Overall Alternative Assets Market

There is no doubt that 2020 has been a tumultuous year with a lot of uncertainty. In addition to the global economic disruption caused by Covid-19, there have been political and social movements that resulted in an up and down environment for investors. As we move into 2021, the outlook for alternatives is strong, with investors looking to allocate more to illiquid, private assets in search of diversification in a volatile market and yield in a “lower for longer” interest rate environment.

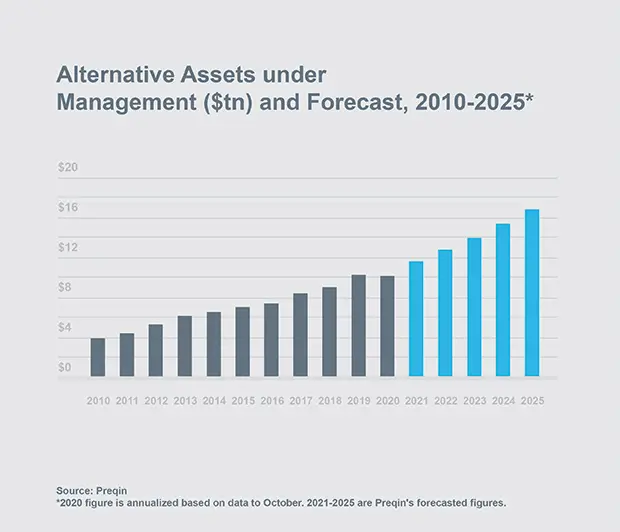

Preqin projects global alternatives assets under management to increase to $17 trillion by 2025.[1] The outlook is strong across various segments, with private equity and private debt expecting the highest growth rates. Strong growth is also expected across geographies, including the relatively more developed markets of the U.S. and Europe and very rapid growth for the developing market in Asia.

Outlook for Middle Market Private Equity and Private Credit

New York Life Investments Alternatives has a long history in the middle market, including both private equity and private credit. After a focus on managing portfolio investments this year, both private equity and private debt should see a rebound from low deal volume in 2020, as managers seek to put large amounts of dry powder to work.

Portfolio Focus in 2020: For much of this year, both private equity and private debt firms were inwardly focused as they worked with portfolio companies during an uncertain time. Given the unique economic situation, portfolio performance has been bifurcated, with services companies – such as financial, healthcare, and technology – performing well through the pandemic. Other industries, such as retail, leisure, and manufacturing, have been more economically impacted which could endure until the pandemic has passed. In general, sponsors and lenders have worked together to bridge borrowers through the crisis, keeping defaults at bay except in severe situations. This collaboration is likely to continue, particularly with recent positive news about a vaccine giving hope for a near-term sustained recovery.

Private Equity Outlook: As we have moved into 4Q 2020, private equity new deal volumes have picked up considerably, and while volume may not fully recover until later in 2021, there is a more positive sentiment than earlier in the year. While deal volume is critical for deploying capital, private equity firms will also be looking to realize returns in existing funds after an anemic 2020.

Interest is high in more insulated industries and resilient companies, and add-on acquisitions remain popular to drive growth in a lower risk manner. With large amounts of capital waiting to be deployed, demand for the strongest businesses could support growth in valuation multiples, which have declined from record highs in early 2020.

Private Credit Outlook: Following the private equity trend, private credit deal volume and pipelines have increased in 4Q 2020. Additionally, leverage levels have declined, and yield expectations have widened, positively affecting the risk/return trade-off for private credit. However, significant capital raised and competition among lenders could push leverage, economics, and credit terms back toward pre-pandemic levels, particularly for the most attractive assets.

Within Europe, private debt, which largely developed after the Great Financial Crisis, has faced its first major test. Capital continues to flow to the region, particularly from U.S. managers seeking platform expansion, and private lenders are positioned well to continue taking market share from banks who will likely focus on managing non-performing loans and continue to de-emphasize lending to middle market businesses.

Growing Focus on ESG in Alternatives

Over the past few years, there has been a push by alternative asset managers to incorporate environmental, social, and governance (ESG) factors into their businesses, with the events of 2020 helping accelerate this trend. Europe tends to be ahead of the U.S. in measuring and reporting on ESG factors, but this gap may start to close as global investors require more transparency and consistent reporting so they can compare managers more easily.

From an investing perspective, there is a growing acknowledgment in private markets that companies with better ESG controls can yield better returns and offer better risk management, with a push to better measure and report ESG factors. In our businesses, while we have always weighed many factors that fall into ESG categories, we have formalized that analysis in a way that allows us to evaluate at the initial investment and monitor changes over time.

From a fundraising perspective, managers are being assessed for how they approach ESG factors in the management and governance of their own businesses, including how they serve their communities and build inclusive cultures.

Finally, the growing interest in ESG and sustainable investing is also likely to impact certain asset classes. Private investors can supplement the work of governments in infrastructure investing, including renewable energy.

[1] Source: Preqin’s The Future of Alternatives 2025, accessed November 2020. https://www.preqin.com/campaign/future-of-alternatives-2025