European equities: Strong start supported by easing inflation figures

European equity markets made a very strong start to the year, supported by easing inflation figures, both in the US and Europe, the surprisingly quick end to the zero-Covid policy in China and the relatively mild winter that has defused the energy crisis in Europe and thus the risk of a deep winter recession.

During this rebound, cyclicals clearly took the lead. Cyclical growth sectors, such as consumer discretionary, industrials and information technology, outperformed the broader European equity market. Defensive sectors, such as consumer staples, healthcare and utilities, strongly underperformed. In addition, falling energy prices dampened momentum in the energy sector, which gave away some of the ground made so far this year.

While performance dispersion was high between value and growth, this was also the case between small and large caps. Small caps have outperformed their larger counterparts since the start of the year. Published economic data was supportive for smaller companies. The eurozone composite purchasing manufacturers’ index (PMI) improved to 50.2, signalling a significant improvement in sentiment and that the region might avoid a winter recession.

In this context, and as mentioned in early January, we have gradually become more positive on small caps and are still looking for a long-term buy opportunity. A turnaround in central bank tightening, the need for more visibility on the economy and companies’ earnings momentum are the missing elements for us to become positive with conviction on European small caps.

Earning expectations and valuations

Valuations have increased slightly with the year-to-date rebound, but remain interesting. European equities are now trading at slightly less than 13 times expected earnings for 2023 and are still significantly cheaper than their long-term average.

Expected earnings growth remains close to 0%, as investors had already significantly revised down expectations at the beginning of the year. Growth is mainly expected to come from financials, while expected earnings growth for both energy and materials is seen as strongly negative this year.

Stay balanced for now

We made no significant strategic changes, as we still feel comfortable with our current positioning. Consumer staples remain our most important conviction. Although the sector has underperformed during the market rebound and a weaker US dollar has weighed on relative performance, we are convinced of the valuation upside, the pricing power and positive earnings momentum of this sector.

In the meantime, we also maintain our +1 on information technology, our -1 on communication services and energy. The latter seems fully valued after the strong gain last year, while profit margins might be pressured by the ongoing energy transition towards renewable energy out of fossil fuels.

The only change we did implement is on an industry level. After downgrading insurance within financials to neutral at the end of November last year, we have now increased our exposure to banks (retail banks).

Finally, we remain convinced that stock picking will become even more important this year and EPS momentum will be key to generating alpha.

US equities: Large growth stocks massively outperforming value ones

Global equities made a strong start to the year, supported by easing inflation figures and decent consumption data despite poor consumer sentiment. The rally was driven by growth stocks on the back of the prospect of a less restrictive monetary policy and a weakening economy that pushed long-term rates lower.

Cyclical growth outperforms

In the US, there has also been a clear difference in performance between growth and value so far since the beginning of the year, especially when looking at large caps. Large growth stocks have massively outperformed value stocks.

Performance dispersion between the various sectors is high. Cyclical sectors that sold off last year such as consumer discretionary, information technology and communication services, massively outperformed the broader US market. Value and more defensive sectors, such as consumer staples, utilities, healthcare, energy and financials, underperformed significantly.

Earnings expectations and valuations

In the meantime, earnings expectations continued to be revised down. Investors count on earnings growth of around 3-4% in 2023. This sounds reasonable considering the current economic context. Growth is mainly expected to come from consumer discretionary, industrials and financials. For other sectors such as materials, energy and real estate, the market consensus expects earnings to decline this year.

With that earnings growth in mind and considering the recent rebound, the US equity market valuation has risen slightly above the long-term median but doesn’t look overly expensive.

There is nevertheless significant valuation dispersion between sectors. Energy and real estate look particularly cheap, whereas consumer discretionary and information technology have become slightly less attractive compared to their long-term average. Financials are now broadly in line with their long-term average.

Temporary downgrade for IT

Equity investors have already taken into account a soft landing for the US economy, witness the recent rebound of cyclical sectors. Leading indicators are indeed pointing in that direction, although it is too early to draw conclusions. If that scenario should start to materialise, it would prompt us to further increase our exposure to cyclical sectors.

However, we believe the equity market rebound is going a little too fast, too far, justifying a more cautious short-term view. In this context, we have decided to temporarily downgrade information technology from +1 to neutral:

- Valuations have increased compared to a few weeks ago. After the recent rebound, a lot of good news is priced in, especially in semiconductors.

- Investors are anticipating a significant economic rebound in the second half of the year. This might be too optimistic.

- The deceleration of cloud consumption is underestimated. Some signals show that final end-demand might weaken. Several companies have already revised down their capex; this will surely have an impact on semiconductors.

- Automotive and industry-related demand remains strong, and some selective names still offer an interesting upside.

This justifies a cautious short-term view on the technology sector, keeping our very strong long-term conviction in automation and robotics in mind.

