Last week in a nutshell

- Prices for French and German power rose to fresh records while British households were told that their power and gas bills will increase by 80%. from October 1st. European short term interest rates rose sharply as central banks are expected to tighten policy to fight high inflation.

- In the US, the preliminary estimate of the Composite PMI for August fell further into contraction at 45.0 points, dragged down by Services. The consumer sentiment recovered for the second month in a row on falling prices, after hitting a multi-decade low in June.

- In the euro zone, business confidence continued to drift lower, dragged down by Germany. Speaking about Germany, the August ifo index remained broadly unchanged while companies remain very pessimistic about the outlook, pointing to a contraction in the local economy.

- The July ECB minutes warned about continuously high inflation and the risk of economic contraction. The 50bp rise in the policy rate shows that the ECB wants to hike sharply at the beginning of the tightening cycle.

What’s next?

- Markets will digest central bankers’ rather hawkish comments made in Jackson Hole. Fed Chair Jerome Powell noted that monetary policy will need to be restrictive for “some time”, warning that history “cautions strongly against prematurely loosening policy”.

- Ahead of the ECB meeting next week, the preliminary CPI releases for the month of August will be a landmark for countries such as France and Germany as the region is struggling with high inflation pushed by ever-rising energy prices.

- Speaking of energy, Gazprom will shut down Nord Stream 1 flows to Europe for three days starting this Wednesday for maintenance reasons.

- In the US, the release of the ISM manufacturing index will be in the spotlight, along with the job report for August, while PMIs in China will shed some light on the strength of the recovery following the lockdowns earlier this year.

Investment convictions

Core scenario

- Our exposure keeps an overall broadly balanced allocation before positioning for the next stage of the cycle, whether it be a soft or a hard landing.

- While the market environment still appears constrained by deteriorating fundamentals, markets are looking to central bank announcements even if they are becoming increasingly data dependent.

- Facing multi-decade high inflation, the Fed continued its hiking cycle in July by adding further 75 bps to its funds rate and plan to pursue its tightening path thereafter. In our best-case scenario, the Fed succeeds in landing the economy. As a result, we expect the rise in the US 10Y yields to fade.

- Inflation is also at highs in the euro zone, hitting businesses, consumers, and ECB policymakers alike. The ECB started its monetary policy tightening cycle in July and delivered a 50bp hike. It also unveiled a new (“unlimited”) tool, the “Transmission Protection Instrument” (TPI). Further hikes are expected as soon as September.

- The reasons for a balanced allocation have been called into question by the decline in Russian gas flow. The European Union is especially vulnerable to the tug of war with Russia. The risks we previously outlined are starting to materialize and are now part of the scenario.

Risks

- Investor concerns are shifting from inflation concerns to growth concerns.

- The war in Ukraine is pushing upwards gas prices. European activity is at the mercy of flows staying open. An emergency plan, “Save gas for a safe winter”, is in progress to curb consumption and find alternative sources of supply.

- The threat of COVID-19, and its variants, remain as the virus keeps evolving and spreading at various speed throughout the world.

Recent actions in the asset allocation strategy

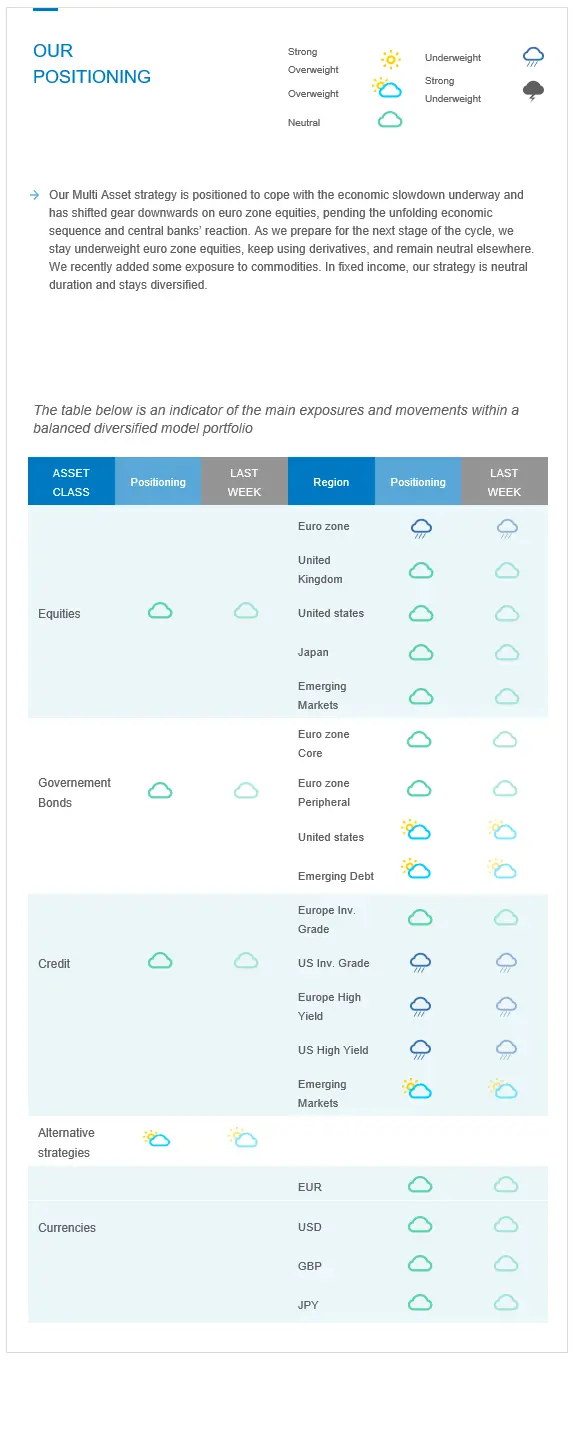

Our Multi Asset strategy is positioned to cope with the economic slowdown underway and has shifted gear downwards on euro zone equities, pending the unfolding economic sequence and central banks’ reaction. As we prepare for the next stage of the cycle, we stay underweight euro zone equities, keep using derivatives, and remain neutral elsewhere. We recently added some exposure to commodities. In fixed income, our strategy is neutral duration and stays diversified.

Cross asset strategy

- Our multi-asset strategy stays more tactical than usual and can be adapted quickly:

- Underweight euro zone equities, with a derivative strategy in place to catch the asymmetric potential. We have a preference for the Consumer Staples sector where we find pricing power.

- Neutral UK equities, resilient segments, and global exposure

- Neutral US equities, with an actively-managed derivative strategy.

- Neutral Emerging markets, because our assessment indicates an improvement, especially in China, both on the COVID-19 / lockdown and stimulus fronts during H2.

- Neutral Japanese equities, as accommodative central bank, and cyclical sector exposure act as opposite forces for investor attractiveness.

- With some exposure to commodities, including gold.

- In the fixed income universe, we acknowledge downward revisions in growth, highs in inflation expectations and strong central bank rhetoric regarding the willingness to tighten and fight inflation. We are neutral duration, with a preference for US duration.

- We continue to diversify and source the carry via emerging debt.

- In our long-term thematics and trends allocation: While keeping a wide spectrum of long-term convictions, we will favour Climate Action (linked to the energy shift) and keep Health Care, Tech and Innovation, Demographic Evolution and Consumption.

- In our currency strategy, we are positive on commodity currencies:

- We are long CAD.