European equities: Falling consumer confidence

European equities: Falling consumer confidence

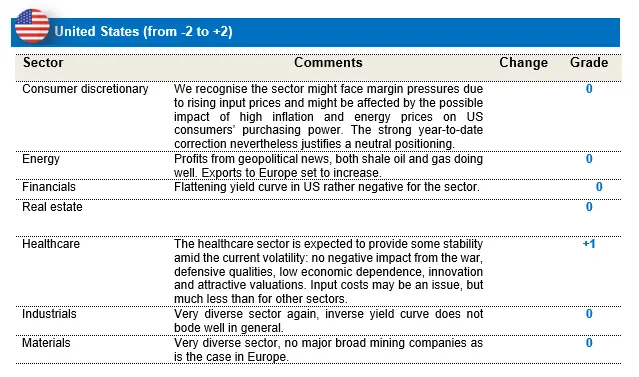

Global equity markets further corrected in June, delivering the worst first half-year returns in over 50 years (for developed markets). The Fed made it very clear that combating inflation was its first priority, even if this could potentially lead to a recession. This hard landing scenario really spooked investors, who reduced their stock holdings. Additionally, the war in Ukraine continues, and apart from the human suffering, continues to put pressure on food and energy prices.

Consumer confidence has also fallen dramatically in Europe. The biggest risk to the European economy is the reduction in gas supplies from Russia, which has driven up prices significantly, and is raising fears of outright shortages and rationing if it continues. Gas shortages could have grave consequences for the European economy. Even without gas rationing, business surveys have started to weaken.

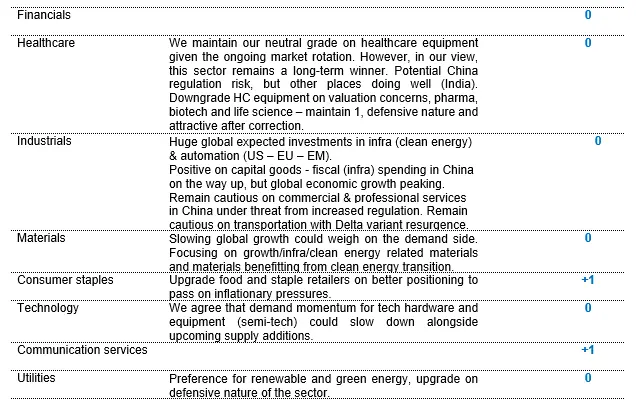

In Europe, Growth stocks outperformed Value stocks over the past four weeks. This outperformance mainly came from Large Caps. Indeed, the top performers in terms of style were Growth Large Caps, while the worst category was Value Small Caps.

In terms of sectors, the energy sector was the worst performer over the last four weeks. Fears related to the economic slowdown have overtaken the shortage in supply as a concern.

If we look at other sectors, the best performers were consumer staples and healthcare. Conversely, materials was the second worst performer after energy, followed by IT, industrials and financials.

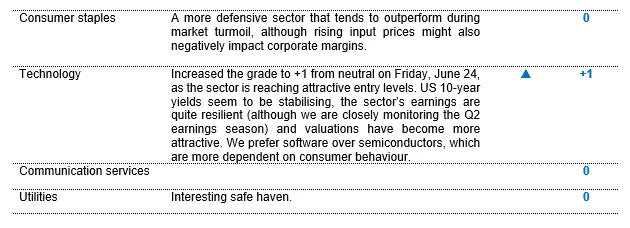

We decided to upgrade technology (from 0 to +1) on 24 June. The sector has declined by around 30% since the beginning of the year, and entry levels are again becoming interesting: stabilising 10-year yield in the US, continued strong earnings in Q1 and cautiously optimistic company guidance, the return of attractive valuations, long-term drivers, etc.

Preferred market segments: we currently have a slight preference for software companies. This market segment is a little less cyclical and less dependent on consumer confidence. In this regard, we are a little more cautious on semiconductors, which are more dependent on consumer behaviour.

We are convinced that the IT sector might start to perform again, although it is not impossible that we will still see some volatility with the release of second-quarter earnings. Despite some temporary bumps, we nevertheless consider current levels as an attractive entry level.

We have neutralised banks (from +1 to 0) and therefore financials (from +1 to 0).

We assume that the announcement by the Spanish Prime Minister of a new tax on large financial institutions, in order to raise EUR 1.5 bn over the next two years, will only affect banks. If this tax remains a one-off, this is manageable for the sector, especially in a rising interest rate environment: it would only impact 3% of the valuation of pure Spanish banks.