Emerging equities: Strong start to the year

Emerging markets got the year off to a strong start, driven by optimism around China’s reopening and supported by a weaker dollar. Except for India, all major EM regions participated in the rebound seen in January. The key drivers of the recovery were mainly the North Asian markets including Taiwan, South Korea and China, but also Mexico. A continuation of favourable policy announcements in China together with a sharp recovery in consumption trends during the Chinese New Year holiday period, helped the Chinese markets to continue their recovery for most of the month, prior to some profit taking towards the end of the month. For Taiwan and South Korea, the recovery was led by expectations of a potential bottom approaching in the semiconductor industry, even as results for leading semiconductor players were hardly optimistic, but the markets are focusing on the outlook for recovery and capex reduction plans. The best performing region during the month was Mexico, where markets found optimism in new investment inflow announcements as the country stands to benefit from US nearshoring efforts. The only market in EM which remained under pressure was India, where profit taking continued after the region had become a rather overcrowded market in the last year. Recent allegations of financial discrepancies within the Adani Group also worsened sentiment around Indian equity performance for the month.

Within the commodity complex, China’s reopening and receding recessionary fears provided a boost to most metals, with iron ore (+10.4%) and copper (+10.3%) the key gainers. Gold prices also ended the month higher by 5.4%, as expectations of peaking rates and dollar provided the precious metal with a tailwind.

Outlook and drivers

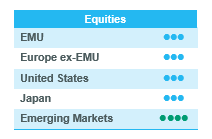

We are optimistic about the outlook for EM equities heading into 2023, where China could be the key driver for EM recovery.

In the last couple of months, we have seen almost all headwinds that weighed on Chinese equity returns turning into tailwinds. While zero-Covid weighed on economic activity for much of last year, China’s swift reopening has opened the door to a pick-up in economic activity and an accelerated recovery in consumption, with consumer savings at all-time highs. On the regulatory front, Alibaba’s Ant Group, which was amongst the first tech names to face regulatory sanctions, recently gained approval for an additional capital increase, signifying that the regulatory tightening we have witnessed in the last two years might be reversed going forward. Lastly, even in the property sector, China might be moving towards relaxing rules on leverage – the famous three red lines policy, which was weighing on growth in the Chinese property sector.

Outside of China too, we are seeing relatively optimistic developments, with inflationary pressure easing and a less than feared slowdown in tech and semiconductor end market demand in the US, which could support the outlook for export-oriented markets like South Korea and Taiwan. Additionally, there are other EM regions that benefit from supportive trends like supply chain diversification and nearshoring including Mexico and India, while Thailand could be the key beneficiary of a full China reopening. Overall, all these factors could drive a higher growth differential of EM over DM in 2023, while valuations are still supportive. From a portfolio positioning perspective, we continue to hold a balanced exposure of sustainable growth names in EM, with thematic beneficiaries in several underlying growth clusters.

Positioning for recovery

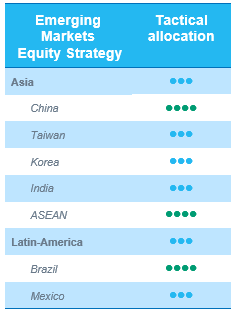

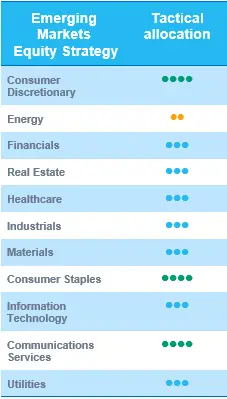

We make no changes to our regional views – maintaining an overweight on China, ASEAN and Brazil, while remaining neutral on other markets. From a sector prespective, we upgrade materials to neutral, while maintaining our overweight on consumer discretionary (retailing).

Regional views:

China: maintain OW – swift reopening has driven a consumption recovery in China, especially going into Chinese New Year celebrations – Year of the Rabbit. On the regulatory front too, newsflow remained constructive, be it the resumption of new gaming licenses or regulatory approval for the capital increase of Alibaba’s Ant Group. On the property and infrastructure side, weakness continues to linger, but there could be further supportive policy decisions. In terms of our preference – we are more balanced in preference for Hong Kong shares vs China domestic.

Brazil: OW – given the market sell-off seen in Brazil in Q4, valuations remain attractive, and macro drivers are broadly supportive. China’s reopening could provide some tailwind to Brazilian equities.

ASEAN: OW – China’s reopening is supportive for ASEAN countries like Thailand (tourism recovery play) and Indonesia (commodity recovery plays), and we thus maintain an OW in the region.

Mexico: Neutral – despite tailwinds from the US nearshoring thematic, we remain neutral for Mexico given the sharp rally we witnessed in Mexican equities last month.

Sector and industry views:

Materials upgrade to neutral – despite the global demand slowdown, China’s reopening could provide incremental demand tailwind for materials. Relative preference remains for materials finding applications in energy transition and thematic exposure like lithium, nickel etc.