% in the US for the coming 12 months. Expectations for 2023 have also already been slightly revised down, with earnings growth expectations close to 8%. With these estimates in mind, the US market valuation is broadly in line with its long-term average, based on 12-month forward price/earnings.

At this time, we are convinced that maintaining a balanced approach remains important. We did not make any strategic changes:

- We maintain our +1 on healthcare, although the sector has underperformed over the past month due to the Inflation Reduction Act and the related healthcare provisions. The immediate impact of the act seems rather limited, and it will not be fully implemented before 2026. The sector remains a rational choice on the back of its defensive characteristics: no negative impact from the war, low economic dependence, supported by demographic trends and ongoing innovation, and attractive valuations.

- Even information technology had a difficult month on the back of rising interest rates. We maintain our +1 on the sector, but with a preference for software and hardware. We are cautious on semiconductors, as they are the most cyclical within IT.

Emerging Markets: Regional divergence continues

Emerging markets stabilised in August, following some relief in inflationary pressure and a correction in commodity and energy prices over the month. However, following the reiteration of the US Fed’s hawkish stance at the Jackson Hole meeting, US treasury yields spiked higher, and the USD strengthened against major EM currencies, putting pressure on EM relative returns. Overall, the MSCI EM© ended the month flat (in USD terms), while still outperforming the MSCI AC World© index by 3.9% (relatively).

On a regional level, the outperforming markets for the month were ASEAN, where Indonesia and Thailand gained 5.3% and 5.0%, followed by India, which gained 3.9% as inflationary concerns receded. Index heavyweight China ended the month flat (with MSCI China© at 0.1% in USD returns), as Covid cases increased towards the end of the month and concerns over a property-related slowdown weighed on consumer sentiment. While China A shares saw some correction during the month, the tech heavyweights in MSCI China© recovered somewhat, with better results thanks to cost-cutting efforts and a surprise preliminary audit agreement for US-listed Chinese companies. Taiwan ended the month 1.5% lower (in USD terms), amid heightened geopolitical risks following the visit of the US House Speaker and retaliatory military drills from Mainland China. South Korea remained under pressure, as inflation stayed high and concerns over a prolonged inventory correction in the semiconductor space weighed on Korean heavyweights.

LatAm also ended the month flat, with a noticeable performance difference at a regional level. While Brazil (+2.2%) and Chile (+2.5%) ended the month higher, with Brazil’s macro recovery better than expected, regions like Mexico (-5.5%) and Colombia (-6.5%) remained under pressure. In the commodity complex, most industrial metals continued to correct due to expectations of softening global demand.

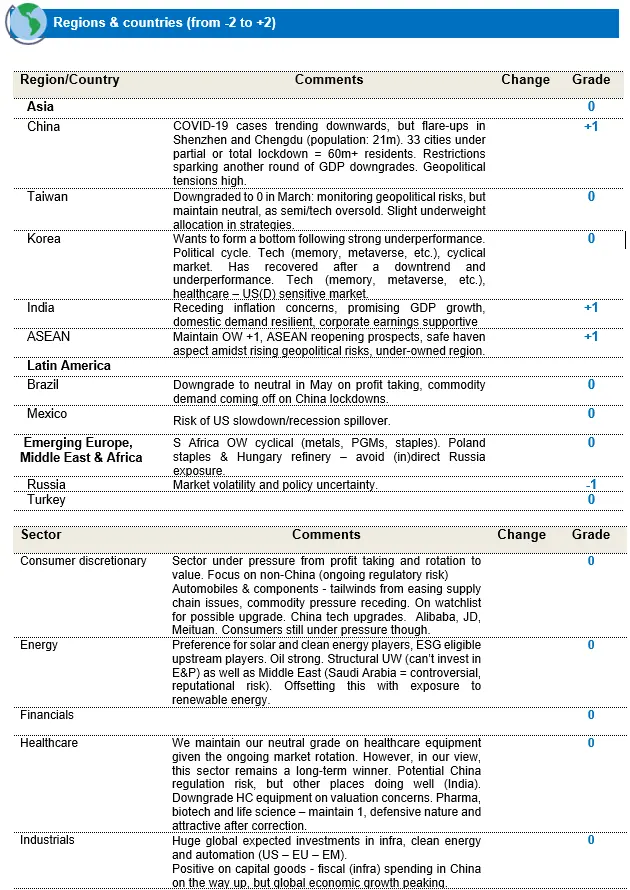

Changes to regional view:

India: upgrade on receding inflationary headwinds (+1)

As commodities and energy price correct, inflationary headwinds, which were one of the key concerns in our earlier downgrade, become more manageable. The region still promises upwards of 7% real GDP growth for FY22E (consensus), in an environment of slowing global growth, while maintaining core CPI in the 6-7% range. More broadly, domestic demand remains resilient and corporate earnings remain supportive, prompting us to upgrade the region.

Mexico: downgrade to neutral (0)

Following a period of relatively resilient performance (in 2021), we are moving Mexico to neutral in our preference, as the region could see some spillover effects from the slowdown in US demand.

Taiwan: maintain Neutral (0) but monitor closely for geopolitical tensions

We are monitoring the region for risks from geopolitical tensions, but maintain our neutral stance, as valuations for regional heavyweights in the tech and semiconductor supply chain discount a lot of near-term concerns on inventory corrections. Strategies are slightly underweight in exposure to the region.

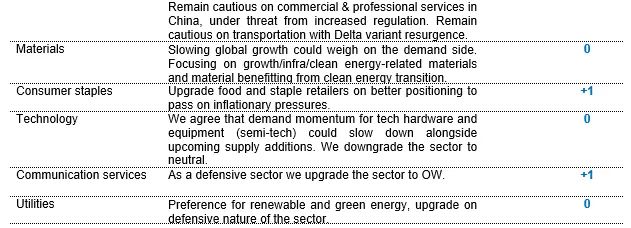

Changes in sector ratings:

No changes to sector ratings for the month.

Automobiles on watchlist for a possible upgrade: Tailwinds: easing semiconductor shortage, commodities and input prices coming down to help margin recovery. We maintain our neutral stance, but are watching the sector for a possible upgrade.

In what has been a volatile period for EM equities so far, we continue to see some of this uncertainty moving into the second half of 2022. For EM ex-China, the key factors to monitor remain the extent of tightening from US and global central banks, and any risks of recessionary fallouts in major global economies. For China, while we have seen some signs of liquidity easing and selective stimulus to stabilise consumption, the lack of meaningful liquidity and fiscal support has kept the markets under pressure. Additionally, China’s zero-Covid policy continues to put pressure on the recovery in consumption. That said, the risk premium for Chinese equities remains near its all-time highs, implying favourable risk rewards for long-term investors. More broadly, the level of divergence in regional performance we saw last year can also be expected to continue this year.

On the brighter side, as commodity prices correct and inflationary pressures start to ease, some EM regions stand to see a recovery in demand and corporate margins. A higher dollar is also beneficial for exporters in the portfolio. From a broader positioning perspective, we continue to hold a balanced and concentrated portfolio of sustainable growth companies in EM, which benefit from thematic and secular demand drivers..