However, it sends a very negative signal to investors. Indeed, after the comments made by Polish Prime Minister about a potential bank tax and with the ECB considering capping banks’ profits on TLTROs, shareholders may again start believing that governments and regulators will not allow bank profits to be passed onto them.

Therefore, and despite very attractive valuations, we prefer to take a more cautious and neutral view on the sector.

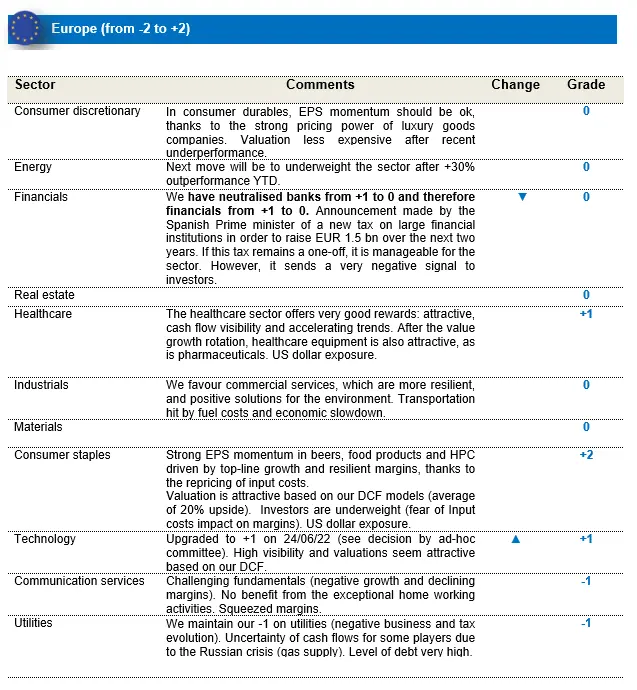

US equities: Recession fears trigger correction

US markets continue to be led by the trend in both inflation figures and interest rates. Although the 12-month forward price earnings of the US market is back in line with its long-term median, we nevertheless remain cautious.

We cannot rule out negative earnings revisions during the ongoing second-quarter earnings season. Consensus expectations still count on high single-digit earnings growth, while the current economic set-up is broadly more in line with earnings growth of between 0% and 5%, which will also be affected by a stronger US dollar.

In this context, we have decided to maintain a balanced approach, with healthcare as our main sector conviction.

Gradually increasing exposure to IT

However, despite the difficult economic environment and remaining uncertainties, we believe the worst is behind us for US equities. In light of this view, we gradually started increasing the grade on information technology to +1, from neutral at the end of last month. Although we might still experience some volatility in the ongoing earnings season, the sector’s tailwinds have started to ease:

- US 10-year yields are stabilising around 3%, while rising yields have been an important reason for investors to reduce their exposure to the sector.

- The sector’s earnings were still strong in Q1, and company guidance is cautiously optimistic. Even companies that closed the quarter at the end of May did not see any significant disruption in end demand.

- Valuations are attractive again and especially when looking on individual company level, we see interesting upside, even with very conservative assumptions on revenue growth and margins. Also compared to the market, they have become more attractive, especially when considering the sector’s superior earnings growth.

- The sector’s long-term drivers remain in place. The sector will continue to benefit from technological breakthroughs, investments in climate change and, to a lesser extent, demographic trends. Long-term investors can benefit from the current sector weakness to gradually build up their exposure in IT.

- Preferred market segments: we currently have a slight preference for software companies. This market segment is a little less cyclical and depends less on consumer confidence. In this regard, we are a little more cautious on semiconductors, which are more dependent on consumer behaviour.

With this in mind, we consider the current levels as attractive, and will gradually start increasing our exposure to information technology.

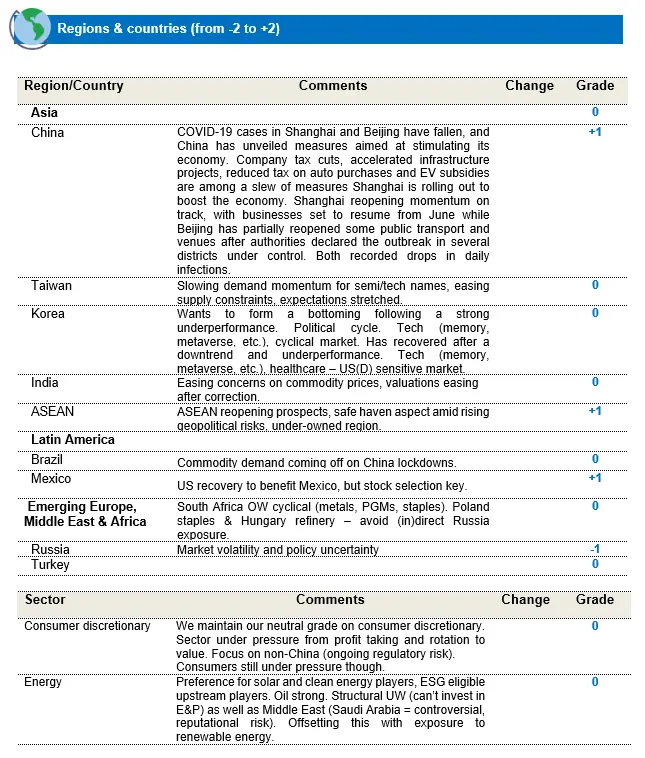

Emerging Markets: Receding headwinds.

June continued to be a volatile month for global equities, but relatively less so for emerging markets. While the MSCI World declined by 8.6%, the MSCI EM corrected by 7.1%, adding to a small relative outperformance. Its strength largely came from China, where after months of negative news flow, some optimism emerged as Covid lockdowns eased and the government announced fiscal stimulus to stabilise consumption. While inflation worries and tightening liquidity conditions continued to raise concerns for ex-China Asian markets, Chinese equities recovered following a sell-off in prior months, posting +5.7% USD returns for June. The best sectors in China were consumer staples, discretionary and industrials, whereas defensives like telecoms, utilities and energy underperformed.

In contrast, ex-China Asian markets including South Korea and Taiwan witnessed a broad-based sell-off on worries of a slowdown in global consumer tech demand and an inventory correction in semiconductor markets. As a result, the tech-heavy North Asian markets of Korea and Taiwan corrected by 16.5% and 15.3% respectively. India, traditionally a market with a more domestic focus, also faced headwinds from inflationary pressure and rising rates weighing on valuations, even as India’s central bank announced surprise rate hikes to cool off demand.

As worries around a global slowdown and recessionary fears intensified, commodities from metal to energy corrected. Commodity-correlated markets including Brazil (-19.3%) and broader Latin American markets (-17.1%) also gave up a large portion of their earlier gains. Following the election victory of leftist leader Gustavo Petro, Colombian equities faced a fierce sell-off (-29.6%).

Regions with a positive view:

Mexico: maintain our positive view:

The region is expected to continue to benefit from a US recovery, supply chain diversification etc. We maintain our positive view, but remain selective.

Maintain ASEAN at OW (+1):

Contrary to past economic cycles, major ASEAN (South East Asian) economies are better positioned from a macro perspective, and can be considered safe havens from a geopolitical perspective. They are beneficiaries of supply chain diversification efforts and additional upside from the full economic reopening.

Sectors with a positive view:

Maintain consumer staples at OW (+1):

In view of the ongoing geopolitical uncertainty, we maintain defensive staple names at OW. However, we prefer retailers and distributors to packagers and manufacturers, which may still face challenges from rising commodity prices.

Maintain telecoms and communication services at OW (+1):

As a defensive sector in a period of rising geopolitical uncertainty, we upgraded telecoms to OW last month and maintain that view.

Remain positive on pharma (+1):

We maintain our positive view on pharma as a defensive sector in a period of high volatility, but also a structural beneficiary of rising healthcare spends.

Remain positive on capital goods (1):

We continue to monitor possible rising input costs and the resulting margin pressure impact for capital goods, but remain positive given the possible return of infra (fiscal) spending in China and the US.

In the face of a slowing global economy and little signs of easing inflation, the outlook for global equities continues to tilt towards the cautious side. However, for emerging markets, the picture looks relatively more optimistic, as the index’s largest weight, China, is showing some initial signs of recovery driven by easing mobility restrictions, policy support on the fiscal side and a regulatory environment turning relatively benign. If China were to achieve its officially stated GDP growth target of 5.5% for 2022, then most of this should come in the second half, increasing the chances of further policy support. From a valuation perspective too, Chinese equities at current valuations do not face as fierce headwinds from rising rates as some of the other EM growth markets like India. As a result, the strategy has moved to an overweight position on China, and we continue to hold our preference for domestic A shares, where we find many more thematic growth opportunities than in offshore H listings. More broadly, the strategy continues to hold a balanced exposure of sustainable growth names with reasonable valuations backed by solid cash flow yields, complemented with a slight defensive tilt in some markets.